Great news from IRS for sellers that short sell

November 15, 2013

Dear Roy,

As the new president of the CALIFORNIA ASSOCIATION OF REALTORS®, I’m pleased to be the first to inform you of some very good news.

We have been working with California Sen. Barbara Boxer to protect distressed homeowners from debt relief income tax associated with a short sale in California. As part of this effort, Sen. Boxer requested the Internal Revenue Service (IRS) to provide guidance on whether mortgage debt forgiveness in a lender-approved short sale would be taxable income under federal law, given California’s recent non-recourse laws for short sales, which were hard fought victories by C.A.R.

The IRS has clarified in a letter that California’s troubled homeowners who sell their homes in a short sale are not subject to federal income tax liability on “phantom income” they never received. The IRS recognizes that the debt written off in a short sale does not constitute recourse debt under California law, and thus does not create so-called “cancellation of debt” income to the underwater home seller for federal income tax purposes. This clarification rescues tens of thousands of distressed home sellers from personal liability upon expiration of the Mortgage Forgiveness Debt Relief Act of 2007 on Dec. 31, 2013.

C.A.R. is seeking a similar ruling from the California Franchise Tax Board (FTB), which has been awaiting the IRS action; we anticipate the FTB will act promptly. Short sales may raise other tax issues and, as always, you should advise your clients to speak with their tax professional regarding the tax consequences of a short sale.

C.A.R.’s Legal Department has prepared a Realegal to further explain the IRS’s clarification.

I know you join me in expressing our thanks, as well as those of our troubled homeowners, to Sen. Boxer for her leadership on this issue. I will keep you informed and provide additional details as I have them.

Sincerely,

![]()

Kevin Brown

2014 President

CALIFORNIA ASSOCIATION OF REALTORS®

New FHA guidelines coming: Purchase 1 year after “Economic Event”

Read the full article HERE

Read the full article HERE

The financial crisis took its toll on Wall Street and Main Street alike. Mistakes were made and bills went unpaid on both sides of the fence, but Main Street sees Wall Street bailouts and asks “where’s my bailout?” Specifically with respect to the housing market, borrowers who have had bankruptcies, foreclosures, deeds-in-lieu, short-sales, or other adverse credit have heretofore been unable to quickly reestablish themselves as worthy borrowers. That’s changing.

Late last week, The Department of Housing and Urban Development on Thursday unveiled a new set of guidelines under the FHA program specifically geared toward homeowners and prospective homeowners adversely impacted by the Great Recession. The “Back to Work” program, as it’s called, doesn’t constitute a free pass for those who would otherwise be unable to qualify for financing, but it does reopen the housing market to a great many borrowers who would otherwise have been waiting for 3-7 years to tick off the clock–depending on their initial credit issue–before being able to qualify for a mortgage. In FHA’s words:

“As a result of the recent recession many borrowers who experienced unemployment or other severe reductions in income, were unable to make their monthly mortgage payments, and ultimately lost their homes to a pre-foreclosure sale, deed-in-lieu, or foreclosure. Some borrowers were forced to file for bankruptcy to discharge or restructure their debts. Because of these recent recession-related periods of financial difficulty, borrowers’ credit has been negatively affected. FHA recognizes the hardships faced by these borrowers, and realizes that their credit histories may not fully reflect their true ability or propensity to repay a mortgage.”

The program will require prospective borrowers to thoroughly document the nature of the “Economic Event,” that it resulted in derogatory credit, and that there has been a satisfactory recovery from the Event per the new guidelines.

Lenders will consider the Economic Event to have caused the derogatory credit if:

- The prospective borrowers had satisfactory credit prior to the event onset

- The prospective borrowers’ derogatory credit occurred after the onset of the event

- The prospective borrowers have reestablished satisfactory credit for at least 12 months since the the end of the event

Lenders will consider borrowers to have reestablished satisfactory credit if:

- The borrower has no late housing or installment debt payments for the past 12 months

- Open mortgage accounts are current and have been paid on time for the past 12 months

- Borrowers have adhered to the agreement of any open modification plan for the past 12 months

- Complete a course of Housing Counseling in person, via telephone, via internet, or other methods approved by HUD (who provides a list of Counseling agencies).

For the purposes of this program, an “Economic Event” is defined as “any occurrence beyond the borrower’s control that results in loss of employment, loss of income, or a combination of both, which causes a reduction in the borrower’s household income of twenty (20) percent or more for a period of at least six (6) months. The Onset of an Economic Event is the month of loss of employment/income.” Lenders will verify the reduction in income or loss of employment with at least one of the following:

- A written termination notice

- Other publicly available documentation of the business closure

- Documentation of the receipt of Unemployment Income

Additionally, lenders have to verify a 20 percent loss of income due to the Economic Event by documenting borrowers’ income prior to the event. This requirement can be satisfied either with a written “Verification of Employment” form with income details provided by the employer or signed tax returns (or W-2s).

[gravityform id=”13″ name=”Have a question or comment?”]

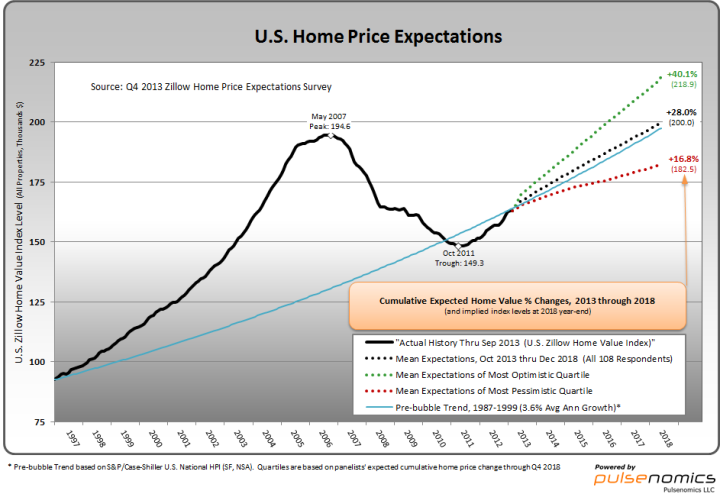

U.S. Home Value Appreciation to Slow in 2014

Pace of Annual Appreciation to Fall to 4.3 Percent in 2014, 3.4 Percent by 2018; Panelists Say Federal Government Should Back 35 Percent of Mortgages, According to Zillow Home Price Expectations Survey

SEATTLE, Nov. 7, 2013 /PRNewswire/ — More than 100 forecasters said they expect the U.S. home values, as measured by the Zillow® Home Value Indexi, to end 2013 up an average of 6.7 percent year-over-year, according to the latest Zillow Home Price Expectations Survey, before slowing over the next five years. Most panelists also said they would like to see the federal government maintain a considerable role in the mortgage market.

The survey of 108 economists, real estate experts and investment and market strategists was sponsored by leading real estate information marketplace Zillow, Inc. and is conducted quarterly by Pulsenomics LLC.

While appreciation is expected to remain strong through the remainder of this year, the pace of home value growth is predicted to slow considerably through 2018. Panelists said they expect appreciation rates to slow to roughly 4.3 percent next year, on average, eventually falling to 3.4 percent by 2018.

Based on current expectations for home value appreciation over the next five years, panelists predicted that overall U.S. home values could exceed their May 2007 peak by the first quarter of 2018, and may cross the $200,000 threshold by the end of 2018.

“The housing market has seen a period of unsustainable, breakneck appreciation, and some cooling off is both welcome and expected,” said Zillow Chief Economist Dr. Stan Humphries. “Rising mortgage rates, diminished investor demand and slowly rising inventory will all contribute to the slowdown of appreciation.”

The most optimistic quartileii of panelists predicted an 8.3 percent annual increase in home values this year, on average, while the most pessimistic quartileiii predicted an average increase of 5.6 percent. Expectations among the optimists fell from 9.3 percent in the last survey, but rose from 5.1 percent among the pessimists. The most optimistic panelists predicted home values would rise roughly 12.5 percent above their 2007 peaks by the end of 2018, on average, while the most pessimistic said they expected home values to remain about 6.2 percent below 2007 peaks.

Diminished, But Still ‘Significant’ Role For Federal Gov’t in Mortgages

A number of public and private plans for overhauling the nation’s mortgage finance system and reforming government-sponsored entities Fannie Mae and Freddie Mac have been proposed, all of which seek to reduce and redefine the government’s role in the mortgage market to some degree. As these policy conversations begin, panelists were asked how involved they think the federal government should be in any re-imagined mortgage system. Among those panelists expressing an opinion, the majority (58.4 percent) said the federal government’s involvement in the conforming mortgage market should be “somewhat significant,” “significant” or “very significant.” Only 8 percent of respondents said the federal government should have a “non-existent” role in the conforming market.

Panelists were also asked to define an appropriate level of government-backing for mortgage loans going forward. Among those panelists expressing an opinion about what maximum percentage of all new mortgages should be backed by the federal government, the median response was 35 percent, roughly the level seen in 2006 at the height of the housing bubble.

“Policy discussions centered on reforming the nation’s housing finance system have only just begun, and it will be very interesting to see what comes out of these debates and how the market will react to new proposals,” Humphries said. “How much mortgages will end up costing average consumers, and the continued availability of traditional mortgage products like the 30-year fixed rate mortgage, are among the critical issues currently at stake for consumers in these debates.”

“Currently, the federal government backs roughly 90 percent of all new mortgage originations in the U.S. in some form,” said Pulsenomics® Founder Terry Loebs. “In 2000, prior to the bubble, the government backed about 50 percent of new mortgages. These benchmarks and survey data are another reminder of the challenges that lie ahead in reforming U.S. housing institutions.”

Banks offering mortgages with only 5% down payments

Good news for homebuyers who don’t have a lot of cash on hand: Banks are offering loans with down payments of just 5%.

After the housing bubble burst, buyers needed to come to the table with as much as 20% down or they had to turn to the Federal Housing Administration for a low down-payment loan.

But now banks like TD Bank, Bank of America (BAC, Fortune 500), and Wells Fargo (WFC, Fortune 500) are loosening the purse strings, offering loans with down payments that are as low as 5%.

TD Bank’s “Right Step” mortgage, for example, allows borrowers to secure a loan with a 5% down payment. It also allows them to receive as much as 2% of the sale price as a gift from a relative or other third party, so they would really only need 3% down.

Why the change of heart? Market opportunity for one thing.

FHA dominated the market for low down payment loans during the housing bust. Taking on all those risky loans, however, depleted the agency’s reserves and has forced it to increase costs.

Related: Money 101 Tips for buying a home

Over the past couple of years, the FHA has been raising premiums. And this year, it started requiring borrowers to buy private mortgage insurance for the life of the loan — an expensive proposition that has sent many prospective borrowers looking elsewhere.

While the loans were far too risky for private lenders to take on before, rising home prices have made them less of a gamble. Plus, the banks think they can offer a better deal than FHA.

“As the FHA selectively reduced market share by increasing premiums, we introduced a substitute for FHA loans,” said Malcom Hollensteiner, the director of retail lending sales for TD Bank.

While the private lenders that are offering the 5%-down loans are also requiring borrowers to buy private mortgage insurance, they are only requiring them to do so until they build up 20% equity in the home.

Related: What will your monthly mortgage payment be?

The difference can really add up. Paying an insurance premium over the life of a $200,000, 30-year fixed-rate loan from FHA that carries an effective mortgage rate of 4.4% (5.75% when you tack on the insurance premium), can add up to nearly $60,000 over the life of the loan.

Of course, homeowners can always refinance to end their FHA insurance, but rates are so low that by the time an FHA borrower is able to refinance to a lower rate, it may not be worth it.

$30.00 Starbucks giftcard drawing

Update…. 11/01/13. Congratulations to Monica Ortega. She won the $30.00 Starbucks gift card. Her son is Austin Rothenbeck. He plays for the Freshman team. STAY TUNED FOR NOVEMBER’S DRAWING FOR TURKEYS!!

Update….Last day to enter $30.00 Starbucks gift card drawing!! Take 2 minutes of your busy day to enter and enjoy coffee for week on us!! Good luck!

Happy October!!

Enter to win our October drawing for a FREE $30.00 Starbuck’s giftcard. Winner will be chosen October 30th, 2013. All entrants will be notified of winning entry via email. One entry per family.

[gravityform id=”10″ name=”$30.00 Starbuck’s giftcard drawing”]

4 Ways to Know Whether to Sell or Stay Put

Every real estate market creates its own buyer and seller personas, or profiles. When the market is slow and prices are low, it brings out ‘the wheeler-dealer’ and ‘the lowballer,’ as well as the ‘paralyzed panicker’ in some buyers.

Every real estate market creates its own buyer and seller personas, or profiles. When the market is slow and prices are low, it brings out ‘the wheeler-dealer’ and ‘the lowballer,’ as well as the ‘paralyzed panicker’ in some buyers.

But sellers aren’t immune.

And in a warm or hot market climate, the rise in home prices makes some sellers wonder whether they should exercise the freedom of finally having some home equity and make a move, or if it’s a better idea to stay put in hopes they can sell for more, next year or later.

Truth is, whether any given person should sell their home or stay put at any given time is a highly personal decision. Market dynamics should come into play, but that should be considered in the context of your personal life, career, family and financial plans.

Trying to figure out whether to sell or stay put? Here are four ways to know which decision is right for you.

1. Sign You Should Sell: You frequently crave a neighborhood upgrade. I have known people who have liveed in “up and coming neighborhoods” for 20 years, and are still waiting for it to up-and-come. Others own homes on streets or in subdivisions they used to love that have changed dramatically because the city has been built up in a different direction, the area was rezoned, or because a school, freeway, commercial development, airport or train station was brought in. And still other home owners fall out of love with their neighborhoods because their job has moved, making their commute a pain.

In any event, if your home’s location is seriously misaligned with your life or your tastes, that fact is one you face all day, every day, for the duration of the time you live in the property. It can become a serious source of life dissatisfaction and resentment that rears its ugly head every time you make your monthly mortgage payment. As I see it, dissatisfaction with your neighborhood or a serious neighborhood-life disconnect can be a strong reason to sell and move, assuming you can make a move to a neighborhood that would better serve your life in a financially responsible way.

2. Sign You Should Stay: You can totally afford a new house – if you sell a kidney. A few years back, a friend of mine wrote a book called Life Would be Perfect if I Lived in That House (Vintage 2011). In it, she told how her mother was so addicted to the grass-is-greener promise of moving to a new home that she would actually take her family Open House hunting, even when they were visiting towns they had no interest in moving to! She went on to relate her inherited real estate addiction to the national trend of “moving on up,” so to speak, with financial recklessness – the trend that many believe led to the Great Recession.

There’s nothing wrong with being a real estate aficionado, but it’s important to watch to make sure grass-is-greener-at-that-house syndrome isn’t motivating you to make a financially unwise decision to sell and move.

If you are considering selling your home and moving up, do your own financial home work. Run your own budgets, income and expense reports and other financials to understand what level of increased financial obligation, if any, your household finances can afford to take. Consider whether you might want to set up some savings, investing or debt elimination targets before making a move. Work with your financial planner, tax professional and your real estate and mortgage pros to fully understand all the financial implications, short- and long-term, of selling and moving before you put the sign up in the yard.

3. Sign You Should Sell: Space-wise, your family is too close for comfort. (And things will get worse before they get better.) I marvel at how much stuff the smallest infant seems to need. I once went to a baby shower that generated so many strollers, packable playpens and sheer gear that it took 2 SUVs and a station wagon to cart it all home – for a kid that ultimately weighed in at 6 pounds and some-odd ounces.

If you have very young children and you’re already tripping over each other, chances are good that their space needs will grow as they do, even after all the baby gear is gone. School-aged kids and teenagers develop their own hobbies and need space for studies and sports – and on top of that, many parents of young children can realistically anticipate moving their own parents in at some point in time.

If you’re struggling to find a space for everything (and everyone), project your space needs out five years into the future. If you think you’ll need less space in five years (e.g., because your kids will likely move out in that time frame), it might not make sense to buy a bigger home now. But if it looks like you’ll need more space before you need less, that can be a sound rationale for making a financially rational move.

4. Sign You Should Stay: You could fix what ails your home with relatively modest remodeling projects. If your home is bothersome primarily because things don’t function very well or its aesthetics are out of whack with your style, you might be tempted to sell and move. Here’s a tip-off: your “dream home” is the Open House one block over that is nearly identical to your home in location, size, architecture, bedrooms and baths, but is impeccably decorated and updated. If you find yourself in this situation, you might very well be able to resolve your issues by investing less than you would spend on the transactional costs of selling and buying another home into some small-to-medium-scale remodeling projects on your current home.

On a budget, painting, landscaping, replacing exterior trims and interior hardware and updating your kitchen appliances will likely give you the biggest boost in home love for your buck. Similarly, you can get a major enjoyment boost out of your home for very little money by bringing a handyperson in to fix all those niggling little items that make a home seem worn out, including:

- drawers that stick

- handles you have to jiggle

- drafts that need stopping up, and

- scrapes and scuffs that make a place look rundown.

That said, when you consider what you would spend on commissions and closing costs to sell one home and buy a nearly-identical new one, you might be able to justify a larger updating/upgrading budget. If you have a little more dough to spend, consider a kitchen or bath remodel, having some custom organizers built in, or putting in the wood floors or deck you’ve always wished for. You might be surprised how fast home hate can turn to love when you start pampering your property.

Sellers: What factors influenced your decision to sell?

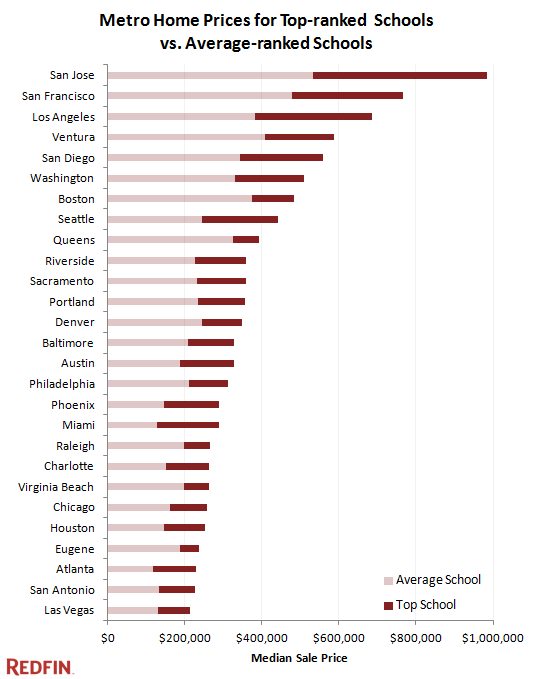

Top schools equal higher home prices

Any good parent wants their child to attend the best school possible, but when it comes to finding a home in a top school district, how much more are buyers willing to pay? A recent study performed by Redfin suggests that many parents are willing to shell out even more than you might think. If you’re trying to sell a home and want to get the most for it, you might want to consider “selling” the school first.

Schools have always played an important role in the buying and selling of real estate. More recently though, premiums for homes served by top-ranked schools have been going up, indicating that buyers place remarkable importance on the quality of schools when buying a house.

An analysis by Redfin illustrates the steep price premiums that homeowners are willing to pay for homes served by top-ranked schools, offering the latest concrete evidence that buyers place remarkable importance on the quality of schools.

The sky-high premiums help explain the ongoing race among listing sites to provide razor-sharp school information.

They could also add fuel to a debate over whether buyers and the real estate agents representing them give too much weight to rankings, which school officials say don’t always provide a complete picture of the differences in the quality of education provided.

Redfin’s study found that buyers pay an average of $50 more per square foot for homes served by top-ranked schools than for those served by average-ranked schools. It also found found that, even within the same neighborhoods, buyers will pay substantially more for homes served by top-ranked schools than they do for comparable homes served by average-ranked schools.

“Homes just a short distance apart with nearly identical attributes are selling for drastically different prices,” the report said. “We’ve looked across the country at homes that have sold in the last three months and found five examples where the prices vary on identical homes by as much as $130,000.”

Not accounting for home size, San Jose, San Francisco and Los Angeles, Calif., carry the highest price premiums for top-ranked schools while Queens, N.Y., Raleigh, N.C., and Eugene, Ore., carry the lowest of all the metros that Redfin analyzed.

The report adds to a growing body of evidence that suggests that many homebuyers are ready to shell out substantial cash for access to top-notch schools.

Three out of 5 homebuyers who responded to a recent realtor.com survey said that school attendance boundaries would be a factor in choosing a home, and most of that group said they’d be willing to go above budget or give up amenities to have their children go to their school of choice.

The online survey, conducted this summer, found that of those who said school attendance boundaries were important:

- 23.6 percent would pay 1 to 5 percent above budget.

- 20.7 percent would pay 6 to 10 percent above budget.

- 9 percent would pay 11 to 20 percent above budget.

- 40.3 percent would not go above budget.

Some school officials have questioned whether buyers and their agents are relying too heavily on test scores and school ranking sites when pricing listings.

Some school officials have questioned whether buyers and their agents are relying too heavily on test scores and school ranking sites when pricing listings.

The San Francisco Chronicle has reported that buyers in San Mateo County, Calif., are willing to pay premiums of $200,000 or more for homes served by schools that score only slightly better than other schools in the same school district. School district officials told the newspaper that homebuyers and their agents may read too much into simplified school rankings offered on real estate sites, and are working with Realtors in the hopes of helping them gain a better understanding of what qualities make for a good school.

A Canadian real estate agent who’s branded herself as her community’s “#1 schools advisor” has rankled school district officials and parents by posting not only standardized test scores on her website, but devising her own system for ranking them. The ranking system penalizes schools with lower household income and parental education levels, or a higher prevalence of single-parent households and English-as-a-second-language (ESL) students.

The increasingly evident focus among buyers on school quality has helped spur a push by listing services to offer deeper school-centric features and data.

Zillow rolled out a school search boundary tool earlier this month that lets users filter home searches for public, private and charter school attendance boundaries by their ratings from a national school rating site.

A handful of other sites, including realtor.com, Trulia and Century 21 Real Estate, offer school-based search tools.

For its study, Redfin analyzed listings on multiple listing services that sold between May 1 and July 31; school zone boundaries provided by Maponics; and additional school data provided by Onboard Informatics and GreatSchools.

Forecast: Calif. home prices to rise 6% in 2014

California home prices and sales are projected to continue rising next year, but price gains will be much more modest than seen in the past year, according to the California Association of Realtors’ 2014 housing forecast.

The 2014 median house price house is projected to rise to $432,800 statewide, up 6 percent from this year’s projected all-year median of $408,600.

The median price of an existing single-family home was up 28.4 percent in the year ended in August and is projected to end the year up 28 percent from 2012 levels. But prices climbed dramatically this year due to a tight supply of homes for sale just as demand came roaring back and interest rates remained at historic lows.

The gains meant that more homeowners who owed more on their mortgages than their homes were worth were freed up to sell their homes.

“As the market continues to improve, more previously underwater homeowners will look toward selling, making housing inventory less scarce in 2014,” said association Chief Economist Leslie Appleton-Young. “As a result of these factors, we’ll see home price increases moderate from the double-digit increases we saw for much of this year to mid-single digits in most of the state.”

Realtor economists also project that home sales will rise 3.2 percent in 2014 to an annual total of 444,000 sales, the most sold in eight years. The 2013 sales tally is projected to fall about 2 percent short of 2012 levels.

Also on the increase: mortgage rates. The association predicted that interest on the traditional 30-year, fixed-rate mortgage will rise to 5.3 percent next year, up from an average of 4.1 percent in 2013.

For a median-priced home with a 20 percent down payment, that 1.2 percentage point gain amounts to a $236 increase in a monthly mortgage payment, or nearly $85,000 in increased interest over the life of the loan.

“The housing market has improved over the past year, and we expect this trend to continue into 2014,” said association President Don Faught. “As the economy enters the fourth year of a modest recovery, we expect to see a strong demand for homeownership, as buyers who may have been competing with investors and facing an extreme shortage of available housing return from the sidelines.”

Article courtesy of OC Register.

O.C. homes for sale double in 6 months

Homes for sale in Orange County have nearly doubled in six months, rising to 6,298 listings as of Thursday, Steve Thomas of ReportsOnHousing.com said in his latest report.

Homes for sale in Orange County have nearly doubled in six months, rising to 6,298 listings as of Thursday, Steve Thomas of ReportsOnHousing.com said in his latest report.

“Orange County housing is moving away from a sizzling hot seller’s market with rapid appreciation to a cost conscious cooler market with restrained appreciation,” Thomas wrote in his latest report.

As listings increased, the number of contracts signings began dropping, falling 25 percent since mid-June, he said.

“The market was starting to cool as values began to dramatically recover from their recession lows a few years ago,” he added. “What looked like a total deal and had attracted a wave of investors had lost a bit of its allure and luster. Investors started looking elsewhere. Homes began receiving fewer offers and buyers shied away from grossly overpriced homes.”

Last year at this time there were 4,416 homes on the market, 1,882 fewer than on Thursday, Thomas reported.

Thomas’ report shows further:

- The biggest increase in listings occurred in the $250,000-to-$750,000 price range. Listings in that price bracket jumped 144 percent to 3,386 homes for sale. That category accounted for just over half off all listings.

- The next biggest increase was in the $750,000-to-$1.5 million price range, which was up 97 percent to 1,536 listings. That group accounted for a fourth of all homes for sale.

- Listings for $1.5 million and above — accounting for 17 percent of the market — increased 39 percent to 1,054 homes.

“Demand continues to drop as we make our way through the autumn market,” Thomas said. “This is cyclically a slower time of the year. … But the downshift is a bit more pronounced this year.”

Article compliments of Johnathan Lansner and Jeff Collins, OC Register.