The Orange County housing market is hot with the strongest demand

in three-and-a-half years.

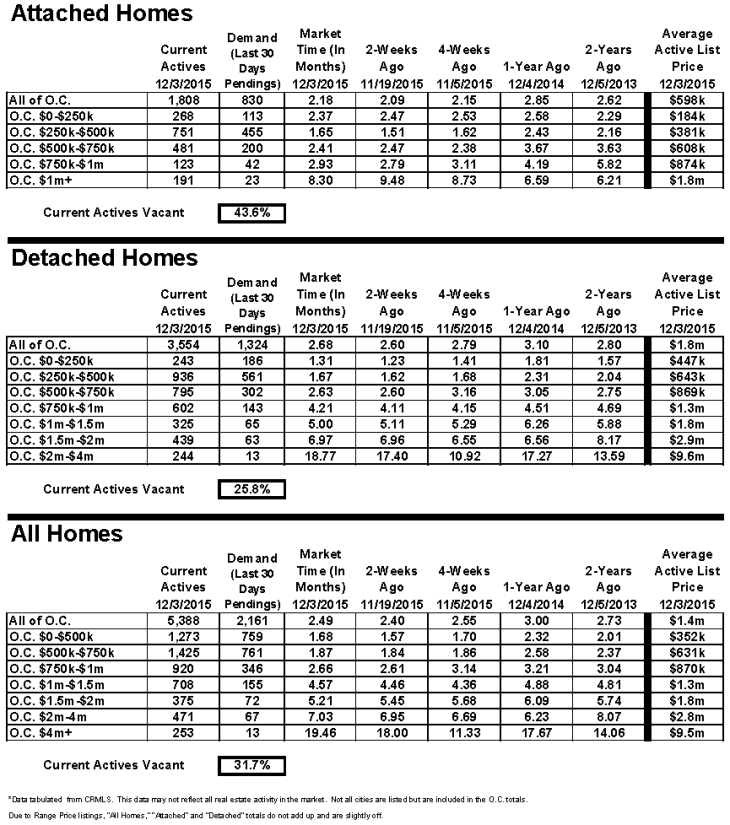

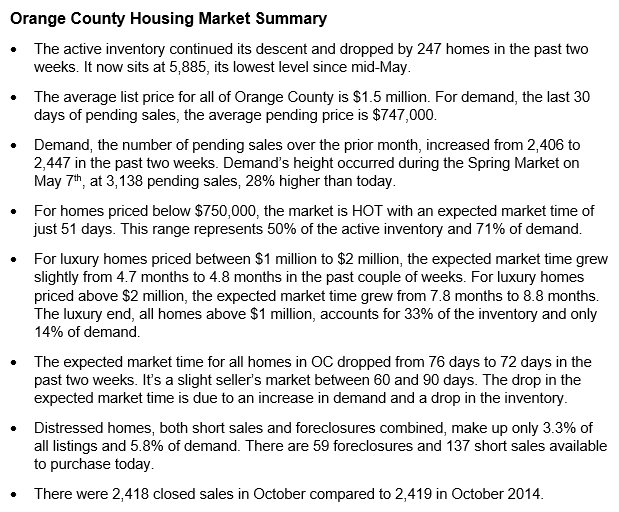

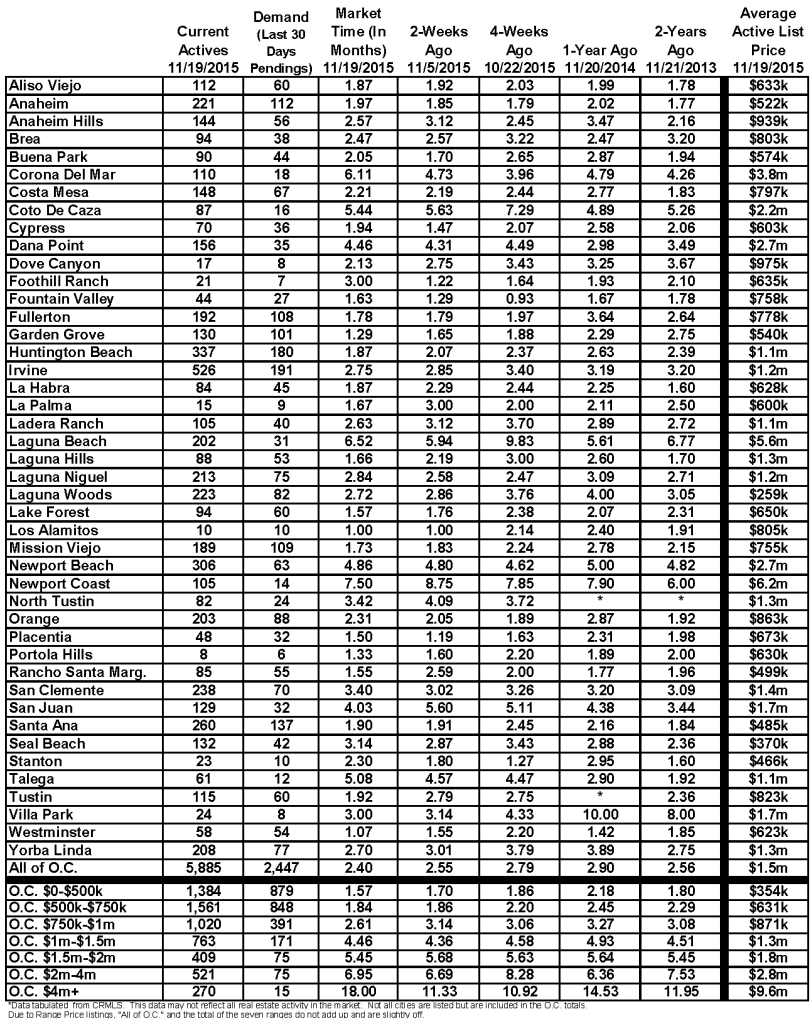

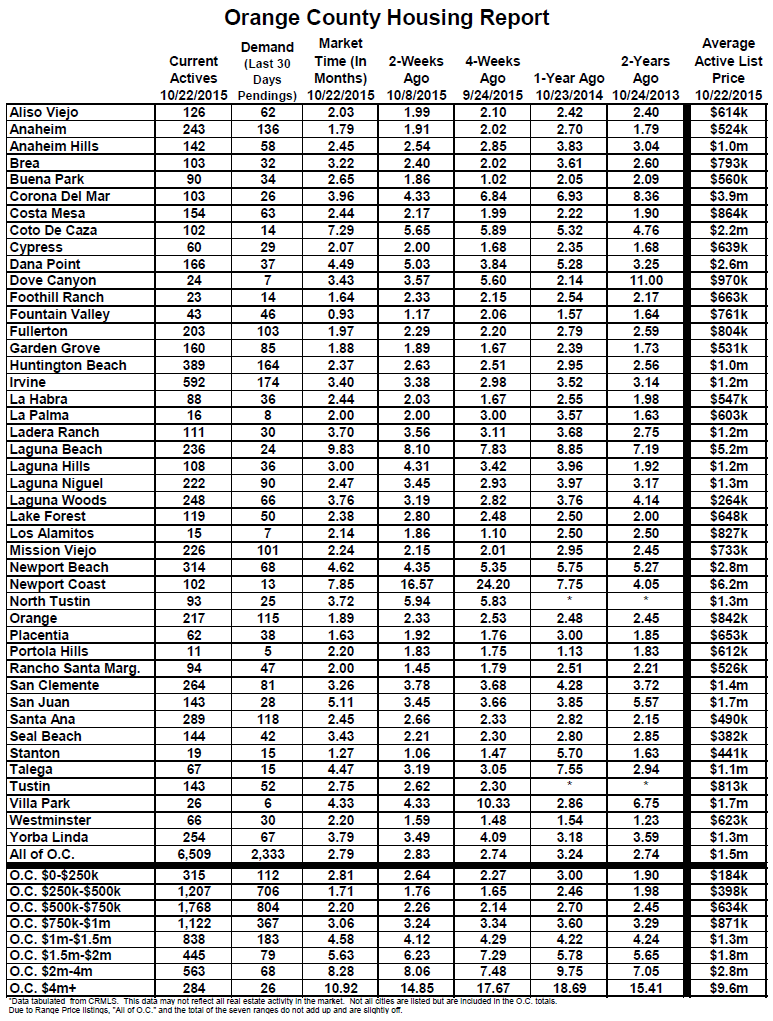

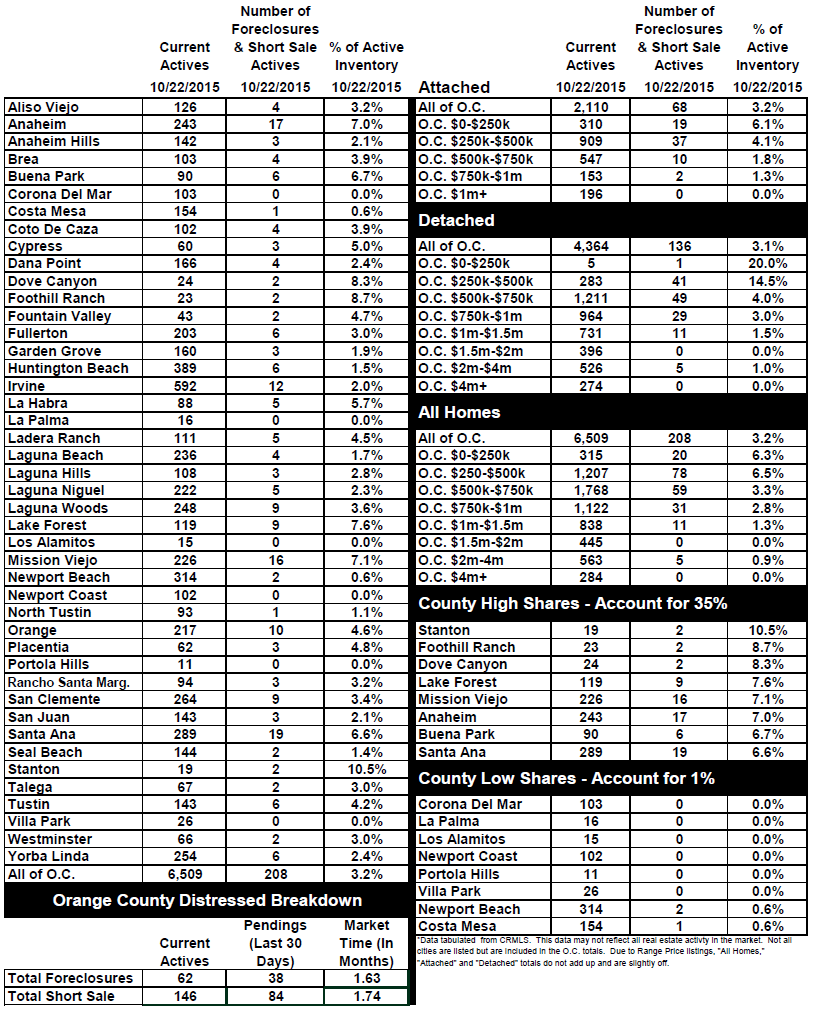

HOT Seller’s Market: Homes priced below $1 million are flying off the market.

HOT Seller’s Market: Homes priced below $1 million are flying off the market.

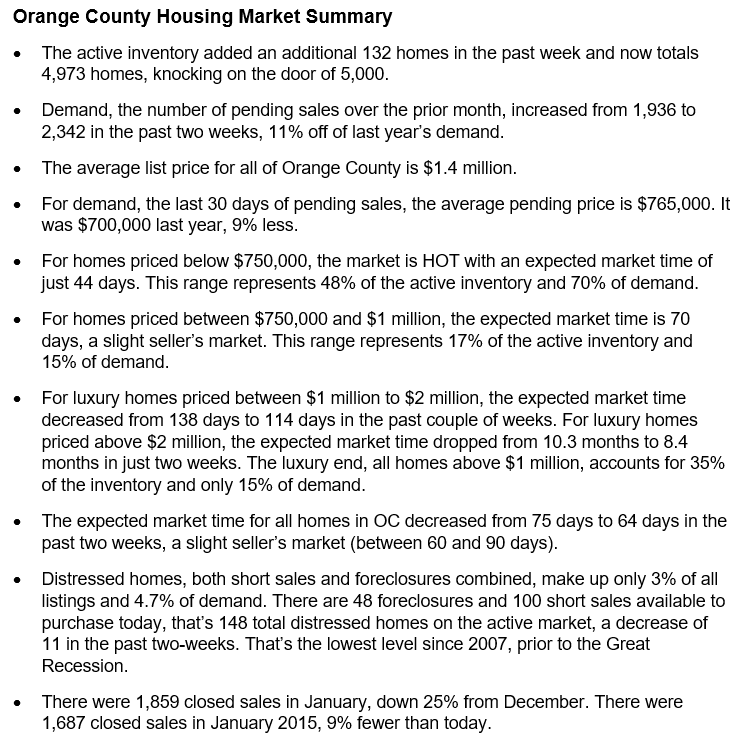

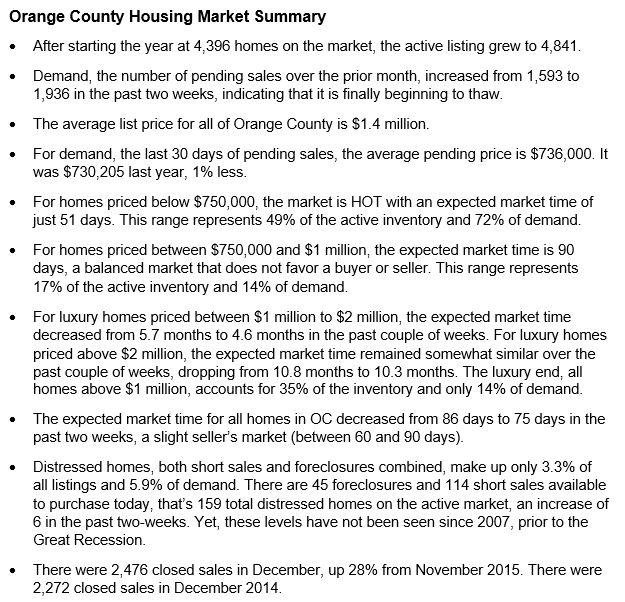

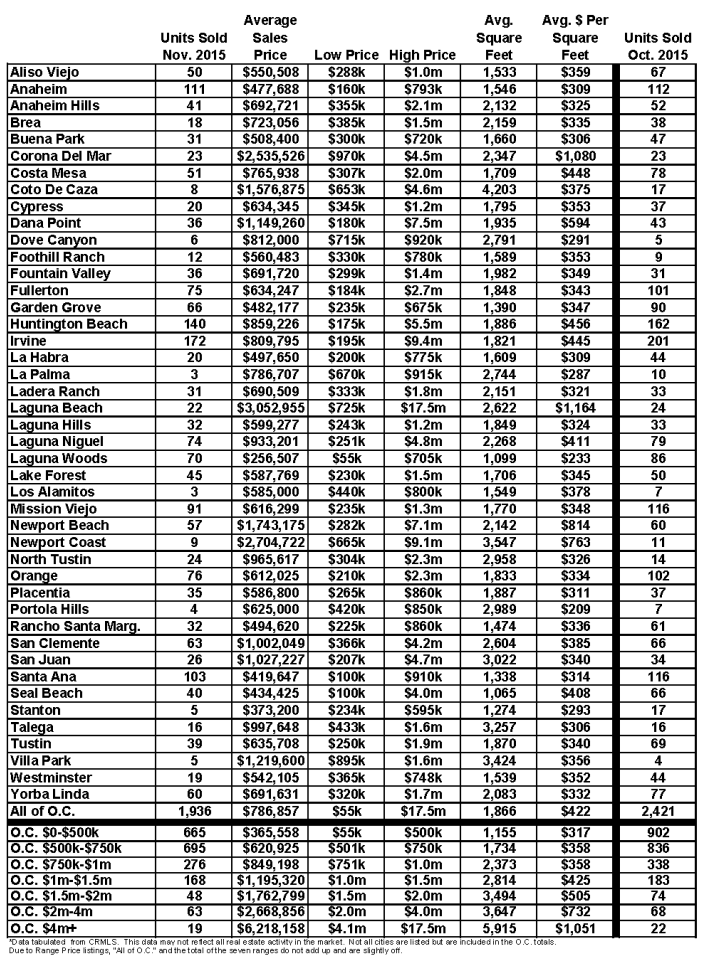

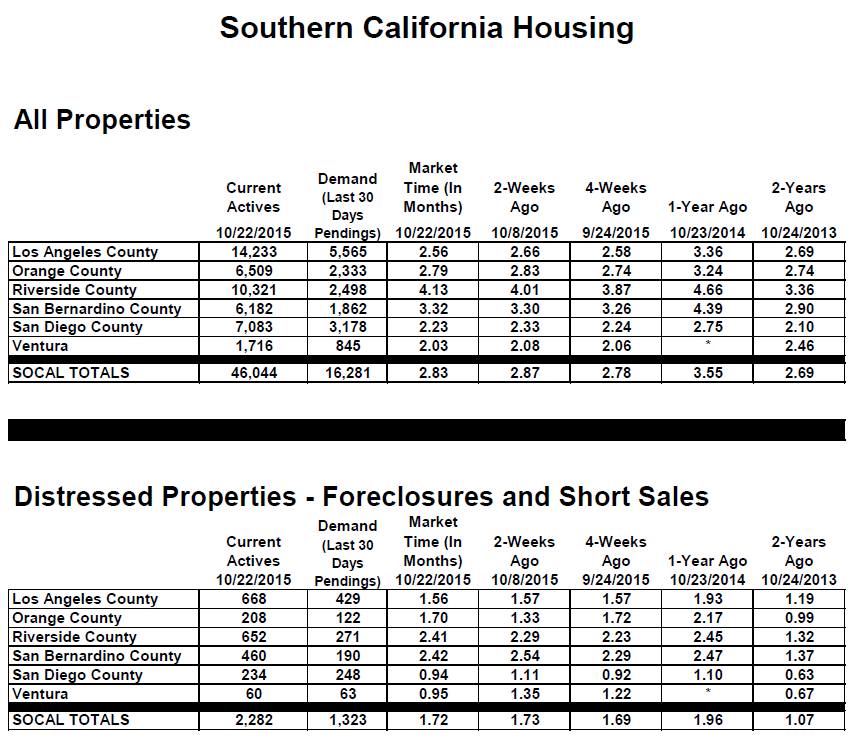

The Orange County housing market is firing on all cylinders and sellers are in the driver’s seat. Multiple offers are back, values are on the rise, and the appraisal is quickly becoming the biggest obstacle in closing. Demand is stronger than one year ago and it appears as if this will be the best Spring Market since 2005.

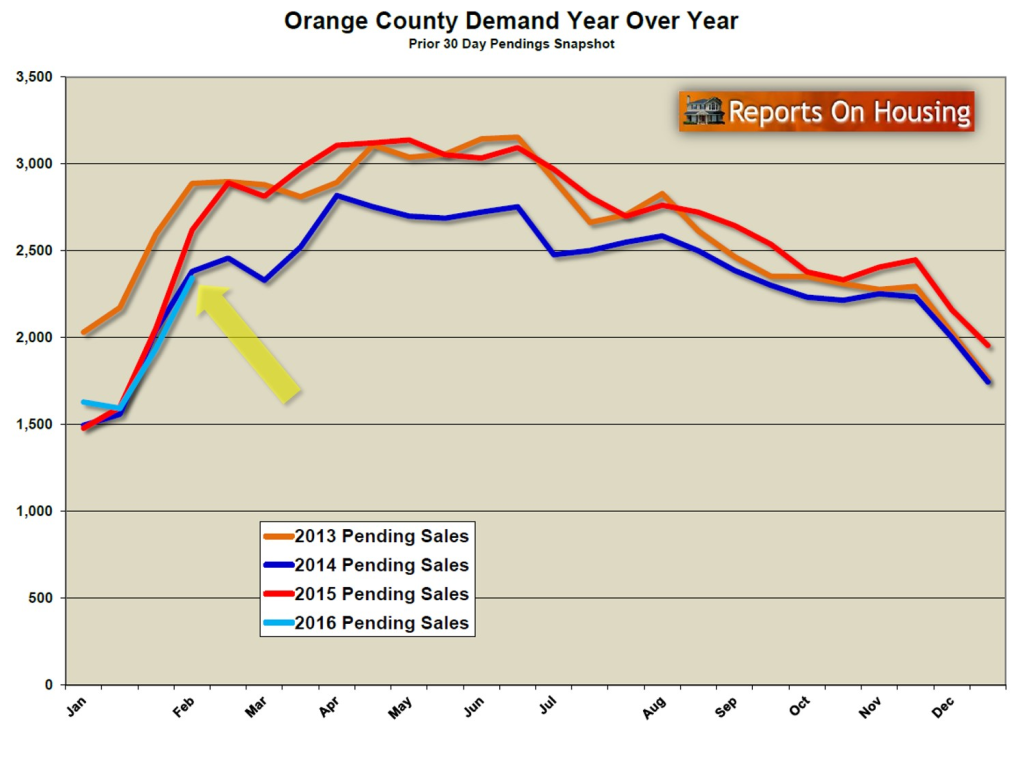

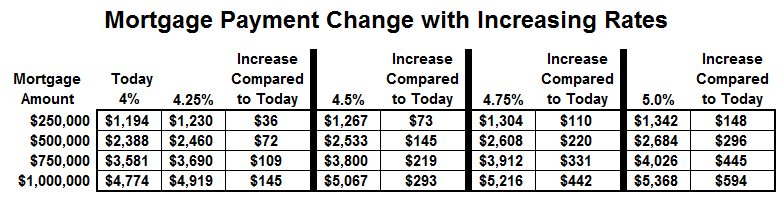

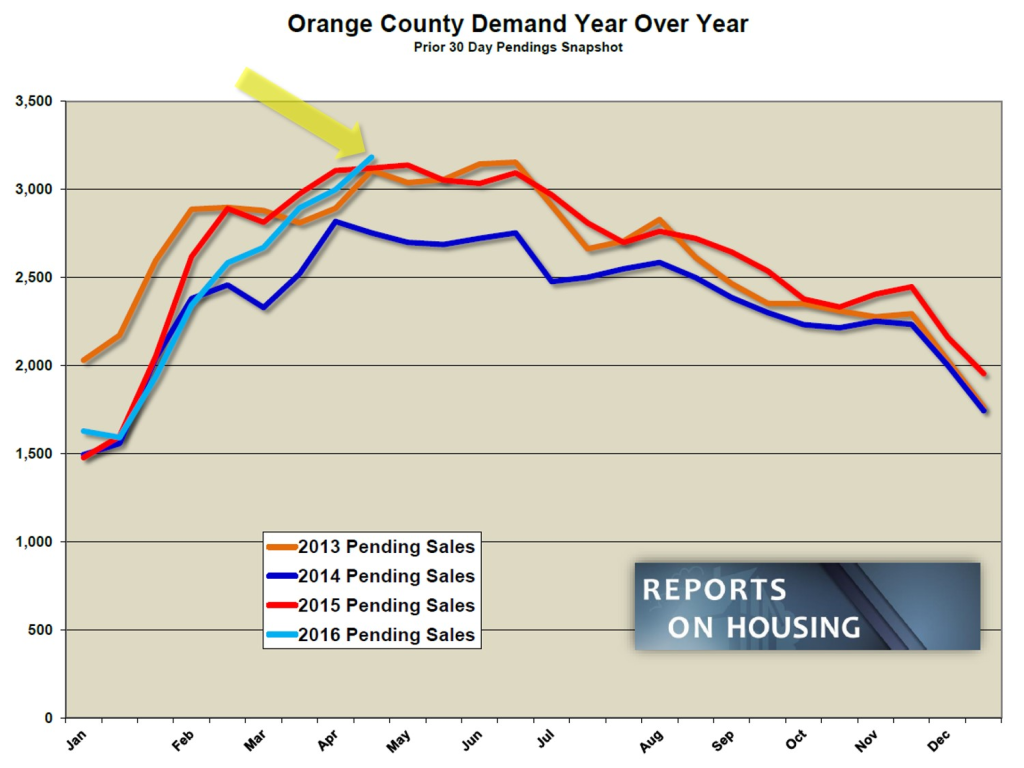

The Spring Market runs from March through mid-June. This is when more real estate activity takes place than any other time of the year. More buyers are bumping into each other in their quest to secure a home, and they are currently flooding the housing market. The historically low interest rates are adding fuel to the fire, allowing buyers to afford even more home.

Mistakenly, many believe that the Summer Market is the best time of the year to sell. It’s just not true. In mid-June, summer distractions creep into the housing market starting with graduation. Graduation, family vacations, the beach, the pool, hiking, and picnics slows the home buying process down a bit. Instead, that is when many of the pending transactions that were put together in the Spring Market close. As a result of all of the summer distractions, there is a cyclical downshift in buyer activity and demand.

Mistakenly, many believe that the Summer Market is the best time of the year to sell. It’s just not true. In mid-June, summer distractions creep into the housing market starting with graduation. Graduation, family vacations, the beach, the pool, hiking, and picnics slows the home buying process down a bit. Instead, that is when many of the pending transactions that were put together in the Spring Market close. As a result of all of the summer distractions, there is a cyclical downshift in buyer activity and demand.

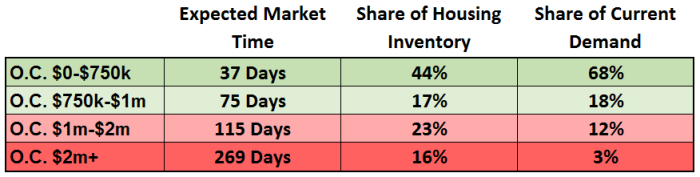

For now, buyers below $1 million are experiencing an extremely challenging time securing a home. Below $750,000 is nothing short of crazy. There are homes that have the look and feel of an auction type of atmosphere. These new homes that hit the market cannot be shown until Saturday at a specific time that coincides with the REALTOR’s “mega open house.” Buyers are quite literally bumping into each other and everybody gets the sense that the bidding process is about to begin. The bids come in the form of multiple offers, the more offers secured, the better the price and terms for the seller. During the negotiating process, offers are pit against each other to drive prices even higher. The end result, only one buyer gets to purchase the home and often at a premium.

In order to find success, many buyers are getting creative. Family pictures combined with personal notes detailing why a house is the perfect place for them to call “home” are included with many offers to purchase. Hand delivered offers to the listing agent at their office, or even the open house, is another strategy. Finding out what the sellers want prior to writing an offer is very important. From a quick closing to renting back, getting the seller what they are looking for can really help secure the deal and enable a buyer to achieve success.

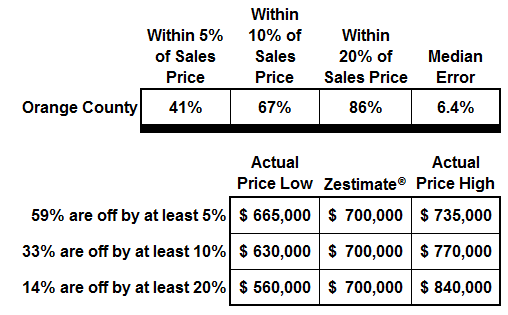

When the housing market tilts heavily in favor of the seller, it is an invitation for new sellers to overprice. Many sellers initially hit the market overconfident and overzealous and price their home off the radar screen. What sellers need to understand is that rapid appreciation is a thing of the past, dating back to when Orange County was underpriced and extremely affordable. In March 2012 the median sales price was $400,000. In March 2016, the median was $625,000, that’s a 56% increase in four years. Since homes are not rapidly appreciating today, the best strategy to employ for a seller is to price their home close to its Fair Market Value. As a result, the realistic value will generate multiple offers, which will ultimately allow them to get their price, and often even more. Values are slowly rising and continue to push the envelope, making the appraisal process a major hurdle to closing the sale.

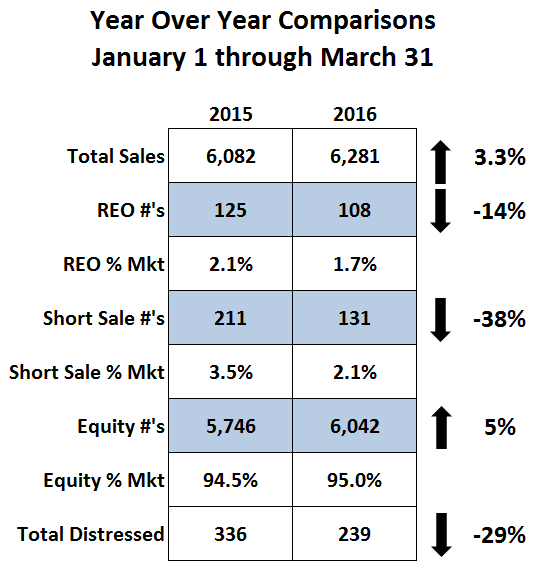

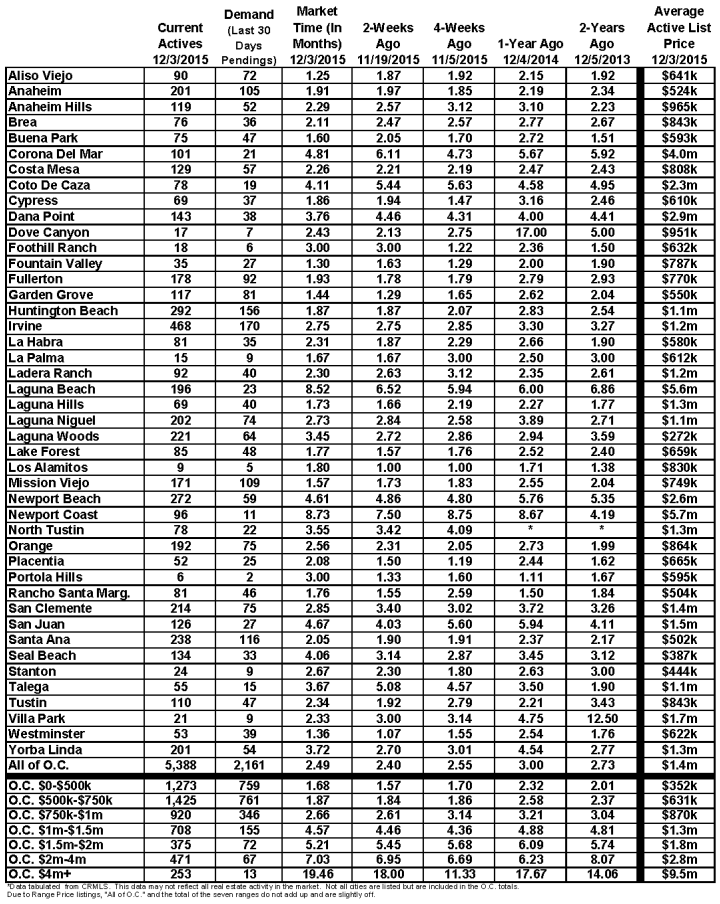

Is the luxury market hot too? In terms of demand, yes, it is stronger this year than one year ago today. In terms of supply, there’s a lot more homes in the luxury end compared to last year. The end result, it has a more sluggish feel to the market. From $1 million to $1.5 million, demand is up 19% and the inventory is up 22% compared to 2015. From $1.5 million to $2 million, demand is up only 2% and the inventory is up 24%. Above $2 million, demand is up 7% and the inventory is up 22%. So, above $1.5 million, demand may be up, but the extra inventory means many home sellers are having a tough time achieving success due to the increased competition. For these sellers it all boils down to price, condition, amenities, and location, and sellers only have control over price and condition.

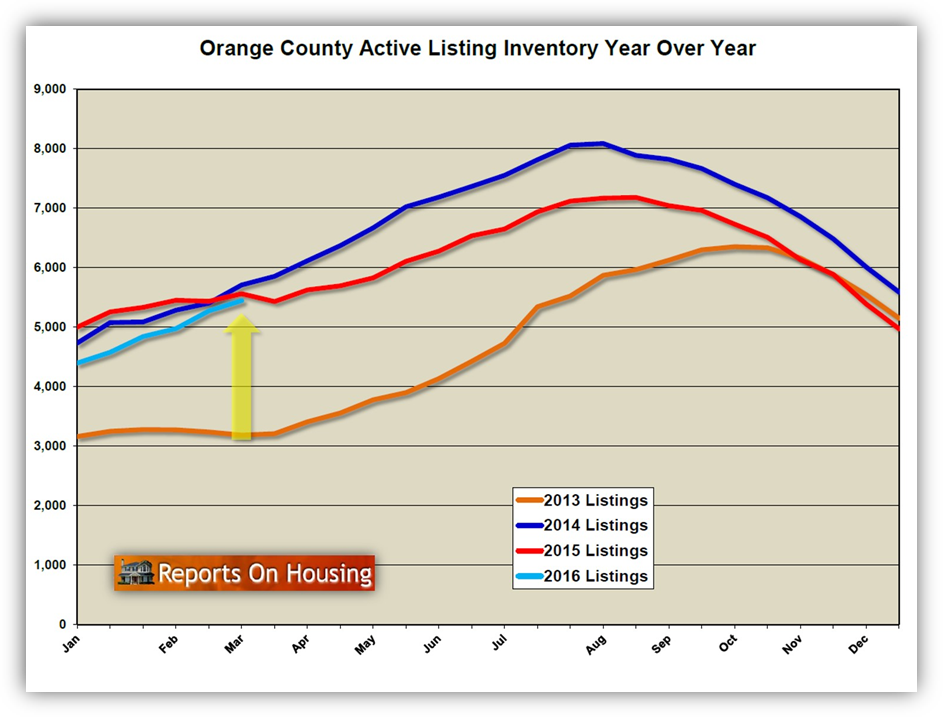

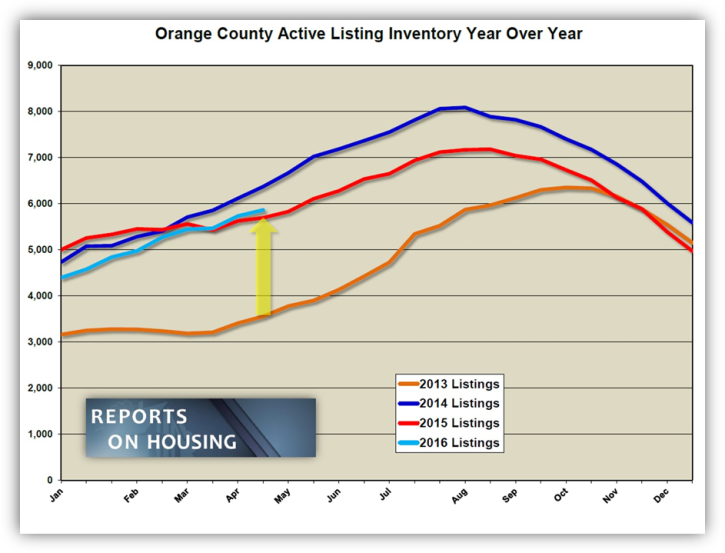

Active Inventory: The inventory increased by only 2% in the past two weeks.

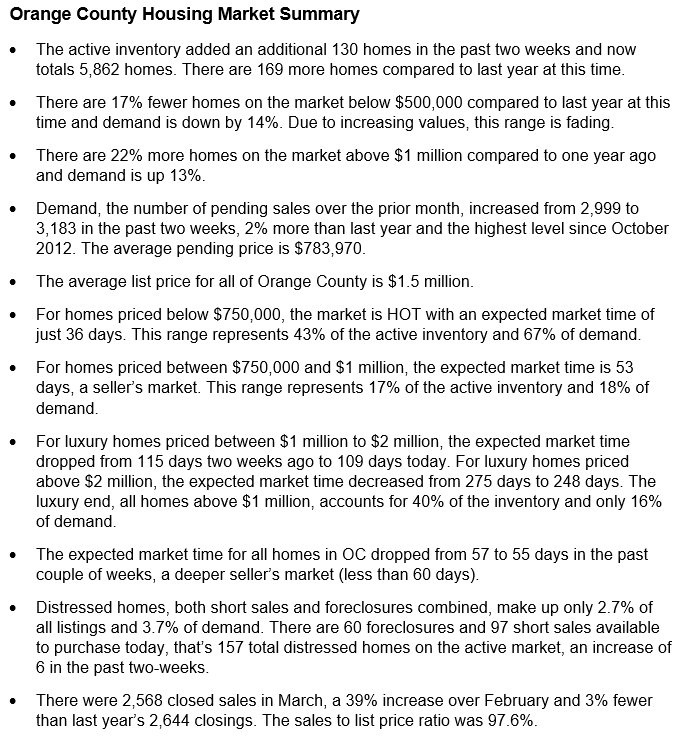

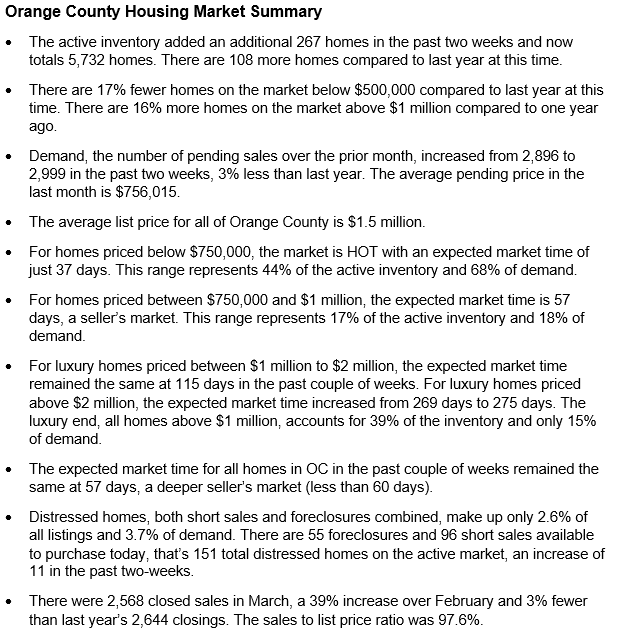

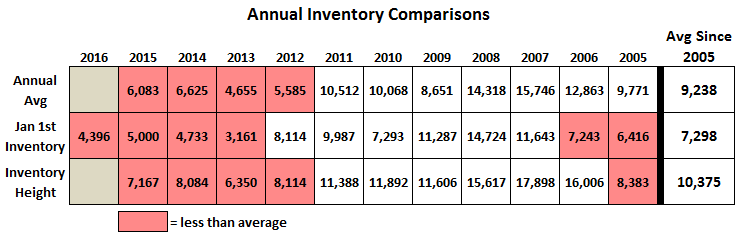

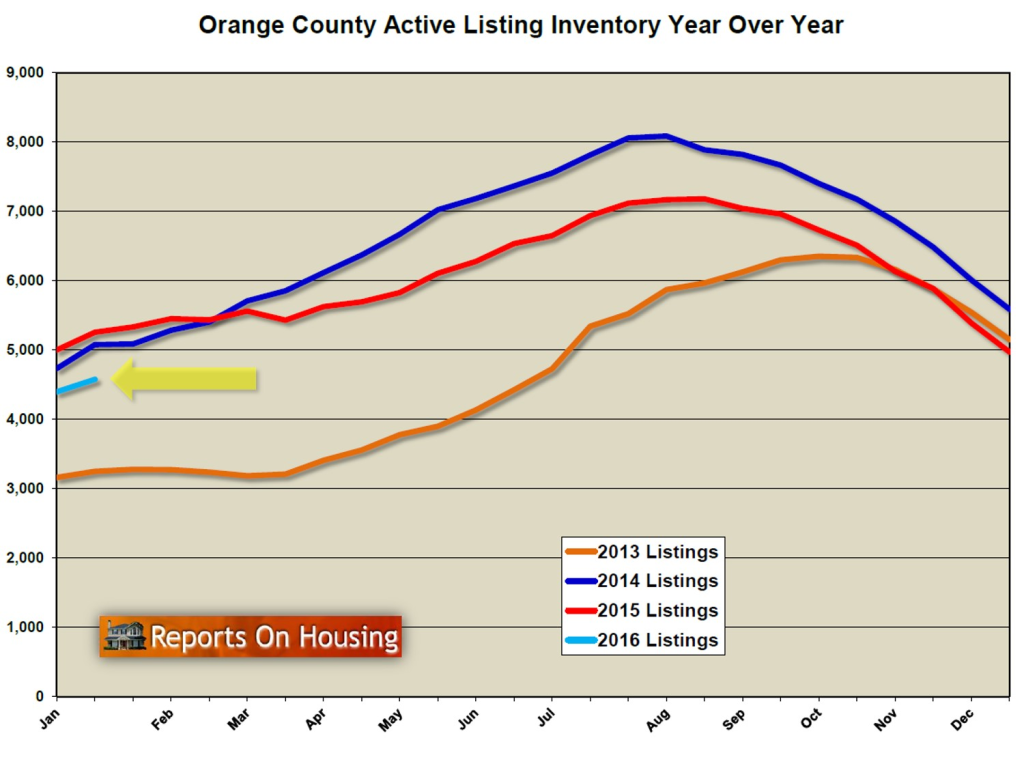

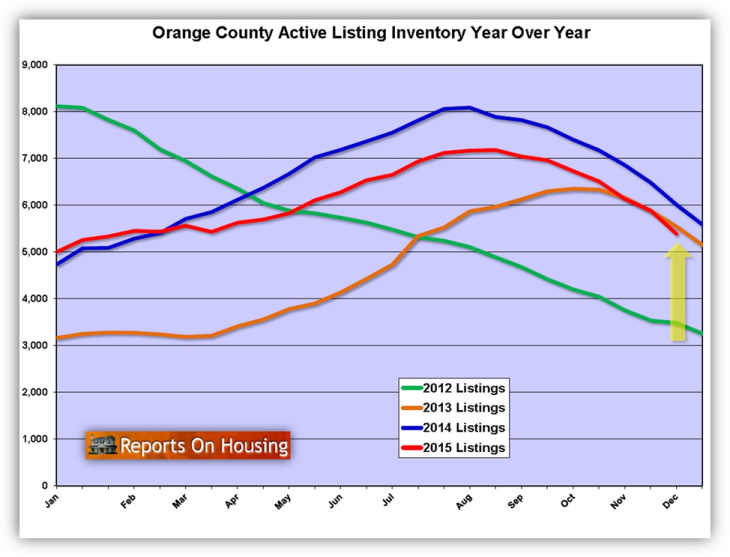

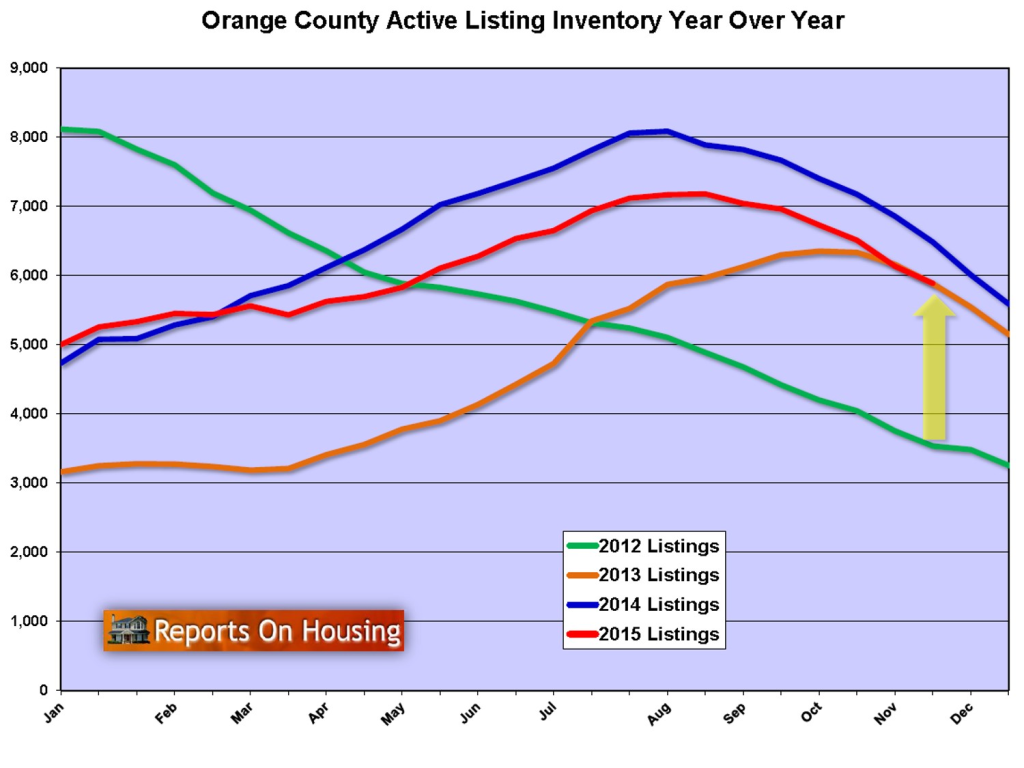

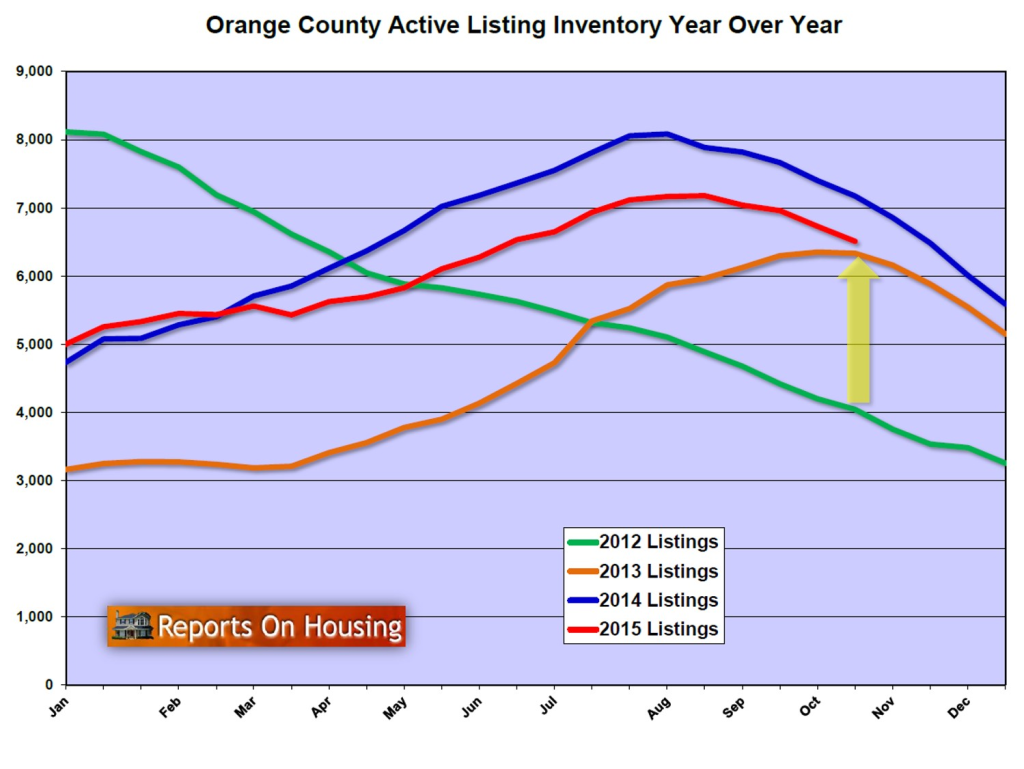

The active inventory increased by 130 homes in the past two weeks and now sits at 5,862. Every price range, except for homes priced below $500,000, experienced a slight increase. The inventory was growing at a much more rapid rate at the beginning of the year when the worldwide stock and financial markets were taking a beating, but as soon as stability was restored, so was Orange County housing demand. Higher demand means more pending sales. More pending sales means fewer active listings on the market. Now that demand is sizzling hot again, homes are not staying on the market and the inventory is not rising as fast. We can expect this trend to continue through mid-June, the start of the Summer Market. From there, the inventory will rise and peak in mid-August and reach levels similar to 2015.

Last year there were 169 fewer homes on the market, 3% less. So far this year, the same number of homes have come on the market compared to one year ago today. Historically speaking, the inventory is well below the long term average of 9,238, an incredible 37% less. There just are not enough homes coming on the market compared to a decade ago.

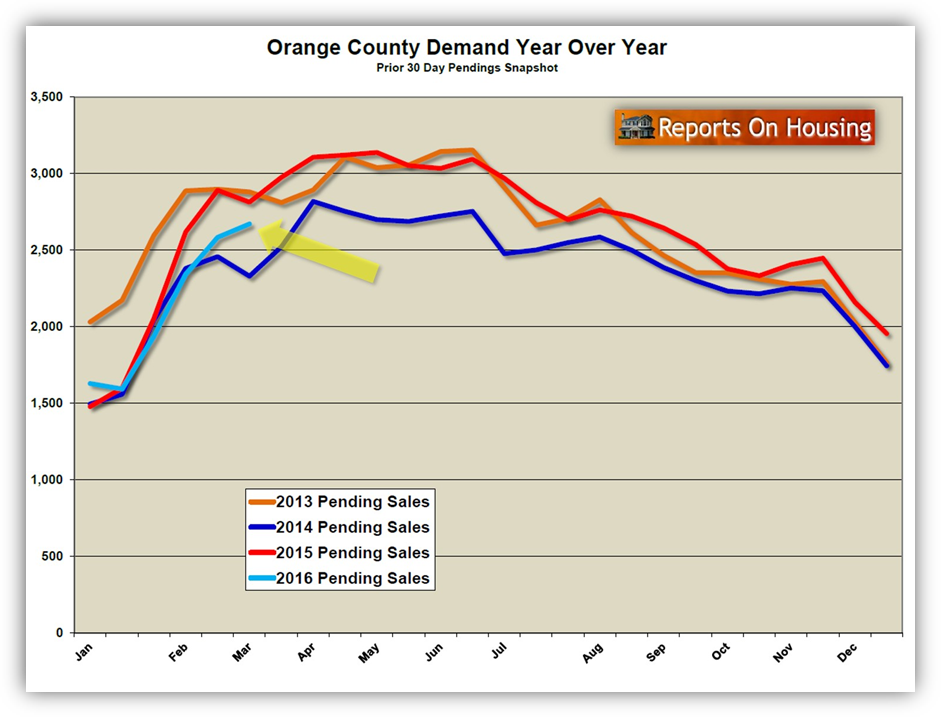

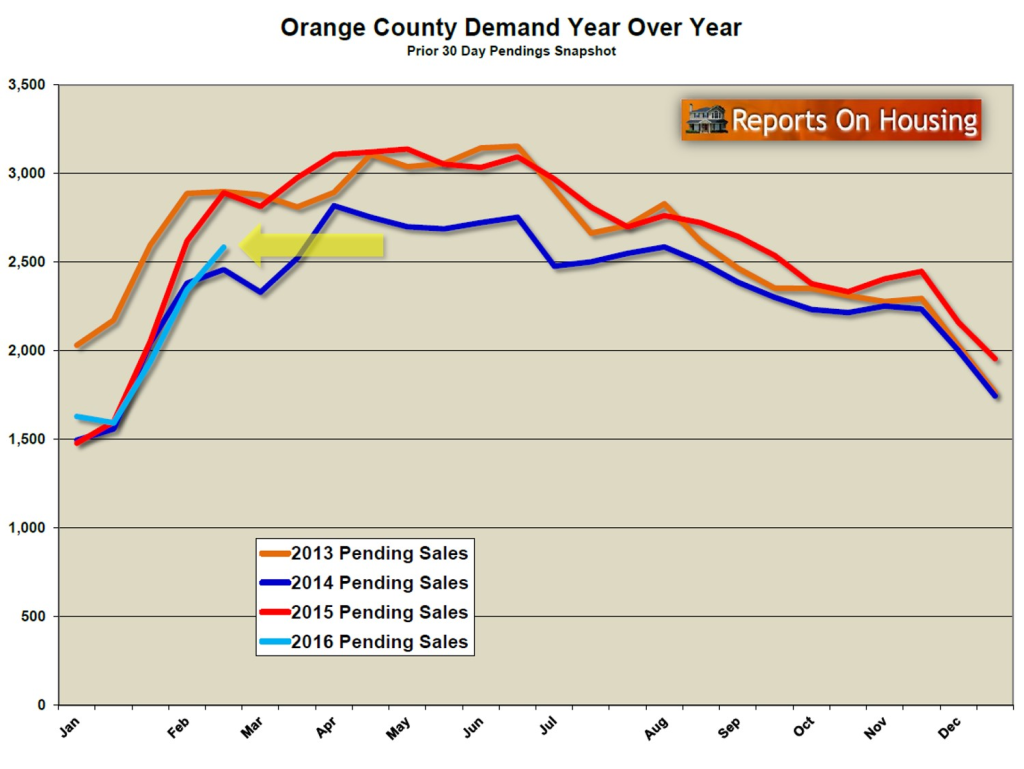

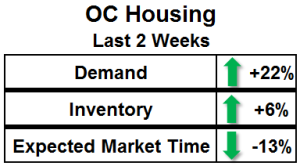

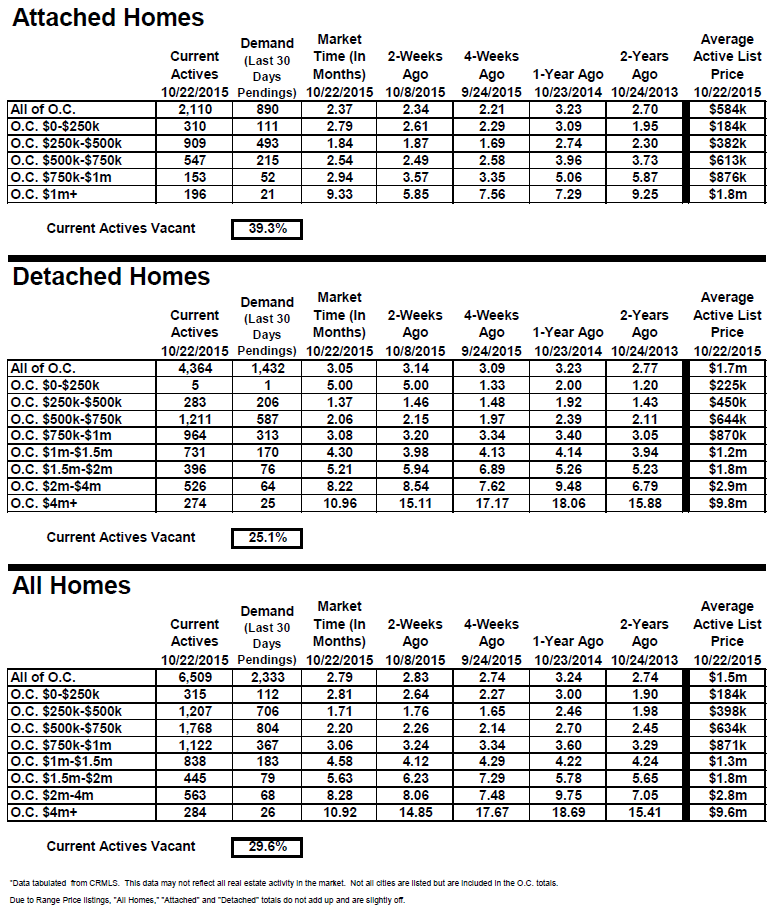

Demand: In the past two-weeks demand increased by 6%.

Demand: In the past two-weeks demand increased by 6%.

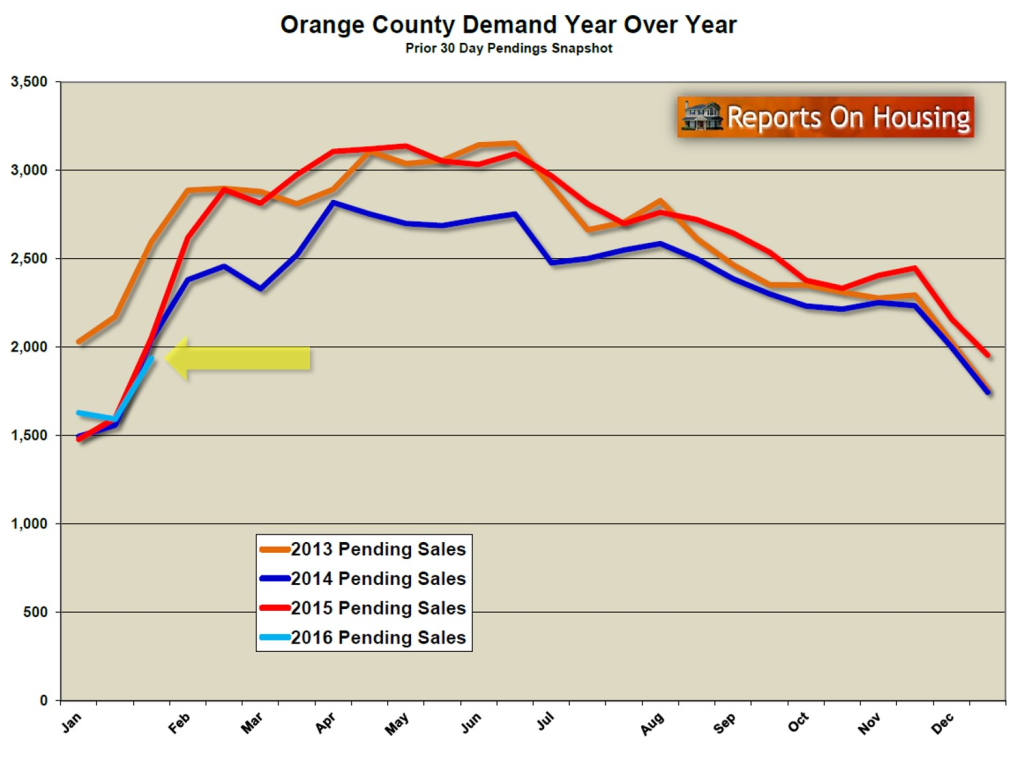

Demand, the number of new pending sales over the prior month, increased by 184 homes in the past two-weeks, and now totals 3,183, the highest level since October 2012 when there were a lot more short sales embedded in demand. Back then, many short sales never closed.

This Spring Market has the potential of being the strongest since 2005, prior to the Great Recession. High demand will equate to higher closed sales. The expected market time for all of Orange County is 55 days, identical to one year ago today.

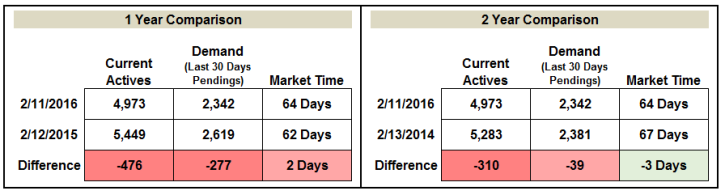

Last year at this time, demand was at 3,121 pending sales, 62 fewer than today.

Summary:

Have a great week.

Sincerely,

Roy Hernandez

TNG Real Estate Consultants

Cell 949.922.3947

[gravityform id=”13″ title=”true” description=”true”]