With less than a month left in the Spring Market, the best timeof the year to sell is about end.

End of the Spring Market: Without exception, the Orange County housing market downshifts every summer.

The window of opportunity to take advantage of the busiest time of the year for Orange County housing is closing. 2016 is flying by, and, before you know it, so will the Spring Market. For homeowners who want to sell and take advantage of the strongest buyer demand of the year, they better be on the market and priced to sell right now.

For sellers, this is not the time to stretch the asking price. It is common for sellers to get overly excited in pricing their homes during a hot seller’s market. Just because it is a hot seller’s market does not mean that buyers are willing to pay tens of thousands more than the most recent comparable or pending sale. Core Logic reported that last month’s median sales price of $645,000 matched the highest level ever in Orange County in June of 2007, but that does not mean that buyers are more inclined to overpay.

Sellers are emotionally tied to their homes and that typically leads to overpricing. It is recommended that they take an emotional step back and look at all of the comparable data objectively. What’s so bad about overpricing? Most activity occurs within the first couple of weeks of placing a home on the market. When a home does not generate offers within the first month in a hot real estate market, it typically means that the home’s price is not accurate. When homes adjust the asking price, it is after the deluge of buyer activity that has already taken place. It does not mean the home will not sell; it means that the buyer frenzy is missed and fewer offers are generated. Pricing a home accurately initially produces more offers and allows a home’s price to be bid up. Often homes are negotiated for at or above the full asking price. An accurate price allows a home to fetch the highest sales price possible.

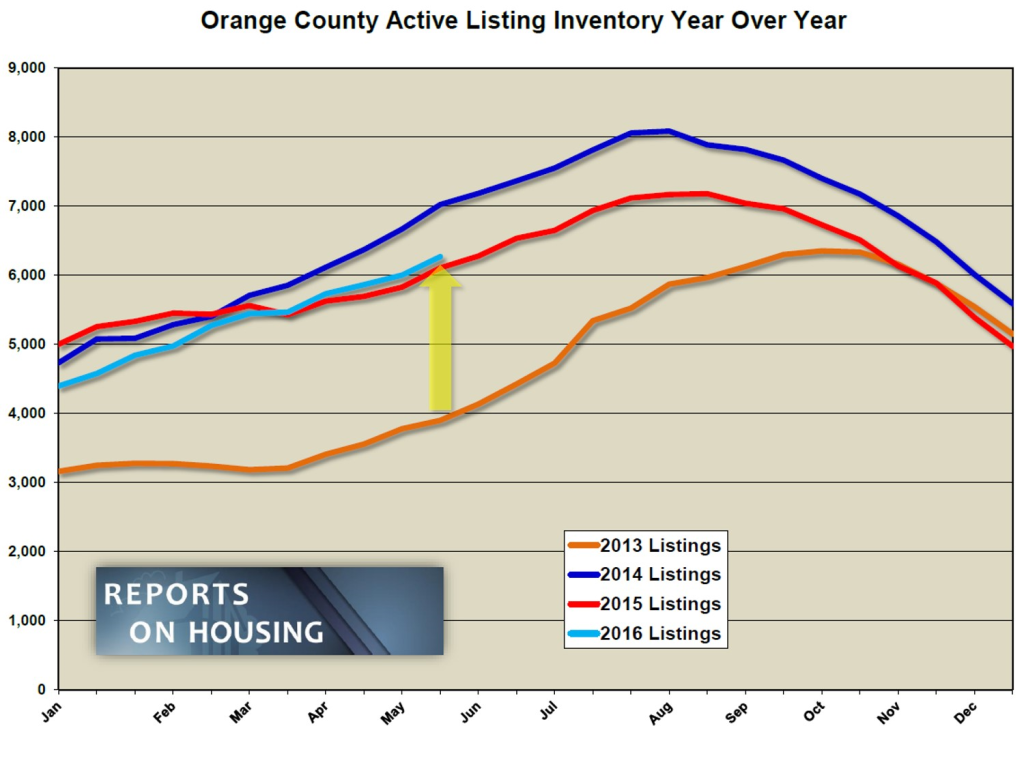

The reason the Spring Market is the best time to sell boils down to a supply and demand issue. Demand is at its highest point during the spring and there is not enough supply. When supply is low and demand is high, the market favors the seller. The end of spring is around the corner and there are already signs of the market starting to shift. Demand is peaking right now and the active listing inventory is actually growing. The reason demand is not continuing to grow despite a low interest rate environment and so many buyers waiting on the sideline ready to pounce on new homes that

hit the market is twofold: (1) many homes are not realistically priced and buyers will not stretch to unreasonable heights; (2) graduations mark the beginning of all of the summer distractions, sidelining many buyers as they celebrate the successes of family and friends that graduate.

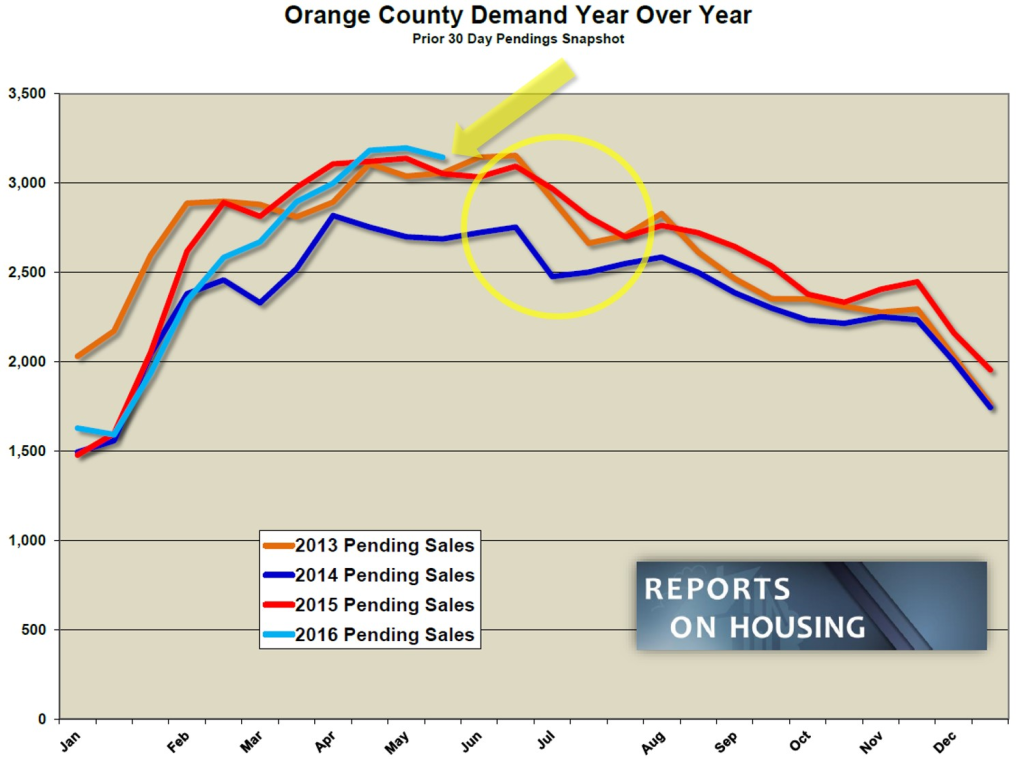

There is a cyclical downshift in buyer demand during the Summer Market. Summer is filled with distractions. That’s when the kids are out of school. Sand castles at the beach, a refreshing dip at the local pool, a picnic at the park, a trip to Disneyland, hiking in the local mountains, Southern California is overflowing with summer activities, distracting buyers from focusing 100% of their efforts on purchasing like they are able to in the spring. As a result, the active listing inventory increases, the supply of homes, and demand drops. When supply increases and demand decreases, the market cools.

Every year the Orange County housing market experiences a noticeable downshift and this year will not be an exception.

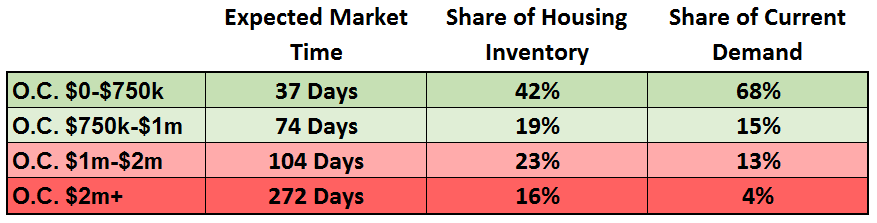

Luxury End: Above $2 million, demand dropped by 10% in the past two weeks.

Homes priced from $1 million to $2 million may not be as hot as homes priced below $1 million, but it’s not an ice cold market either. With an expected market time of 104 days, offers are generated when homes are priced right. It’s a different story above $2 million. The expected market time is 272 days, or 9-months. There is plenty of competition among sellers and not enough buyers to go around. Many will not find success over the remaining Spring and Summer markets. And, over the past couple of weeks, demand dropped by 10% for homes priced above $2 million, a sign that the luxury market may be cooling.

There are 1,017 homes priced above $2 million and demand, the number of new pending sales over the prior month, is at 112. If demand remains the same over the course of the next month, only 112 homes will be placed in escrow, leaving 905 unsuccessful sellers remaining on the active market.

Active Inventory: The inventory increased by 2% in the past two weeks.

The active inventory increased by 267 homes in the past two weeks and now total 6,267, its highest level since October of last year. The inventory will continue to climb through the end of the Spring Market and will pick up steam as demand slows a bit during the summer.

Last year there were 163 fewer homes on the market, 3% less.

Demand: In the past two-weeks demand decreased by 2%.

Demand, the number of new pending sales over the prior month, decreased by 52 homes in the past couple of weeks, now totaling 3,144, a 2% drop. Two weeks ago, demand had reached a height for 2016 and was the highest level since October 2012. Demand may have already peaked, but it will remain at the current elevated level through the end of spring.

Last year at this time demand was at 3,052 pending sales, 92 fewer than today. The expected market time was 60 days, identical to today.

Summary:

Have a great week.

Sincerely,

Roy A. Hernandez

TNG Real Estate Consultants

RoyaltyAgent@Gmail.com

Cell 949.922.3947

[gravityform id=”13″ title=”true” description=”true”]

Leave a Reply