Today’s sellers and buyers turn to the Internet to determine their

Today’s sellers and buyers turn to the Internet to determine their

home’s value but forget to look at the fine print.

Online Home Valuation Tools: even though sellers and buyers turn to Internet sites to establish the property value of a home, it’s not even close to being accurate.

Everything is on the Internet. Recipes, comparison shopping, product ratings, music, dating, news, financial tips, economic analysis, entertainment, medical information, every business and every person is now on the Internet. With access to so much information, sellers and buyers now feel empowered with the ability to go online to learn as much about the home selling and home buying process as they wish. They can search to their hearts content as everything is now seemingly at their fingertips.

With this access comes the sense that sellers and buyers can control the process. They feel like they are in the driver’s seat. From home searches, to researching about the skillset of a REALTOR®, to looking at payment calculators, they can do a tremendous amount of research from the comfort of their homes. Zillow.com, REALTOR.com, Trulia.com, OCRegister.com, LATimes.com, YahooRealEstate.com, CNN.com, CNBC.com, etcetera, there are plenty of choices to learn more about the local, regional, and national real estate markets. There is a lot of great information available to real estate consumers to help in the process. Unfortunately, there is plenty of misinformation too.

The number one real estate website is Zillow.com. The main purpose of the site is to determine a home’s value, what they more affectionately refer to as a Zestimate®. Tragically, sellers and buyers rely on this site in their attempt to secure the precise value of a home. In looking up the Zestimate® of a home, sellers and buyers feel as if they are tapping into the most complex, accurate real estate program known to man. They enter in an address and Zillow® spits out the exact market value of a home. The problem is that it is NOT accurate at all. The site admits to its own shortcomings on the landing page and states, “Use the Zestimate® as a starting point in determining your current and future home value.” Not too many buyers are going to take the time to read that admission.

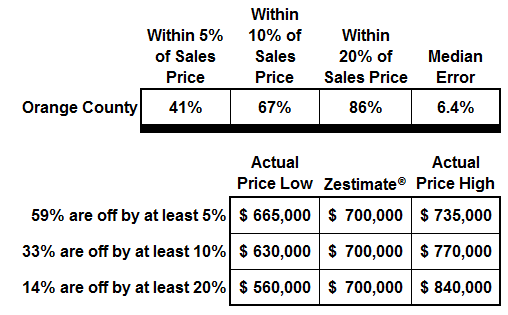

Good luck on finding the fine print too. You have to click on the term “Zestimate®,” even though it does not have a hyperlink, to learn more about what goes into their estimate. The fine print can be found by then clicking on “How Accurate is the Zestimate®?” Isolating Orange County is an even further challenge. The numbers illustrate exactly why sellers and buyers cannot rely on this tool to accurately hone in on a home’s value. It also illustrates why they should not even rely on the site as a “starting point” in the home valuation process.

Their numbers are eye opening. Shocking is an even better description when anybody with an economic background takes a closer look. Zestimate® accuracy is computed by comparing the actual final sales price of a home to the Zestimate® that the system originally came up with. In Orange County, only 41% of all closed sales were within 5% of the actual sales price. That means that 59% were off by more than 5%. For proper perspective, let’s take a look at a $700,000 Zestimate®. 5% of $700,000 is $35,000. It could be off by $35,000 more OR $35,000 less. That means that the actual value would be somewhere between $665,000 and $735,000, a $70,000 gap. That is just way too big of a spread to be able to pinpoint the value of a home.

67% of all closed sales were within 10% of the Zestimate®, meaning that 33%, one-third, is off by more than 10%. For the $700,000 Zestimate® example, the actual sales price would be somewhere between $630,000 and $770,000, a $140,000 gap. And, 86% of all closed sales were within 20% of the Zestimate®, meaning that 14% were off by more than 20%. That basically means that 1.4 out of 10 homes is off by a truckload. For the $700,000 Zestimate® example, the actual sales price would be somewhere between $560,000 and $840,000, a $280,000 gap.

To rely on Zillow® to determine the value of a home is nothing short of absurd. Sellers and buyers typically only bring up the Zestimate® when it works in their favor, about a 50/50 chance of that happening. If a home that should really sell for $650,000 has a Zestimate® at $700,000, the seller stubbornly ends up overpricing their home and is forced to reduce in order to find success. As a result of so many sellers feeling empowered to price based upon an online valuation tool, the housing market is plagued with overpriced homes.

There are thousands of valuation tools and some claim to be even more accurate than Zillow®, but that claim doesn’t really say much. Instead, buyers and sellers need to know the fine print which illustrates that while the Internet may be chalk fool of great real estate information, it just cannot be used to determine a home’s value. There are just too many factors that go into the price of each and every home. Every home is unique, making the valuation process too complex for even the most sophisticated computer program.

So, if you cannot use an online program to determine a home’s value, what is the best method in coming up with the Fair Market Value? Sellers and buyers need to turn to their REALTOR® to isolate the value, the true professional. They are able to help factor the condition, location, upgrades, and amenities of a home, something a computer program cannot duplicate.

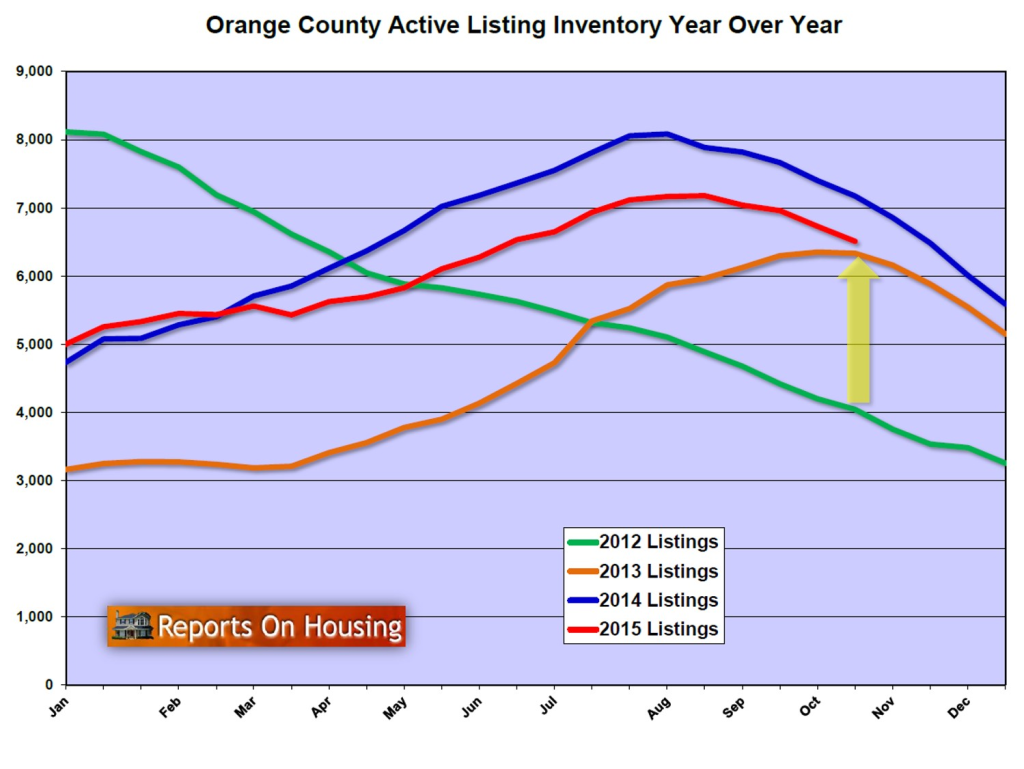

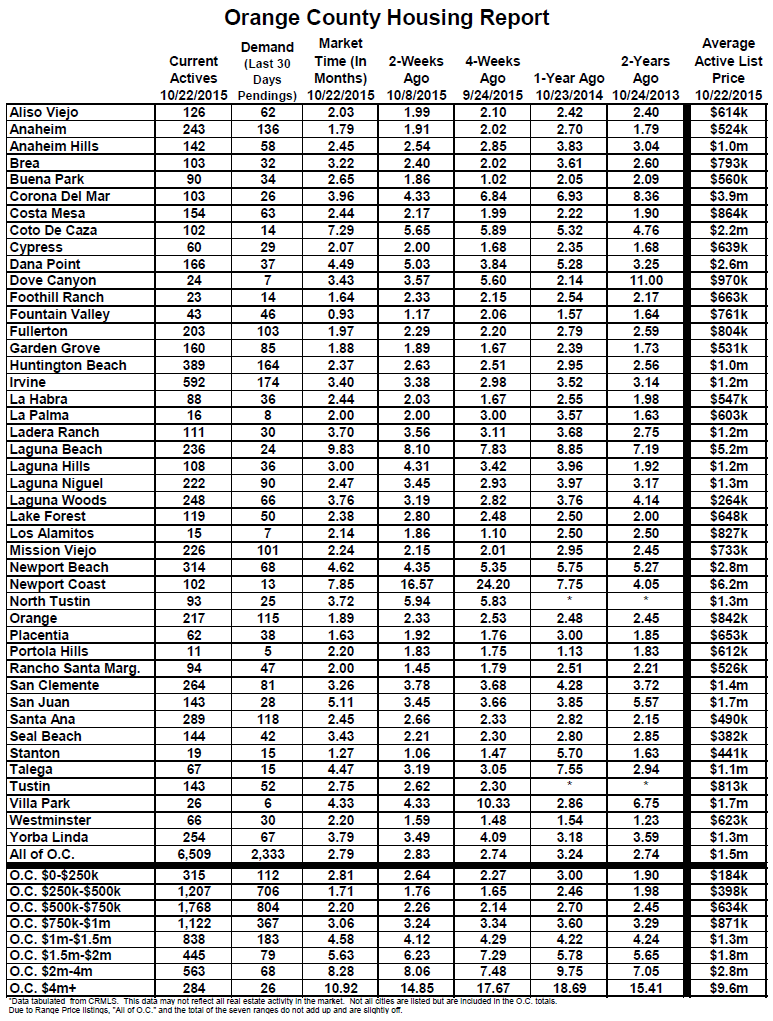

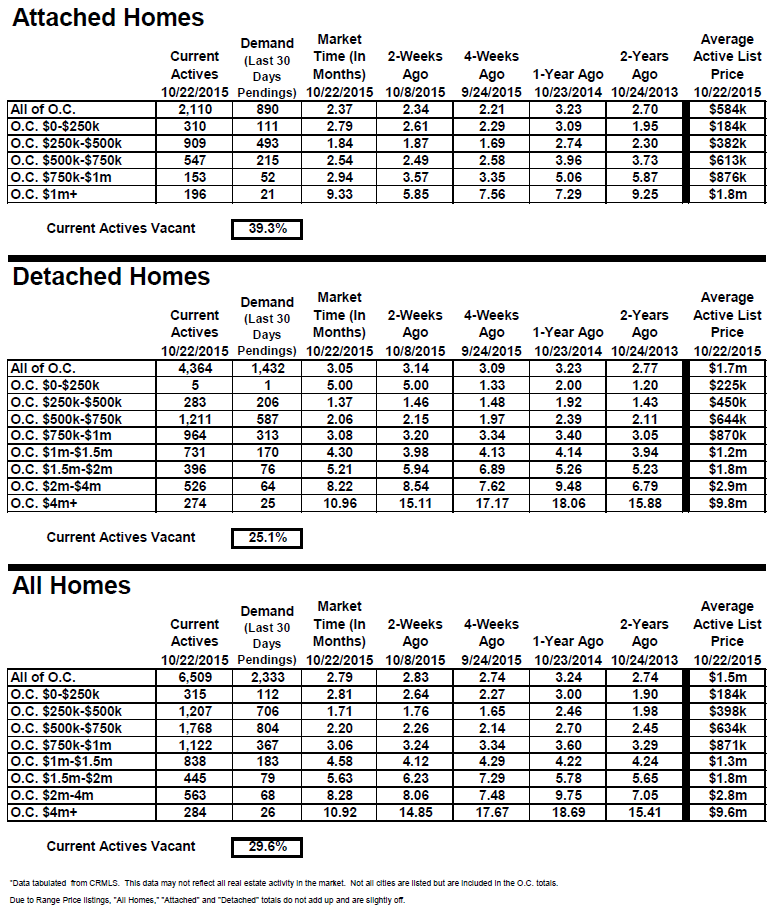

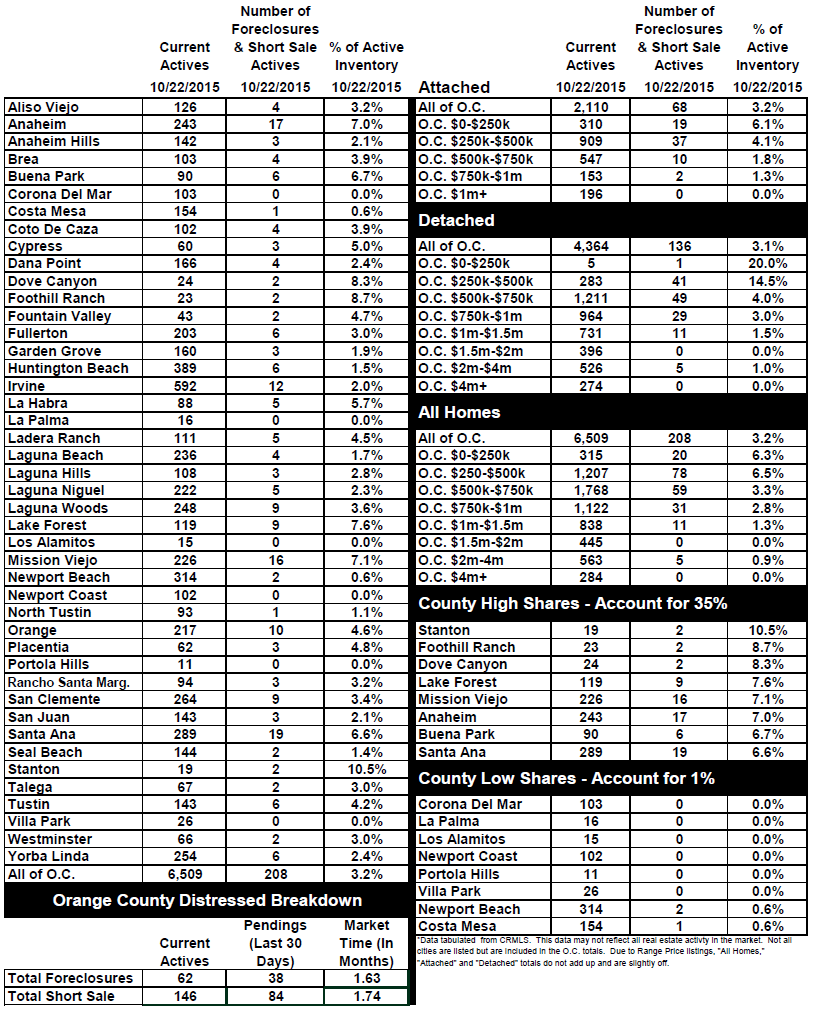

Active Inventory: the inventory continued its descent, and shed another 3% in the past two weeks.

The Autumn Market inventory drop continued in the past couple of weeks, shedding 220 homes in the past two weeks and 450 over the past month. It now totals 6,509. This is the time of the year when not as many sellers are coming on the market and many unsuccessful sellers are throwing in the towel as we quickly approach the Holiday Market, now just a few weeks away. The inventory will continue its descent through the end of the year.

Last year at this time the inventory totaled 7,174 homes, 665 more than today, with an expected market time of 3.24 months, or 97 days. That’s 13 days longer than today.

Demand: Demand decreased by 2% in the past couple of weeks and 8% in the past month.

Demand, the number of new pending sales over the prior month, decreased by 45 homes in the past two weeks and now totals 2,333 homes. The drop is its lowest since the end of August. Demand stays fairly steady for the next month until it drops further as we dive into the Holiday Market. By the end of the year, it will drop to its lowest level, levels not seen since January.

Last year at this time there were 118 fewer pending sales, 5% less, totaling 2,215.

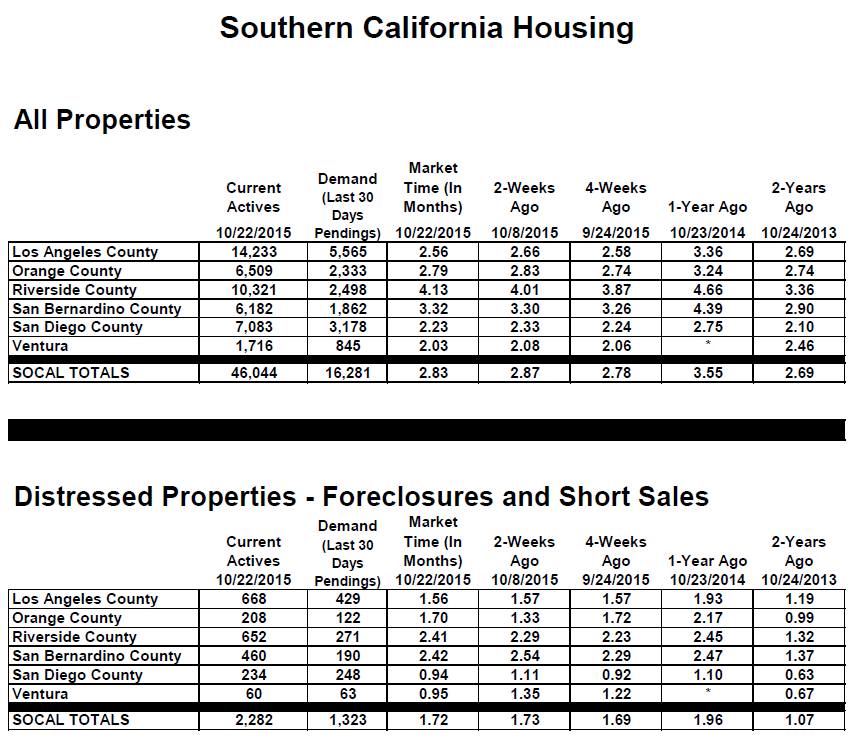

Distressed Breakdown: The distressed inventory increased by 23 homes in the past couple of weeks.

The distressed inventory, foreclosures and short sales combined, increased by 12%, or 23 homes, and now totals 208. Distressed homes are quickly reaching pre-Great Recession levels, a normal market.

In the past two weeks, the foreclosure inventory increased by 12 homes and now totals 62, Only 1% of the total active inventory is a foreclosure. The expected market time for foreclosures is 49 days. The short sale inventory increased by 11 homes in the past two weeks and now totals 146. The expected market time is 52 days. Short sales represent just 2% of the total active inventory.

Have a great week.

Leave a Reply