Buying or Selling soon? Get the latest real estate news with ROY!

Read Roy’s take first!

Foreclosures accounted for just 0.4% of all closed sales, and short sales accounted for 0.2%. That means that 99.4% of all sales were good ol’ fashioned sellers with equity. Many fear a foreclosure wave, but I don’t think our government will be forcibly evicting people out of their homes. Not a good political move for either Democrats or Republicans. Foreclosures will increase and short sales will begin next year, but I don’t believe it’ll be a huge wave of foreclosures to hit the market. Look for banks and lenders to work out financing solutions with homeowners in order to keep folks in their homes.

See complete article below…….

OC Housing Report: Wave of Foreclosures?

Foreclosures and short sales have played an exceedingly small part in the housing market for years, yet many feel that is about to change.

The Distressed Market:

Foreclosures and short sales make up less than half a percent of the listing inventory and demand.

Parents worry about their kids all the time. Often, their minds jump to the worst-case scenario. As their newly licensed teenager drives down the street solo for the first time, mom and dad are concerned that their inexperience could result in a devastating accident. Hiking as a family on one of Southern California’s many hilly trails often leads to unexpected sheer cliffs just feet away. Many parents visualize the potential for one of their children to lose their footing and slip to their peril. Parenting is full of anguish. To keep their kids safe, they, unfortunately, must consider the most severe outcome that can reasonably be projected to occur in every situation. Similarly, due to the recession, everybody is jumping to the worst-case scenario for housing, the inevitable wave of foreclosures to come.

It is crucial to immediately point out the simple fact that just because the economy is in the midst of a recession does not mean that the housing market will tank, values must go down, and many homeowners will lose their homes due to foreclosures or short sales. In fact, in the past five recessions, only two have led to declines in real estate values, the recession that began in 1991 and the Great Recession that started in 2008. Both were fueled by asset bubbles in housing that eventually popped. The recession in 1991 was powered by the savings and loan crisis. The Great Recession was driven by subprime lending and risky investments in mortgage securities. Thus, a wave of foreclosures ensued.

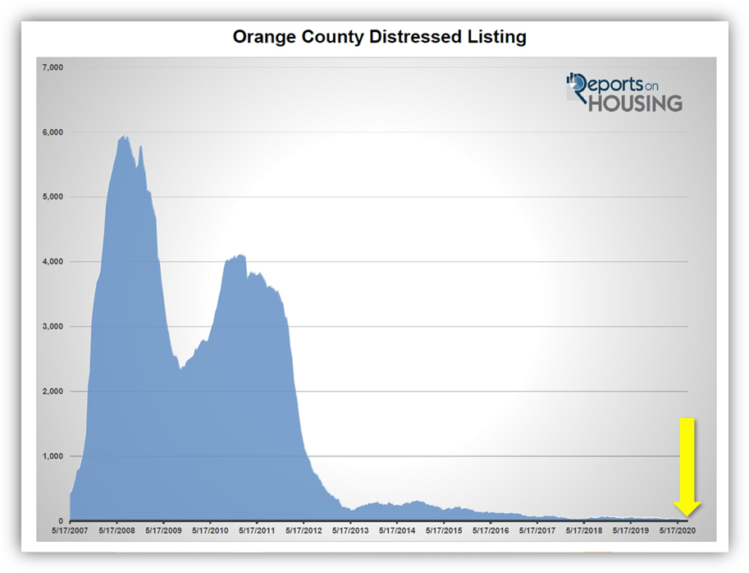

Today, there are only 11 foreclosures and 7 short sales to purchase in all of Orange County, that is 18 total distressed listings, the lowest level since initially tracking distressed listings began back in 2007. It represents only 0.4% of the active listing inventory and 0.4% of demand. Compare that to January 2009 when there were 5,104 distressed listings, 44% of the active listing inventory, and demand (the last 30-days of pending sales) was at 1,428 pendings, 67% of total demand.

That meant that two-thirds of all escrows were distressed. Lenders were in control of the market, either through bank owned listings, foreclosures, or short sales where the lender (or lenders) needed to approve taking less than the outstanding loan balance.

Today, the supply of homes to purchase is low, demand is high, and home values are on the rise. Multiple offers are once again the norm. Homes are flying off the market and into escrow. And, tight lending qualifications continue to be the bedrock and strength of housing.

Even with the strength, many homeowners are worried that the housing market will tank again, and a wave of foreclosures will inevitably follow. This stems from remembering the burn from the Great Recession. Everybody was either burned or knew someone who was hurt by the collapse in housing prices. The economy ground to a halt and unemployment grew to levels last seen at the beginning of the 1980’s. With COVID-19, the economy stopped and unemployment spiked to levels not seen since the Great Depression. As a result, everyone is jumping to the worst-case scenario in their collective minds: housing must suffer.

The current recession is unprecedented. Recessions occur due to a weakness in one area of the economy that is preceded by an implosion of an asset bubble. However, the current COVID-19 recession was instigated by a forced stop of the economy, which allowed United States citizens the ability to hunker down and flatten the curve in the spread of the Coronavirus. It was the pandemic that caused the recession and not a single sector of the economy. This is precisely why the recovery has been distinctly different than a customary recovery. Housing has seen a “v-shaped” recovery, and so has manufacturing and retail sales.

A closer look at unemployment illustrates that it is affecting the lower wage earners. According to the Wall Street Journal, Bureau of Statistics, employment has only dropped 2% since December 2019 for those with bachelor’s degrees. For 16 to 24-year old’s, employment has dropped by 20.6%. Restaurants, movie theaters, amusement parks, and many retail stores have been hit hard. Younger workers have been hit the hardest. Younger, lower wage earners are not homeowners.

There are about 4 million homeowners in active forbearance, which is 7.5% of all active mortgage. Of all current forbearances which are past due on their mortgage payment, 77% have at least 20% equity in their homes, and 90% have at least 10% equity. Upon exiting forbearance, homeowners can negotiate a payment plan to pay back the missed mortgage payments or defer the payments to the back end of their loans. If they are continuing to experience a hardship and are forced to sell, most will have plenty of equity to tap into that will allow them to sell, avoiding the short sale or foreclosure route.

With about 10% of homeowners in forbearance with less than 10% equity, those owners are vulnerable to becoming a distressed sale if they experience a financial hardship. That amounts to approximately 400,000 homeowners. But not all 100% will suffer this fate. Also, with values on the rise, their equity positions will increase in time. Some will not be able to avoid becoming a foreclosure or short sale statistic, but that is a 2021 story. It will be more of ripple in the market than a wave.

The bottom line: do not count on a wave of foreclosures or short sales due to the economic fallout of the COVID-19 recession. While there may be a bit more distressed in 2021, a slight rise, it will pale in comparison to the Great Recession. Nobody should expect any type of a deal anytime soon, especially with mortgage rates that dipped below 3%, reaching yet another record low.

Active Listings

The current active inventory decreased by 3% in the last two weeks.

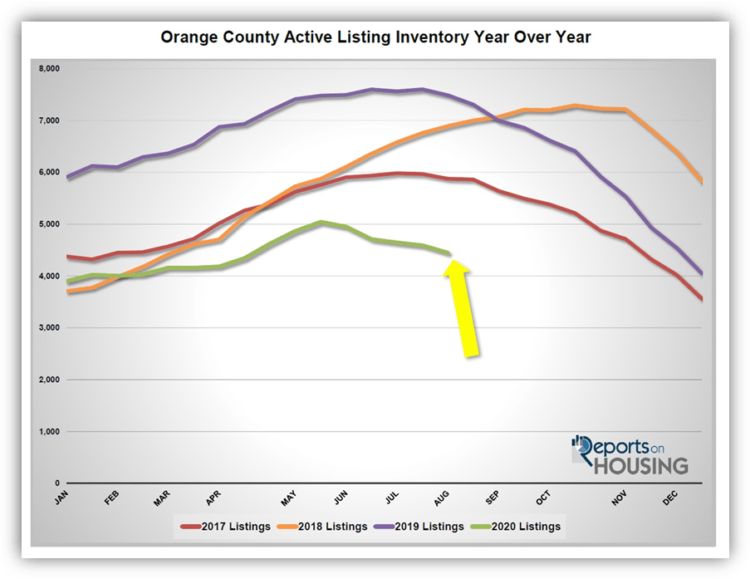

The active listing inventory shed 141 homes in the past two-weeks, down 3%, and now sits at 4,449, the lowest level for August since tracking began in 2004. The active inventory reached a peak back in May at 5,044 homes and has dropped by 12% since. Expect the active inventory to continue to slowly drop from here and pick up steam during the holidays. It appears as if 2021 is going to start at a record low level.

In July, there were 2% more homes placed on the market compared to last year, and it was identical to the 5-year average. COVID-19’s grip on suppressing the inventory has finally vanished.

Last year at this time, there were 7,488 homes on the market, 3,039 additional homes, or 68% more. There were a lot more choices for buyers last year.

Demand

Demand increased by 3% in the past two weeks.

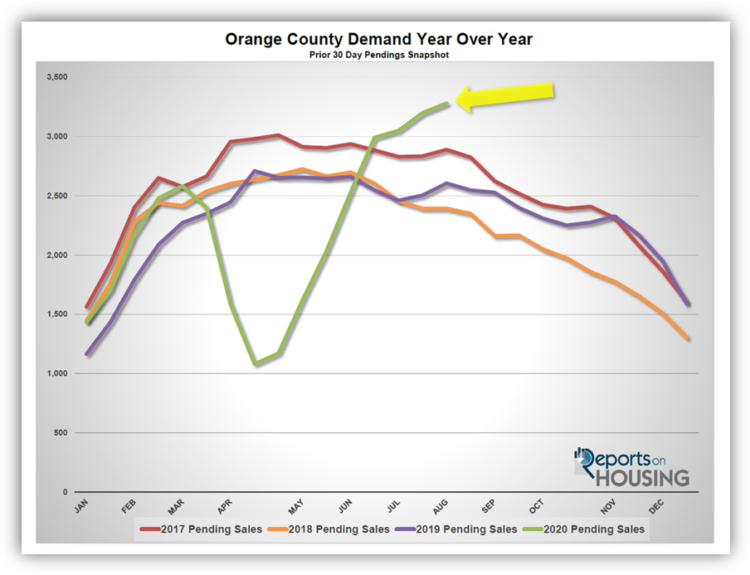

Demand, the number of new pending sales over the prior month, increased from 3,200 to 3,281, an additional 81 pending sales, up 3% in two weeks. This is the highest demand reading since September 2012, eight years ago. Demand customarily reaches a peak between April and May, but due to COVID-19 freezing the market in April, the incredible Spring Market activity was pushed to the Summer Market. The velocity of this current market is unprecedented for the summer months. Once the kids go back to school later this month, anticipate demand to slowly drop. It may not be as large of a drop due to record low mortgage rates and the ability for families to move more readily with online learning.

Last year, demand was at 2,606, that is 375 fewer pending sales compared to today, or 21% less.

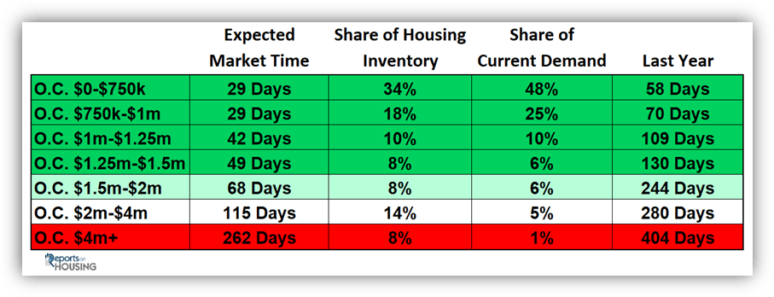

In the past two-weeks the Expected Market Time dropped from 43 to 41 days, a Hot Seller’s Market (less than 60 days), where sellers get to call the shots during the negotiating process and home values are on the rise. This is the strongest level since June 2013. Last year the Expected Market Time was at 86 days, much slower than today.

Luxury End

The luxury market continued to improve with a drop in the supply and a rise in demand.

In the past two-weeks, demand for homes above $1.25 million increased by 9 pending sales, up 2%, and now totals 575. Luxury demand remains elevated at unprecedented levels. Demand is not growing as much and should reach a peak very soon, but it appears that it will remain at a strong level. The luxury home inventory shed 59 homes, a 3% drop, and now totals 1,711. With a small rise in demand coupled with a slight drop in the supply, the overall Expected Market Time for homes priced above $1.25 million decreased from 94 to 89 days in the past couple of weeks. The luxury market remains healthy and strong.

Year over year, luxury demand is up by 244 pending sales, or 74%, and the active luxury listing inventory is down by 796 homes, or 32%. The Expected Market Time last year was at 227 days, drastically slower than today.

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the Expected Market Time decreased from 53 to 49 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 81 to 68 days. For homes priced between $2 million and $4 million, the Expected Market Time increased from 109 to 115 days. For homes priced above $4 million, the Expected Market Time decreased from 274 to 262 days. At 262 days, a seller would be looking at placing their home into escrow around April 2021.

Leave a Reply