L ike the rest of “daily life,” the housing market has not been spared from the sweeping effects of sheltering in place.

ike the rest of “daily life,” the housing market has not been spared from the sweeping effects of sheltering in place.

Supply and Demand: A low supply is confronted with low demand.

Life has changed. Public schools, private schools, day care, universities, date night, dine-in restaurants, sporting events, organized sports, concerts, movie theaters, trips to the mall, amusement parks, public pools, beaches, neighborhood parks, travel, and frozen yogurt have all been put on hold. The “stay at home” order has affected every aspect of daily life. The Orange County housing market is no different.

A man in Orange County tested positive for COVID-19 on January 25th, becoming the first confirmed case in California. On March 4th, Gov. Newsom declared a state of emergency for the Golden State. Disneyland closed its gates and most major sports leagues suspended their seasons on March 12th. Schools closed on March 13th. The “stay at home” order was announced by the governor on March 19th. That means that California citizens had been sheltering in place for four weeks as of April 16th.

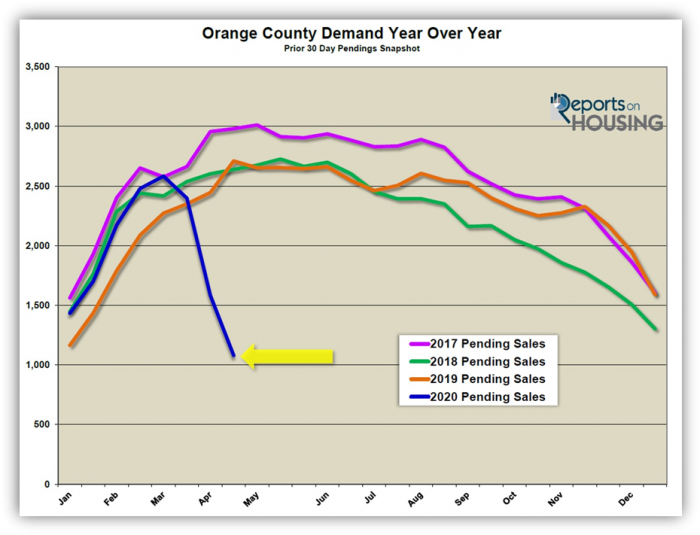

Demand is defined as the past 30-days of pending sales activity. Up to this point, demand readings have included weeks prior to the order when the housing market was still hitting on all cylinders. The market was scorching hot at the very beginning of march despite the state of emergency that was declared. The market began to decelerate in the second week of March. By March 19th, with the kids already at home and preparing for online learning, housing demand slowed to a COVID-19 crawl. It was at inherent demand levels.

Now that it has been more than four weeks of virus suppressed demand, the Orange County demand readings are a true depiction of the number of pending sales that will take place under the “stay at home” circumstances. The current reading is an accurate indicator of the current market until the economy begins to reopen down the road. There is a broad housing market interruption due to the Coronavirus that has had a major impact on the velocity of the market, demand, and the supply of homes, the active inventory. Both have been impacted significantly. Yes, demand is at ultra-low, anemic levels, but so is the active listing inventory. Buyers are not writing that many offers, and fewer homeowners are pounding FOR SALE signs in their front yards.

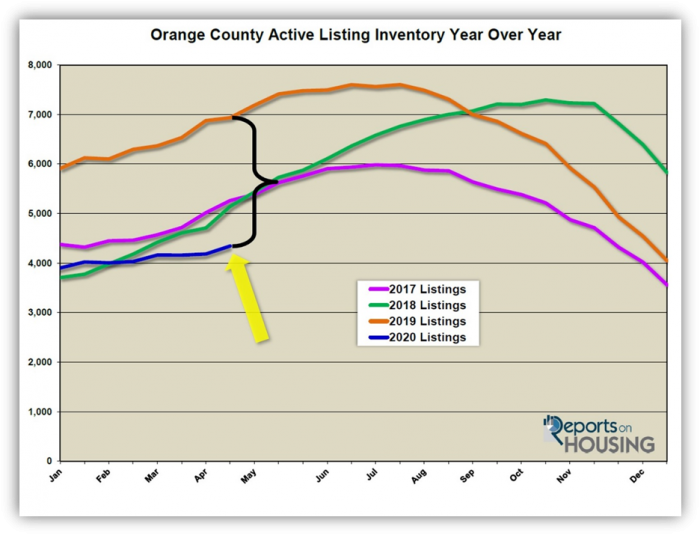

As a result of everyday life grinding to a halt, demand dropped by 55% in the past month, from 2,398 pending sales to 1,080. These demand levels were last seen in 2007. Since the “stay at home” order on March 19th, the number of homes placed on the market dropped by 52% compared to the prior 5-year average. That is 1,972 fewer homeowners entering the fray. Consequently, the active inventory has only grown by 185 homes in the past four weeks, a 4% rise, and the inventory now sits at 4,344 homes. While demand may be at Great Recession levels, the inventory is not growing like it did in 2006 through 2008 when it reached nearly 18,000 homes.

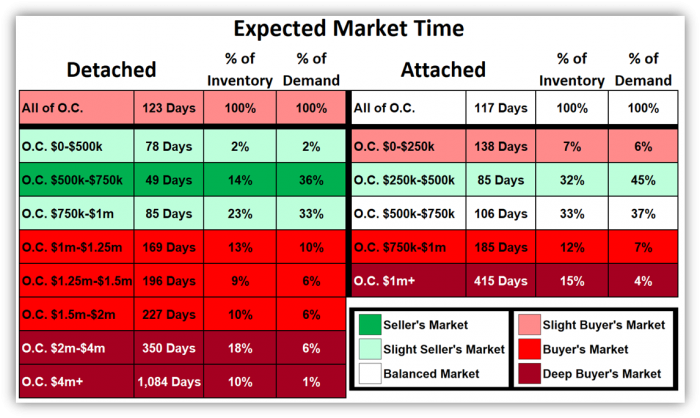

In looking at the county’s different price ranges and detached versus attached, the entire market has been impacted. Yet, there are a few ranges that are still functioning. They have evolved from an extremely hot price range to one that still favors sellers but a bit slower. For detached homes, everything below $1 million lines up at least slightly in the seller’s favor. Between $500,000 to $750,000, the “bread and butter” of the local housing market, detached homes are obtaining more offers than any other range and sellers get to call most of the shots. The Expected Market Time (the time between hammering in the FOR-SALE sign to opening escrow) for that range is at 49 days, a Seller’s Market. Four weeks ago, it was at 25 days. For detached above $1,000,000, the market slows considerably, leaning in favor of buyers. Above $2 million has nearly ground to a halt. For attached, only condominiums between $250,000 to $500,000 slightly favors sellers with an Expected Market Time of 85 days. It was at 34 days four weeks ago. The $500,000 to $750,000 price range for condominiums is balanced. All other condominium ranges, including those below $250,000, favor buyers. For attached above $1 million, the market is extremely slow.

WARNING TO BUYERS: There is very little price movement within the overall Orange County housing market; do not expect a deal. From the real estate trenches, some prospective buyers are expecting values to drop 10%, 20%, or even 30% like they did during the Great Recession. The current Expected Market Time for Orange County is 121 days, a slight Buyer’s Market, a market where buyers get to call more of the shots, but values are not changing much at all. During the Great Recession the Expected Market Time climbed to nearly 500-days for all of Orange County. Only at those levels will values drop substantially,

WARNING TO SELLERS: Until the shelter in place order is lifted expect meager buyer activity, showings, and offers. Even with real estate being reclassified as an essential service, it really has not moved the needle in terms of demand. Expect demand to remain at its current, inherent levels and the active inventory to continue to slightly grow, ultimately slowing the market further until the economy is unlocked.

Across the board, the broad housing market has been interrupted and the disruption will continue. Even when the governor opens economic activity, it will not be a light switch flipped to “on;” instead, it will be more like a dimmer. Demand will slowly thaw as more homeowners opt to place their homes on the market. It will be a slow, gradual evolution and there will not be a sudden spike in either supply or demand.

Active Inventory: The current active inventory increased by 4% homes in the past two-weeks.

The active listing inventory increased by 161 homes in the past two-weeks, up 4%, and now sits at 4,344. This is the lowest level for mid-April since 2013, when the inventory reached the most anemic level of the housing expansion. Quite simply, there are very few homes on the market right now. This is due primarily to homeowners opting to NOT come on the market right now, with 52% fewer new FOR SALE signs in the past four-weeks compared to the prior 5-year average. This will continue until the economy is opened for business.

Last year at this time, there were 6,933 homes on the market, 2,589 more than today, a 60% difference. There were a lot more choices for buyers last year.

Demand: In the past two-weeks demand continued to plunge.

Demand, the number of new pending sales over the prior month, decreased from 1,584 to 1,080, shedding 504 pending sales, down 32%. Demand reflects all new escrows within the past four weeks. The current level is the first accurate picture of COVID-19 suppressed demand. Prior snapshots have included weeks prior to sheltering in place, with higher demand readings. Current demand is a much more accurate depiction of the business that can take place in the current environment. It will no longer continue to “plunge” as it has for the prior month. It will flatten from here until the economic activity at large can resume. At that point, demand will begin to thaw and rise once again.

Last year, there were 1,644 more pending sales compared to today, 152% extra, more than double.

In the past two-weeks the Expected Market Time increased from 79 to 121 days, a SLIGHT Buyer’s Market (between 120 and 150 days), where buyers get to call more of the shots, but home values are not appreciating much at all. Expect the market to only slightly cool from here as the inventory slightly rises and demand remains flat. Last year the Expected Market Time was at 76 days, much better than today.

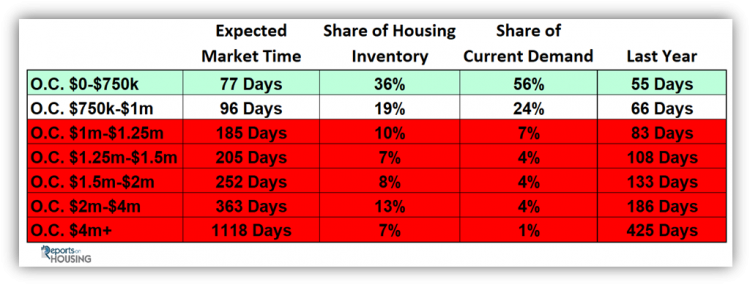

Luxury End: The luxury market is nearly grinding to a halt.

In the past two-weeks, demand for homes above $1.25 million decreased by 66 pending sales, down 32%, and now totals 140. The luxury home inventory increased by 29 homes, up 2%, and now totals 1,501. Many luxury homeowners will continue to opt to wait to list their homes until after the outbreak and demand will remain at these low levels. With a substantial drop in demand, the overall Expected Market Time for homes priced above $1.25 million increased from 214 to 322 days in the past couple of weeks.

Year over year, luxury demand is down by 284 pending sales, or 67%, and the active luxury listing inventory is down by 778 homes, or 34%. The Expected Market Time last year was at 161 days, much better than today.

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the Expected Market Time increased from 120 to 205 days. For homes priced between $1.5 million and $2 million, the Expected Market Time increased from 140 to 252 days. For homes priced between $2 million and $4 million, the Expected Market Time increased from 323 to 363 days. For homes priced above $4 million, the Expected Market Time increased from 903 to 1,118 days. At 1,118 days, a seller would be looking at placing their home into escrow around May 2023.

Orange County Housing Market Summary:

• The active listing inventory increased by 161 homes in the past two-weeks, up 4%, and now totals 4,344. In the past four-weeks, 52% fewer homes were placed on the market compared to the prior 5-year average. Last year, there were 6,933 homes on the market, 2,589 more than today, a 60% difference.

• Demand, the number of pending sales over the prior month, decreased by 504 pending sales in the past two-weeks, down 32%, and now totals 1,080. In the past 5-years, demand has increased an average of 4%. The drop is due to the Coronavirus. Last year, there were 2,724 pending sales, 152% more than today.

• The Expected Market Time for all of Orange County increased from 79 days to 121, a slight Seller’s Market (between 120 and 150 days). The increase is due to the Coronavirus. It was at 76 days last year, much better than today.

• For homes priced below $750,000, the market is a slight Seller’s Market (between 60 and 90 days) with an expected market time of 77 days. This range represents 36% of the active inventory and 56% of demand.

• For homes priced between $750,000 and $1 million, the expected market time is 96 days, a Balanced Market (between 90 and 120 days). This range represents 19% of the active inventory and 24% of demand.

• For homes priced between $1 million to $1.25 million, the expected market time is 185 days, a Buyer’s Market (greater than 150 days).

• For luxury homes priced between $1.25 million and $1.5 million, in the past two weeks, the Expected Market Time increased from 120 to 205 days. For homes priced between $1.5 million and $2 million, the Expected Market Time increased from 140 to 252 days. For luxury homes priced between $2 million and $4 million, the Expected Market Time increased from 323 to 363 days. For luxury homes priced above $4 million, the Expected Market Time increased from 903 to 1,118 days.

• The luxury end, all homes above $1.25 million, accounts for 35% of the inventory and only 13% of demand.

• Distressed homes, both short sales and foreclosures combined, made up only 0.9% of all listings and 1.7% of demand. There are only 18 foreclosure s and 23 short sales available to purchase today in all of Orange County, 41 total distressed homes on the active market, down 4 from two-weeks ago. Last year there were 59 total distressed homes on the market, slightly more than today.

• There were 2,383 closed residential resales in March, 5% more than March 2019’s 2,277 closed sales. March marked a 17% increase compared to February 2020. The sales to list price ratio was 98.4% for all of Orange County. Foreclosures accounted for just 0.4% of all closed sales, and short sales accounted for 0.5%. That means that 99.1% of all sales were good ol’ fashioned sellers with equity.

Leave a Reply