Every where I turn these days I see signs or large billboards advertising selling your home for quick cash. The signs say, “sell your home UGLY” with the cartoonish Caveman. Often I think to myself, “why would anyone sell to these hawkish investors”? Whenever someone sells out of necessity or they need cash fast, do they ever get a fair price for their asset? For example, do you ever receive top dollar for anything sold at a pawn shop? The answer is easy. NO! No matter the circumstances, selling a house quickly and “UGLY” is never a good idea. In today’s market of extremely high priced houses, why would anyone sell without first consulting with a professional about getting TOP Dollar for their home. My point is this, it’s OK to sell quickly in a must need fast cash scenario, however, sell wisely and speak with a real estate professional first. I see so many investors taking advantage of homeowners by giving them pennies on the dollar because they need a quick sale for immediate cash. If this is you, let’s talk first. I propose we sell your home for TOP Dollar by me HELPING-YOU-FLIP your home for maximum profit to the seller, not the investor! Makes sense right? Dont sell your “UGLY” house for pennies on the dollar. Let me help you fix or repair your home so it can become a FLIP house and sell for TOP DOLLAR!

Every where I turn these days I see signs or large billboards advertising selling your home for quick cash. The signs say, “sell your home UGLY” with the cartoonish Caveman. Often I think to myself, “why would anyone sell to these hawkish investors”? Whenever someone sells out of necessity or they need cash fast, do they ever get a fair price for their asset? For example, do you ever receive top dollar for anything sold at a pawn shop? The answer is easy. NO! No matter the circumstances, selling a house quickly and “UGLY” is never a good idea. In today’s market of extremely high priced houses, why would anyone sell without first consulting with a professional about getting TOP Dollar for their home. My point is this, it’s OK to sell quickly in a must need fast cash scenario, however, sell wisely and speak with a real estate professional first. I see so many investors taking advantage of homeowners by giving them pennies on the dollar because they need a quick sale for immediate cash. If this is you, let’s talk first. I propose we sell your home for TOP Dollar by me HELPING-YOU-FLIP your home for maximum profit to the seller, not the investor! Makes sense right? Dont sell your “UGLY” house for pennies on the dollar. Let me help you fix or repair your home so it can become a FLIP house and sell for TOP DOLLAR!

The end game here is simple. Don’t sell you home UGLY and miss out on the record high housing market. Let’s talk first. Let me HELP-YOU-FLIP your home for maximum profit.

The end game here is simple. Don’t sell you home UGLY and miss out on the record high housing market. Let’s talk first. Let me HELP-YOU-FLIP your home for maximum profit.

- Need to sell, but you need cash immediately, no problem.

- Need to sell, but you don’t have the cash to remodel your kitchen and baths first, no problem.

- Need to sell, but your house needs paint and new carpet first, no problem.

Whatever the scenario, contact me first. Don’t sell to the Caveman for quick cash. Let me HELP-YOU-FLIP your home for maximum profit to the YOU THE SELLER!

Tell a friend! I love referrals!

Roy Hernandez

TNG Real Estate Consultants

Royaltyagent@gmail.com

cell/text 949.922.3947

[gravityform id=”22″ title=”true” description=”true”]

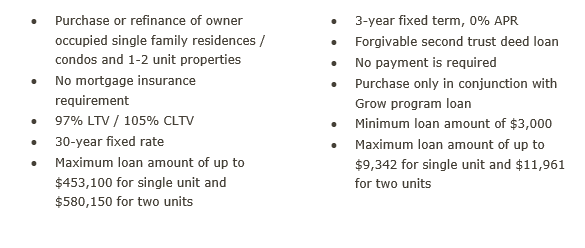

With homes prices going up and no price relief on the horizon, lenders are coming up with new ways to get buyers into houses. My lender David Wood of 20 years has a new loan program for income qualified buyers short of a large down payment. See below for details.

With homes prices going up and no price relief on the horizon, lenders are coming up with new ways to get buyers into houses. My lender David Wood of 20 years has a new loan program for income qualified buyers short of a large down payment. See below for details.