Mortgage rates have fallen close to their lowest levels in nearly a year, but housing demand hasn’t budged much yet.

Freddie Mac FMCC -1.36% reported Thursday that the average 30-year, fixed-rate mortgage rose to 4.14% this week, up from 4.12% last week but down from 4.4% just two months ago. This puts rates at roughly the same level seen in late October 2013 and again last June, when rates were zipping up as investors braced for an end to the Federal Reserve’s bond-buying programs.

But even with low rates, mortgage applications have been soft, according to a separate report from the Mortgage Bankers Association, a sign of still muted demand for home loans.

What’s going on?

First, a longer view helps. True, mortgage rates are low—as low as they’ve been in almost 12 months. But in the same way that shoppers may not be lured by “low prices” at a department store that is always advertising a sale, mortgage rates at 4.1% may not be seen as a steal by buyers who lived with rates that were even lower for all of 2012 and the first half of 2013—especially considering that prices have moved higher.

Put differently, which change is more dramatic—a decline in interest rates from 5% to 3.5% over the two years beginning in February 2011 or the decline from 4.5% in January to 4.1% in May?

Given the time it takes for home purchases to come together and the fact that the decision to purchase a home isn’t purely rate-driven—buyers also must weigh what’s for sale, their family and job situation, etc.—it could take a while to see what effect, if any, the recent drop in interest rates has had on demand.

So do rates really matter? At the margins, yes. They’re a key component of a borrower’s monthly payment. And often the first conversation between a real-estate agent and a potential buyer—”How much are you willing to spend?”—can be influenced quite a bit by mortgage rates, provided the buyer isn’t paying entirely in cash.

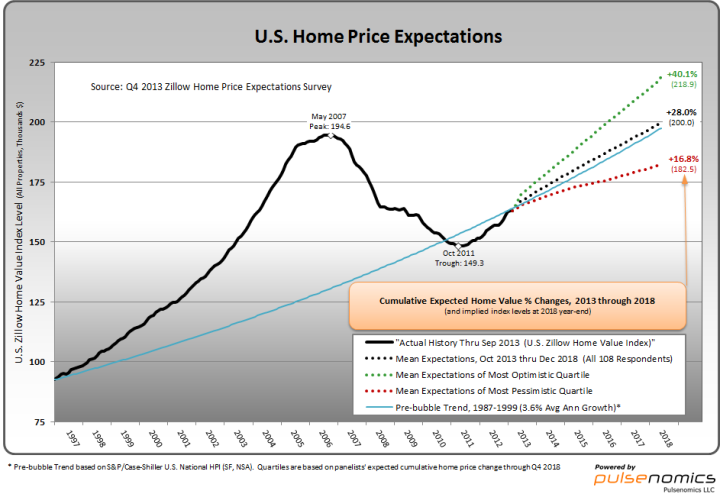

What does this payment picture look like right now? The monthly payment on the median-priced U.S. home fell from $673 in February 2011 to $552 in September 2012 as interest rates fell. Interest rates stayed low through May 2013, but the average payment rose to $586 as home prices ticked up. (These calculations assume a 20% down payment on the national median home value as calculated by Zillow).

After interest rates jumped last summer, that average payment bounced to $674 in September 2013. Rising prices and, especially, higher rates eroded the affordability gains of the previous 2½ years in a matter of months. Payments haven’t budged much since then. Modest declines in interest rates have offset modest gains in home prices.

Some look at this and say: wait a minute, a 4.5% mortgage is still an insanely good deal. Why would a rise in rates to levels that are still quite low hurt housing demand? One possible explanation: the overall level of rate matters over the long run, but the speed with which rates rose last year could have dented demand in the short run.

Several economists have argued recently that mortgage rates increases played an important role in last year’s sales slowdown. In part, that’s because activity received a larger boost when mortgage rates were falling from 2011 to 2013 than previously anticipated, wrote Goldman Sachs economists Sven Jari Stehn and David Mericle in a recent report.

The Goldman analysis suggests that the slide in mortgage rates between 2011 and 2013 increased residential investment—the primary measure of housing’s contribution to GDP—by 5 percentage points. “As this tailwind dissipates going forward, the trend in housing activity might be somewhat lower than previously assumed,” they write.

Last year’s mortgage rate increase accounts for nearly half of the difference in expected housing growth and the lower, actual growth, according to a separate analysis published last week by economists at the Federal Reserve Bank of Cleveland.

This isn’t to say that the cold winter and the rate jump are the only reasons housing has slowed down. Low rates and prices may have spurred the release of pent-up demand throughout 2012, as home prices began to rise. This one-time benefit, together with aggressive home purchase by investors (also a temporary phenomenon), could have given false signals about the true health of the demand side of the market in 2012 and 2013.

Moreover, incomes have showed little growth, meaning that it will be harder for more buyers to buy homes if prices continue to rise absent some gains in wages or even bigger declines in financing costs. Sales are also being restrained by low levels of homes for sale, which is pushing prices higher. Some would-be buyers don’t have enough equity to sell their current home, while others have high levels of student debt.

WSJ by Nick Timiraos