[mortgage mortgage_term=”30″]

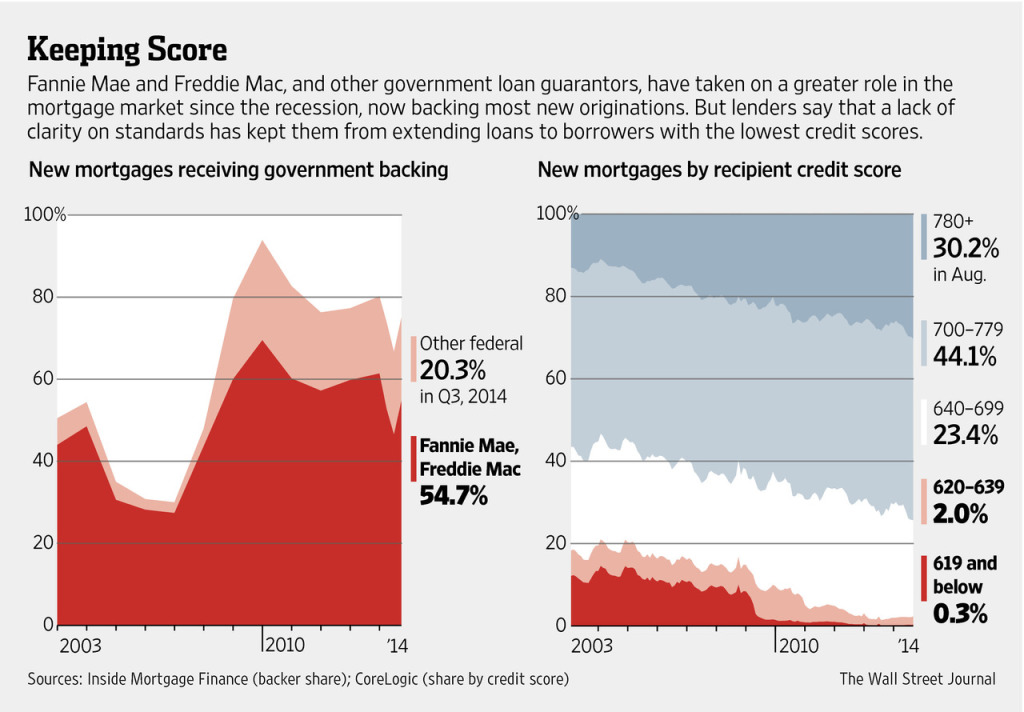

Fannie Mae and Freddie Mac on Monday announced details of a controversial plan to allow some first-time homeowners to obtain a mortgage while putting down just 3% of the price of the home.

The shift back toward low down payments has drawn intense criticism from an array of legislators and lending and housing experts who say the plan revives the same lax lending practices that led to the 2008 financial crisis.

In a statement, Fannie Mae said the loans that allow for 3% down payments will be held to the same eligibility requirements as other Fannie loans, including underwriting, income documentation and risk management standards.

In addition, Fannie said the loans will require mortgage insurance “or other risk sharing,” the same as Fannie loans that require a 20% down payment.

“This option alone will not solve all the challenges around access to credit. Our new 97 percent LTV offering is simply one way we are working to remove barriers for credit-worthy borrowers to get a mortgage,” Andrew Bon Salle, Fannie Mae Executive Vice President for Single Family Underwriting, Pricing and Capital Markets, said in the statement. “We are confident that these loans can be good business for lenders, safe and sound for Fannie Mae and an affordable, responsible option for qualified borrowers.”

Critics of the plan aren’t as confident.

Jeb Hensarling (R-Texas), Chairman of the House Financial Services Committee, said after the plan was announced earlier this year that lowering down payment standards for government-backed mortgages is “an invitation by government for industry to return to slipshod and dangerous practices that caused the mortgage meltdown in the first place and wrecked our economy.”

In the aftermath of the 2008 financial crisis, which stemmed directly from the collapse of the U.S. housing market as millions of Americans defaulted on their home loans, Fannie Mae and Freddie Mac were accused of easing credit both in an effort to promote loans under pressure from both Democratic and Republican administrations to increase home ownership, as well as to boost their own profits.

Many private lenders were accused of relaxing their lending standards for the same reasons.

In its statement Monday, Fannie included a laundry list of precautions ingrained in the new 3% down payment plan to ensure that borrowers can repay the money and that taxpayer won’t be on the hook if they can’t. For instance, Fannie will require income documentation to avoid “low-doc” or “no-doc” lending, and will require income verification, two practices that fell out of favor as the housing bubble expanded in the early 2000s.

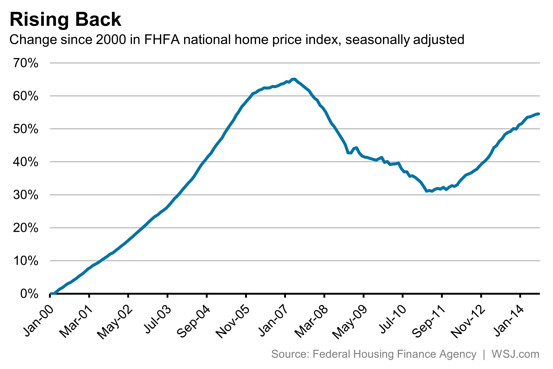

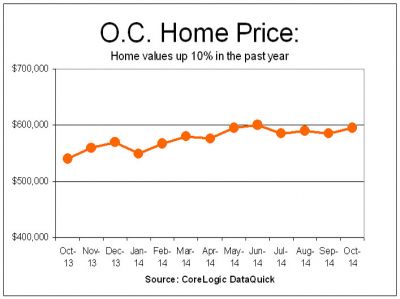

Since the housing bubble burst, sending the U.S. into a deep recession, lenders have been enforcing far tighter credit standards, making it difficult for many first-time home buyers to scrape together a down payment and qualify for a mortgage.

Consequently, despite historically low interest rates that have brought mortgage rates to their lowest levels in decades, many consumers haven’t been able to get approved for a mortgage and the U.S. housing market has struggled to gain traction as the economic recovery slowly moves forward.

Fannie and Freddie found themselves on the verge of collapse at the height of the financial crisis and were taken over by the government in 2008 and ultimately kept afloat through a $185 billion bailout. They quasi-government agencies remain in conservatorship.

Congress has been fighting over whether to reform the existing agencies or scrap them altogether. Earlier this year, a bipartisan Senate plan to replace Fannie and Freddie as part of a broader housing-finance overhaul stalled.

[gravityform id=”13″ name=”Have a question or comment?”]

Halloween Fair and Haunted House

Halloween Fair and Haunted House Anaheim Fall Festival & Halloween Parade

Anaheim Fall Festival & Halloween Parade Halloween Treat-or-Treating at Anaheim Town Square

Halloween Treat-or-Treating at Anaheim Town Square Kidz Block Party

Kidz Block Party

Pacific Symphony ‘Sherlock Holmes Halloween’

Pacific Symphony ‘Sherlock Holmes Halloween’

City of Cypress Halloween Carnival

City of Cypress Halloween Carnival Halloween Kids Boo Cruise

Halloween Kids Boo Cruise