Buyer demand may not be as hot as prior years, but the Housing market is not collapsing either.

No Housing Collapse: The underlying housing fundamentals have stabilized significantly compared to last year’s slide.

Little kids often have a tough time climbing under the covers and swiftly dozing off to sleep. Instead, they look under their bed to make sure there is nothing there. They look in their closet and then close the door tight. They make certain that the nightlight is brightly shining. There are even times when they will ask dad or mom to be absolutely certain that there are no monsters in their room. Finally, they anxiously fall asleep.

For buyers or sellers wondering if there are any monsters lurking around the corner, they can be rest assured that the sky is not falling, there are no surprises on the housing front anytime soon. Reports from the housing trenches are that many buyers expect the market to drop like a rock and that is when they will finally be able to purchase. That simply is not on the horizon. Sitting back and waiting on the sidelines will prove to be a waste of time.

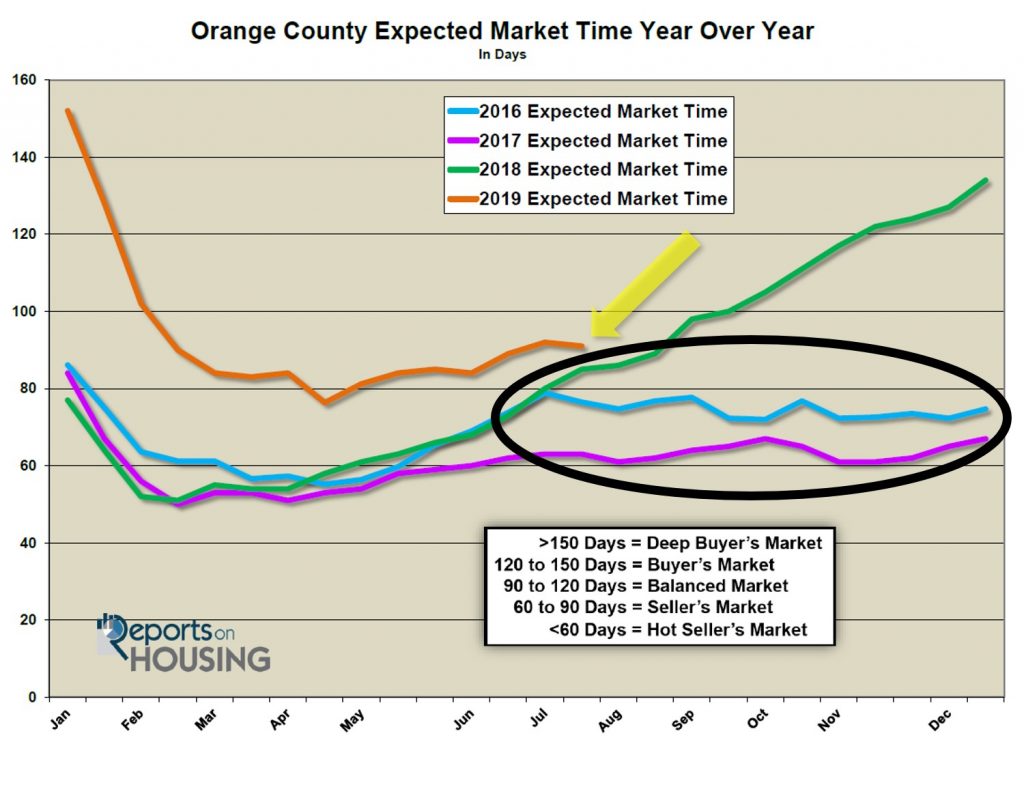

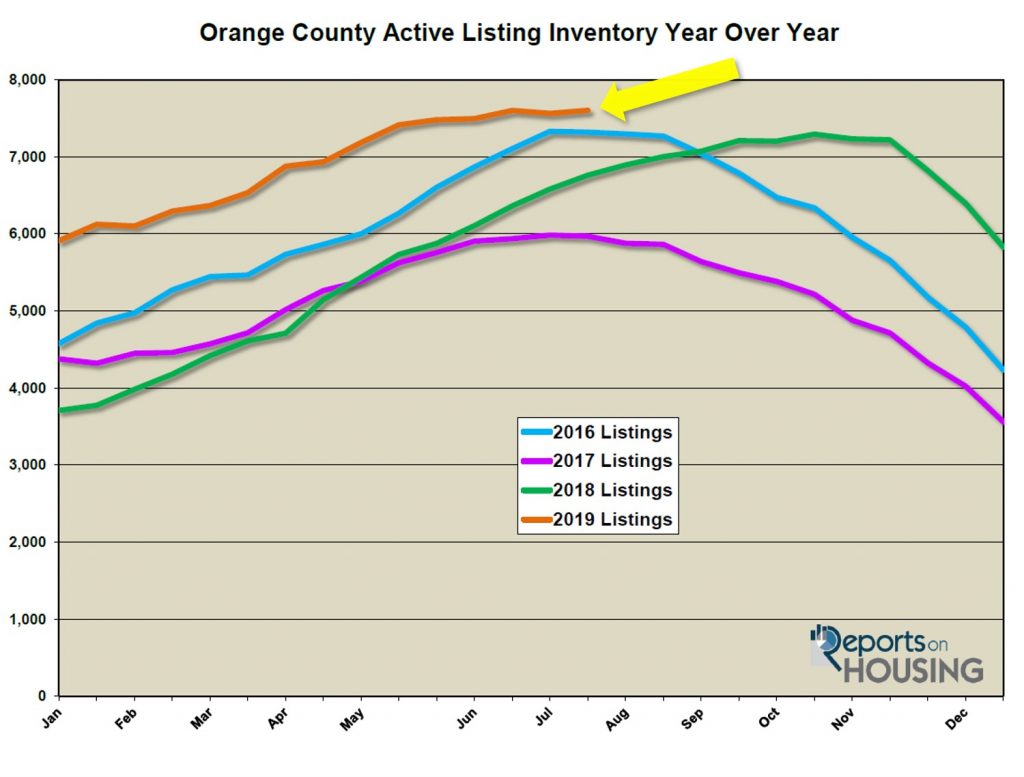

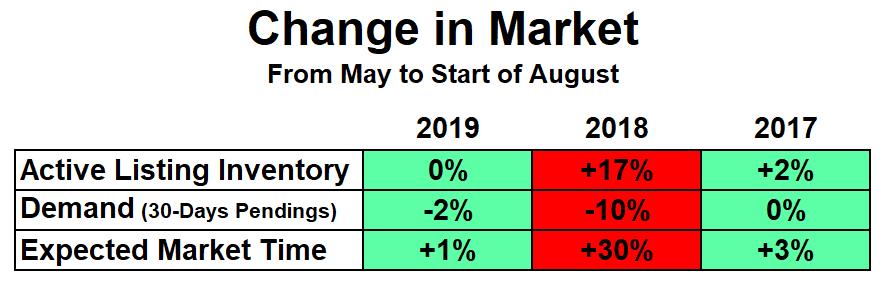

Last year, major cracks in the housing market emerged. The HOT market continued from 2012 through the start of 2018, until the underlying fundamentals quickly eroded. From May through August of last year, the active inventory climbed by 17%, demand dropped by 10%, and the Expected Market Time (the amount of time it would take from hammering in the FOR SALE sign to opening escrow) rocketed upward. The Expected Market Time continued to soar by climbing an additional 56% from August through the end of the year, compared to a 7% average from 2012 through 2017.

This year, from May to the start of August, the active inventory has remained unchanged, demand has only dropped by 2%, and the Expected Market Time increased by only 1%. Housing is not grinding to a halt. The sky is not falling. Typically for this time of the year, the Summer Market, the active inventory rises, demand drops slightly, and the Expected Market time slowly increases. This year, there has not been much change at all.

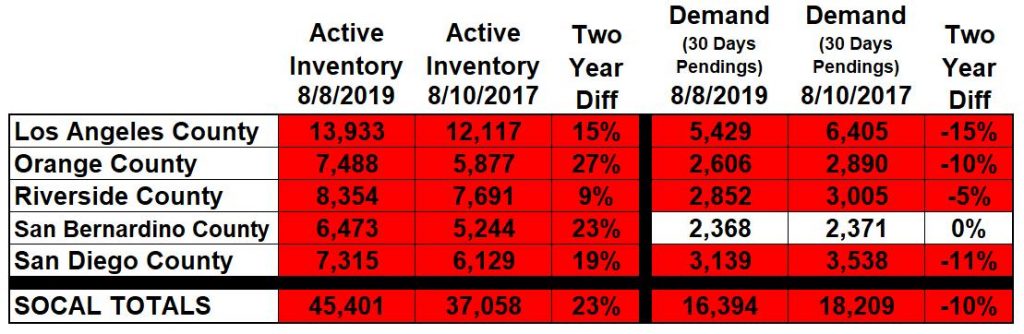

Orange County housing has improved dramatically since all the cracks of last year. But that does NOT mean that the market is back on track and will rapidly appreciate like it did before. Take a closer look at demand. It is up 9% compared

to last year. But, do NOT get too excited in comparing the market this year to last year. The numbers are going to look great for the rest of the year compared to 2018. However, housing grinded to a halt from July to the end of 2018. A better comparison is to look at the market when it was hot, improving, and appreciating.

Contrasting this year to 2017 paints a much better picture as to where local real estate is heading. Demand in Orange County is off by 10% compared to 2017. It is still muted, just not sliding off a cliff like it was last year. The inventory is up by 27% compared to two years ago. The Expected Market Time is at 86 days compared to 61 days in 2017.

It is time for everybody’s expectations to be adjusted. The market is not as hot as before. Housing is not sliding into the abyss. Property values are not skyrocketing right now, but they are not falling either. Local real estate is not changing that much; what you see is what you get. Low mortgage rates have saved the day and they are not going anywhere. Instead, they are on the decline, reaching three-year lows. These low rates will cushion the market from stalling.

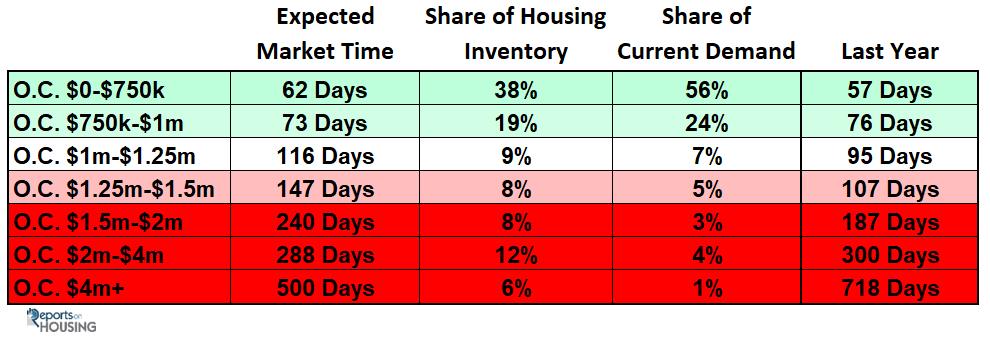

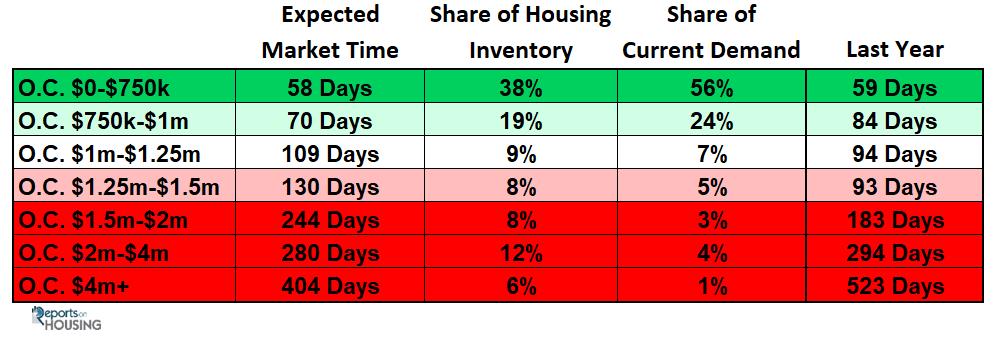

The Expected Market Time today is 86 days, identical to last year. Unlike last year, when it climbed to 134 days by year’s end, it will only rise slightly from here. At 86 days it is a slight Seller’s Market. That is a market that is characterized by not a lot of appreciation, but sellers get to call more of the shots during negotiations. It will most likely move to a Balanced Market from here, one that does not favor sellers or buyers. The market is hottest in the lower ranges where there are more multiple offers and sales prices are closer to their list prices. As the price climbs above $1 million, the market slows considerably, Expected Market Times climb, multiple offers are NOT the norm, sales prices are not as close to their asking prices, and there are a lot fewer success stories.

The bottom line: while housing is not as robust today as prior years, it is not spiraling out of control and will not result in a housing downturn anytime soon. The sky is not falling.

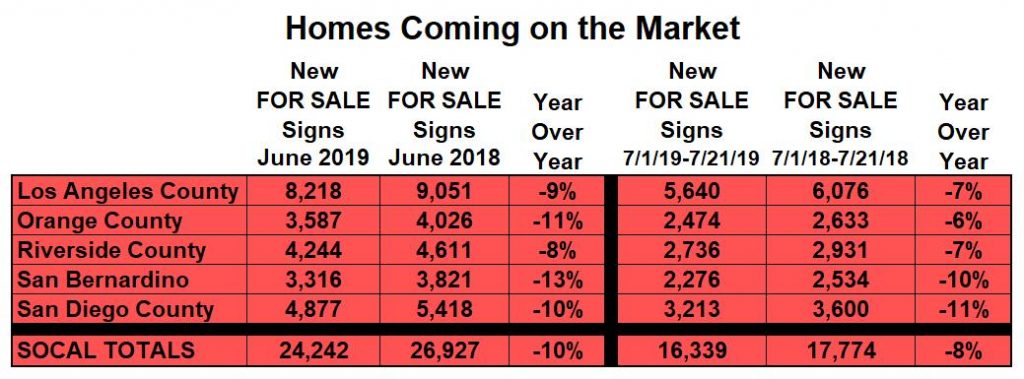

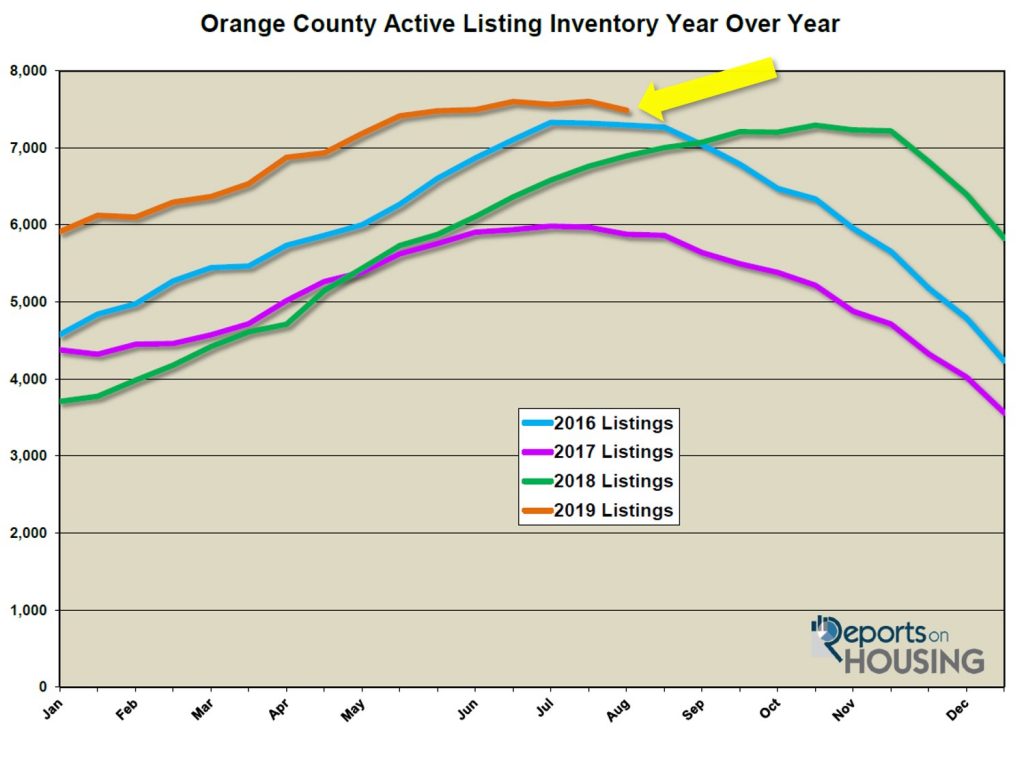

Active Inventory: The current active inventory shed 113 homes in the past two-weeks. In the past two-weeks, the active listing inventory dropped by only 113 homes, down 1%, and now totals 7,488. It looks as if the housing peak occurred two weeks ago and will drop from here. In comparing this year to last year, the difference at the beginning of the year was staggering. There were 2,204 more homes than 2018 at the start of January, 59% more. Today, there are 595 more homes compared to last year in August, 9% more. The difference is dissipating and within the next month, there will be fewer homes compared to the prior year.

From now through the end of the year, the active listing inventory will slowly drop, and will pick up speed during the holidays when fewer homes come on the market and many unsuccessful sellers pull their homes off the market.

Demand: In the past two-weeks, demand increased by 4%. Demand, the number of new pending sales over the prior month, increased by 101 pending sales in the past two-weeks, up 4%, and now totals 2,606. It is the largest gain for the beginning of August since 2013. In the coming weeks ahead, the market will be transitioning to the Autumn Market when fewer homes come on the market and demand begins to dip slowly, leaving behind the two best times of the year in terms of activity, the Spring and Summer Markets. It will slowly decline for the remainder of the year, picking up steam during the holidays.

Last year at this time, there were 212 fewer pending sales than today. Current demand is still muted, just not as severe as this time last year when interest rates were climbing. Two years ago, it was 11% stronger than today.

The current Expected Market Time decreased from 91 days to 86 days in the past two weeks, a slight Seller’s Market (60 to 90 days), where sellers get to call more of the shots during a negotiation and property values are not increasing by much. Last year, the Expected Market Time was at 86 days, identical to today.

Luxury End: The luxury market improved in the past couple of weeks. In the past two-weeks, demand for homes above $1.25 million increased by 15 pending sales, a 5% increase, and now totals 331. The luxury home inventory decreased by 44 homes and now totals 2,507, a 2% drop after reaching a height for the year two-weeks ago. The overall Expected Market Time for homes priced above $1.25 million decreased from 242 days to 227 over the past two-weeks, still sluggish.

Year over year, luxury demand is the same and the active luxury listing inventory is up by an additional 355 homes, or 16%. Extra seller competition and continued muted demand is a trend that will persist for the remainder of the year. The expected market time last year was at 195 days, better than today.

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the Expected Market Time decreased from 147 to 130 days. For homes priced between $1.5 million and $2 million, the Expected Market Time increased from 240 to 244 days. For homes priced between $2 million and $4 million, the Expected Market Time decreased from 288 to 280 days. For homes priced above $4 million, the Expected Market Time decreased from 500 to 404 days. At 404 days, a seller would be looking at placing their home into escrow around September 2020.

Orange County Housing Market Summary:

- The active listing inventory decreased by 113 homes in the past two-weeks, down 1%, and now totals 7,488. The inventory most likely reached a peak for the year of 7,601 two weeks ago. Last year, there were 6,893 homes on the market, 595 fewer than today. There are 9% more homes than last year.

- Demand, the number of pending sales over the prior month, increased by 101 pending sales in the past two-weeks, up 4%, and now totals 2,606. Last year, there were 2,394 pending sales, 9% fewer than today.

- The Expected Market Time for all of Orange County decreased from 91 days two weeks ago to 86 days today, a slight Seller’s Market (between 60 to 90 days). It was at 86 days last year.

- For homes priced below $750,000, the market is a hot Seller’s Market (less than 60 days) with an expected market time of 58 days. This range represents 38% of the active inventory and 56% of demand.

- For homes priced between $750,000 and $1 million, the expected market time is 70 days, a slight Seller’s Market. This range represents 19% of the active inventory and 24% of demand.

- For homes priced between $1 million to $1.25 million, the expected market time is 109 days, a Balanced Market.

- For luxury homes priced between $1.25 million and $1.5 million, in the past two weeks, the Expected Market Time decreased from 147 to 130 days. For homes priced between $1.5 million and $2 million, the Expected Market Time increased from 240 to 244 days. For luxury homes priced between $2 million and $4 million, the Expected Market Time decreased from 288 to 280 days. For luxury homes priced above $4 million, the Expected Market Time decreased from 500 to 404 days.

- The luxury end, all homes above $1.25 million, accounts for 34% of the inventory and only 13% of demand.

- Distressed homes, both short sales and foreclosures combined, made up only 0.8% of all listings and 1.4% of demand. There are only 20 foreclosures and 37 short sales available to purchase today in all of Orange County, 57 total distressed homes on the active market, up one in the past two-weeks. Last year there were 88 total distressed homes on the market, slightly more than today.

- There were 2,871 closed residential resales in July, 5% more than July 2018’s 2,734 closed sales. July marked a 6% increase compared to June 2019. The sales to list price ratio was 98.3% for all of Orange County. Foreclosures accounted for just 0.5% of all closed sales, and short sales accounted for 0.24%. That means that 99.3% of all sales were good ol’ fashioned sellers with equity.

Article courtesy of Steven Thomas Quantitative Economics and Decision Sciences.

Sincerely,

Roy Hernandez

TNG Real Estate Consultants

Cell 949.922.3947