Any good parent wants their child to attend the best school possible, but when it comes to finding a home in a top school district, how much more are buyers willing to pay? A recent study performed by Redfin suggests that many parents are willing to shell out even more than you might think. If you’re trying to sell a home and want to get the most for it, you might want to consider “selling” the school first.

Schools have always played an important role in the buying and selling of real estate. More recently though, premiums for homes served by top-ranked schools have been going up, indicating that buyers place remarkable importance on the quality of schools when buying a house.

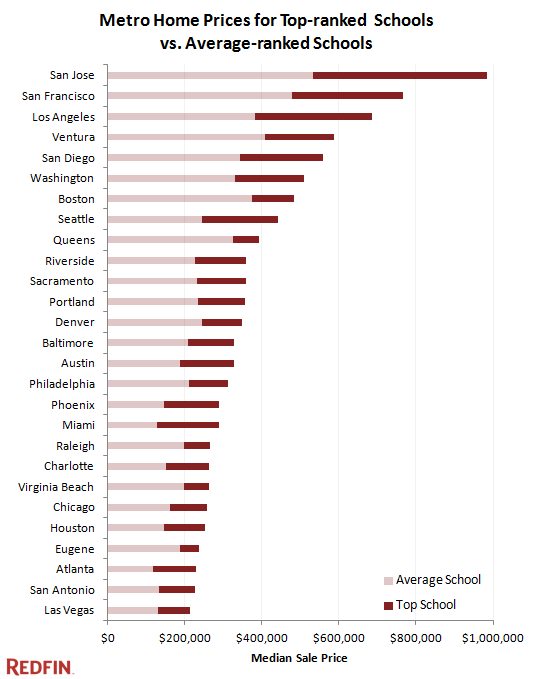

An analysis by Redfin illustrates the steep price premiums that homeowners are willing to pay for homes served by top-ranked schools, offering the latest concrete evidence that buyers place remarkable importance on the quality of schools.

The sky-high premiums help explain the ongoing race among listing sites to provide razor-sharp school information.

They could also add fuel to a debate over whether buyers and the real estate agents representing them give too much weight to rankings, which school officials say don’t always provide a complete picture of the differences in the quality of education provided.

Redfin’s study found that buyers pay an average of $50 more per square foot for homes served by top-ranked schools than for those served by average-ranked schools. It also found found that, even within the same neighborhoods, buyers will pay substantially more for homes served by top-ranked schools than they do for comparable homes served by average-ranked schools.

“Homes just a short distance apart with nearly identical attributes are selling for drastically different prices,” the report said. “We’ve looked across the country at homes that have sold in the last three months and found five examples where the prices vary on identical homes by as much as $130,000.”

Not accounting for home size, San Jose, San Francisco and Los Angeles, Calif., carry the highest price premiums for top-ranked schools while Queens, N.Y., Raleigh, N.C., and Eugene, Ore., carry the lowest of all the metros that Redfin analyzed.

The report adds to a growing body of evidence that suggests that many homebuyers are ready to shell out substantial cash for access to top-notch schools.

Three out of 5 homebuyers who responded to a recent realtor.com survey said that school attendance boundaries would be a factor in choosing a home, and most of that group said they’d be willing to go above budget or give up amenities to have their children go to their school of choice.

The online survey, conducted this summer, found that of those who said school attendance boundaries were important:

- 23.6 percent would pay 1 to 5 percent above budget.

- 20.7 percent would pay 6 to 10 percent above budget.

- 9 percent would pay 11 to 20 percent above budget.

- 40.3 percent would not go above budget.

Some school officials have questioned whether buyers and their agents are relying too heavily on test scores and school ranking sites when pricing listings.

Some school officials have questioned whether buyers and their agents are relying too heavily on test scores and school ranking sites when pricing listings.

The San Francisco Chronicle has reported that buyers in San Mateo County, Calif., are willing to pay premiums of $200,000 or more for homes served by schools that score only slightly better than other schools in the same school district. School district officials told the newspaper that homebuyers and their agents may read too much into simplified school rankings offered on real estate sites, and are working with Realtors in the hopes of helping them gain a better understanding of what qualities make for a good school.

A Canadian real estate agent who’s branded herself as her community’s “#1 schools advisor” has rankled school district officials and parents by posting not only standardized test scores on her website, but devising her own system for ranking them. The ranking system penalizes schools with lower household income and parental education levels, or a higher prevalence of single-parent households and English-as-a-second-language (ESL) students.

The increasingly evident focus among buyers on school quality has helped spur a push by listing services to offer deeper school-centric features and data.

Zillow rolled out a school search boundary tool earlier this month that lets users filter home searches for public, private and charter school attendance boundaries by their ratings from a national school rating site.

A handful of other sites, including realtor.com, Trulia and Century 21 Real Estate, offer school-based search tools.

For its study, Redfin analyzed listings on multiple listing services that sold between May 1 and July 31; school zone boundaries provided by Maponics; and additional school data provided by Onboard Informatics and GreatSchools.