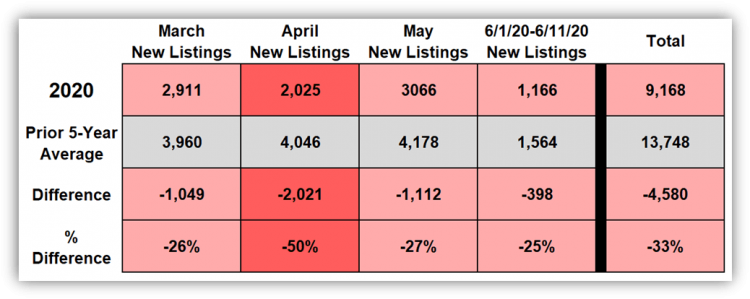

In March, there were 1,049 fewer homes placed on the market in Orange County compared to the 5-year average, 26% less. In April, there were 2,021 fewer, 50% less. In May, there were 1,112 fewer, 27% less. And, for June, through June 11th, there were 398 fewer, 25% less. That is a total of 4,580 fewer homes placed on the market since March, a third less than the 5-year average. That is a lot of homes. For perspective, it is 93% of the current active inventory.

It makes sense that homeowners opted to not sell at the beginning of the virus lockdown. There was so much uncertainty and fear, which is why COVID-19 affected both supply and demand. But, as the lockdown wore on and Californians moved towards reopening the economy, demand returned, instigated by record low rates. The real estate industry has adapted to the virus as well. Documents have been created by the California Association of REALTORS® to properly inform and protect buyers and sellers. Real estate agents are showing homes utilizing masks, gloves, and proper social distancing. The real estate industry is fully operational again, except for the number of homes coming on the market.

Quite simply, there just are not enough homes on the market to satiate the recent spike in demand. Homeowners are reluctant to come on the market because of the false narrative that is playing out in the public right now. The economy is in a recession, so housing must go down just like it did during the Great Recession. Yet, that is not how the storyline is playing out. Housing was one of the strongest sectors of the economy prior to the COVID-19 lockdown. It was pumping on all cylinders and was extremely healthy, not a bubble and not an area of concern for economists. Buyers had to qualify for loans. Down payments were large. Homeowners were not using their houses like piggy banks and pulling out cash to pay for life’s luxuries. Subprime loans, pick-a-payment loans, and fraudulent lending were not in the mix. And, rates have been low and have remained low for a very long time, improving home affordability tremendously.

So, yes, the housing market can be strong in the midst of a recession. Demand is flourishing under the current record low mortgage rate environment. It is time for sellers to enter the arena as well. It is time for sellers to seize the day.

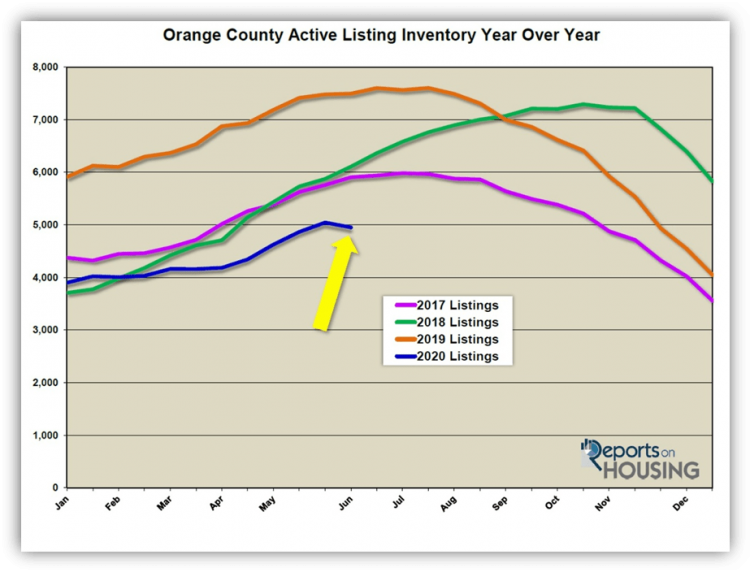

Active Inventory: The current active inventory decreased by 2% in the past two-weeks. The active listing inventory dropped by 94 homes in the past two-weeks, down 2%, and now sits at 4,950. In the past 5-years, the inventory, on average, has risen by 3%. So this recent drop is unprecedented for this time of the year. The issue is that there are not enough homes coming on the market to satisfy the current level of demand. Homes are coming off the market faster than they are coming on right now. Hopefully, as more homeowners discover that the current market lines up heavily in the sellers favor in spite of the ongoing COVID-19 epidemic, the number of new listings reaches levels similar to prior years. Last year at this time, there were 7,493 homes on the market, 2,543 more than today, a 51% difference. There were a lot more choices for buyers last year.

Demand: In the past two-weeks demand continued to surge, increasing by 24%. Demand, the number of new pending sales over the prior month, increased from 2,035 to 2,529, an additional 494 pending sales, up an incredible 24% in just two weeks. In the past 4-weeks, demand has added 907 pending sales, a 56% rise. With mortgage rates dropping to all-time record lows, demand is exploding. Buyers want to take advantage of the current, unprecedented ultra-low mortgage environment. It is easy to see when they do the math. For a $700,000 mortgage, the monthly payment prior to the lockdown was at $3,242 per month with a mortgage rate of 3.75%. Today, at 3%, the monthly payment drops to $2,951, a $291 per month savings, or a discount of 9%.

Last year, there were 132 more pending sales than today, 5% extra. In mid-April, at the low point of the COVID-19 pandemic, demand was off by 60% year over year. The year over year gap has nearly vanished.

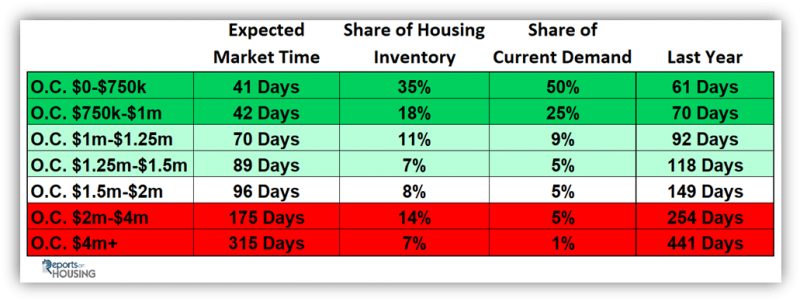

In the past two-weeks the Expected Market Time dropped from 74 to 59 days, a Hot Seller’s Market (less than 60 days), where sellers get to call the shots during the negotiating process and home values are on the rise. Last year the Expected Market Time was at 84 days, much slower than today.

Luxury End: The luxury demand continues to soar higher. In the past two-weeks, demand for homes above $1.25 million increased by 87 pending sales, up 28%, and now totals 400, nearly reaching the height of 416 established on March 5th prior to the COVID-19 lockdown. The luxury market is back on a strong footing, beating everybody’s expectations of the luxury end. The luxury home inventory increased by 34 homes, up 2%, and now totals 1,797. With another dramatic improvement in demand, which is outpacing the rise in the inventory, the overall Expected Market Time for homes priced above $1.25 million decreased from 169 to 135 days in the past couple of weeks. In mid-April, it was at 322 days. The luxury market is not quite where it was on March 5th, 121 days, but it nearly there.

Year over year, luxury demand is down by 6 pending sales, or 1%, and the active luxury listing inventory is down by 725 homes, or 29%. The Expected Market Time last year was at 186 days, much slower than today.

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the Expected Market Time decreased from 98 to 89 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 116 to 96 days. For homes priced between $2 million and $4 million, the Expected Market Time decreased from 258 to 175 days. For homes priced above $4 million, the Expected Market Time decreased from 455 to 315 days. At 315 days, a seller would be looking at placing their home into escrow around April 2021.

Contact Roy first when the time is right,

Leave a Reply