Ever since ringing in the New Year, 2016 has had its own look and

Ever since ringing in the New Year, 2016 has had its own look and

feel and it is not a repeat of last year.

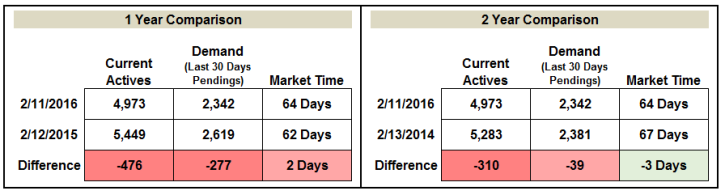

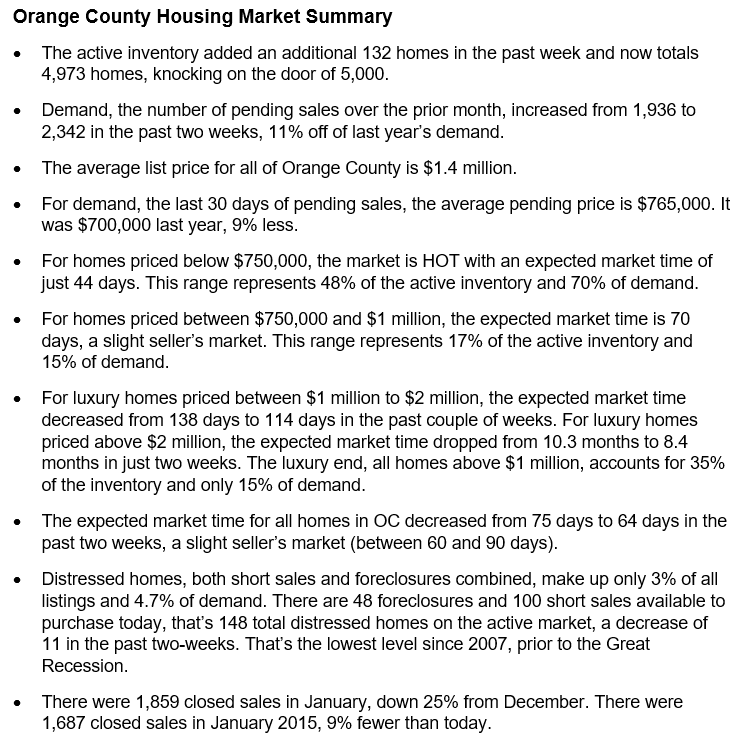

Not 2015: Demand is off by 11% and the inventory is 9% less than last year.

This year’s housing market has its own unique look and feel. There are major differences from this time last year. The biggest glaring difference is that there are not enough homes on the market, 476 fewer. That would not be that big of an issue if we were anywhere close to the long term average inventory for Orange County, 9,238 homes; however, there are fewer than 5,000 homes on the market right now. The current trend of a very low inventory dates back to 2012, and todays even more anemic supply can truly be felt in the streets of the local housing market.

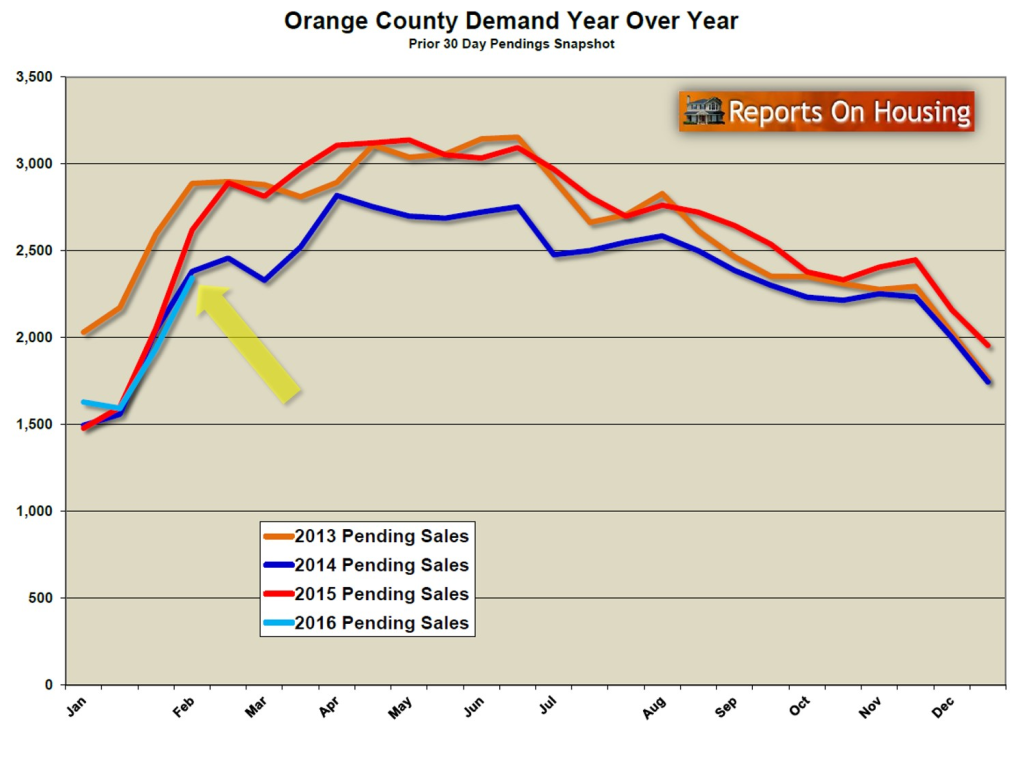

Another major difference is that demand is down significantly as well. Within the last month, there have been 277 fewer pending sales compared to 2015. Demand is actually much more similar to 2014 levels. Demand is increasing right now, just not at the incredible pace of one year ago when it just took off in February.

So, where are we headed in 2016? It appears as if 2016 is looking a lot more like 2014 than 2015. One of the biggest reasons for the shift is the amount of uncertainty surrounding worldwide financial and stock markets, and the current volatility in Wall Street. Even the Federal Reserve seems a little less certain of their monetary policy than they were just a couple of months ago. That’s good news for interest rates. The chances that they will continue to increase the short term federal funds rate has dropped precipitously. As a matter of fact, interest rates have dropped well below 4% and are at unprecedented levels again.

If you are wondering how interest rates could drop so low right after the Federal Reserve increased the short term rate in December, it is because long term rates are not directly tied to the short term rate. Instead, they are tied to long term United States treasury bonds. With all of the worldwide financial uncertainty, everybody from around the world is turning to US treasury bonds as a safe haven. With so much money flooding to treasuries, the long term rate has dropped significantly. And, it doesn’t seem like things are going to be changing anytime soon either; so, the low interest rate environment looks like it will stick around for most of 2016. It is a great time to be a buyer, as these low rates make housing affordability a once in a lifetime opportunity. These rates are almost unbelievable in historical context.

For sellers, the uncertainty in the air means that they will not be able to get away with stretching the value of their home by pricing it much more than the Fair Market Value. This value can be determined by carefully analyzing the most recent sales and pending activity, taking into consideration location, condition, amenities, and upgrades.

In 2012 through 2013, sellers were able to aggressively stretch their price and, more often than not, they eventually got it. In 2014, buyers focused on the Fair Market Value and overpriced homes remained on the market without success until they reduced their asking prices more in alignment with their true value. The inventory grew on the backs of overpriced homes. But, in 2015, with stronger demand, the inventory remained low and sellers were able to get away with stretching the price again. They were not able to stretch as much as 2012 and 2013, but values were on the rise for the first half of the year. The second half of last year was more like 2014 and sellers needed to be priced right in order to find success. With demand more in line with two years ago, the current trend in the market indicates that this year will be a lot more like 2014.

The bottom line: Seller will find success when priced according to the Fair Market Value and buyers will still be diving into the housing market to take advantage of historically low interest rates.

Active Inventory: the inventory increased by only 3% as more homes are placed into escrow.

The active inventory increased by 132 homes, or 3%, in the past two weeks and now sits at 4,973, knocking on the door of 5,000 homes for the first time since the start of December. Thus far in 2016, fewer homes are coming on the market compared to the same time last year, 7% fewer. With fewer homes added to the inventory and more homes pulled off as they are placed into escrow, the inventory is not climbing as rapidly as it was during January, a cyclical phenomenon for February.

Last year at this time the inventory totaled 5,449 homes, 476 more than today, with an expected market time of 2.08 months, or 62 days, a slight seller’s market. Today’s expected market time is similar at 64 days, also a slight seller’s market. A slight seller’s market means that there is not much price appreciation but sellers get to call more of the shots in terms of negotiating the finer details of a contract.

Demand: in the past two-weeks demand jumped by 21%.

Demand, the number of new pending sales over the prior month, increased by 406 homes in the past two-weeks, and now totals 2,342, the most since November. That’s the largest increase since one year ago today, also a cyclical phenomenon that occurs in the month of February. During the same two-week period in 2015, demand actually increased by 566 pending sales and it totaled 2,619, or 12% more than today.

Today’s demand looks a lot more like 2014 when it reached 2,381 pending sales, just 39 more than today.

Expect demand to continue to increase methodically through March and then remain elevated through the end of Spring, mid-June

Have a great week.

Sincerely,

Roy Hernandez

TNG Real Estate Consultants

949-922-3947

RoyaltyAgent@Gmail.com

Leave a Reply