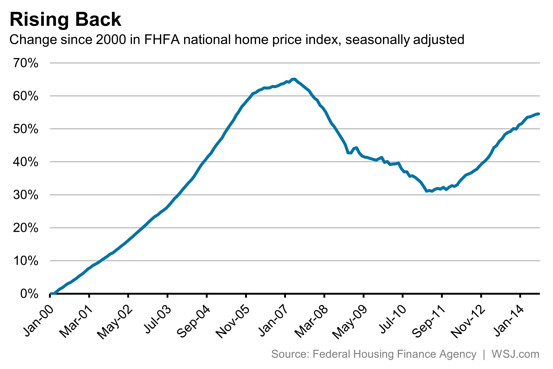

The pace at which U.S. home prices are rising has slowed down, but a new report Tuesday shows that home prices have retraced much of the ground they lost after the 2008 crash.

Prices rose 0.1% in July after adjusting for seasonal factors, according to an index maintained by the Federal Housing Finance Agency. The index is calculated using prices on mortgages backed by Fannie Mae and Freddie Mac. That was down from increases of 0.3% in June and 0.2% in May, but it represents the eighth straight monthly gain.

With the latest increase, home prices are now up 4.4% over the past year. What’s more surprising is that the index shows U.S. prices now standing just 6.4% below their previous peak in April 2007.

The S&P/Case-Shiller index is a separate tool used to measure home prices. It showed a bigger home price boom—and a bigger accompanying bust—in part because it included more expensive homes with loans that weren’t eligible for purchase by Fannie and Freddie. It also didn’t include loans financed by subprime mortgage lenders that weren’t selling loans to Fannie and Freddie.

Also, the FHFA index is unit-weighted, meaning all sales count equally. The Case-Shiller index is value-weighted, which means price changes in more expensive properties receive greater emphasis.

The Case-Shiller national index, which is set to report its own measure of July home prices next Tuesday, showed that home prices in June were 9.9% below their 2006 peak.