With holiday distractions behind us, the Orange County housing Market has thawed and is beginning to rev its engine.

With holiday distractions behind us, the Orange County housing Market has thawed and is beginning to rev its engine.

Housing Awakens: Inventory and demand improved dramatically in the past couple of weeks.

The stock market was taking a beating, driven by low oil prices and worldwide economic turmoil. The start of 2016 had everybody, including the Orange County housing market, on pins and needles. It seemed that the Holiday Market slowdown was not going to thaw like it typically does starting in mid-January.

Right after the Super Bowl’s clock winds down to zero, housing’s Spring Market begins. However, an important step needs to occur first, a cyclical thaw in January with an increase in the inventory and the number of homes coming on the market followed by an increase in demand. All of the holiday trappings of eggnog, family gatherings, the exchanging of gifts, and New Year’s resolutions were now in the rearview mirror. It was time to move on and for the Orange County housing market to awaken. But, it was not happening.

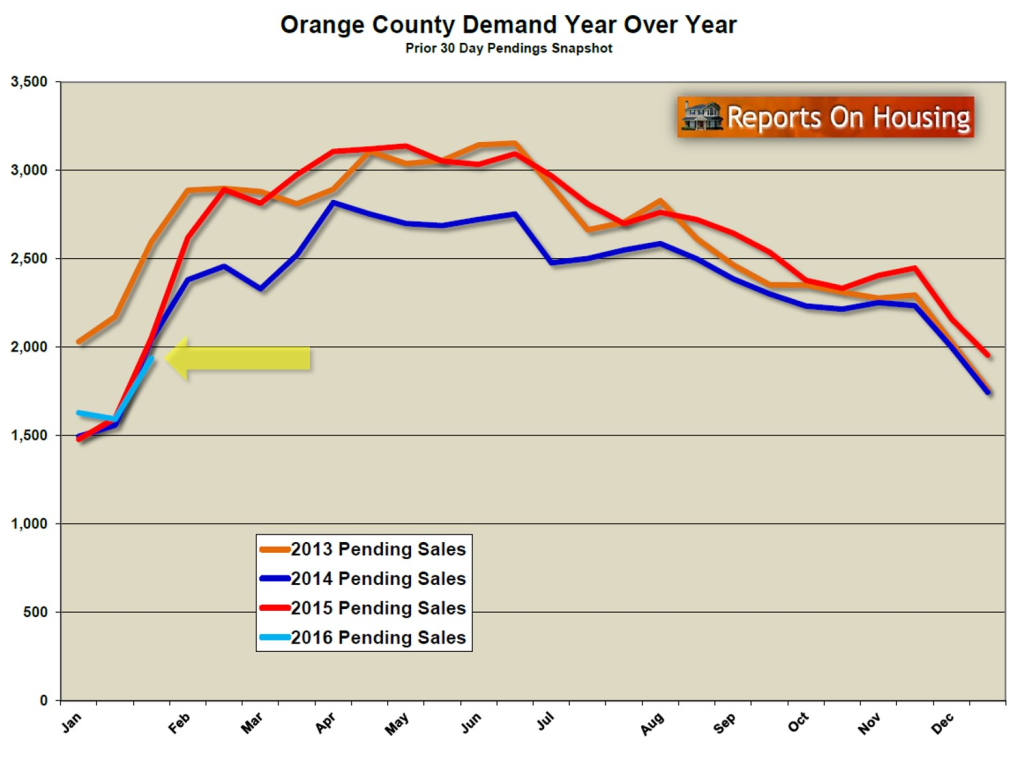

Both inventory and demand were off during the first couple weeks of the year. It appeared as if homeowners and buyers were all taking a wait and see attitude before jumping into the housing market. After the first three weeks of 2016, there were 8% fewer homes coming on the market compared to the start of last year. Demand actually dropped from the start of the New Year to the second week of January, something it had never done in the last decade.

Had the recent Fed hike in the short term rate slowed housing? Did the worldwide economic turmoil and the collapse in financial markets and Wall Street infect Orange County housing? It may have seemed like it, but it’s just not the case. As it turns out, interest rates are actually lower today than when the Federal Reserve hiked the short term rate for the first time in nine years in December. Long term interest rates for housing are not directly tied to the short term rate. Instead, those rates are more closely tied to treasury bonds. Because of all of the international turmoil, worldwide investors have flocked to treasury bonds as one of the safest investments on the globe. As a result, interest rates have actually dropped despite the Fed increasing the short term rate. However, if they continue to increase that rate, it will eventually spread to long term rates and have an effect on housing.

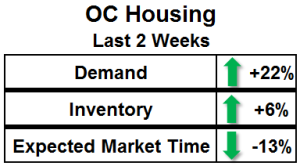

At first, it seemed as if the Orange County housing market’s slow start was tied to Wall Street and the worldwide economic turbulence. Regardless of the reason, it doesn’t matter now. The housing market has turned the corner and revved its powerful engine. In the past two weeks, demand jumped 22% with more buyers and sellers signing on the bottom line. The active inventory has been climbing as well, despite more pending transactions (when homes are changed to pending, they no longer count as part of the active listing total). More homeowners are taking advantage of the low, anemic inventory levels and entering the fray.

With interest rates so low, it is a great time to purchase and cash in on the historically low interest rates. The average interest rate since 1990 is 6.6% (since 1972 it is 8.5%). Today’s rates are unbelievably low. And, it looks as if the Federal Reserve has paused their rate hikes for now due to worldwide economic instability. So, it appears as if these low rates will be around for at least the first half of 2016, making it extremely advantageous to be a buyer. Despite Orange County home values inching its way closer to its prior peak set just prior to the Great Recession, the current interest rate environment has made homeownership much more affordable.

The monthly payment for the detached single family residence median sales price in December of $670,000, at today’s rate of 3.75% and 20% down, would be $2,482. When rates eventually rise to 4.75%, and they will (Freddie Mac forecasted 4.7% by the end of 2016), the payment would rise to $2,796 per month. That’s an increase of $314 per month or $3,768 per year. The bottom line: it makes sense to take advantage of today’s rates. Down the road, today’s buyers will be thrilled that they did.

For sellers in Orange County, the current inventory is extremely anemic and there are buyers waiting for new product to hit the market. The Spring Market officially begins next week after the Super Bowl and there is less competition today than there will be in the middle of spring. While April through May is typically the peak for the year in terms of demand, it is also a peak in the number of homes coming on the market, more competing homes. Waiting in anticipation of more appreciation makes sense in markets that are appreciating rapidly, but buyers today are not overly excited to stretch much more than the most recent sale. Instead, they are looking to purchase at or near a home’s Fair Market Value. Homes are no longer appreciating rapidly. The bottom line: it makes sense to take advantage of today’s low inventory and less competition.

Active Inventory: the inventory has increased by 10% thus far this year.

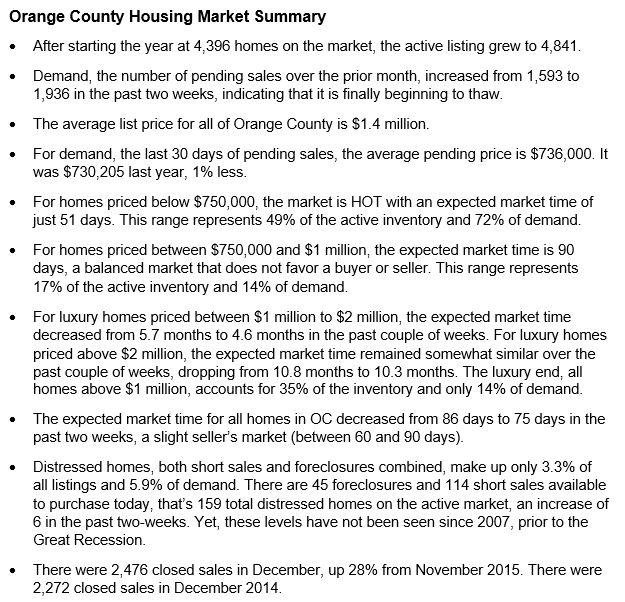

The active inventory increased by 265 homes, or 6%, in the past two weeks and now sits at 4,841. That’s the largest increase in the inventory since July of last year. With interest rates being so low coupled with a low inventory, today’s hot demand may keep the inventory from growing rapidly until the Summer Market. That remains to be seen and depends upon how quickly seller adjust their prices closer to their Fair Market Values. Last year, 10% of the active inventory reduced the asking price each and every week. Overzealous sellers will have to reduce this year as well until they are in alignment with the Fair Market Value.

Last year at this time the inventory totaled 5,331 homes, 490 more than today, with an expected market time of 2.6 months, or 78 days, a slight seller’s market. Today’s expected market time is similar at 75 days, also a slight seller’s market. A slight seller’s market means that there is not much price appreciation but sellers get to call more of the shots in terms of negotiating the finer details of a contract.

Demand: in the past two-weeks demand skyrocketed and increased by 22%.

Demand, the number of new pending sales over the prior month, increased by 343 homes in the past two-weeks, and now totals 1,936. That’s the largest increase since February of last year. During the same two-week period in 2015, demand actually increased by 454 pending sales and it totaled 2,053, or 6% more than today.

Expect demand to increase sharply through February and then remain elevated through mid-June, peaking sometime between April and May.

Summary:

Have a great week.

Sincerely,

Roy Hernandez

TNG Real Estate Consultants

Cell 949.922.3947

[gravityform id=”13″ title=”true” description=”true”]

Leave a Reply