In a market where home inventory is low and demand is soaring, your sellers may think that their home will move in mere minutes–and at a price that defies even the loftiest expectations. When left untethered, these dreams of big prices and warp speed sales can spell disaster–and major disappointment–for you and your clients.

Don’t worry! You’re not doomed to this fate. With a few smart, premeditated steps you can head-off seller miseducation and common misconceptions and start your client on the path to a successful sale from the get-go. Here are six scripts and simple talking points that your sellers need to know before their home hits the market.

1. Staging matters–big time!

Every agent knows the old adage, “Homes that don’t show well don’t close well.” But still, time and time again we see sellers rail against the time and cost associated with staging a home. Afterall, if they love their home as it is, why shouldn’t everyone else? This is a situation where sometimes showing trumps telling. If you have a particularly stageing-averse client, take them on a two-home showing; one where the home is staged and one where the home is not.

Be sensitive, but firm. Their decor may be a beautiful expression of their personality, but sometimes less is more. You can also download and share Trulia’s 10 Hardcore Staging Tips for Sellers so that they can reference it before every open house.

2. The market sets the price, not the owner.

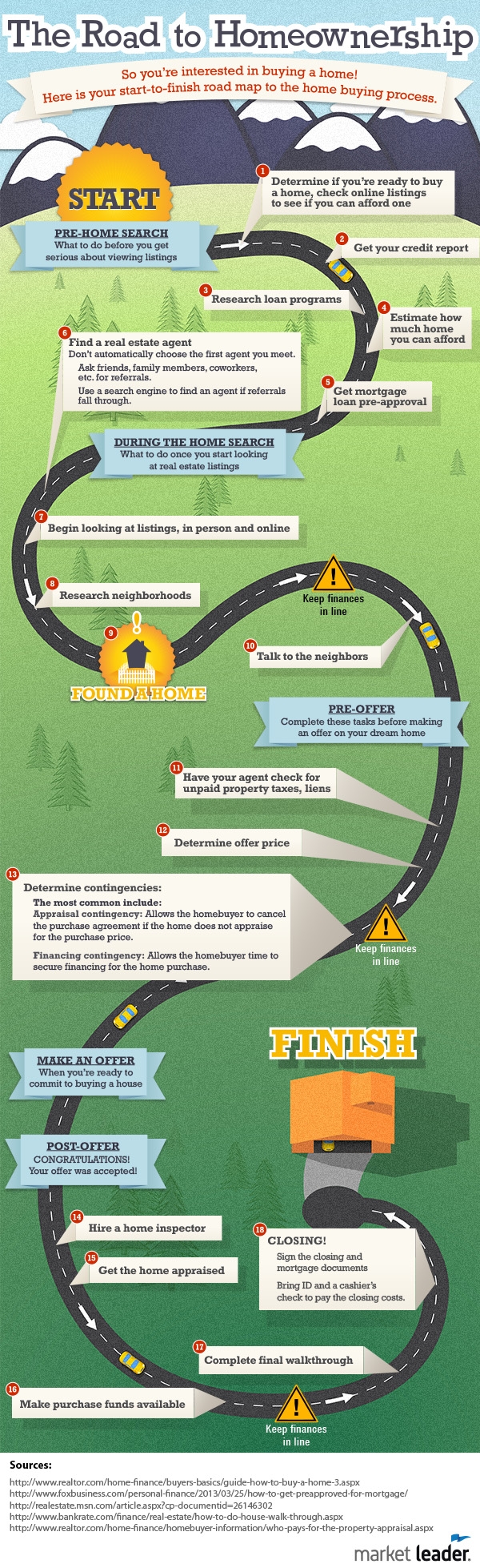

It’s understandable that many home sellers think that their home is above the price that the market dictates. Sentimental value often translates into an inflated sense of the home’s worth, but when it comes price, the winning opinion is always the market’s opinion. You know it’s impossible to effectively price a home without taking into account the competition. Unfortunately, too many sellers don’t.

First, it’s essential to determine how much the seller thinks their home is worth. If their expectation is wildly inappropriate, it may be worth taking the clients to see a home that is on the market and priced at their expectation. Then, take the seller to a comparable home that is priced similarly to where you feel their home should be priced. Take the time to both educate them on the competition and give them expert home pricing tips to help them understand your pricing strategy.

Need more resources:

- Download and share Trulia’s home pricing tips handout

- Send the seller their Trulia home estimate report, which uses market data to create a customize report.

3. Small renovations may mean big bucks later

In many cases, the cost of a home repair is less expensive than a potential buyer perceives the cost of the repair to be. If buyers over estimate the cost of fixing the problem, it may negatively impact the offer amount and end up costing the seller more in the long run. Be upfront with your seller clients when you spot unsightly blemishes that could cost your clients the deal.

Before you list and start marketing the property, counsel your sellers on the improvements you know will make a difference when it comes to price. If you need a starter list of simple ways to boost a home’s value and its showing potential, download our guide on the 10 ways to boost your home’s value.

4. Incentives can help close the deal faster.

Offering practical incentives might not sound sexy, but those that fill legitimate buyer needs have the power to differentiate a listing from the competition and attract just the right attention needed to get the home sold for the right price.

Talk to your sellers early about how they might be prepared to sweeten the deal if the right offers don’t come rolling in. Talking incentives early and building them into the marketing plan can arm both agent and seller with the ammunition to jump potential marketing hurdles and beat out the competition for a fast sale.

If you need help deciding what incentives help sell homes check out this popular home seller handout on the Top 4 Incentives that Sell Homes.

5. Serious buyers never stop the hunt.

Too many sellers see the winter months as the slow season. The reality is, there are plenty of upsides to listing and marketing a home when everyone else is taking a break.

Check out and share our free agent download 5 Unexpected Upsides to Off-Season House Hunting to show your clients that holding off on listing could ultimately make selling harder than it has to be.

6. Real estate is a local business.

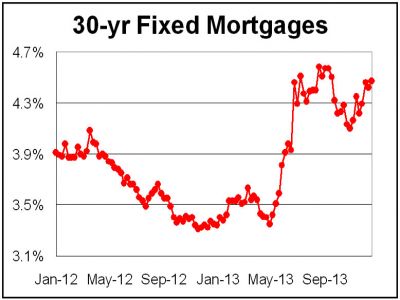

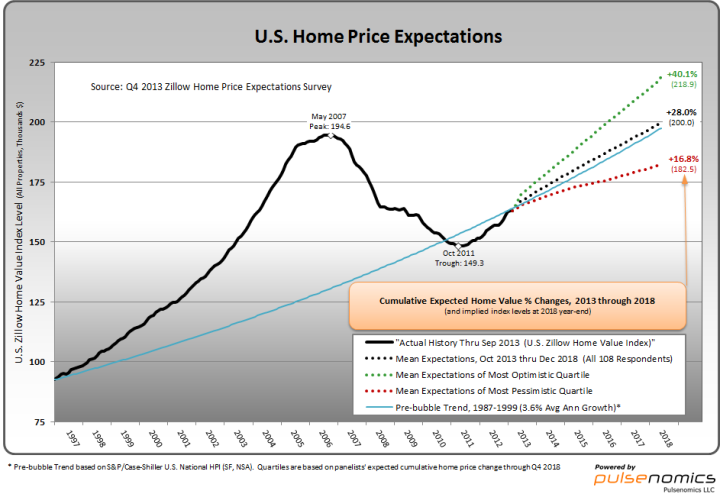

The last few years have turned real estate headlines into high-profile news. Home prices are on the rise. In fact, last month home prices were up 11.9% over the year past. While this is great news for the country as a whole, be sure to remind your sellers that real estate is a local industry and that asking price isn’t everything.

To do this, consider posting your own local market updates on your personal real estate blog. In addition, check out and use these tips for showing your clients the difference between asking and listing price in your local market. For many sellers, seeing the numbers is just the ammo they need to agree to the right price.