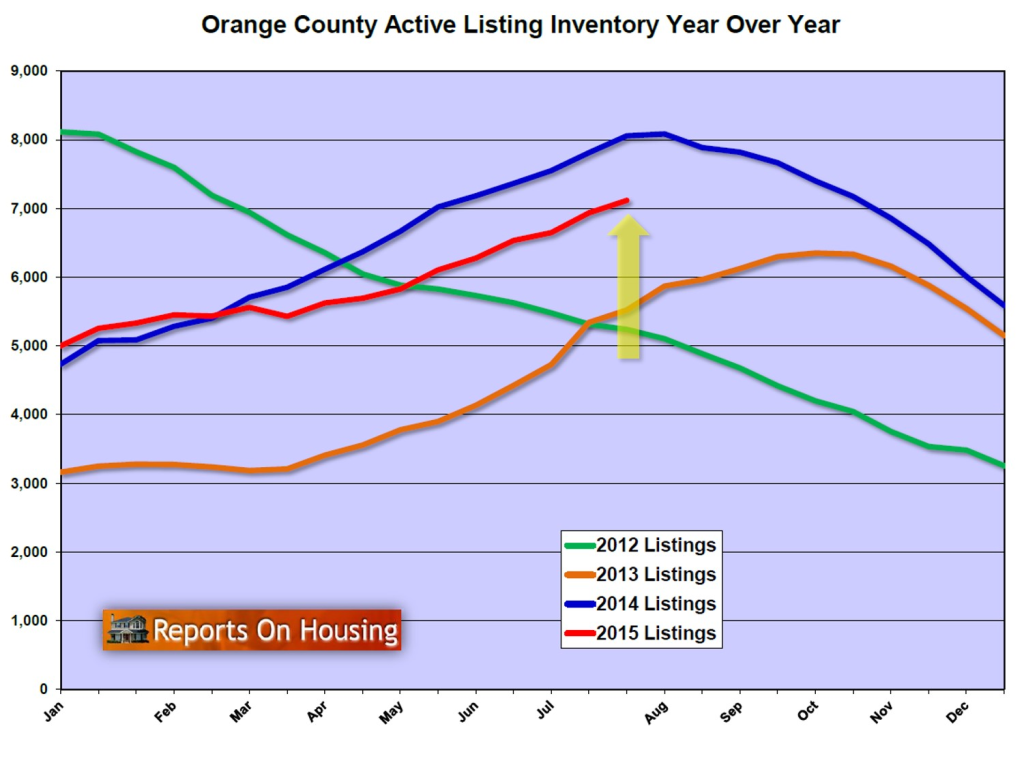

Part of the normal summer housing cycle, the active inventory continues to grow without pause.

Part of the normal summer housing cycle, the active inventory continues to grow without pause.

A Growing Inventory: the active inventory has grown by 42% since the beginning of the year.

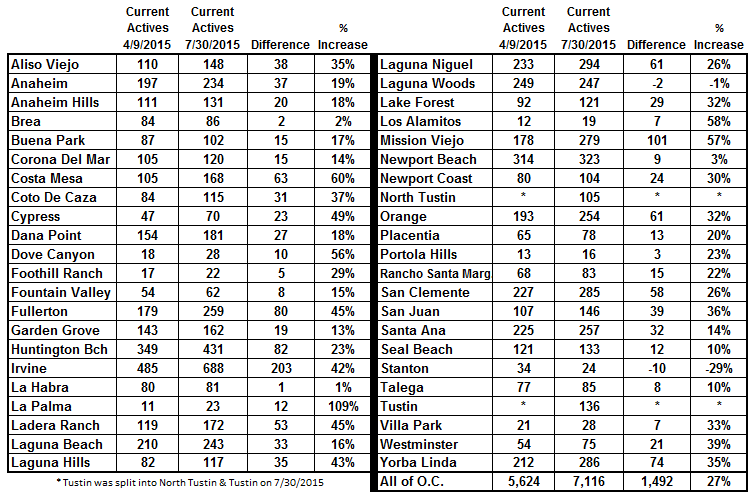

Quietly, one house at a time, the active inventory has been growing. In order for the inventory to rise, homes have to come on the market faster than they are coming off. Homes come off the market for one of two reasons: either they are placed into escrow or a seller opts to pull their home off of the market. So, in order for the inventory to blossom from 5,000 homes at the beginning of 2015 to 7,116 homes today, homes have to sit on the market without success.

But how can that occur when we have heard so much about the extremely hot market this year? Quite simply, too many overzealous homeowners inaccurately priced their homes outside of reality and sat on the market until they came to their senses. It’s no wonder that 10% of the housing inventory in Orange County reduces their asking price each and every week.

Don’t get me wrong; the market is a lot stronger this year compared to last year. There were a similar number of homes placed on the market so far this year compared to last year, but the active inventory last year was 6% higher. The inventory was higher because demand was not as strong during the Spring Market. When fewer homes are placed into escrow, the inventory rises.

In spite of the robust market, the inventory is still rising. A hotter market is not a free pass to price a home wherever a seller wishes. Those sellers realize the error in their ways after sitting on the market without reviewing a single offer. Now that summer is almost over, the Orange County housing market is beginning its annual transition into the Autumn Market. Have you seen more Open House directional arrows at busy cross streets? That’s a definitive sign that there are fewer buyers in the marketplace, that homes are not selling as quickly, and that too many homes are not priced accurately.

April 9th of this year was the absolute peak of the spring selling season. The expected market time was at 1.81 months, or

54 days. The market was a very hot seller’s market and prices were rising, homes were flying off of the market, and offers were coming in above the listing price. Since then, the inventory has grown by 27%, 1,792 homes, and demand has dropped by 13%, or 409 pending sales. When supply rises and demand drops in housing, the expected market time that it would take for the average home to be placed into escrow rises, the higher the expected market time, the slower the overall market. It has climbed to 2.64 months, or 79 days, moving from a deep seller’s market to a slight seller’s market.

The expected market time is marching its way to three months. When it is between three and four months, it is a balanced market, one that does not favor a buyer or seller. At its current level, sellers are able to call the shots, but appreciation has slowed to a crawl. Without appreciation, proper pricing is vital in order to succeed. At this point, sellers wishing to stretch the price will simply sit on the market until they finally wake up to the reality that they are overpriced and will attract no offers.

Success today can be achieved a lot swifter with the sound strategy of pricing a home as close to its Fair Market Value. This cannot be determined by any online tool or valuation calculator, as they can be off by 20%, or even more. Instead, it is best to utilize the expertise of a seasoned REALTOR®, an expert who is able to take into consideration location, condition, upgrades and amenities, carefully comparing a home to the most recent pending and closed sales activity to determine the price.

The bottom line: price is the determining factor in successfully selling and stretching the price is a strategy that will not work for the remainder of 2015.

Active Inventory: The inventory increased by 7% in the last month.

The active inventory increased by 469 homes in the past month and now totals 7,116. October of 2014 was the last time the inventory was above the 7,000 home mark. Last year at this time the inventory totaled 8,057 homes, 941 more than today, with an expected market time of 3.16 months, or 95 days. That’s 16 additional days compared to today.

From here we can expect the listing inventory to continue to grow through the end of the summer before turning lower in September as fewer homes come on the market and sellers start to throw in the towel with both the Spring and Summer Markets in the rearview mirror.

Demand: Demand decreased by 9% in the past month.

Demand, the number of new pending sales over the prior month, decreased by 271 homes in the past month and now totals 2,698 homes, its lowest level since February. Demand will remain at these levels for the remainder of summer before it downshifts again after the kids go back to school.

Last year at this time there were 149 fewer pending sales, totaling 2,549. The year over year difference has diminished substantially. On July 2nd there were 492 more pending sales compared to 2014, 20% more. The current difference is the smallest since February, just 5%.

Distressed Breakdown: The distressed inventory increased by 12 home in the past couple of weeks.

The distressed inventory, foreclosures and short sales combined, increased by 12 homes in the past two weeks, but for the month it is actually down by nine. Year over year, there are 31% fewer distressed homes today. With a sharp turnaround in prices in the past few years the number of distressed homes has fallen appreciably. Only a few percent of all mortgaged homes are upside down. During the Great Recession, the number was as high as 25% of all mortgage homes. The distressed market has been reduced to an asterisk of the current Orange County housing scene.

In the past two weeks, the foreclosure inventory increased by 10 homes and now totals 68. Less than 1% of the inventory is a foreclosure. The expected market time for foreclosures is 51 days. The short sale inventory increased by 1 homes in the past two weeks and now totals 139. The expected market time is 48 days. Short sales represent just 2% of the total active inventory.

Have a great week.

[gravityform id=”13″ title=”true” description=”true”]

Leave a Reply