Hello,

Many would be buyers are holding off on purchasing and

waiting for the market to change.

When Will the Market Change: The Orange County housing market has reached record heights and has been appreciating for over five years now.

The Orange County Housing Market has been going up nonstop for over five years now. It has been like the initial chain lift hill on one of the many roller coasters at Knott’s Berry Farm. Clickety clack, clickety clack, clicket clack… it seems as if the housing roller coaster could go up forever. Yet, many buyers believe that roller coaster ascent has to reach a peak soon.

Housing does not go up forever. There are peaks and there are troughs. There are times when buyers are in control, and there are times when sellers are in control. The skeptical buyers who are waiting for an end to this madness find many reasons for a housing downturn on the horizon. They point to record prices. They recall mid-2007 when the housing market began to unravel; however, prior to it unravelling, almost everybody felt like the market would increase forever. Very few economists and prognosticators forecasted a crippling housing downturn.

It is completely understandable where these buyers are coming from. They are right. The market will eventually reverse course and depreciate. The questions boils down to “when?” The answer is simply, “not anytime soon.”

To better understand why the market is poised to continue to accelerate forward, it is best to dust off that old Econ 101 book that details supply and demand. When there is too much supply and demand is low, it favors the buyer. When there is not enough supply and demand is high, it favors the seller. With years of a lack of supply of homes and red hot demand, it is no wonder that it has been a hot sellers market for quite some time now.

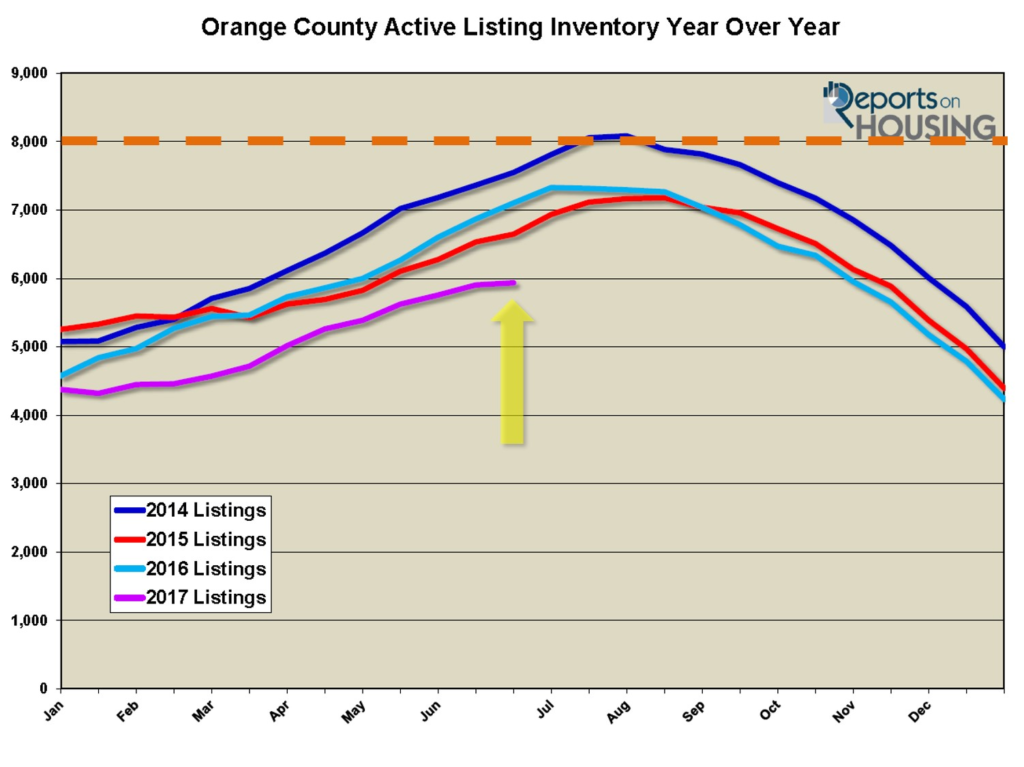

Currently, there are 5,936 homes on the market, the lowest level for this time of the year since 2013. Back then there were 4,732 homes on the market and it was even more difficult for buyers to secure a home than it is today. For housing to move away from a seller’s market towards a balanced market, one that does not favor a buyer or seller, there needs to be at least 8,000 homes on the market for a sustainable amount of time. The more homes on the market, the higher the supply of homes. With more supply often comes softer demand. Only then could housing finally shift towards a buyer’s market.

That is the issue. Supply needs to increase and demand soften. For proper perspective, at the end of June 2007, there were 17,250 homes on the market and the expected market time was over 9-months (that is the amount of time a home is on the market prior to being placed into escrow). Demand (the last month of pending sales) was at 1,894 back then compared to 2,885 today. The current expected market time is 62 days, quite a bit different than a decade ago.

The trend of a lack of inventory and red hot demand stoked by ultra low interest rates, does not look like it will change course anytime soon. Multiple offers is the norm. This holds true for just about any property priced below $1.25 million that is in great condition, nicely appointed, in a good location, and priced right, close to its Fair Market Value. And, in the lower price ranges, buyers are tripping over each other to secure their piece of the American Dream.

For buyers waiting on the market to change, they are in store for a long wait.

Active Inventory: The active inventory increased by only 31 homes in the past couple of weeks.

The active listing inventory added an additional 31 homes in the past two-weeks, a 1% increase, and now sits at 5,936. The biggest issue for Orange County housing this year has been a real lack of inventory. Thus far this year, there have been 6% fewer homes placed on the market. In the past month alone, there have been 10% fewer homes placed on the market. This issue has prevented additional closed sales and has undermined the performance of housing this year.

We can expect the inventory to continue to rise throughout the Summer Market until it reaches a peak somewhere around mid-August. From there, the market will transition into the Autumn Market, from mid-August through Thanksgiving, with fewer homes coming on the market with both the spring and summer in the rearview mirror.

Last year at this time, there were 7,104 homes on the market, 20% more than today.

Demand: Demand decreased by 2% in the past couple of weeks.

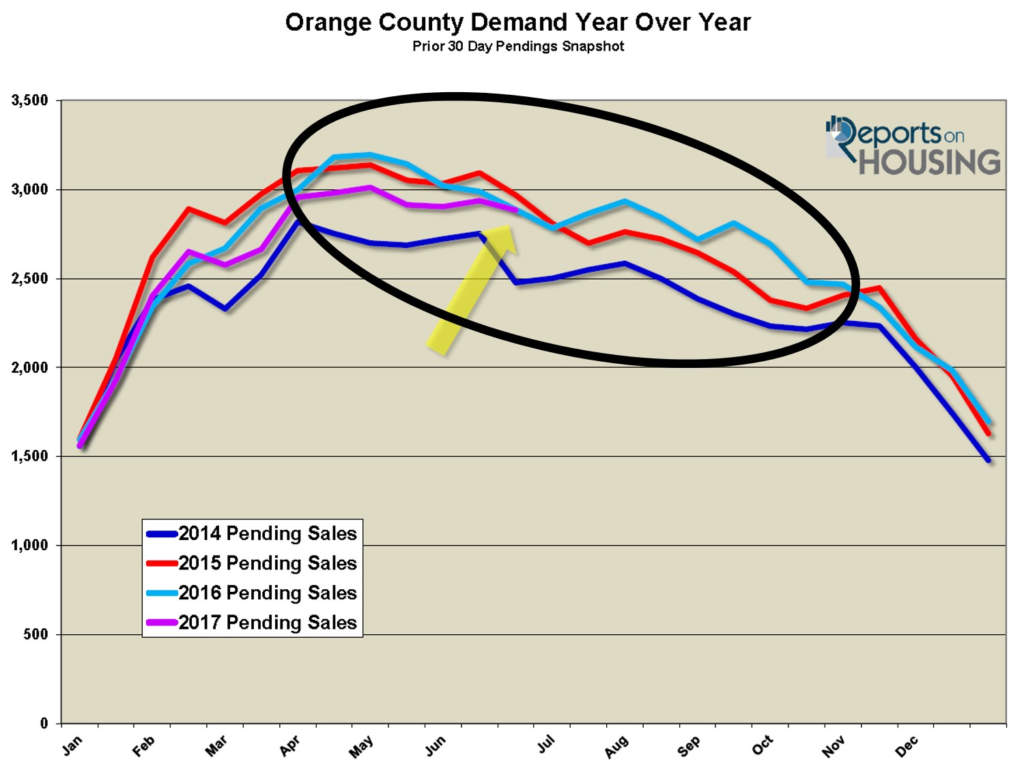

Demand, the number of homes placed into escrow within the prior month, decreased by 52 pending sales in the past two-weeks and now totals 2,885, a 2% decline. Demand is off the most in the entry-level market, homes priced below $500,000. With 22% fewer homes that have been placed on the market so far this year below $500,000, demand is now off by 17%. This market has been underperforming all year due to a real lack of inventory.

We can expect demand to drop slightly from now through the end of the summer.

Last year at this time, there were 2 more pending sales totaling 2,887, almost identical. The expected market time increased from 60 to 62 days in the past couple of weeks. At 62 days, the market is no longer a HOT seller’s market, but a tepid seller’s market with muted appreciation. Last year it was at 74 days.

Luxury End: Luxury demand decreased by 7% in the past couple of weeks while the inventory grew by 3%.

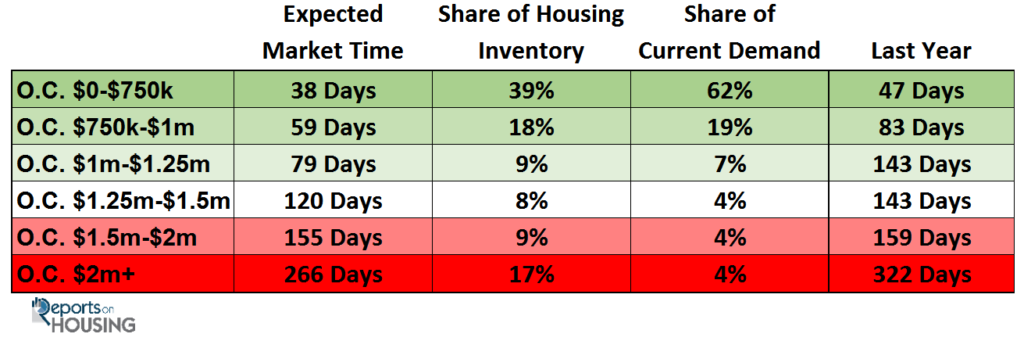

In the past two weeks, demand for homes above $1.25 million decreased from 371 to 344 pending sales, a 7% decline. The luxury home inventory increased from 2,011 homes to 2,068, up 3%. The luxury market downshifted with the beginning of the Summer Market. The supply is up and demand is down.

For homes priced between $1.25 million and $1.5 million, the expected market time increased from 96 to 120 days. For homes priced between $1.5 million to $2 million, the expected market time increased from 148 to 155 days. In addition, for homes priced above $2 million, the expected market time increased from 253 days to 266 days. At 266 days, a seller would be looking at placing their home into escrow around the end of March of next year.

Orange County Housing Market Summary:

• The active listing inventory increased by just 31 homes, or 1%, in the past couple of weeks, and now totals 5,936, knocking on the door of the 6,000 home level. Last year, there were 7,104 homes on the market, 1,168 more than today.

• There are 39% fewer homes on the market below $500,000 today compared to last year at this time and demand is down by 17%. Fewer and fewer homes and condominiums are now priced below $500,000. This price range is slowly disappearing.

• Demand, the number of pending sales over the prior month, decreased by 2% in the past couple of weeks, declining 52 pending sales and now totals 2,885. The average pending price is $830,508.

• The average list price for all of Orange County remained at $1.6 million. This number is high due to the mix of homes in the luxury ranges that sit on the market and do not move as quickly as the lower end.

• For homes priced below $750,000, the market is HOT with an expected market time of just 38 days. This range represents 39% of the active inventory and 62% of demand.

• For homes priced between $750,000 and $1 million, the expected market time is 59 days, a hot seller’s market (less than 60 days). This range represents 18% of the active inventory and 19% of demand.

• For homes priced between $1 million to $1.25 million, the expected market time is at 79 days, a tepid seller’s market.

• For luxury homes priced between $1.25 million and $1.5 million, the expected market time decreased from 96 to 120 days. For homes priced between $1.5 million to $2 million, the expected market time increased from 148 to 155 days. For luxury homes priced above $2 million, the expected market time increased from 253 to 266 days.

• The luxury end, all homes above $1.25 million, accounts for 34% of the inventory and only 12% of demand.

• The expected market time for all homes in Orange County increased from 60 days to 62 in the past couple of weeks, a tepid seller’s market (60 to 90 days). From here, we can expect the market time to slowly rise throughout the Summer Market.

• Distressed homes, both short sales and foreclosures combined, make up only 1.3% of all listings and 2.2% of demand. There are only 27 foreclosures and 49 short sales available to purchase today in all of Orange County, that’s 76 total distressed homes on the active market, 5 more than two weeks ago. Last year there were 135 total distressed sales, 82% more than today.

• There were 3,147 closed sales in May, an 18% increase over April 2017 and a 4% increase over May 2016. The sales to list price ratio was 97.8% for all of Orange County. Foreclosures accounted for just 1.1% of all closed sales and short sales accounted for 1.7%. That means that nearly 97.2% of all sales were good ol’ fashioned equity sellers.

Have a good weekend!

Sincerely,

Roy A. Hernandez

TNG Real Estate Consultants

Cell 949.922.3947

[gravityform id=”22″ title=”true” description=”true”]

Leave a Reply