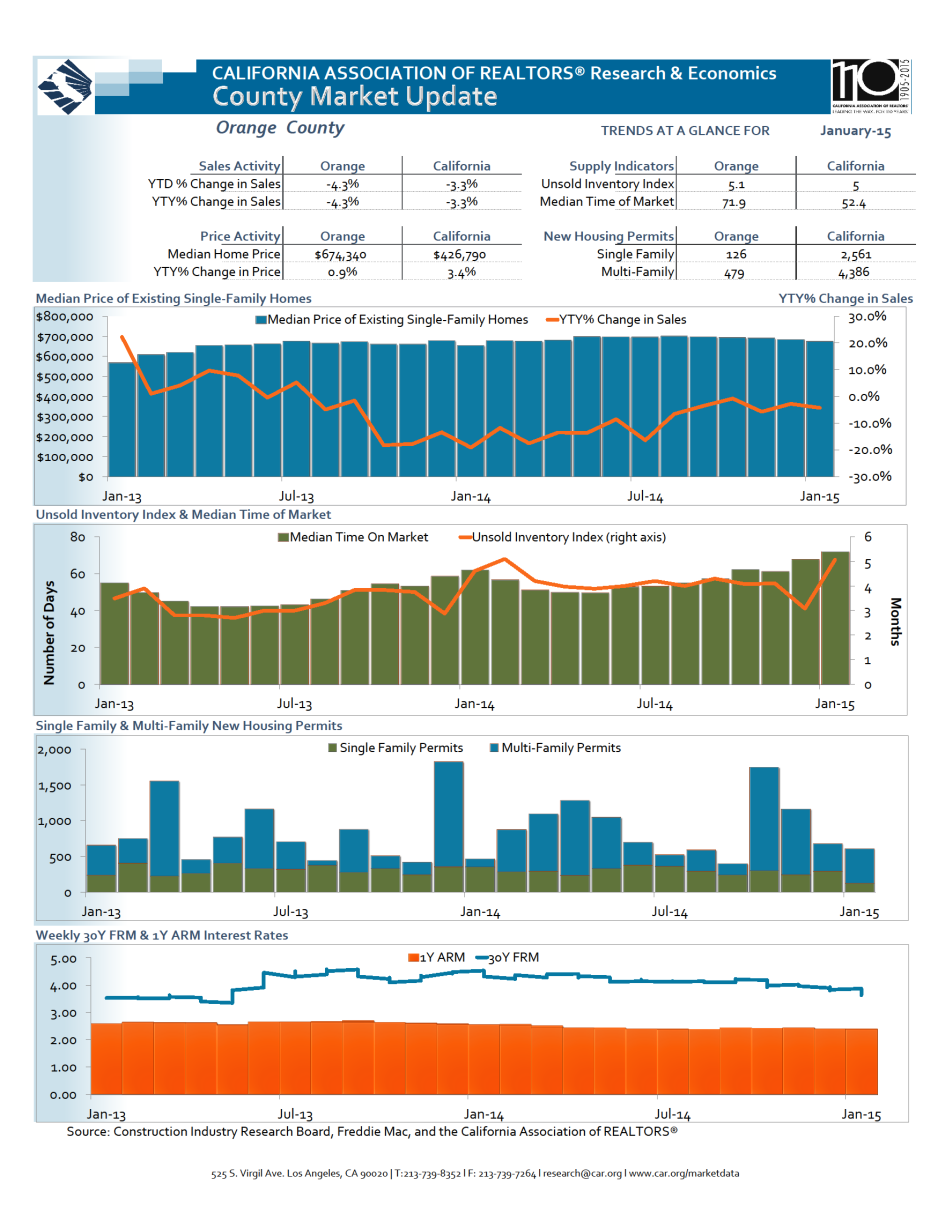

Despite many promising factors leading in to 2015, the market got off to a relatively slow start to begin the year. Though the winter months are typically considered an “off season” for brokers and agents around the nation, there were still many who had hoped that the record low interest rates and slowing home appreciation would be enough to drive sales forward – I was one of them. This clearly wasn’t the case in January, when sales throughout California and most of the nation dropped from the month before, but not all hope should be lost. New research from the California Association of Realtors has found that existing home sales increased across California in February – likely a result of slowing home appreciation and increasing inventory, and the latest indicator of a stronger market ahead.

Despite many promising factors leading in to 2015, the market got off to a relatively slow start to begin the year. Though the winter months are typically considered an “off season” for brokers and agents around the nation, there were still many who had hoped that the record low interest rates and slowing home appreciation would be enough to drive sales forward – I was one of them. This clearly wasn’t the case in January, when sales throughout California and most of the nation dropped from the month before, but not all hope should be lost. New research from the California Association of Realtors has found that existing home sales increased across California in February – likely a result of slowing home appreciation and increasing inventory, and the latest indicator of a stronger market ahead.

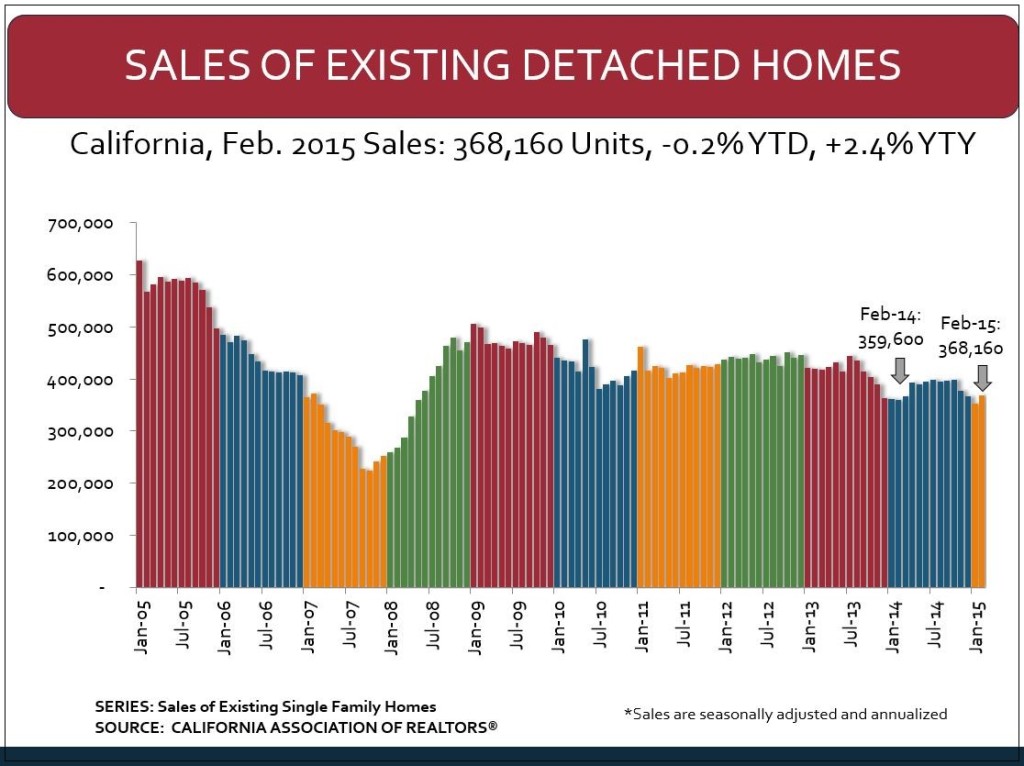

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 368,160 units in February, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. Sales in February were up 4.7 percent from a revised 351,480 in January and up 2.4 percent from a revised 359,600 in February 2014. The year-over-year increase was the largest observed since December 2012. The statewide sales figure represents what would be the total number of homes sold during 2015 if sales maintained the February pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

“While February’s statewide improvement in the housing market was moderate, it’s an encouraging sign, nevertheless, as we head into the spring home-buying season,” said C.A.R. President Chris Kutzkey. “On the supply side, housing inventory improved overall with active listings growing at a faster pace of 5.3 percent when compared to last February. Regionally, both active listings in Southern California and Central Valley increased moderately from last year, while housing supply declined 10 percent in the Bay Area.”

The median price of an existing, single-family detached California home was essentially flat from January’s median price, inching up from $426,660 in January to $428,970 in February. February’s median price was 5.5 percent higher than the revised $406,460 recorded in February 2014. While the statewide median home price is higher than a year ago, the rate of increase has narrowed significantly since early 2014. The median sales price is the point at which half of homes sold for more and half sold for less; it is influenced by the types of homes selling as well as a general change in values.

“The California housing market regained some traction in February as sales activity improved on a year-over-year basis for the second time in three months,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “At the state level, the market is moving in the right direction as the growth of sales continues its upward trend and home prices start stabilizing. At the regional level, however, the San Francisco Bay Area continued to be hampered by constrained inventory and low housing affordability.”

[gravityform id=”13″ title=”true” description=”true”]

Seasonal decorations are a great way to dress up a drab property or make a vacant house look “lived in.” Fall decorations are my favorite. Not everyone decorates their home and yard for autumn like they do for Christmas, so your efforts will be noted.

Seasonal decorations are a great way to dress up a drab property or make a vacant house look “lived in.” Fall decorations are my favorite. Not everyone decorates their home and yard for autumn like they do for Christmas, so your efforts will be noted. Not ready to invest 10 percent of the value of the home in landscaping, as the American Society of Landscaping Architects (

Not ready to invest 10 percent of the value of the home in landscaping, as the American Society of Landscaping Architects (