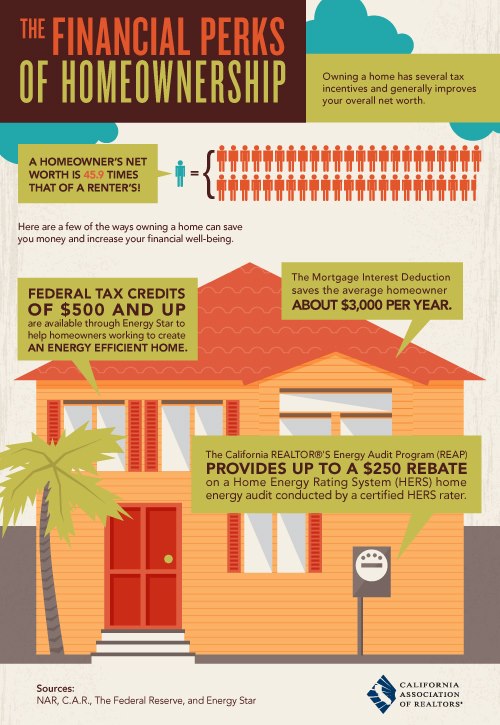

There are many reasons people invest in real estate. Besides the myriad of personal reasons to buy, here are just illustrations of the financial perks of buying a home in California. Call or text me for more information or questions at 949-922-3947.

5 Reasons Your Home’s Staging Might Not Be Awesome (Even if You Think it Is)

Nowhere in life is the old adage that beauty is in the eye of the beholder truer than in real estate. One woman’s dream home might be a mid-century modern, Mad Men styled contemporary, while another’s includes all the gingerbread charm of a classic Victorian. But when it comes to prepping a home to be viewed and (fingers crossed!) sold, there is both art and science to staging a home before its listed to maximize its appeal to the broadest number of target buyers.

Nowhere in life is the old adage that beauty is in the eye of the beholder truer than in real estate. One woman’s dream home might be a mid-century modern, Mad Men styled contemporary, while another’s includes all the gingerbread charm of a classic Victorian. But when it comes to prepping a home to be viewed and (fingers crossed!) sold, there is both art and science to staging a home before its listed to maximize its appeal to the broadest number of target buyers.

The challenge is this: staging is an investment, one every seller can’t afford to make (although studies have shown professionally staged homes sell faster and for more than non-staged counterparts). So many take it on as a do-it-yourself project which, like all DIY home improvement projects, can be fantastic or, mmm, not – depending on the approach, skill, and resources of the “self” who does it.

The only thing worse than not staging your home for sale at all is to spend your time and money doing the work only to have buyers react badly to it. Here are a few common scenarios in which sellers think their staging is awesome and buyers, well, beg to differ:

1. You used beat up or ugly furnishings and decor. Great staging – DIY or professional – includes choosing furniture that shows the home off in its best light, and positioning the furnishings optimally, too. Sometimes this can be done using certain pieces of the seller’s furniture, other times, furniture must be rented or otherwise obtained. One area in which budget-minded sellers like to save money on staging is by finding cheaper alternatives than renting new furniture from a staging company or store.

In this era of Craigslist, eBay, Freecycle, estate sales and other peer-to-peer online stores and trading sites, there is an abundance of access to used furniture at great prices. I have no bone to pick with the smart sellers who use these tools to replace their own furniture with something that is in better condition, more attractive or a smaller scale than their own, so as to highlight how much space their home truly offers. That said, using old, floral sofas from Craigslist’s Free Section, unattractive thrift store “artwork” or even your own truly worn out, old furniture is a recurring reason buyers cite for focusing on how bad the staging is vs. the house itself.

What’s worse, the furnishings you might think was THE BEST BARGAIN EVER might actually give your nice home a worn-down, unkempt feel to the buyers who come to see it.

2. You created distracting themes and scenes. My friend Barb Schwarz is the head of the International Home Staging Professionals Association; she defines staging as “preparing a home for sale so the buyer can mentally move in.” The goal is for buyers to visualize the new-and-improved versions of their lives that your home will help them realize, so some pro stagers will set up objects to communicate the lifestyle activities that a home facilitates. It’s not bizarre to see a breakfast table and chairs on the patio of a home with lovely views, a crib and baby gear-vignette in a small room suitable for a nursery, or a popcorn maker and recliners to show off a media room’s theater-readiness.

Occasionally, though, these scenes and vignettes can go rogue, creating borderline bizarre scenarios that distract and detract more than they help.

A beach scene (ball, umbrella and all) in a midwestern bedroom, a lively Parisian mural and Eiffel tower replica in a California condo and bizarre collections (taxidermy, anyone?) are all real-life examples of staging scenes that have done more harm than good.

3. Your house is neither clean nor clutter-free. For various reasons, some homes just take time to sell. And if you’re living in a home that is on the market for long, it can be challenging to ensure it is perfectly pristine at all times, meaning every single time a buyer enters it. And it doesn’t take a truly filthy house to turn a buyer’s impression of your home from awesome to awful. The little messes that a family accumulates through daily living can be perceived by buyers as distracting at best – disgusting, at worst.

If your home is well staged, do not underestimate the power of piles of clothes, mail, paperwork, dishes or kids’ toys to deactivate the home-selling power of all the hard work and money that went into preparing the property in the first place.

4. There are glaring gaps. Sometimes a home’s staging leaves a glaring gap, an elephant in the room house, so to speak. This often happens when sellers run out of time and money to prepare a place, but it can be avoided through smart advance planning and budgeting for your pre-listing property preparation.

Rooms – Listen, I personally live in a house that is beautiful everywhere until you poke your head into my young adult son’s room. So I can relate. This situation might be okay to live with, but it’s a real home staging fail for a property that’s on the market. Don’t let there be one or two rooms that it looks like the stager – or house cleaner – missed. And this goes for the garage, closets, cupboards and drawers, too. Buyers like to look inside these areas to see how much space they have – if they are crammed full of junk, it creates the impression that the house lacks storage and order.

Exterior vs. interior. Some homes have amazing curb appeal, but look like they’ve been run over roughshod on the inside. And the opposite is true: some look like Martha Stewart handled the inside and junk man extraordinaire Fred Sanford was in charge of the yard. Neither of these is ideal.

Multi-sensory gaps. If your home is beautiful to the eye but smells bad, is strangely hot or cold, or has a noise issue (think: neighbors’ music, freeway noise or strange in-house creaks or whirrs), buyers might appreciate the visuals but fixate on the multi-sensory challenges. Especially if you have pets, you might want to ask a friend or your agent to step in from the outside and give you a gut check on whether your home is smelly – you might be so used to it you can’t trust your own senses.

5. You lacked a neutral, expert eye. Home decorating and home staging are two different things. When you decorate your home, you customize it with your specific tastes, preferences and aesthetics in mind. When you stage it, you aim to neutralize your home’s look and feel so it appeals to more buyers and doesn’t have turn-off potential.

Schwarz puts it this way: “Decorating a home is personalizing it. Staging a home is depersonalizing it.”

I cannot count the number of beautifully decorated homes I’ve seen where the seller must have thought they needed to do zero staging, and where the seller was simply wrong. Their very personal tastes in Elvis quilt art, red lacquer furnishings or sewing machine collections had been beautifully executed for them, but also were so highly personal, so very specific that it was near-impossible for a buyer to envision their own lives or families or homes or activities taking place in that space.

This is one reason I encourage even sellers who are on a tight budget and can’t afford pro staging and sellers whose homes that have been beautifully decorated to at least have a home staging consultation with their agent and a professional stager. These pros can call out little “edits” (furniture or decor items you should remove) and give you advice about what buyers love and hate to see in a home that you might be able to execute yourself at a surprisingly low cost.

From Trulia Real Estate, author Tara Nicholle Nelson (broker in San Francisco)

5 Things Consumers Should Expect From Housing Market In 2013

In 2012, the national housing market finally turned a corner. We’ve now experienced 13 straight months of home value appreciation. Sales were up significantly over 2011 as buyers returned to the market, boosting demand.

So what will 2013 have in store? Here are five things consumers can expect to see in the housing market next year:

Up, Up and Away

- The national housing market hit bottom in October 2011, and home values have since risen 5.3 percent from that trough. The most recent Zillow Home Value Forecast calls for 2.5 percent appreciation nationwide from November 2012 to November 2013.

- According to a recent Zillow survey of more than 100 economists and analysts, respondents predicted home values (based on the S&P/Case-Shiller U.S. National Home Price Index) to rise 3.1 percent in 2013, on average.

- Most markets covered by Zillow’s Real Estate Market Reports have already bottomed out, with only 10 of 255 covered metro areas not projected to hit a bottom within the next year.

Bottom Line: Homeowners looking to sell in 2013 can largely rest assured they won’t be selling at the bottom, and many will find themselves in a sellers’ market. Potential buyers in 2013 may be more motivated to get a deal done while affordability is still extremely high and mortgage rates continue to be historically low.

Real Estate Is Local Again

- According to the Zillow Breakeven Horizon, buying beats renting when staying in the home for three years or more in roughly 60 percent of U.S. metros. The areas where it might make more sense to buy (if you’re planning on staying for three-plus years) are clustered in the Southwest and Southeast. If you won’t be staying put for at least a few years, consider renting in the Northeast, where buying often doesn’t make more financial sense until five years or more.

- The goal of Zillow’s Buyer/Seller Index is to determine where buyers have the most leverage in a sale, and where sellers might have the upper hand. In general, we determined that metro areas in the West and Southwest – including the Bay Area, Las Vegas and Phoenix – are strong for sellers. Metros in the Midwest and Mid-Atlantic – places such as Chicago, Cleveland and Philadelphia – are best for buyers.

Bottom Line: The housing market recovery has remained true to the old real estate axiom of “location, location, location.” How your local market is faring today – and if it makes more sense to buy or rent, to sell now or to hold off if possible – is largely determined by unique, local factors and fundamentals. Arming yourself with timely and comprehensive local market information is good advice at any time, but will be even more important in 2013 as buyers continue to seek bargains and sellers look to maximize returns.

Coming Up for Air

- In the third quarter of 2012, the percentage of homeowners with a mortgage in negative equity – or “underwater,” owing more on their mortgage than their home was worth – fell below 30 percent for the first time since Zillow began tracking that data using an improved methodology in early 2011.

- Still, 28.2 percent of homeowners with a mortgage remain underwater. Because underwater owners have a far more difficult time selling their home, a large number of homes that otherwise might end up on the market aren’t getting listed. As a result, inventory in many areas is incredibly tight, leaving buyers to fight it out amongst themselves, which in turn can help drive up prices. This, among other factors, has led to tight inventory in many of the hardest-hit cities around the country.

Bottom Line: As home values continue their upward march in 2013, more homeowners currently trapped underwater will begin to surface. This will be good for buyers exhausted by limited inventory and intense competition in markets such as Phoenix and Miami, but it will also have the effect of cooling price increases. As a result, in 2013, we predict home value appreciation in many areas will look more like a series of steps, characterized by cycles of price spikes and plateaus. Price spikes will free some homeowners from negative equity, allowing them to sell, thereby easing supply constraints and dampening prices until the cycle is repeated.

Historically Affordable

- Mortgage interest rates have been hovering at or near historic lows for the past year, and the Federal Reserve has taken concrete steps to ensure they stay low for at least the foreseeable future.

- At the same time, home values – while recovering nicely – still have a long way to go to reach their pre-bubble levels. Overall, national home values in November were still down 19.4 percent from their peak in May 2007, according to Zillow.

Bottom Line: Between 1985 and 2000, Americans spent, on average, about 20 percent of their household income on mortgage payments. That percentage increased to more than 24 percent by 2006, before falling to just 13 percent by the second quarter of 2012. If you can qualify for a home loan, the combination of low rates and low prices means your home-buying dollar will continue to take you farther in 2013 than in recent years, even for buyers on modest budgets.

Mortgage Interest Deducted?

- Changes to the mortgage interest deduction (MID) may be a key element of any “grand bargain” reached by politicians in order to avert the year-end fiscal cliff. If adopted, any measure to limit or repeal the MID will result in some home price impacts over time and by market segment.

- Home values at the high end of the market will likely be more negatively impacted by MID changes than home values overall, according to a recent Zillow survey of economists. For example, in the event that the maximum MID-eligible mortgage amount is reduced from $1 million to $500,000 and the deduction allowance for second homes is eliminated, the majority of respondents said they expect high-end home prices to fall while U.S. home prices overall experience little or no price impact.

Bottom Line: Real estate lobbying groups have long fought against changes to tax rules allowing for the deduction of mortgage interest, arguing that any changes will impact or eliminate some of the historic financial advantages of owning a home. But unless you’re buying a proportionally more expensive home or are buying in a more expensive area, the impacts of MID changes will likely be muted. The decision to buy or sell a home is highly personal and dependent on a number of factors, only one of which is potential tax implications. In 2013, make your decision to buy or sell based on your own informed opinion and your unique situation.

Click here to contact Roy for more information or questions concerning your real estate goals.

- « Previous Page

- 1

- …

- 3

- 4

- 5