Hello!

For years now the Orange County housing inventory has been

low, but this year it is more pronounced.

Low Supply: The active listing inventory has been down all year and it is currently off by 14% compared to 2016.

Whew! It is tough to be a buyer looking for a home in today’s market. The biggest complaint has to be that there are simply not enough choices. In fact, nearly 1,200 fewer homes have come on the market so far this year compared to last year. The active inventory currently sits at 5,905 homes; that is 14% fewer than the 6,868 that were available last year.

The trend of fewer homes hitting the market dates back to the beginning of the Great Recession, 2008. Ever since then, fewer and fewer homeowners have placed a FOR SALE sign in their yard. This trend is nothing close to a blip on the radar screen. Something happened to everybody’s collective psyche during the drawn out and bruising recession. Homeowners are staying put.

This year has been off from last year, averaging 222 fewer homes placed on the market each month. As the half way point for the 2017 housing market rapidly approaches, the slower pace has added up. Buyers who have been working hard to secure a home without any luck can attest to the need for additional choices. Yet, the 222 year over year difference is nothing compared to the number of homes on the market during the first decade of the 2000’s. In 2006, there were 2,239 additional homes FOR SALE coming on each and every month. That added up to an additional FOR SALE sign in just about every neighborhood on a monthly basis.

Price is determined by supply and demand. Just for kicks, imagine that demand remained the same. When the same number of buyers are interested in purchasing a home, yet the supply drops considerably, the highest bidder wins. As a result, prices rise. Essentially, that is what has happened over the past five years. In 2012, demand spiked; however, there were not enough homes on the market to satiate the voracious appetite for buyers to buy. Home values have been on the rise ever since.

In past housing run-ups, homeowners have been encouraged and enticed to join the fray, eager to cash in on the market and make a move. That has not been the case during the current five year run. Homeowners have not been tempted to sell like they did from 2000 through 2007.

ADVICE FOR BUYERS: be realistic out of the gate. Don’t delay in pulling the trigger to write an offer to purchase a home. You do not have to overpay, especially now that the housing has transitioned into the Summer Market. Offer the FAIR MARKET VALUE for a home. Most of all, pack your patience.

ADVICE FOR SELLERS: be realistic out of the gate. Far too many seller hit the market overpriced. The market has been on the rise, but it does a majority of its annual appreciation during the Spring Market. Homes appreciate at a much slower rate for the rest of the year. Orange County detached housing values have been increasing at a pace of about 5% per YEAR. That is 365 days, not 30 days. So, price accordingly. A wise strategy is to price a home at its FAIR MARKET VALUE. The better the price, the more activity that is generated. Multiple offers drive the sales price up.

Active Inventory: The active inventory increased by 3% in the past couple of weeks.

The active listing inventory added an additional 148 homes in the past two-weeks, a 3% increase, and now sits at 5,905. Within the next couple of weeks, the inventory will eclipse the 6,000 home mark. Last year that occurred at the start of May.

We can expect the inventory to continue to rise throughout the Summer Market until it reaches a peak somewhere around mid-August. From there, the market will transition into the Autumn Market, from mid-August through Thanksgiving, with fewer homes coming on the market with both the spring and summer in the rearview mirror.

Last year at this time, there were 6,868 homes on the market, 16% more than today.

Demand: Demand increased by 1% in the past couple of weeks.

Demand, the number of homes placed into escrow within the prior month, increased by 33 pending sales in the past two-weeks and now totals 2,937, a 1% increase. Demand is off the most in the entry-level market, homes priced below $500,000. With 23% fewer homes that have been placed on the market so far this year below $500,000, demand is now off by 21%. This market has been underperforming all year due to a real lack of inventory.

We can expect demand to drop slightly from now through the end of the Summer Market.

Last year at this time, there were 52 more pending sales totaling 3,989, or 2% more. The expected market time increased from 59 to 60 days in the past couple of weeks. At 60 days, the market is no longer a HOT seller’s market, but a tepid seller’s market with muted appreciation. Last year it was at 69 days.

Luxury End: Luxury demand increased by 6% in the past couple of weeks while the inventory grew by 2%.

In the past two weeks, demand for homes above $1.25 million increased from 351 to 371 pending sales, a 6% increase and nearly the same level as a month ago. The luxury home inventory increased from 1,981 homes to 2,011, up 2%. Even with the increase in demand, the luxury market is NOT a robust seller’s market, taking months in order to find success.

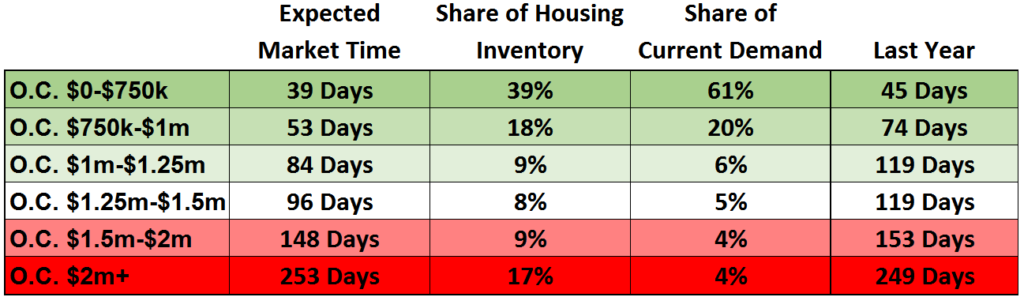

For homes priced between $1.25 million and $1.5 million, the expected market time decreased from 108 to 96 days. For homes priced between $1.5 million to $2 million, the expected market time increased from 144 to 148 days. In addition, for homes priced above $2 million, the expected market time decreased slightly from 256 days to 253 days. At 253 days, a seller would be looking at placing their home into escrow around the end of February of next year.

Orange County Housing Market Summary:

• The active listing inventory increased by 148 homes, or 3%, in the past couple of weeks, and now totals 5,905, knocking on the door of the 6,000 home level. Last year, there were 6,868 homes on the market, 963 more than today.

• There are 35% fewer homes on the market below $500,000 today compared to last year at this time and demand is down by 21%. Fewer and fewer homes and condominiums are now priced below $500,000. This price range is slowly disappearing.

• Demand, the number of pending sales over the prior month, increased by 1% in the past couple of weeks, adding 33 pending sales and now totals 2,937. The average pending price is $845,004.

• The average list price for all of Orange County remained at $1.6 million. This number is high due to the mix of homes in the luxury ranges that sit on the market and do not move as quickly as the lower end.

• For homes priced below $750,000, the market is HOT with an expected market time of just 39 days. This range represents 39% of the active inventory and 61% of demand.

• For homes priced between $750,000 and $1 million, the expected market time is 53 days, a hot seller’s market (less than 60 days). This range represents 18% of the active inventory and 20% of demand.

• For homes priced between $1 million to $1.25 million, the expected market time is at 84 days, a tepid seller’s market.

• For luxury homes priced between $1.25 million and $1.5 million, the expected market time decreased from 108 to 96 days. For homes priced between $1.5 million to $2 million, the expected market time increased from 144 to 148 days. For luxury homes priced above $2 million, the expected market time decreased from 256 to 253 days.

• The luxury end, all homes above $1.25 million, accounts for 34% of the inventory and only 13% of demand.

• The expected market time for all homes in Orange County increased from 59 days to 60 in the past couple of weeks, changing from a hot seller’s market to a tepid seller’s market (60 to 90 days). From here, we can expect the market time to slowly rise throughout the Summer Market.

• Distressed homes, both short sales and foreclosures combined, make up only 1.2% of all listings and 2.1% of demand. There are only 25 foreclosures and 46 short sales available to purchase today in all of Orange County, that’s 71 total distressed homes on the active market, 5 fewer than two weeks ago. Last year there were 138 total distressed sales, 94% more than today.

• There were 3,147 closed sales in May, an 18% increase over April 2017 and a 4% increase over May 2016. The sales to list price ratio was 97.8% for all of Orange County. Foreclosures accounted for just 1.1% of all closed sales and short sales accounted for 1.7%. That means that nearly 97.2% of all sales were good ol’ fashioned equity sellers.

Have a safe Holiday!

Sincerely,

Roy A. Hernandez

TNG Real Estate Consulants

Cell 949.922.3947

[gravityform id=”22″ title=”true” description=”true”]

Leave a Reply