Buying or Selling soon? Get the latest real estate news here!

After grinding to a complete halt, the luxury market is pumping on all cylinders.

Summary:

The luxury housing market in Orange County came to screeching halt in mid-April. However, slowly demand picked up in every price range. Luxury was revived on the backs of increased confidence in Wall Street, a low mortgage rate environment, and the realization of the importance of “home” in the middle of a pandemic. In taking a closer look at luxury, today’s Expected Market Time is at its lowest point in years, 111 days. That sounds high compared to the overall Orange County housing market at 47 days, but it is extremely strong for the upper end, and quite an improvement from the 322 day mark reached in mid-April.

See below for complete article! Contact me for questions. 25 years experience goes a long way to optimize your bottom line!

Luxury Strength: The upper end of the housing market is strong with plenty of demand. In Batman v Superman, in order for Superman to kill Doomsday, a gigantic monster that is also from the planet Krypton, he sacrifices himself by taking a krypton spear (his only weakness) and launches it into Doomsday. Both Superman and Doomsday die. Many moviegoers left the movie theater in disbelief, the ultimate superhero had perished. Yet, in Justice League (2017), through the power of the Mother Box and a giant electric spark from The Flash, Superman was revived to help save Earth from the evil Apokoliptian general Steppenwolf and his army of Parademons. Superman returned, was unstoppable, and helped defeat the villain.

The luxury housing market in Orange County came to screeching halt in mid-April. It appeared as if luxury housing had perished in 2020 and would not be revived until 2021 at the earliest. The Expected Market Time (the amount of time between hammering in the FOR-SALE sign to opening escrow) increased to 322 days for all homes priced above $1.25 million. Fear and uncertainty shrouded the upper end amidst the COVID-19 pandemic and California’s “stay at home” order. It left many luxury sellers in disbelief, wondering if they would ever be able to sell their homes without major price cuts.

Yet, the market began to improve after bottoming in April. Slowly but surely demand picked up in every price range. Luxury was revived on the backs of increased confidence in Wall Street, a low mortgage rate environment, and the realization of the importance of “home” in the middle of a pandemic. Everybody is acutely aware of the significance of the home office, additional living space, a larger yard, and the many amenities that make life at home more enjoyable.

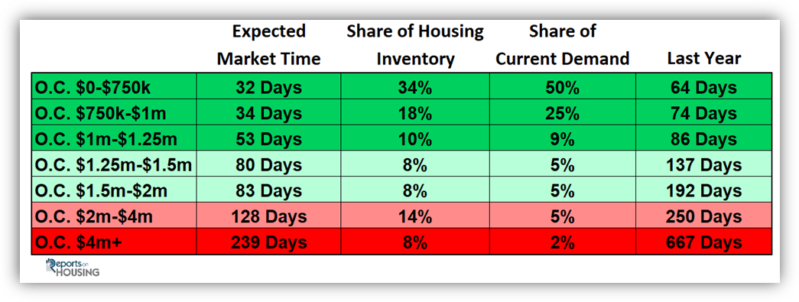

In taking a closer look at luxury, today’s Expected Market Time is at its lowest point in years, 111 days. That sounds high compared to the overall Orange County housing market at 47 days, but it is extremely strong for the upper end, and quite an improvement from the 322 day mark reached in mid-April, the middle of the Spring Market. In fact, it is a record low for 2020 so far, beating the March 5th level of 121 days, a low reached just prior to COVID-19’s impact on housing and the “stay at home” order. Last year, the luxury Expected Market Time was at 217 days at the end of June, and the lowest level for 2019 was achieved in April at 161 days.

Luxury has dramatically improved and it is not because there are fewer homeowners placing their homes on the market, limiting the supply of available homes. That is true for the market as a whole, with 21% fewer homes placed on the market compared to the 5-year average. However, for luxury, there have been 2% more homes placed on the market compared to the 5-year average. It all boils down to demand, the last 30-days of pending sales activity. It has improved from 140 pending sales on April 16th to 476 today, an astonishing 240% increase. That is the highest demand reading in years.

It is important to note that the upper end still takes a lot longer to sale compared to the lower ranges. Multiple offers and a steady stream of buyers are not as common. This is simply because there are fewer potential buyers that can afford a higher priced home. It all boils down to supply and demand. The lower ranges do not have enough supply, and demand is through the roof. For the luxury market, the pool of potential buyers shrinks due to pricing constraints and there is a bit more seller competition. For luxury sellers, if the price of a home is not compelling, they will not find success. When a home is priced well, it attracts attention.

As in all price ranges, success is determined by motivation. Many luxury sellers claim that they “don’t have to sell” to help rationalize their price. They stretch their asking price and sit on the market, generating little activity and no offers. Sellers who are motivated will price their homes according to their Fair Market Value. They are not afraid to listen to the market and adjust their asking price if necessary.

Orange County’s luxury market has not only returned, it is pumping on all cylinders. While it may not be as sizzling hot as the lower ranges, it is the most favorable environment for luxury in years.

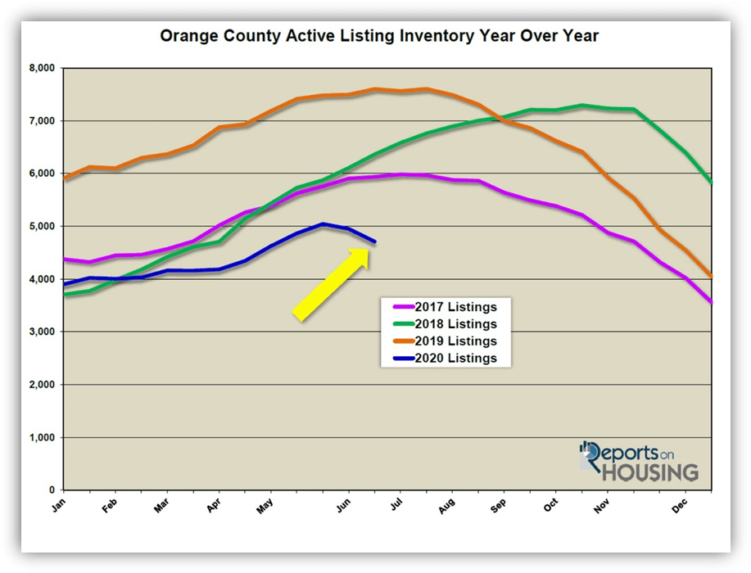

Active Inventory: The current active inventory decreased by 5% in the past two-weeks. The active listing inventory dropped by 239 homes in the past two-weeks, down 5%, and now sits at 4,710, the lowest level since 2013. In the past 5-years, the inventory, on average, has risen by 2%. The inventory has been declining for the past month, completely uncustomary during the Summer Market. There are not enough homes coming on the market as COVID-19 still has a grip on the supply. With extremely hot demand, homes are being placed into escrow at a faster clip than the number of homes that are coming on the market; thus, the inventory is dropping. The Orange County housing market is in dire need of more homeowners opting to enter the fray.

Last year at this time, there were 7,600 homes on the market, 2,889 more than today, a 61% difference. There were a lot more choices for buyers last year.

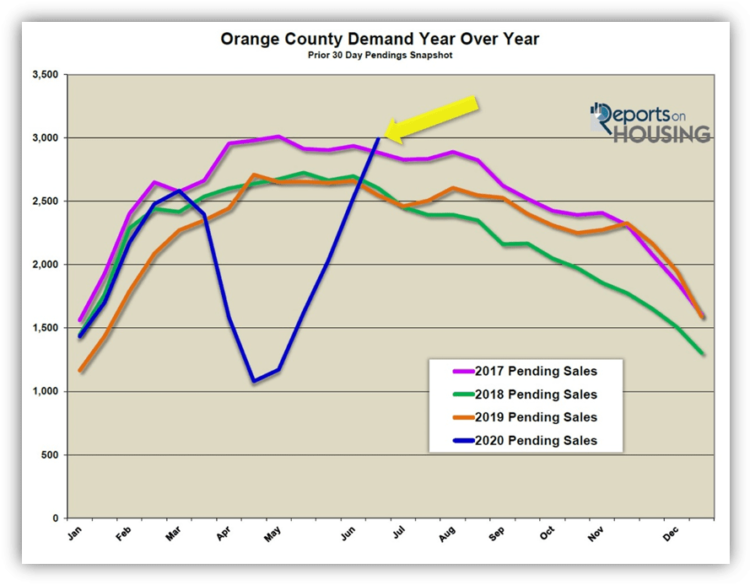

Demand: The surge in demand continues to rocket upward. Demand, the number of new pending sales over the prior month, increased from 2,529 to 2,975, an additional 446 pending sales, up an astonishing 18% in just two weeks, and the best reading of 2020. In the past 4-weeks, demand has added 940 pending sales, a 46% rise. The record low mortgage environment at around 3% is the rocket fuel that is propelling housing to sizzling hot levels last experienced in 2013. It appears as if the summer of 2020 is poised to be one of the hottest on record.

Last year, there were 427 fewer pending sales than today, 14% less.

In the past two-weeks the Expected Market Time dropped from 59 to 48 days, a Hot Seller’s Market (less than 60 days), where sellers get to call the shots during the negotiating process and home values are on the rise. Last year the Expected Market Time was at 89 days, much slower than today.

Luxury End: Luxury demand continues to climb.

In the past two-weeks, demand for homes above $1.25 million increased by 76 pending sales, up 19%, and now totals 476, exploding past the prior height of 2020 established on March 5th prior to the COVID-19 lockdown of 416. The luxury market is not only back on a strong footing, beating everybody’s expectations, it is rocketing to unprecedented levels. The luxury home inventory decreased by 32 homes, down 2%, and now totals 1,765. With another spectacular improvement in demand coupled with a drop in the supply, the overall Expected Market Time for homes priced above $1.25 million decreased from 135 to 111 days in the past couple of weeks. The luxury market is healthy and strong.

Year over year, luxury demand is up by 124 pending sales, or 35%, and the active luxury listing inventory is down by 784 homes, or 31%. The Expected Market Time last year was at 217 days, much slower than today.

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the Expected Market Time decreased from 89 to 80 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 96 to 83 days. For homes priced between $2 million and $4 million, the Expected Market Time decreased from 175 to 128 days. For homes priced above $4 million, the Expected Market Time decreased from 315 to 239 days. At 315 days, a seller would be looking at placing their home into escrow around February 2021.

Leave a Reply