Pace of Annual Appreciation to Fall to 4.3 Percent in 2014, 3.4 Percent by 2018; Panelists Say Federal Government Should Back 35 Percent of Mortgages, According to Zillow Home Price Expectations Survey

SEATTLE, Nov. 7, 2013 /PRNewswire/ — More than 100 forecasters said they expect the U.S. home values, as measured by the Zillow® Home Value Indexi, to end 2013 up an average of 6.7 percent year-over-year, according to the latest Zillow Home Price Expectations Survey, before slowing over the next five years. Most panelists also said they would like to see the federal government maintain a considerable role in the mortgage market.

The survey of 108 economists, real estate experts and investment and market strategists was sponsored by leading real estate information marketplace Zillow, Inc. and is conducted quarterly by Pulsenomics LLC.

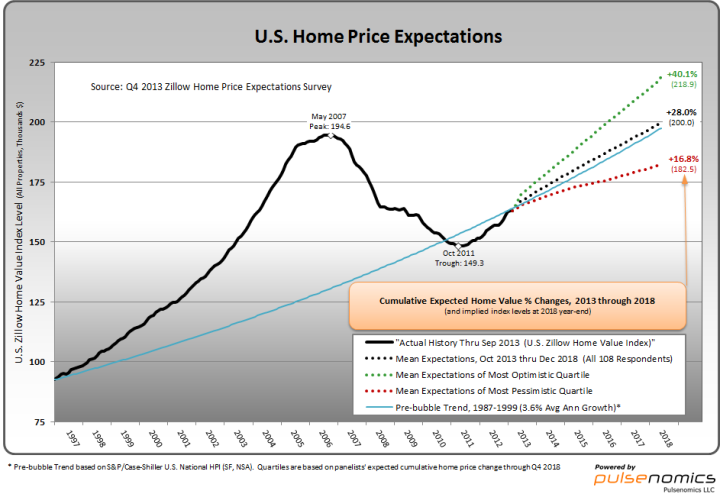

While appreciation is expected to remain strong through the remainder of this year, the pace of home value growth is predicted to slow considerably through 2018. Panelists said they expect appreciation rates to slow to roughly 4.3 percent next year, on average, eventually falling to 3.4 percent by 2018.

Based on current expectations for home value appreciation over the next five years, panelists predicted that overall U.S. home values could exceed their May 2007 peak by the first quarter of 2018, and may cross the $200,000 threshold by the end of 2018.

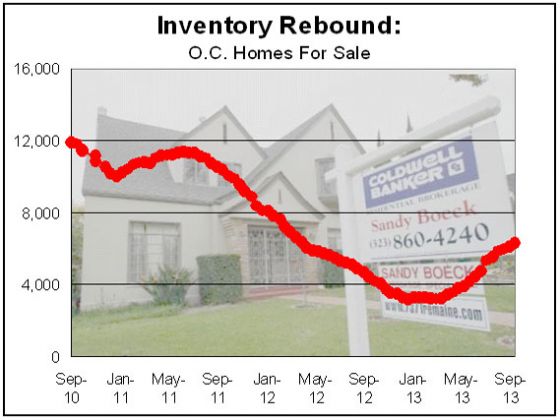

“The housing market has seen a period of unsustainable, breakneck appreciation, and some cooling off is both welcome and expected,” said Zillow Chief Economist Dr. Stan Humphries. “Rising mortgage rates, diminished investor demand and slowly rising inventory will all contribute to the slowdown of appreciation.”

The most optimistic quartileii of panelists predicted an 8.3 percent annual increase in home values this year, on average, while the most pessimistic quartileiii predicted an average increase of 5.6 percent. Expectations among the optimists fell from 9.3 percent in the last survey, but rose from 5.1 percent among the pessimists. The most optimistic panelists predicted home values would rise roughly 12.5 percent above their 2007 peaks by the end of 2018, on average, while the most pessimistic said they expected home values to remain about 6.2 percent below 2007 peaks.

Diminished, But Still ‘Significant’ Role For Federal Gov’t in Mortgages

A number of public and private plans for overhauling the nation’s mortgage finance system and reforming government-sponsored entities Fannie Mae and Freddie Mac have been proposed, all of which seek to reduce and redefine the government’s role in the mortgage market to some degree. As these policy conversations begin, panelists were asked how involved they think the federal government should be in any re-imagined mortgage system. Among those panelists expressing an opinion, the majority (58.4 percent) said the federal government’s involvement in the conforming mortgage market should be “somewhat significant,” “significant” or “very significant.” Only 8 percent of respondents said the federal government should have a “non-existent” role in the conforming market.

Panelists were also asked to define an appropriate level of government-backing for mortgage loans going forward. Among those panelists expressing an opinion about what maximum percentage of all new mortgages should be backed by the federal government, the median response was 35 percent, roughly the level seen in 2006 at the height of the housing bubble.

“Policy discussions centered on reforming the nation’s housing finance system have only just begun, and it will be very interesting to see what comes out of these debates and how the market will react to new proposals,” Humphries said. “How much mortgages will end up costing average consumers, and the continued availability of traditional mortgage products like the 30-year fixed rate mortgage, are among the critical issues currently at stake for consumers in these debates.”

“Currently, the federal government backs roughly 90 percent of all new mortgage originations in the U.S. in some form,” said Pulsenomics® Founder Terry Loebs. “In 2000, prior to the bubble, the government backed about 50 percent of new mortgages. These benchmarks and survey data are another reminder of the challenges that lie ahead in reforming U.S. housing institutions.”