7/10/15

Chief cites improving economy.

Federal Reserve Chair Janet Yellen yesterday said the Fed is on track to begin raising interest rates later this year, but economists say any decision still will depend on signals the economy is continuing its recovery from the Great Recession.

“The big deal is will growth continue at a good clip,” said Nariman Behravesh, chief economist at IHS Global Insight in Lexington. “The economy has shrugged off the weakness of the first quarter, but she still is worried about whether the labor market has fully healed from the wounds of the recession.”

Employers added 223,000 jobs in June, and the unemployment rate dipped to 5.3 percent, but wages were stagnant.

“But the fall in the unemployment rate overstates the strength of the labor market,” said Peter Ireland, a Boston College economist.

Wage growth — a good indicator of whether the labor market is tightening — is a particular concern, Behravesh said. And there are external risks, namely the Greek debt crisis and China’s plunging stock market.

In a speech in Cleveland, Yellen outlined her concerns, from weak wage growth to a low labor participation rate to “disappointing” productivity. She reiterated that inflation is still well below the Fed’s 2 percent target and noted that cautious business owners “have not substantially increased their capital expenditures.”

Still, Yellen, who is scheduled to deliver the Fed’s mid-year economic report to Congress next week, saw reasons for encouragement. Consumer spending appears to be picking up, she said, and employment is likely to keep expanding.

“Based on my outlook, I expect that it will be appropriate at some point later this year to take the first step to raise the federal funds rate,” Yellen said, referring to the Fed’s key short-term interest rate, which has been at a record low near zero since December 2008.

Yellen said even when the Fed does start raising rates, the increases will be gradual.

The increase is not expected to exceed 0.25 percent, making any negative effects “negligible,” Behravesh said.

The housing market is unlikely to be hurt by such an increase, “especially given that home buyers are feeling more confident because of the improving job market,” Ireland said.

“(The Fed) wants to signal to everybody that the economy is getting back to normal,” he said, “but they’re not in a hurry to raise the rate significantly until next year at the earliest.”

From Boston Herald.

[gravityform id=”13″ title=”true” description=”true”]

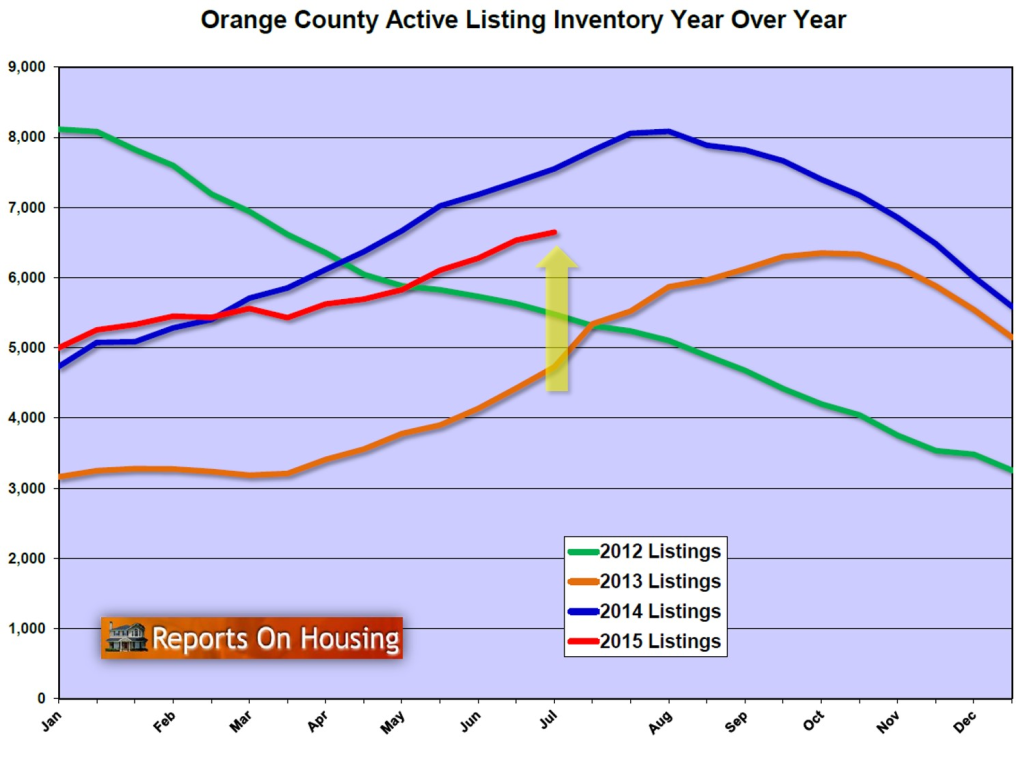

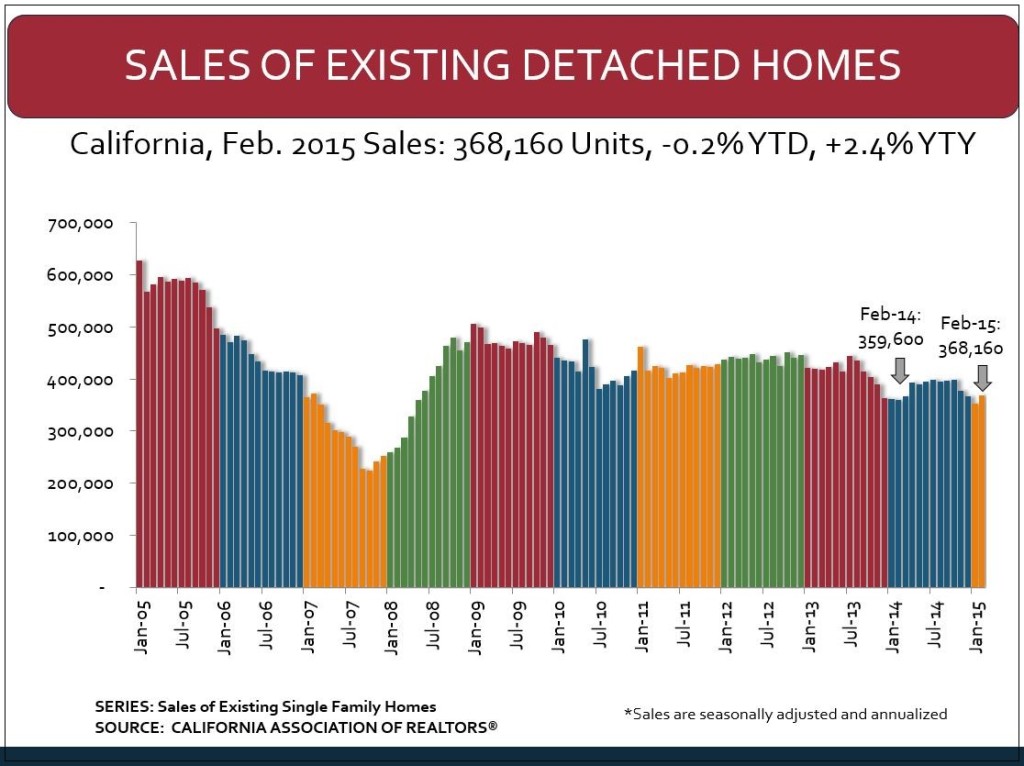

Despite many promising factors leading in to 2015, the market got off to a relatively slow start to begin the year. Though the winter months are typically considered an “off season” for brokers and agents around the nation, there were still many who had hoped that the record low interest rates and slowing home appreciation would be enough to drive sales forward – I was one of them. This clearly wasn’t the case in January, when sales throughout California and most of the nation dropped from the month before, but not all hope should be lost. New research from the California Association of Realtors has found that existing home sales increased across California in February – likely a result of slowing home appreciation and increasing inventory, and the latest indicator of a stronger market ahead.

Despite many promising factors leading in to 2015, the market got off to a relatively slow start to begin the year. Though the winter months are typically considered an “off season” for brokers and agents around the nation, there were still many who had hoped that the record low interest rates and slowing home appreciation would be enough to drive sales forward – I was one of them. This clearly wasn’t the case in January, when sales throughout California and most of the nation dropped from the month before, but not all hope should be lost. New research from the California Association of Realtors has found that existing home sales increased across California in February – likely a result of slowing home appreciation and increasing inventory, and the latest indicator of a stronger market ahead.

Seasonal decorations are a great way to dress up a drab property or make a vacant house look “lived in.” Fall decorations are my favorite. Not everyone decorates their home and yard for autumn like they do for Christmas, so your efforts will be noted.

Seasonal decorations are a great way to dress up a drab property or make a vacant house look “lived in.” Fall decorations are my favorite. Not everyone decorates their home and yard for autumn like they do for Christmas, so your efforts will be noted. Not ready to invest 10 percent of the value of the home in landscaping, as the American Society of Landscaping Architects (

Not ready to invest 10 percent of the value of the home in landscaping, as the American Society of Landscaping Architects (