July 8, 2015

Good Afternoon!

The Spring Market is now in the rearview mirror, making way for a whole new season in selling: summer.

The Summer Shift: The expected market time has increased by two weeks longer since the prime Spring Market.

Housing tends to follow a similar cycle every year. This time of year is no different. It started a couple of weeks ago with graduation. The market slowed a bit; many houses were not selling as rapidly as they were in April and May. The explanation from the real estate trenches was that it was due to graduations and the end of the school year.

Then there is our national holiday, the Fourth of July. Not as many buyers tour homes as they turn their focus to playing in the sun, barbecues, and fireworks. In housing, the holiday turns into a distraction of grand proportions and the lingering effects can be felt for a week.

As Southern California experiences summer heat waves, many will turn to the oasis known as the community pool, and others will flock to cool off in the welcoming, crashing waves of the Pacific. The heat will also distract the real estate market from performing on all cylinders.

Finally, the slower housing scene will be blamed on the family vacation. From Hawaii, to the East Coast, to the ultimate family destination, Orlando, it is the season for summer vacations. Camping, airplanes, house boats, motor homes, and road trips, just about everybody has plans. It is hard to tour homes or conduct real estate transactions when you are checking in to a Hyatt and touring the Empire State Building.

Many will blame the slower housing market on graduation, the 4th of July, hot summer days, and family vacations. It is, quite simply, the Summer Market. It happens every year. For sellers and buyers in the real estate trenches today, they are all experiencing the shift in the housing market already and we are just a couple of weeks into the official start of summer.

A Summer Approach for Sellers: with buyer traffic down and the expected market time rising, it is now more important than ever to NOT get too far ahead of the market by overpricing. Multiple offers can still be attained, but only for those homes that are priced at, or very close to, their Fair Market Values. Here’s a quick refresher for determining that value: take the most current closed and pending sale activity and carefully adjust for upgrades, location, amenities, and condition. The Fair Market Value is not determined by arbitrarily pricing a home out of thin air. Ignoring the fundamental shift in activity during the Summer Market will result in many homes being overpriced with absolutely no success; instead, they will waste valuable market time during the second best time of the year to sell.

A Summer Approach for Buyers: although competition dips a bit during the summer, buyers must respect the fact that it is still a seller’s market. Buyers are not able to call the shots. Sticking to paying the Fair Market Value determined by recent market activity is key. Also, knowing the local or neighborhood market conditions is extremely important as well. It may be the case that a certain neighborhood is a bit hotter than another and when a home comes on the market that is priced well and is in great condition, buyers must be willing to push the envelope a bit in terms of value. Paying a few thousand dollars more than the last comparable sale may be the winning strategy that will allow a buyer to beat out the competition. Grossly overpaying is not advised. Sometimes waiting for the next shift in housing, the Autumn Market, may be a wise approach as well.

For both buyers and sellers, the Summer Market shift means a new approach to the market is crucial in order to find success. Realistic, level headed, patient buyers and sellers will be rewarded from now through the first few weeks of August. From there, the housing market will experience another shift, the Autumn Market. Stay tuned…

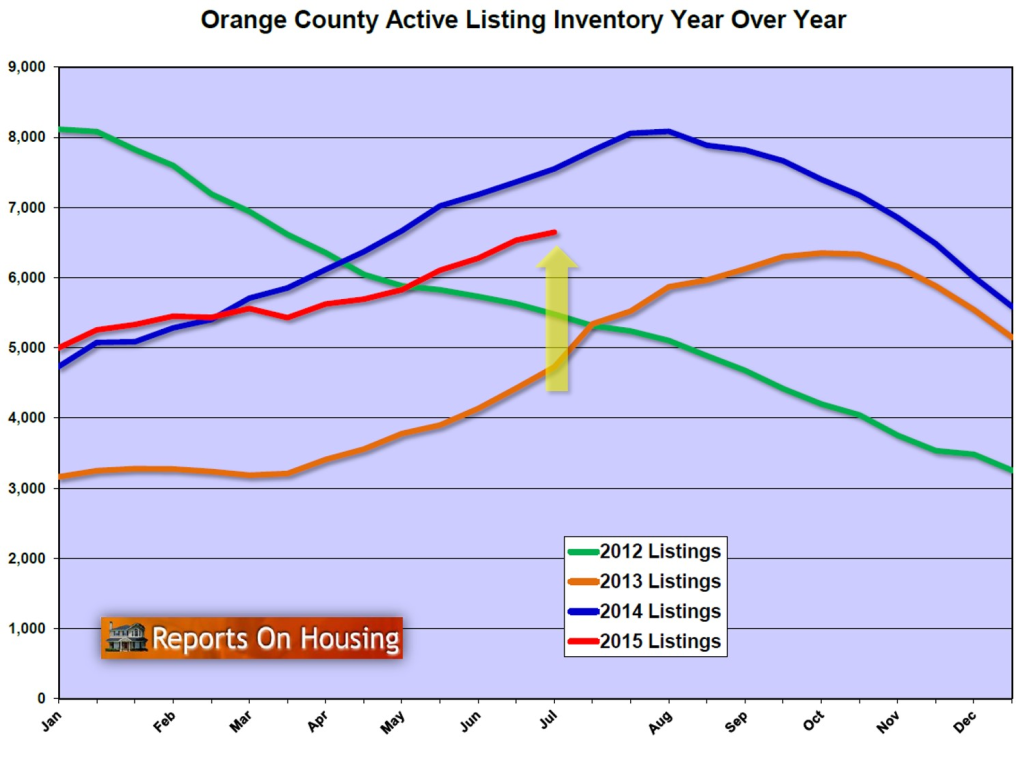

Active Inventory: The inventory increased by 2% in the last couple of weeks.

The active inventory increased by 113 homes in the past two weeks and now totals 6,647, a 2% gain. Since the end of March, the inventory has grown without pause, adding 1,218 homes to the active listing inventory, a 22% gain. While the underlying market is hot, a rise in the inventory means that homes are not flying off the market regardless of the price; instead, homes that are overpriced are staying on the market and not generating offers. These overpriced homes are accumulating and the inventory is rising. While pending activity is strong, more homes are coming on the market than are being placed into escrow. The rise will continue through the end of August; and, if homeowners ignore the slower Autumn Market and place their homes on the market despite the slower season, the inventory may continue to rise through October. That occurred in the autumn of 2013.

Last year the inventory totaled 7,550 homes, 903 more than today, with an expected market time of 3.05 months, or 90 days. It was the first time in 2013 that the housing market had reached balance, not favoring buyers or sellers. We probably will not reach a balance until the autumn, right after school starts.

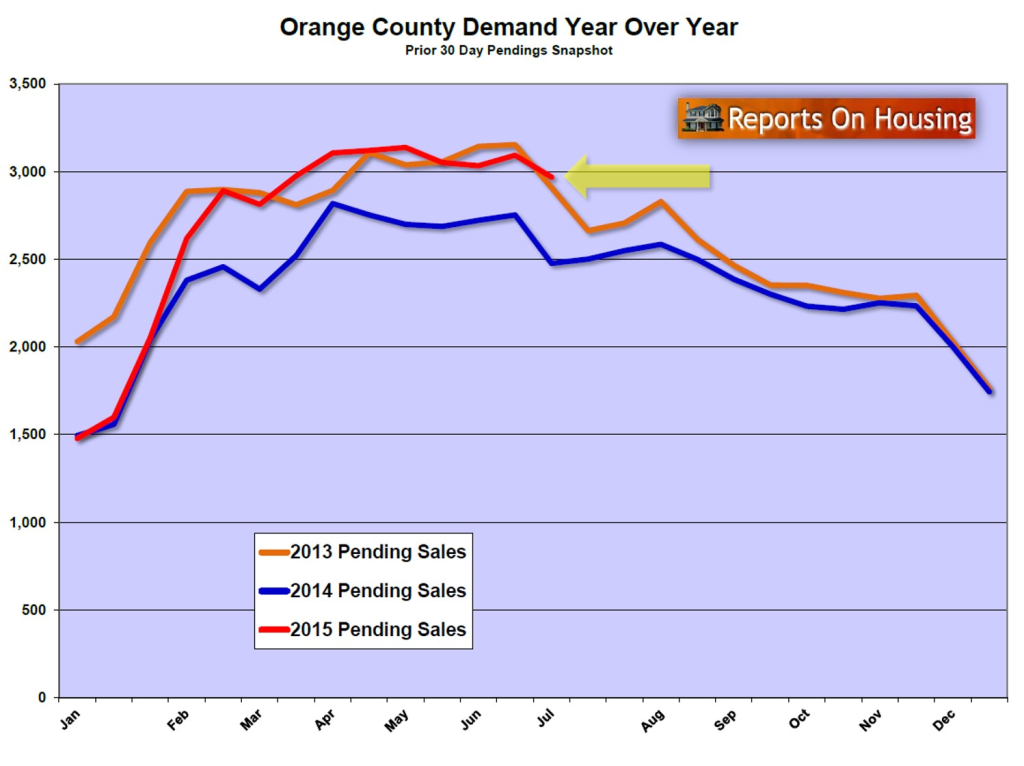

Demand: Demand decreased by 4% in the last couple of weeks.

Demand, the number of new pending sales over the prior month, decreased by 125 homes in the past two weeks and now totals 2,969 homes. This is quite typical for this time of the year as the market transitions into the summer. This is the season of distractions that place house shopping on the back burner for some. Kids are out of school, the smell of barbecue is in the air, dazzling firework shows light up the sky, and pools and beaches are bursting at the seams. It is still a fantastic time to sell a home and to tour neighborhoods in search for a home, just not as hot as the spring.

The expected market time for all of Orange County grew from 63 days to 67 days in the past couple of weeks. The hottest price ranges are homes priced below $1 million, with an expected market time of 52 days. The upper ranges, all homes priced above $1 million are really beginning to slow, with an expected market time of 154 days, over five months. The higher the price range, the slower the market.

Last year at this time there were 492 fewer pending sales, totaling 2,477.

Distressed Breakdown: The distressed inventory decreased by one home in the past couple of weeks.

The distressed inventory, foreclosures and short sales combined, decreased by one home. Year over year, there are 20% fewer distressed homes today. In June, only 2.5% of all closed sales were short sales and only 1.2% were foreclosures, leaving 96.3% that were good ol’ fashioned healthy sellers with equity in their homes. With the market humming on all cylinders for the past several years, the distressed market in Orange County has become nothing more than a footnote to the current housing story.

In the past two weeks, the foreclosure inventory decreased by 15 homes and now totals 58. Less than 1% of the inventory is a foreclosure. The expected market time for foreclosures is 46 days. The short sale inventory increased by 14 homes in the past two weeks and now totals 153. The expected market time is 48 days. Short sales represent just 2% of the total active inventory.

Have a great week.

Leave a Reply