Housing is shifting gears quickly now that the kids are back in school.

Housing is shifting gears quickly now that the kids are back in school.

Housing in Autumn: The Orange County housing market is quickly evolving as it enters the Autumn season.

In the coming weeks, many who are involved in the real estate market will exclaim, “The housing markets is slowing! Homes are starting to sit on the market longer! There are not as many showings! What’s going on?!?” It’s actually a cyclical phenomenon. We experience it every year. It’s called AUTUMN.

Here’s what happens; every year the kids go back to school and the market changes. Yes, homes take a little longer to sell. Yes, there are fewer showings. There are also fewer sellers coming on the market. Many sellers who were unsuccessful during the Spring and Summer Markets will decide to throw in the towel and pull their homes off of the market completely. Collectively, with both fewer sellers coming on the market and many sellers throwing in the towel, the active listing inventory drops for the remainder of the year, until it reaches a low on New Year’s Day.

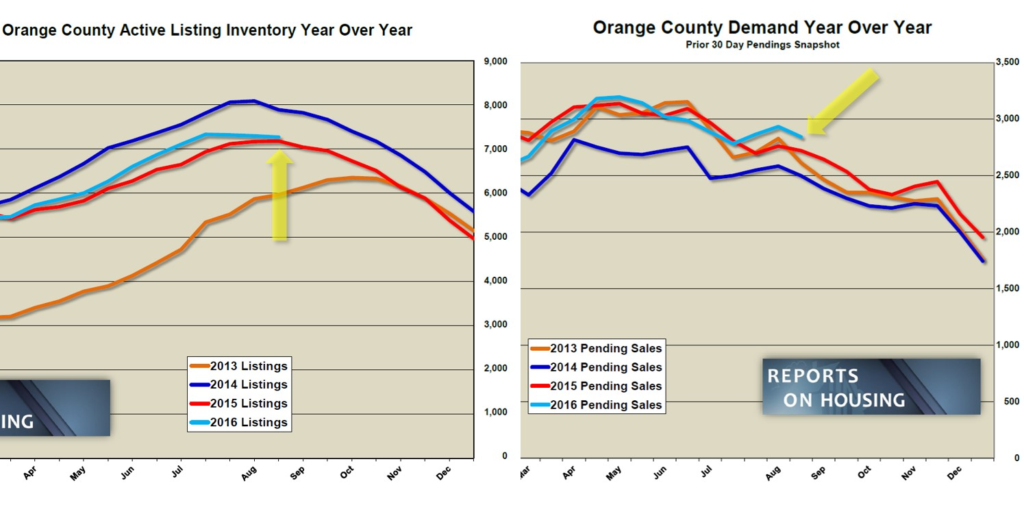

Last year, from the end of August through the end of the year, the active listing inventory dropped 31%. Homeowners get it: the Spring and Summer markets are officially in the rearview mirror. With the best and second best time of the year to sell now is the past, fewer homeowners pull the trigger and list their homes. As a result, the inventory falls as the year unwinds.

The number of buyers in the marketplace drops as well. Now that the kids are back in school, it is not the most advantageous time of the year to move. Moving is disruptive, which is precisely why more closed sales occur in June, July, and August. It’s much easier to move a family during the summer months when the kids are in transition from one school year to the next.

With fewer homes coming on the market for the remainder of the year, that means there are fewer choices. This too contributes to a drop in demand. As a result, demand drops for the remainder of the year, until it hits a low on New Year’s Day. If you are keeping track, both demand and the listing inventory drop to their lowest levels on New Year’s Day. It’s not just a lack of demand; it’s also a lack of supply.

Some buyers mistakenly think they can get a big “deal” during this time of the year, especially in November and December. The standard logical thinking sounds a bit like this: “If a homeowner has their home on the market during the holidays, they must be desperate.” It’s just not the case. We have been in an appreciating market for years now. Just because it is the holly, jolly season does not mean that sellers are all of a sudden going to become generous and provide a big discount. “Merry Christmas, Happy Hanukkah, Happy Kwanzaa!! Mr. and Mrs. Buyer, go ahead and take 20% off the asking price.” It’s just not going to happen. Sellers simply want every dime they can get for their home, regardless of the time of year.

And, for those buyers that are holding out for a major correction, there is not one on the horizon, not anytime soon. There are still not enough homes on the market and demand is HOT. With interest rates remaining below 4% and not looking to change much in the near future, Orange County will continue to experience a seller’s market. Janet Yellen, chair of the Federal Reserve, just last week stated that they are most likely going to increase the short term rate in December. In December last year, she foreshadowed that they were looking at increasing the rate four times in 2016; instead, it will only be one little change of a quarter percent and it won’t come until the very end of the year. These low interest rates are fueling the hot demand that we are experiencing today.

Sellers need to be wary of the season as well. This is not the time of the year where buyers are willing to stretch that far beyond the most recent comparable sale. Overprice today and sellers will not find success for the remainder of the year. It’s that simple. It is the season where everybody is a bit more price sensitive. Price according to the most recent comparable pending and closed sales and most homes fly off the market, even during the Autumn and Holiday Markets.

Luxury End: Luxury demand has dropped 4% in the past couple of weeks.

In the past couple of weeks, demand for homes above $1 million dropped from 483 pending sales to 465, a 4% drop. The inventory of luxury homes now totals 2,658. Demand will continue to drop as we push our way into the Autumn Market, but so will the luxury inventory.

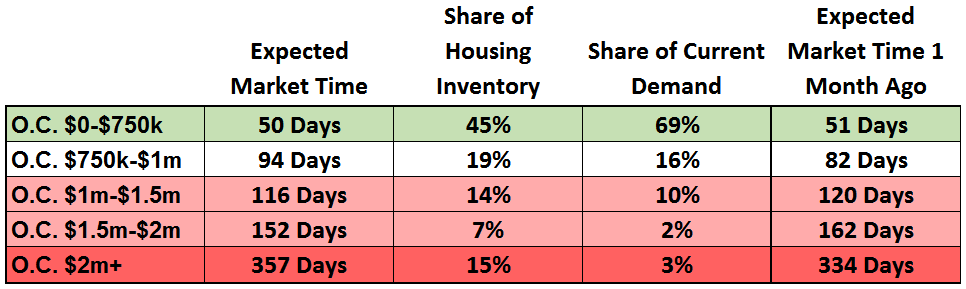

For homes priced between $1 million to $1.5 million, the expected market time increased slightly from 114 days to 116 in the past two weeks. For homes priced between $1.5 million to $2 million, the expected market time decreased slightly from 159 days to 152 days. For homes priced above $2 million, the expected market time dramatically increased from 304 days to 357 days, just shy of a complete year.

Regardless of how hot the market it in the lower ranges, it behaves differently in the luxury ranges, especially above $1.5 million. Homes do not fly off the market with multiple offers like they do in the lower ranges. Price, patience, and perseverance are essential ingredients in order to find success.

Active Inventory: The inventory has hit a plateau and is poised to start its cyclical drop.

The active inventory peaked early this year, mid-July, at 7,329 homes, but it really has not changed much since. In the past couple of weeks it dropped by only 28 homes, and, since reaching the peak, has only shed 62 homes. Today, the inventory sits at 7,267 homes. Now that the kids have gone back to school, summer is over and fewer homeowners will place their homes on the market; and, many sellers leftover from the Spring and Summer Markets are going to throw in the towel and pull their homes off the market. As a result, the inventory will drop.

Last year there were 89 fewer homes on the market, 1% less, totaling 7,178.

Demand: In the past two-weeks demand dropped by 3%.

Demand, the number of new pending sales over the prior month, dropped by 92 homes, or 3%, and now totals 2,843 pending sales. Demand is still much stronger for this time of the year, levels not seen since prior to the Great Recession. Last year at this time there were 121 fewer pending sales, 4% less than today.

The expected market time increased from 75 days two weeks ago to 77 days today.

Orange County Housing Market Summary:

• Typically, the active inventory peaks in August, but this year it peaked in mid-July and has since dropped by 62 homes, now totaling 7,267. There are 89 more homes on the market compared to last year at this time. The inventory is about to drop as we move into the Autumn Market.

• There are 19% fewer homes on the market below $500,000 compared to last year at this time and demand is down by 10% as well. As home values continue to rise, this range is slowly vanishing.

• Demand, the number of pending sales over the prior month, decreased by 3% from 2,935 to 2,843 in the past two weeks. Demand was at 2,722 last year, 4% less than today. The average pending price is $778,632.

• The average list price for all of Orange County is $1.5 million.

• For homes priced below $750,000, the market is HOT with an expected market time of just 50 days. This range represents 45% of the active inventory and 69% of demand.

• For homes priced between $750,000 and $1 million, the expected market time is 94 days, a balanced market (between 90 and 120 days). A balanced market does not favor sellers or buyers. This range represents 19% of the active inventory and 16% of demand.

• For luxury homes priced between $1 million to $1.5 million, the expected market time is at 116 days, increasing slightly by 2 days in the past couple of weeks. For homes priced between $1.5 million to $2 million, the expected market time dropped slightly from 159 days to 152 days. For luxury homes priced above $2 million, the expected market time increased dramatically from 304 days to 357 days.

• The luxury end, all homes above $1 million, accounts for 37% of the inventory and only 16% of demand.

• The expected market time for all homes in Orange County increased from 75 to 77 days in the past couple of weeks, a slight seller’s market.

• Distressed homes, both short sales and foreclosures combined, make up only 1.9% of all listings and 3% of demand. There are 43 foreclosures and 93 short sales available to purchase today, that’s 136 total distressed homes on the active market, increasing by 6 in the past two weeks. Last year there were 219 total distressed sales.

• There were 2,820 closed sales in July, a 9% drop from June and 13% fewer than last year’s 3,243 closings. The sales to list price ratio was 97.5%. Foreclosures accounted for 1% of all closed sales and short sales accounted for 1.7%. That means that 97.3% of all sales were good ol’ fashioned equity sellers.

Have a great week.

Sincerely,

Roy A. Hernandez

TNG Real Estate Consultants

Cell 949.922.3947

[gravityform id=”22″ title=”true” description=”true”]

Leave a Reply