Good evening!

Even though the housing market is not as hot as prior years,trends have emerged that confirm that it is starting to heat up.

Green Shoots: Trends are developing which demonstrate that the housing cool down is beginning to heat up.

Headlines are the same across the country: there are more homes on the market and it is taking a lot longer to sell a home. Multiple offers and instantaneous success are characteristics of housing a couple of years ago. After many years of rapid appreciation, demand for homes slowed considerably as mortgage rates climbed to 4.5% in March 2018. Demand deteriorated further when rates unexpectedly squeezed past 5% last November.

Ever since the housing market slowed last year, demand has remained sluggish, a bit subdued in comparison to the hot years from 2012 through 2017. Those markets were characterized by a very limited inventory and sizzling demand. Yet, behind the scenes, the 2019 housing market has been boosted by falling mortgage rates. After starting the year at 4.5%, rates have dropped ever since, dipping below 4% in June for the first time since the end of 2017. Today, they sit at 3.5%, the lowest level since October 2016, nearly three years ago.

As a result of the return to historically low mortgage rates, trends have surfaced that highlight a marketplace that is heating up.

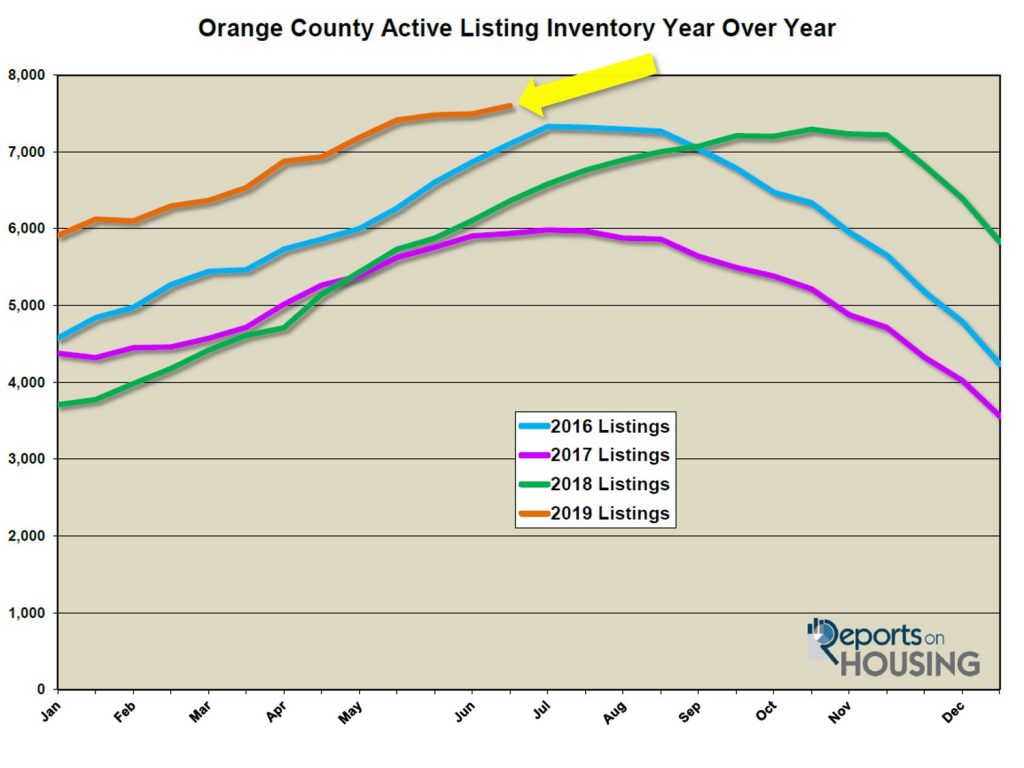

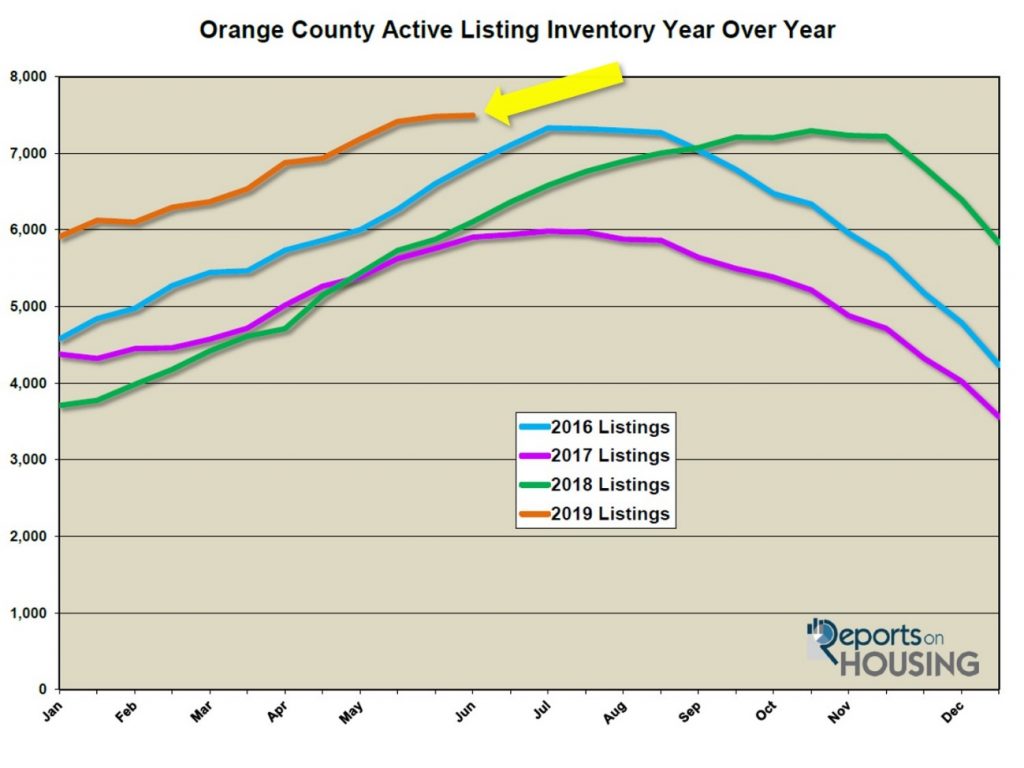

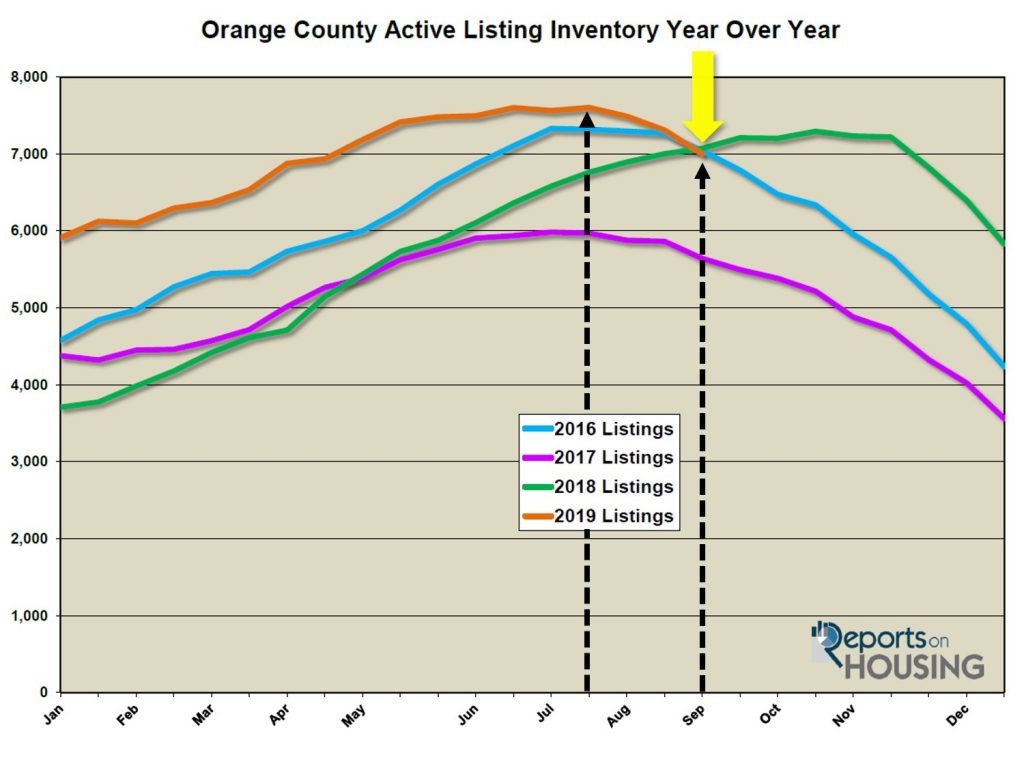

GREEN SHOOT – The current active inventory has dropped by 8% since the end of July. The inventory shed 604 homes in that time, the largest drop since 2008. Today, there are 6,997 homes on the market. It is the first time that there are fewer homes compared to the prior year since April 2018. The current trend is for a rapidly falling active inventory and fewer homes on the market than the prior year.

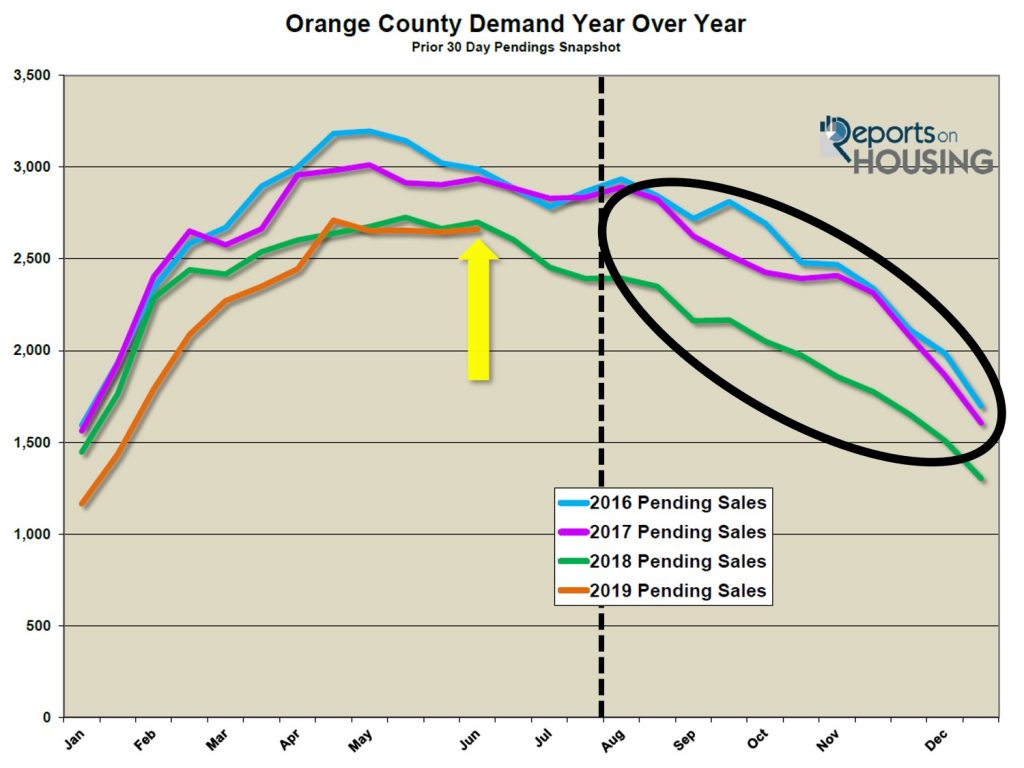

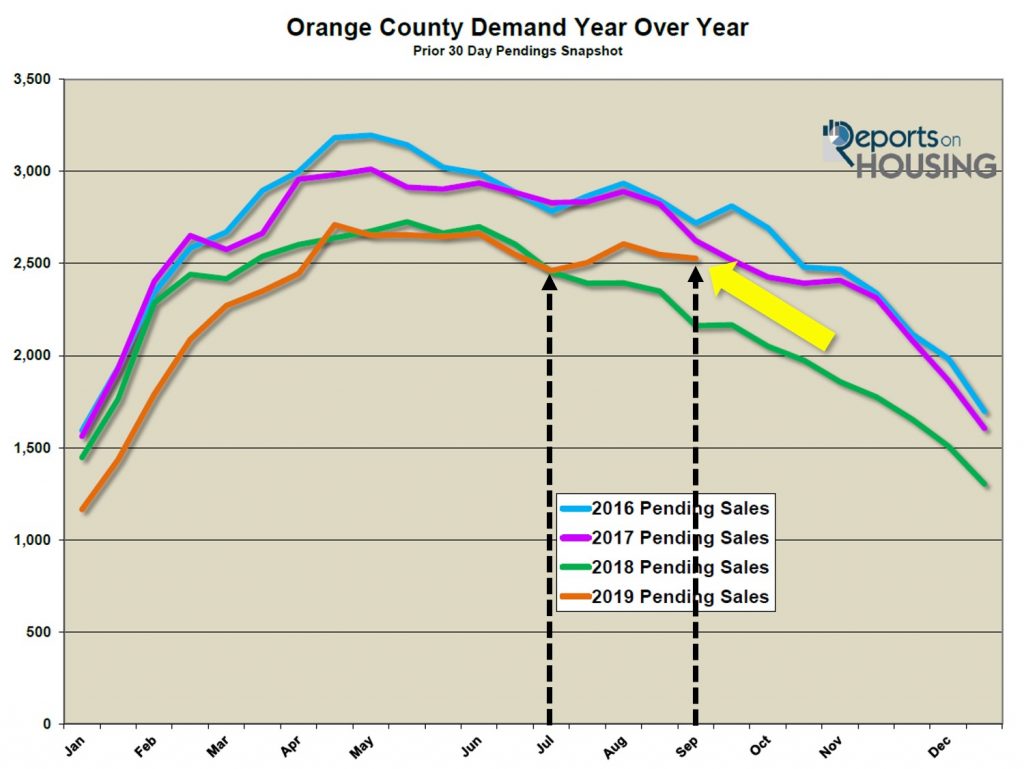

GREEN SHOOT – Demand has only dropped by 7% since peaking back in April. That is the smallest drop since 2009. On average, demand (the number of new pending sales over the prior month) has dropped by 19% after peaking in the spring. And, since mid-July, it has surprisingly increased by 3%. During that same time period, mortgage rates dropped from 3.8% to 3.5%. Lower interest rates are absolutely propping up buyer demand in Orange County. Today, demand is at 2,528 pending sales, which is 17% higher than last year’s anemic 2,162 reading.

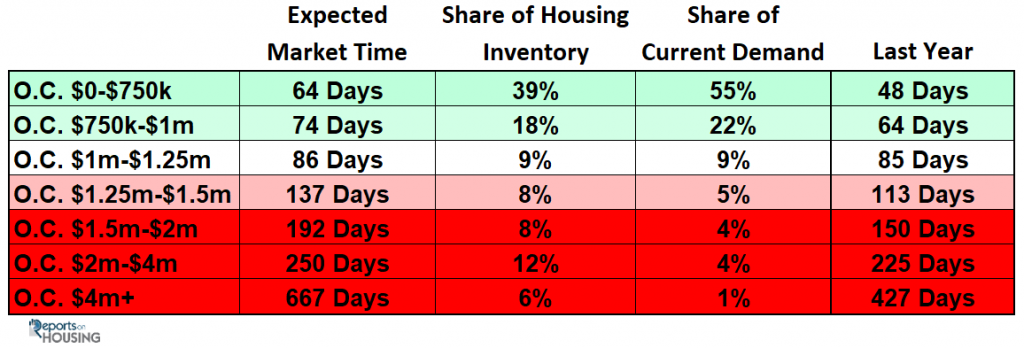

GREEN SHOOT- The Expected Market Time dropped from 92 days back in mid-July to 83 days today. Typically, from July to September the Expected Market Time (the amount of time from coming on the market to opening escrow) increases or remains flat. This year it dropped from 92 days to 83 days, a 10% dip. It was the largest decline since 2011. Last year, the Expected Market Time was at 98 days and climbed all the way to 134 days by year’s end. At 83 days, other than last year, it is still the highest level for this time of the year since 2014, but it is moving in the right direction. It is a slight Seller’s Market where homes are not appreciating much at all, but sellers get to call more of the shots during negotiations.

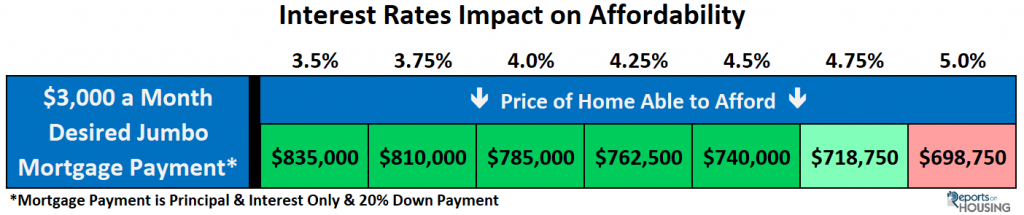

GREEN SHOOT – Affordability has dramatically improved since November of last year. So many buyers are hoping for housing to tilt in their favor and for home values to fall like they did during the Great Recession. Quite simply, that is not going to happen anytime soon. Instead, buyers really need to focus on how affordability has substantially improved since last November when rates eclipsed 5%. With mortgage rates falling back down to historically low levels, affordability is absolutely tilting in their favor. If a buyer was looking for a $3,000 monthly payment with 20% down, they would have been looking at a home priced at $698,750 in November 2018 with a 5% interest rate. Today’s 3.5% rate allows a buyer to look at homes priced at $835,000 with the exact same $3,000 per month payment. That is an extra $136,250 in a time when there has been very little appreciation in the past year. These low rates are a total gift to home buyers.

While definite green shoots have emerged, the market is still a slight Seller’s Market. It is just not as cool as the winter of 2018. These trends have slowly developed this year. The market is on track to improve further, but it will take time. The housing market will not change overnight. While promising for sellers, the market still necessitates a more cautious, deliberate strategy and approach to housing. For buyers, the current low interest rate environment is a strong advantage that has reduced the monthly mortgage payment significantly and greatly improved affordability.

Active Inventory: The current active inventory shed 310 homes in the past two-weeks.

In the past two-weeks, the active listing inventory dropped by 310 homes, down 4%, and now totals 6,997, the largest drop of the year. In the past month, it has dropped by 491 homes, a 7% plunge. The inventory will continue to drop for the rest of the year. The decline is the fastest pace since 2012. That means that there will be far fewer homes to start 2020 compared to the start of this year. The headlines once again will be an anemic inventory.

Last year at this time, there were 7,070 homes on the market, 73 more than today, or 1%. Two years ago, there were 19% fewer homes on the market compared to today.

Demand: In the past two-weeks, demand decreased by 1%.

Demand, the number of new pending sales over the prior month, decreased by 20 pending sales in the past two-weeks, down 1%, and now totals 2,528. Expect demand to continue to drop through the end of the year, just not at the same downward pace as is customary. Lower mortgage rates are having a positive impact on demand.

Last year at this time, there were 366 fewer pending sales than today, 14% less. Two years ago, it was 4% stronger than today.

In the past two-weeks, the Expected Market Time dropped from 86 days to 83 days, a slight Seller’s Market (60 to 90 days), where home values do not change much, and sellers get to call more of the shots during the negotiating process. Last year, the Expected Market Time was at 98 days, slower than today. Two years ago, it was at 64 days.

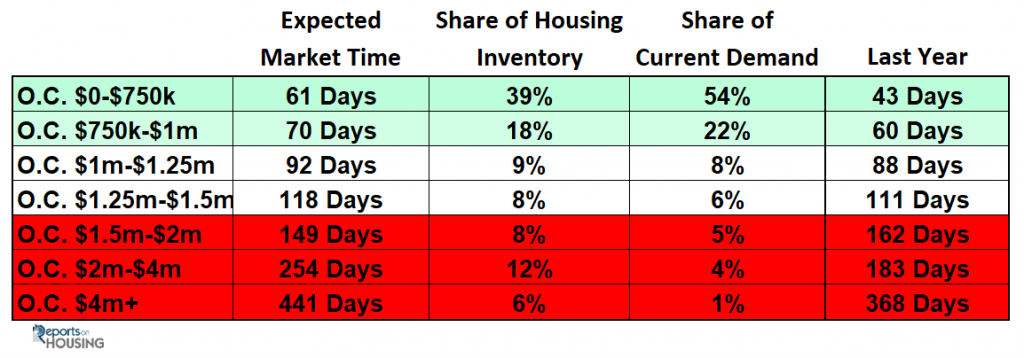

Luxury End: Since July, the luxury market has continuously improved.

In the past two-weeks, demand for homes above $1.25 million decreased by only 2 pending sales, a 0.6% drop, and now totals 347. The luxury home inventory decreased by 124 homes and now totals 2,337, a 5% drop. The overall Expected Market Time for homes priced above $1.25 million decreased from 212 days to 202 over the past two-weeks, moving in the right direction.

Year over year, luxury demand is up by 28 pending sales, or 9%, and the active luxury listing inventory is up by an additional 193 homes, or 9%. The Expected Market Time last year was identical to today, 202 days. There are more luxury homes on the market, but demand is a lot stronger.

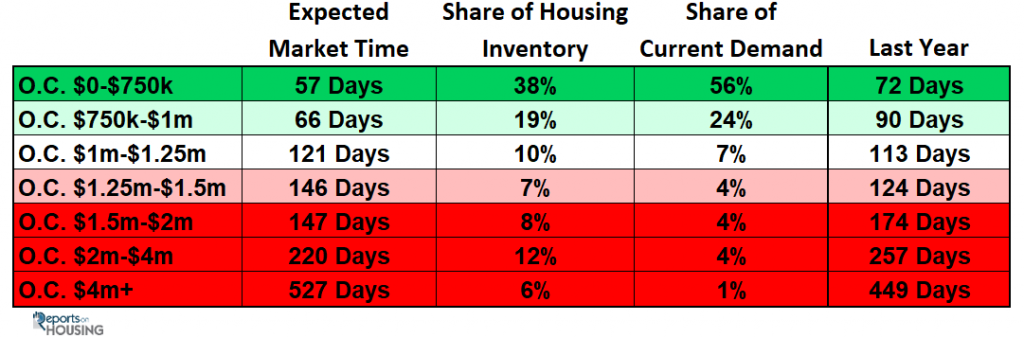

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the Expected Market Time decreased from 149 to 146 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 162 to 147 days. For homes priced between $2 million and $4 million, the Expected Market Time decreased from 249 to 220 days. For homes priced above $4 million, the Expected Market Time increased from 509 to 527 days. At 527 days, a seller would be looking at placing their home into escrow around February 2021.

Orange County Housing Market Summary:

- The active listing inventory decreased by 310 homes in the past two-weeks, down 4%, and now totals 6,997. It was the largest drop so far this year. Last year, there were 7,070 homes on the market, 73 more than today. Two years ago, there were 19% fewer homes on the market.

- Demand, the number of pending sales over the prior month, decreased by 20 pending sales in the past two-weeks, down 1%, and now totals 2,528. Last year, there were 2,162 pending sales, 14% fewer than today. Two years ago, demand was 4% stronger than today.

- The Expected Market Time for all of Orange County remained dropped from 86 to 83 days, a slight Seller’s Market (between 60 to 90 days). It was at 98 days last year.

- For homes priced below $750,000, the market is a hot Seller’s Market (less than 60 days) with an expected market time of 57 days. This range represents 38% of the active inventory and 56% of demand.

- For homes priced between $750,000 and $1 million, the expected market time is 66 days, a slight Seller’s Market. This range represents 19% of the active inventory and 24% of demand.

- For homes priced between $1 million to $1.25 million, the expected market time is 121 days, a Balanced Market.

- For luxury homes priced between $1.25 million and $1.5 million, in the past two weeks, the Expected Market Time decreased from 149 to 146 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 162 to 147 days. For luxury homes priced between $2 million and $4 million, the Expected Market Time decreased from 249 to 220 days. For luxury homes priced above $4 million, the Expected Market Time increased from 509 to 527 days.

- The luxury end, all homes above $1.25 million, accounts for 33% of the inventory and only 13% of demand.

- Distressed homes, both short sales and foreclosures combined, made up only 0.7% of all listings and 1.4% of demand. There are only 27 foreclosures and 23 short sales available to purchase today in all of Orange County, 50 total distressed homes on the active market, down two in the past two-weeks. Last year there were 56 total distressed homes on the market, slightly more than today.

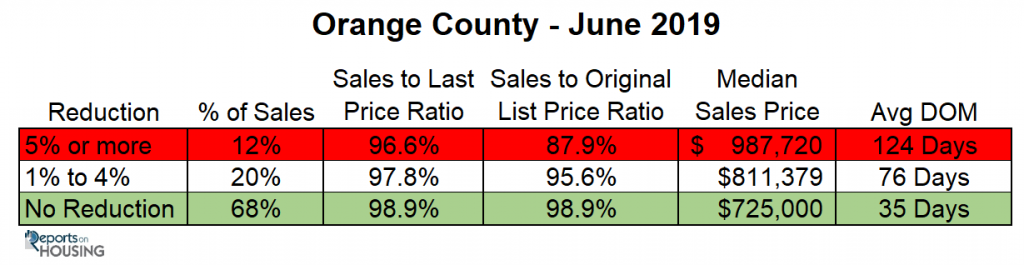

- There were 2,871 closed residential resales in July, 5% more than July 2018’s 2,734 closed sales. July marked a 6% increase compared to June 2019. The sales to list price ratio was 98.3% for all of Orange County. Foreclosures accounted for just 0.5% of all closed sales, and short sales accounted for 0.24%. That means that 99.3% of all sales were good ol’ fashioned sellers with equity.

Have a great weekend,

Compliments of ….

Roy Hernandez

TNG Real Estate Real Estate Consultants

Cell 949.922.3947

Article courtesy of Steven Thomas and Quantitative Economics and Decision Sciences