From OC Register December 19th, 2013.

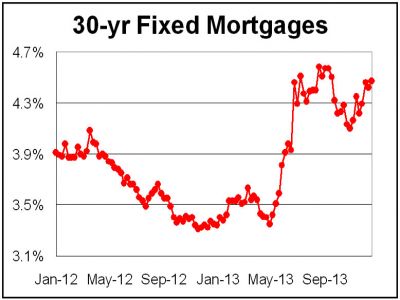

From Freddie Mac’s weekly survey the 30-year fixed rate climbed to 4.47 percent and .7 point from last week’s 4.42 percent and .7 point. The 15-year fixed rose to 3.51 percent and .6 point from last week’s 3.43 percent and .7 point.

BOTTOM LINE: In the past year—assuming a well-qualified borrower received the average 30-year conforming fixed rate on $417,000 — you would have saved $263 had you funded your loan a year ago on the previous rate of 3.37 percent and payment of $1,842 compared to today’s 4.42 rate and payment of $2,105. Today’s 15-year fixed rate of 3.51 percent and monthly payment of $2,983 is $173 higher than last year’s payment of $2,810 on the previous rate of 2.65 percent.�

APPLICATION NEWS

The Mortgage Bankers Association weekly survey reports a 6 percent drop in loan applications compared to last week. Purchase loans now represent 34 percent of all applications. The Federal Housing Finance Agency announced (Fannie’s and Freddie’s regulator) announced shockingly large increases to loan level pricing adjustments as well as a separate guarantee fee increase. Simply stated, these loan point taxes could increase your loan costs in certain instances by .85 point to 1.6 points. Ouch!

WHAT I SEE: From rate sheets hitting my desk that are not part of Freddie Mac’s survey: Locally, not-so-well qualified, self-employed borrowers can get their income cleared on conforming and jumbo loans with a letter from their CPA and a current P & L on conforming and jumbo loans. Well-qualified borrowers can get a 30-year fixed rate at 4.25 percent and 1 point or 4.625 percent and zero cost. Or take a 15-year fixed at 3.25 percent and 1 point or 3.625 percent and zero cost. The 5/1 ARM for conforming or jumbo is very attractive at 3.5 percent, no-cost and some borrower rebate money on higher loan amounts.

WHAT I THINK: My 2014 top 10 predictions, in consultation with my crystal ball, are now etched in stone, with numbers 1 through 5 posted today. I’ll reveal 6-10 next week.

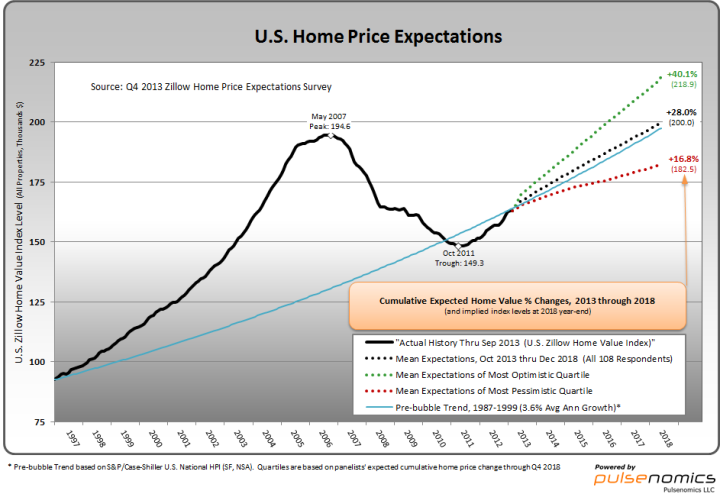

1) Home prices in Orange and Los Angeles Counties will drop between 6 and 8 percent in 2014. This will be due to a continuum of the current housing sales slowdown (that’s code for the housing economy is rapidly flattening), very untimely higher taxes on mortgages in the form of loan level pricing adjustments and guarantee fees and higher FHA mortgage insurance charges (that were introduced in 2013), as well as the tighter underwriting standards that start January10, aka the Qualified Mortgage and Ability-to-Repay rules.

2) Interest rates will rise in the first half of the year, touching 5 percent. The second half of the year will see a nosedive with 30-year fixed rates dropping to 3.25 percent to provide housing CPR and regain a market pulse.

3) In a new twist, lenders will be mandated by their regulators to do property occupancy inspections to be certain the home is really being rented (as rental properties are exempt from the new Qualified Mortgage rules).

4) Loosey-goosey underwriting programs will creep back in on particular programs that will include cruddy credit, very high ratios and tax preparer letters instead of IRS income proof. This is akin to the fast and loose stated income world of old.

5) Home equity lines-of-credit (HELOCs) will be rampant next year. In addition to traditional usage as a second lien, they will be marketed for owner-occupied first trust deed purchases and refinance loans, as well as rental financing, as that is another program exempt from Qualified Mortgage and Ability to Repay rules.

[gravityform id=”13″ name=”Have a question or comment?”]