It is tough to be a first-time home buyer in a seller’s market and it is not really student debt that is preventing them from buying.

First Time Home Buyers: first-time home buyers are finding it very difficult to buy in Orange County and student debt is not their biggest hurdle.

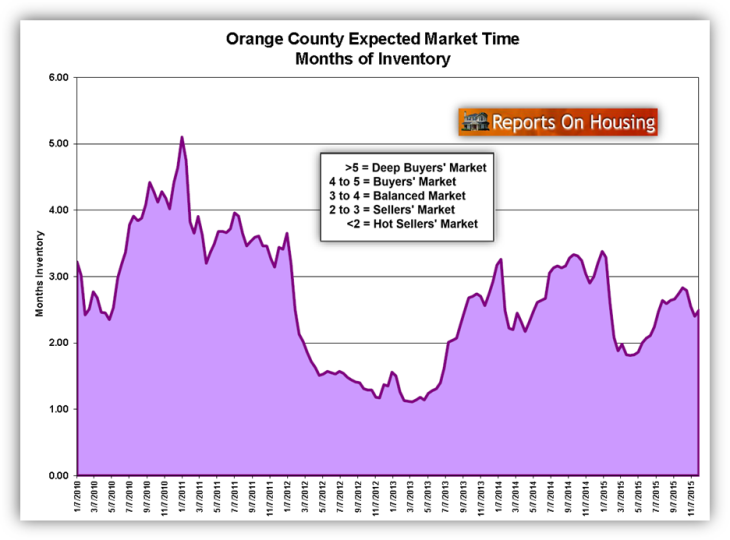

The lack of first-time home buyer activity has been unfairly blamed on strong growth in student debt over the past decade. For all buyers in Orange County, it has been tough to purchase for several years now. The main culprit, that it has been a seller’s market for the past four years. It all started back in 2012 and the same underlying market forces have been driving homebuyers nuts ever since.

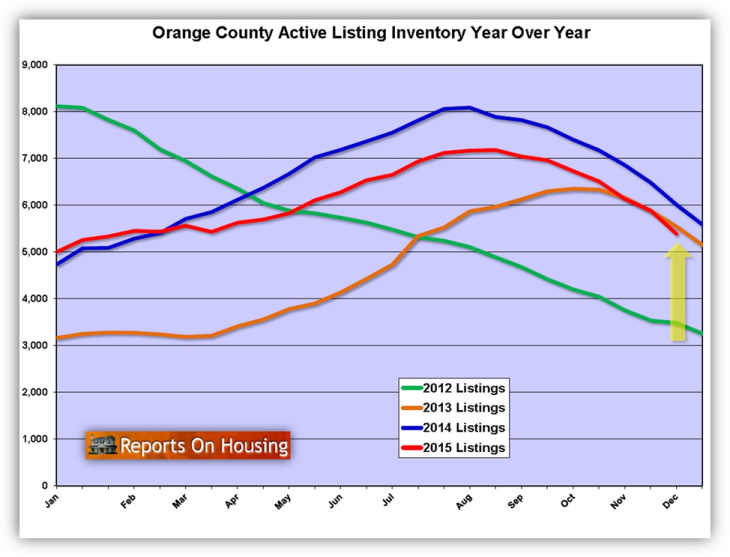

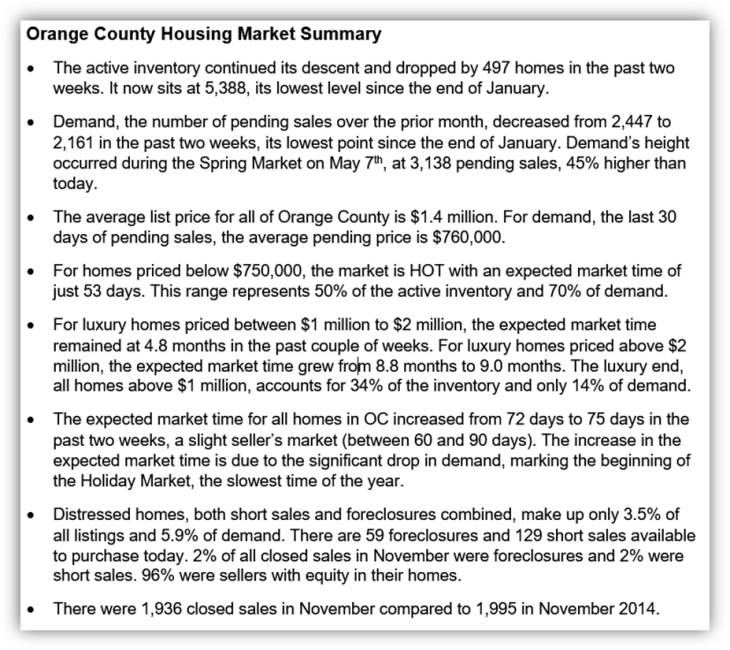

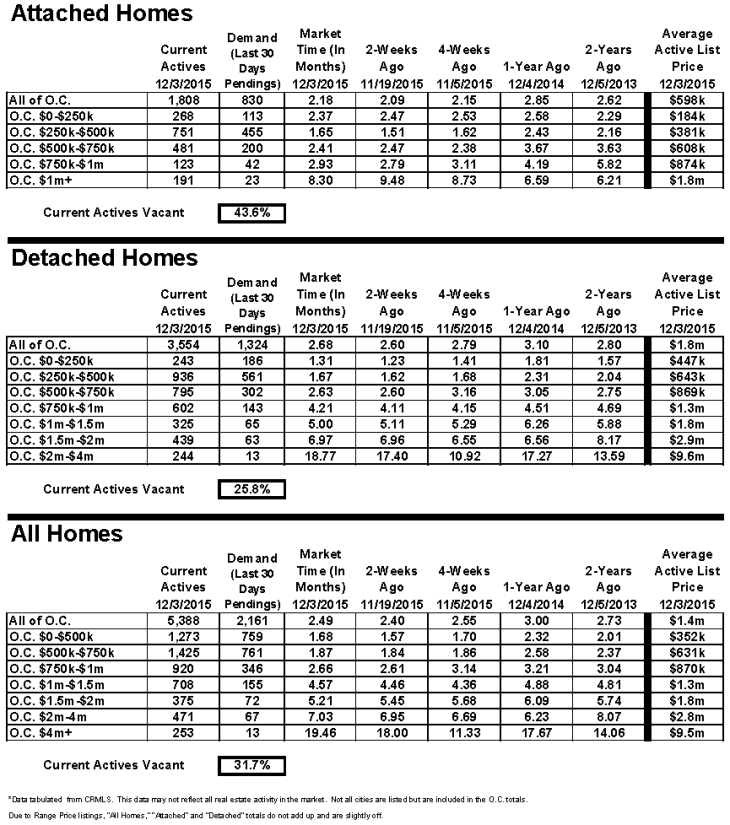

The housing supply, the number of active homes on the market, has been well below the long-term average of 8,500 homes. The inventory peaked in mid-August this year, just shy of 7,200 homes. There are less than 5,400 homes on the market today. So, as far as choices are concerned, there are not that many homes for buyers to choose from.

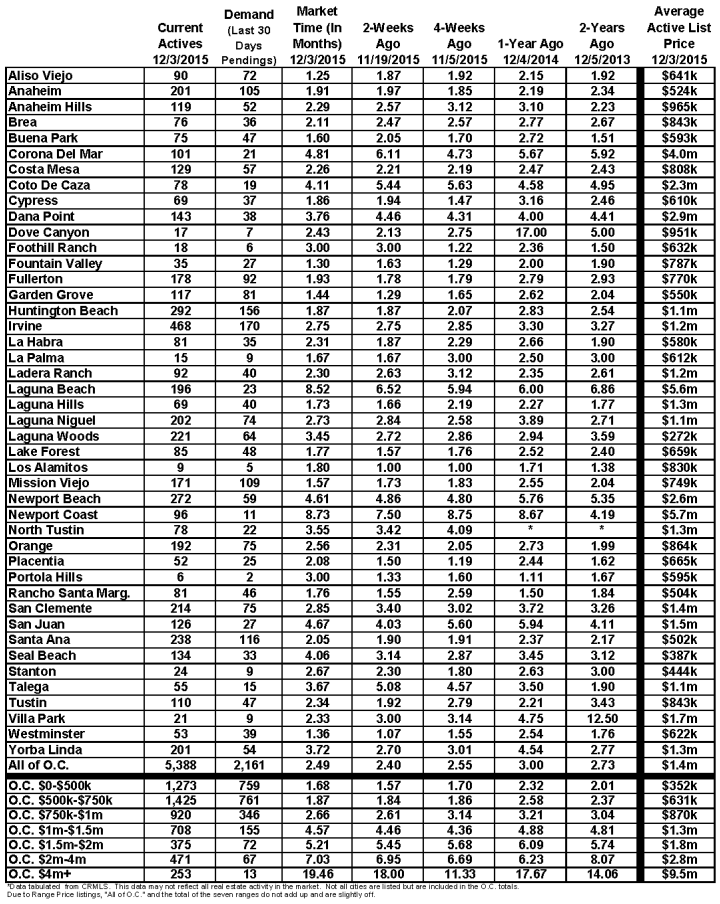

On the other hand, demand has remained extremely strong, resulting in appreciation and restoring the overall health in the Orange County housing market. Due to strong demand coupled with an anemic active inventory, the expected market time has remained very low since 2012, tipping the market in favor of sellers ever since. The last time the tables were turned and buyers were in control of housing dates all the way back to January of 2011. A buyer’s market is when the expected market time, the average amount of time it takes to place a home on the market and into escrow, is more than four months. In 2011, it was the year of equilibrium, not favoring buyers or sellers, an expected market time between three and four months. Last year the housing market experienced equilibrium for the second half of the year, but not this year. It has been a seller’s market ever since the end of January of this year, and will probably remain one through the end of 2015. The expected market time today is at 2.49 months, or 75 days.

What does this mean for buyers? Most buyers do not get their first choice in a home. They need to write offer after offer, especially in the lower ranges, homes priced below $750,000. They need to sharpen their pencils and write offers at the Fair Market Value, or maybe even a bit higher if the price range and neighborhood warrant it. Buyers are simply not in the driver’s seat.

What does this mean for buyers? Most buyers do not get their first choice in a home. They need to write offer after offer, especially in the lower ranges, homes priced below $750,000. They need to sharpen their pencils and write offers at the Fair Market Value, or maybe even a bit higher if the price range and neighborhood warrant it. Buyers are simply not in the driver’s seat.

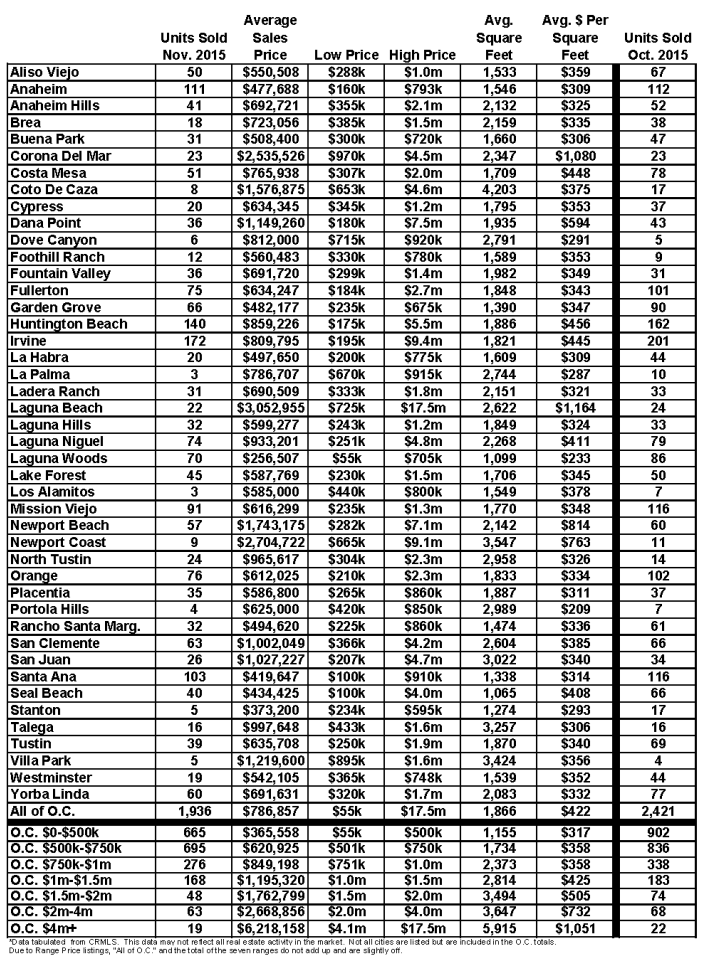

For first-time buyers, the challenges are even greater. Most first time buyers are looking for a home priced under $750,000. For homes priced below $500,000, the expected market time is at a very low 1.68 months, or 50 days, which is an even deeper seller’s market compared to the county as a whole. Between $500,000 and $750,000, the expected market time is at 1.87 months, or 56 days. When the expected market time is below two months, it is a “hot seller’s market” with a lot more competition to buy. Buyers are bumping into each other within these ranges, and the chances of dealing with multiple offers grows considerably.

The issue for most first-time buyers is that they lack a considerable down-payment. Most are looking in the lower ranges where it is still a “hot seller’s market” even in the month of December during the holiday, making it very difficult for first-timers to purchase. If a home is placed on the market in good condition and close to its Fair Market Value, it has a high likelihood of generating several offers. If a home produces three offers all with identical purchase prices where one is a first-time buyer with FHA, 3% down financing, another is at 10% down, and the final one provides 20% down financing, which one would you pick? In talking to agents across Orange County, unanimously, they all said the one with 20% down. This exercise is playing out every day, over and over again, in the lower ranges. First-time buyers have struggled to purchase and have had to write many offers in order to find success.

According to the California Association of REALTORS®, the long-term average for the share of first-time buyers is at 38%. In California, for the past three years it has been around 30%. The drop can be attributed to the continual seller’s market that has made it difficult to purchase for first-timers. Adding fuel to the fire is the lack of inventory and strong demand. Buyers who require low down payment financing often lose out in multiple offer situations, which is quite common in the lower price ranges where most firs-time buyers are looking.

Many believe that skyrocketing outstanding student debt is the reason for the drop in first-time buyer purchases. A study out of Dartmouth revealed that there is only an extremely slight decrease in the probability for someone with student loans to own a home versus someone who has no loans at all. Only if somebody does not graduate and has student debt does it then have a significant impact on owning a home.

The bottom line: there are plenty of first-time buyers who want to purchase; unfortunately, it is not easy to succeed. The secret sauce to success is plenty of patience, tenacity, ingenuity (family pictures and a letter to the seller will go a long way), and a very sharp pencil so that an offer to purchase will stand out. It may take writing many offers, but, eventually, victory will come, and the first-time buyer will be handed the keys to their share of the American dream.

Active Inventory: the inventory dropped by 8% in just two weeks.

The active inventory dropped by 497 homes, or 8%, in the past two weeks and now sits at 5,388. As we dive deeper into the Holiday Market, from Thanksgiving through the first few weeks of the New Year, the inventory drops to its lowest levels of the year. The absolute lowest point will occur on January 1st, and that will be after we drop below the 5,000 mark for the first time in a couple of year.

From there, expect the inventory to slowly rise, but by the end of January it will not even climb to where we are today. The inventory will not start to really rise until March.

Last year at this time the inventory totaled 6,010 homes, 622 more than today, with an expected market time of 3 months, or 90 days, a balanced market that does not favor a buyer or seller. In comparison, today’s expected market time is 75 days, a slight seller’s market. A slight seller’s market means that there is not much price appreciation.

Demand: the Holiday Markets are here and demand dropped substantially in the past couple of weeks.

Demand, the number of new pending sales over the prior month, plunged by 286 homes, or 12%, in the past two weeks, a strong signal that the Holiday Market has finally arrived. Buyers move from touring homes and writing offers to carving the turkey and shopping for holiday gifts. Demand will continue to drop through the end of the year and will not reverse course until mid-January. It will pick up steam right after Super Bowl Sunday.

Last year at this time there were 159 fewer pending sales, 8% less, totaling 2,002.

Have a great week.

Roy A. Hernandez

TNG Real Estate Consultants

Cell 949-922-3947

RoyaltyAgent@Gmail.com

[gravityform id=”13″ title=”true” description=”true”]

Leave a Reply