Agreement With Fannie, Freddie Potentially Paves Way for More Applicants to Qualify for Loans

Lenders also are expected to widen the scope of the types of borrowers they will accept by reducing credit-score requirements and giving greater leeway to consumers whose credit history suffered because of one-time events, such as a job loss or big medical bill.

Economists have long maintained that tight credit could be holding back the housing recovery and damping economic growth. On Tuesday, the S&P/Case-Shiller Index showed that U.S. home prices grew 4.8% in the 12 months ending in September, their slowest pace in two years.

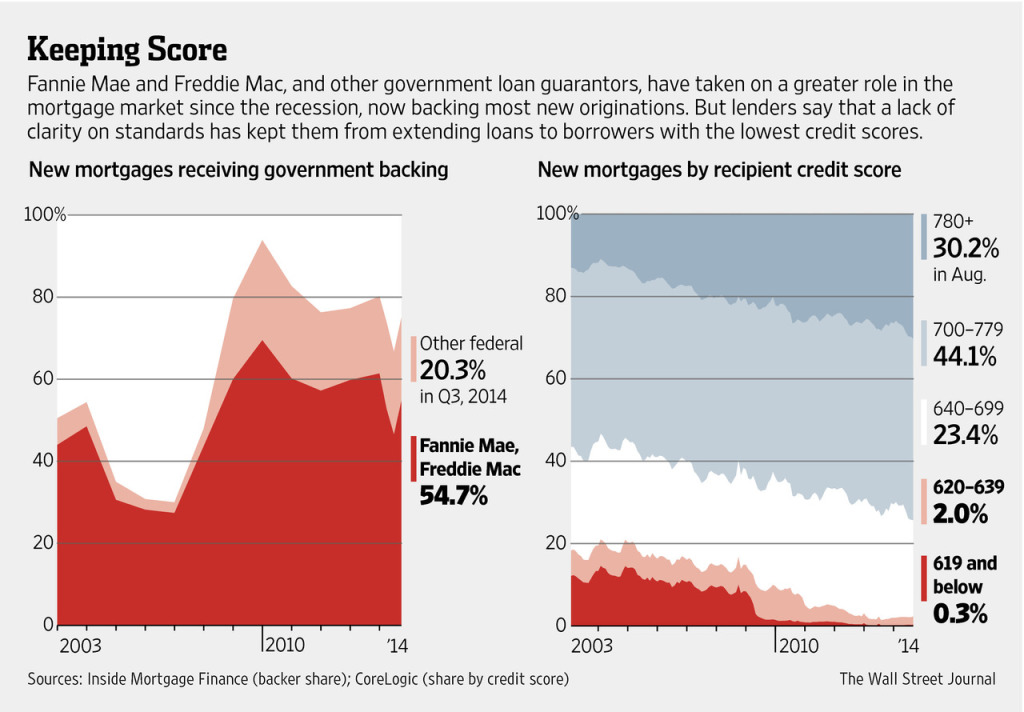

After the financial crisis, Fannie and Freddie made banks repurchase tens of billions of dollars in loans that the companies said didn’t meet their standards. In turn, many lenders stopped making loans to all but the most pristine of borrowers.

In many cases, they required borrowers to have substantially higher credit scores and put in place other measures—so-called credit overlays—that were more stringent than what Fannie and Freddie required.

With the new agreement, “I’ve been told with absolute confidence that some lenders are lifting almost all of their overlays,” said David Stevens, president of the Mortgage Bankers Association.

Wells Fargo, the nation’s largest mortgage lender, lifted its credit-score overlay earlier this year, which the bank said was in anticipation of the agreement with Fannie and Freddie. Now it says borrowers can expect a smoother process of getting a loan with less “excessive” paperwork.

“It’s providing greater certainty for all the parties so that you can lend more confidently and make the whole judgment process much easier and more clear cut,” said Mike Heid, president of Wells Fargo Home Mortgage.

For example, under the previous system, Mr. Heid said a borrower who had a late payment on an auto loan might have been asked to write a memo describing what happened, even if such a mistake wasn’t critical to the decision to make a loan or not. That was because Wells couldn’t be certain what would trigger a repurchase demand from Fannie or Freddie, he said.

Now, they are less likely to be required to ask for such documentation, he said, which should speed the process of securing a loan.

Jerome Lienhard, CEO of SunTrust Mortgage, said the new guidelines likely would allow the company to lift its overlays by “a pretty meaningful amount.” He said the bank is still analyzing which overlays to remove, but he is confident many will be eliminated. “This is real. This is substantive,” he said.

Before the new rules were put in place, Mason-McDuffie Mortgage Corp. in San Ramon, Calif., typically wouldn’t make a loan to a borrower with a credit score below 660, said Bill Godfrey, the company’s executive vice president of capital markets. Now, he said he believes the company will lend down to 620, the limit for loans backed by Fannie and Freddie.

“We will be able to be looser and open up the net wider,” said Mr. Godfrey.

Not all lenders are poised to relax their underwriting rules. On an earnings call a few days after the agreement was announced, U.S. Bank Chief Executive Richard Davis called it “a good sound bite” and indicated that his bank wasn’t prepared to make changes.

“Unless we are convinced that the rules are going to be permanent and there is not going to be a look back or a reach back in future times…we are simply going to stay on the sidelines in the concerns of both compliance risks and other uncertainties,” said Mr. Davis.

“You won’t see us start to expand our criteria much past what we’ve done,” said Bank of America Chief Executive Brian Moynihan at an investor conference this month.

Isaac Boltansky, an analyst at Compass Point Research & Trading, said some lenders are still too “shellshocked due to litigation and the shifting regulatory environment” to ease credit conditions soon.

Still, overall, Fannie Mae CEO Timothy J. Mayopoulos this month said lenders were “reacting positively to those developments. I do think that lenders are nonetheless concerned about other factors in the environment that we do not control.”

By JOE LIGHT, WSJ

[gravityform id=”20″ name=”Purchasing a house soon and need a home loan?”]

Leave a Reply