The Federal Reserve has kept interest rates intact for years, but it looks as if that is going to change.

Interest Rates: at 4.125%, the current interest rate is a screaming deal in historical perspective.

For years, leading economists have been hinting at interest rate hikes. For years, interest rates have remained flat, baffling economists as they scratch their collective heads wondering just how long the Federal Government can keep the short term rate at their current historical lows. So, if leading economists can get it wrong year after year, who can you believe? The answer is simple: the Federal Reserve.

The Federal Reserve has been talking about raising the short term rate and their warnings are getting louder and louder. They are most likely going to ceremoniously live up to all of their talk in raising the rate by the end of this year with one small rate hike. This will pave the way to future hikes as long as the overall economy continues along its path to improving.

The threat of an increase in interest rates has motivated buyers to step in and purchase homes at a much hotter pace compared to just one year ago. Last year, the market was incredibly flat in terms of appreciation, but not this year. This is solely due to an increase in buyer demand. There really have not been too many fundamental differences economically in comparing 2015 to 2014, yet closed residential resale homes are up 12%. So, why the jump in demand this year?

Buyers are not incompetent; they have been busy reading and listening to news reports about the Federal Reserve’s desire to raise rates. They remember when they announced that they would start “tapering” their involvement in the secondary market back in June of 2013. Up to that point they were propping up the entire secondary market. They lived up to their promise and completely backed out of the secondary market in October of last year. Now that the Federal Reserve is talking about increasing rates by year’s end, buyers have been busily purchasing real estate and locking in these historically low interest rates.

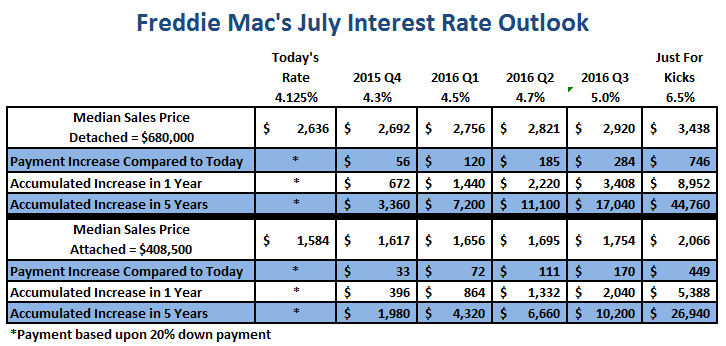

Freddie Mac (Federal Home Loan Mortgage Corporation) forecasted in July that interest rates would slowly rise over the next year, topping out at 5%. Buyers intuitively know that as rates rise, so do monthly payments. But, it is essential to drill down a little bit further and look at the actual numbers. Yes, moving from 4.125%, where rates are today, to 4.3%, their end of 2015 prediction, may seem like an insignificant change in the monthly payment, but it’s presumably just the beginning. For a detached median priced home, it’s only a $672 increase each year; and for the median priced condominium, it’s only a $396 increase.

The thing to remember is that interest rates will slowly rise. As they do, before you know it, everybody will be talking about 5% interest rates as the new normal. At 5%, the detached median sales price home now has a monthly payment that is $284 more than today’s payment. That is a difference of $3,408 each and every year. Locking in today is like getting a very nice free vacation to Hawaii every year for 30 years. At 5%, the median sales price condominium has a monthly payment that is $170 more than today’s payment. That’s an extra $2,040, still a pretty considerable chunk of change.

Just for kicks, let’s take a look at 6.5%, where rates were just prior to the Great Recession and prior to the Federal Reserve stepping in and slashing rates to their historical lows. For the detached median sales price, the payment increases by $746 per month, or $8,952 per year. Over 5 years, it is an extra $44,760, that’s equivalent to two brand new 2015 Honda Accords ($22,105 MSRP each).

For those who are too young to remember, 6.5% is actually a great rate, historically speaking. In 2000, interest rates were at 8%. In 1990, they were 10%. In 1982, it was 17%. Yes, we are all used to 4% interest rates, yet I can recall a time when we celebrated when interest rates dropped to the single digits. Here’s a cautionary warning for buyers: be careful what you get used to. While economists may have incorrectly forecasted interest rate movement in the past, listen closely to the Federal Reserve as they prepare the nation for imminent rate hikes. Buying today is a smart move because of the government’s gift of rock bottom interest rates. That gift is most likely coming to an end.

Active Inventory: The inventory increased by only 1% in the past couple of weeks.

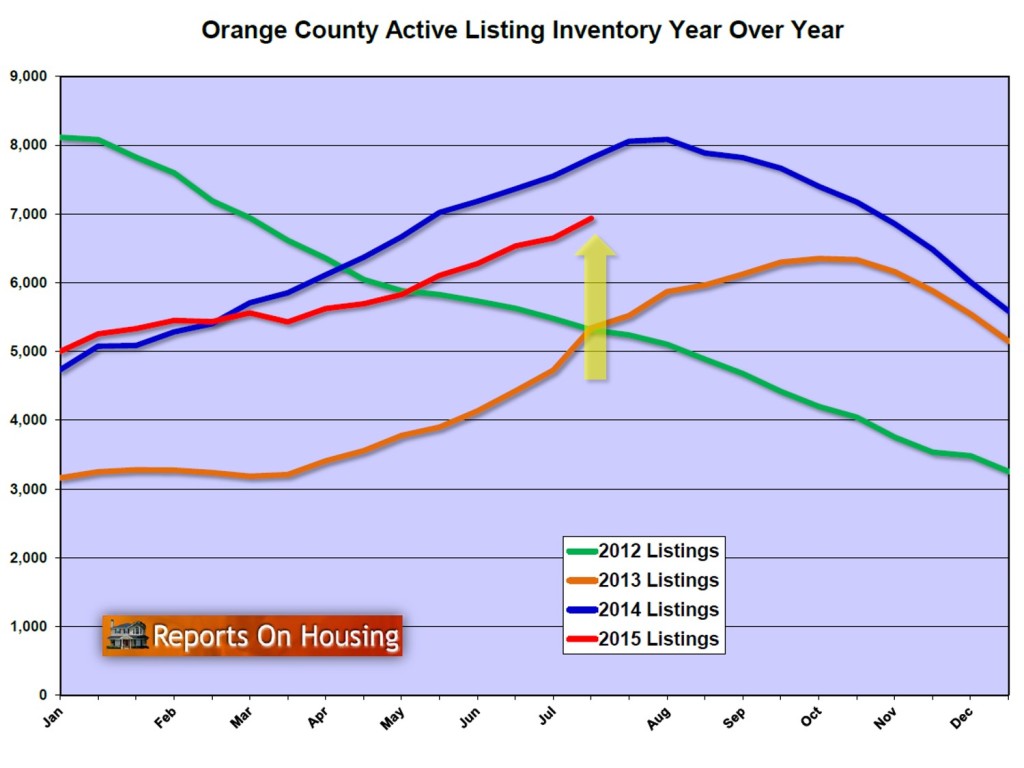

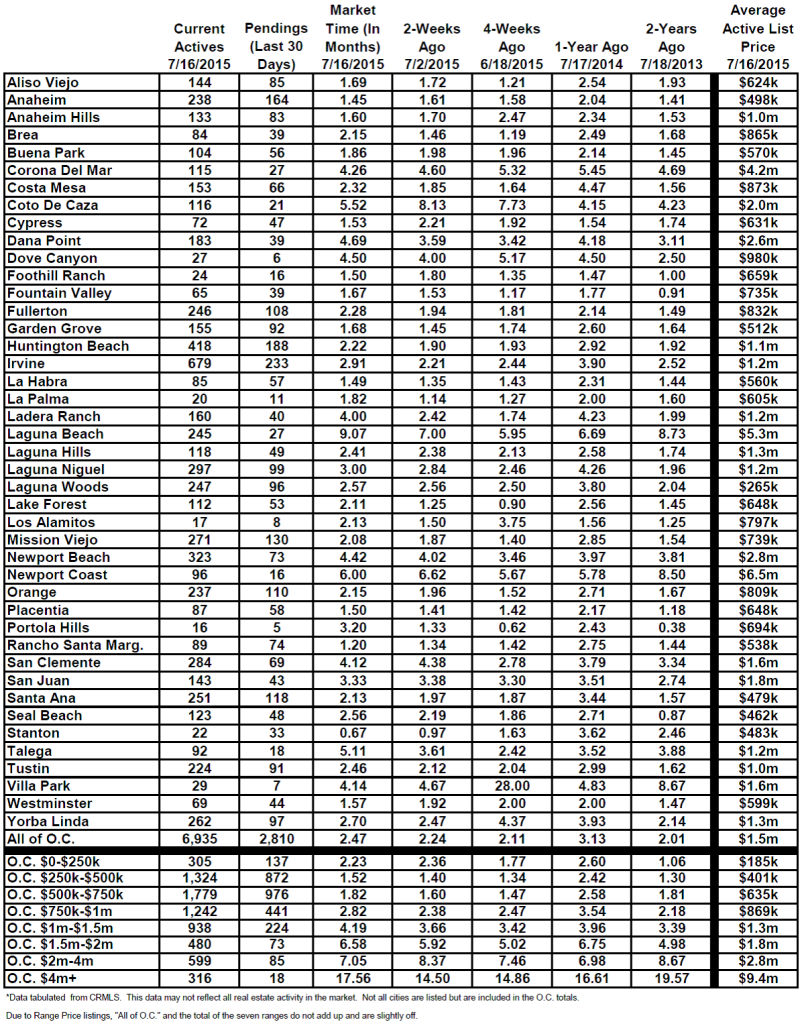

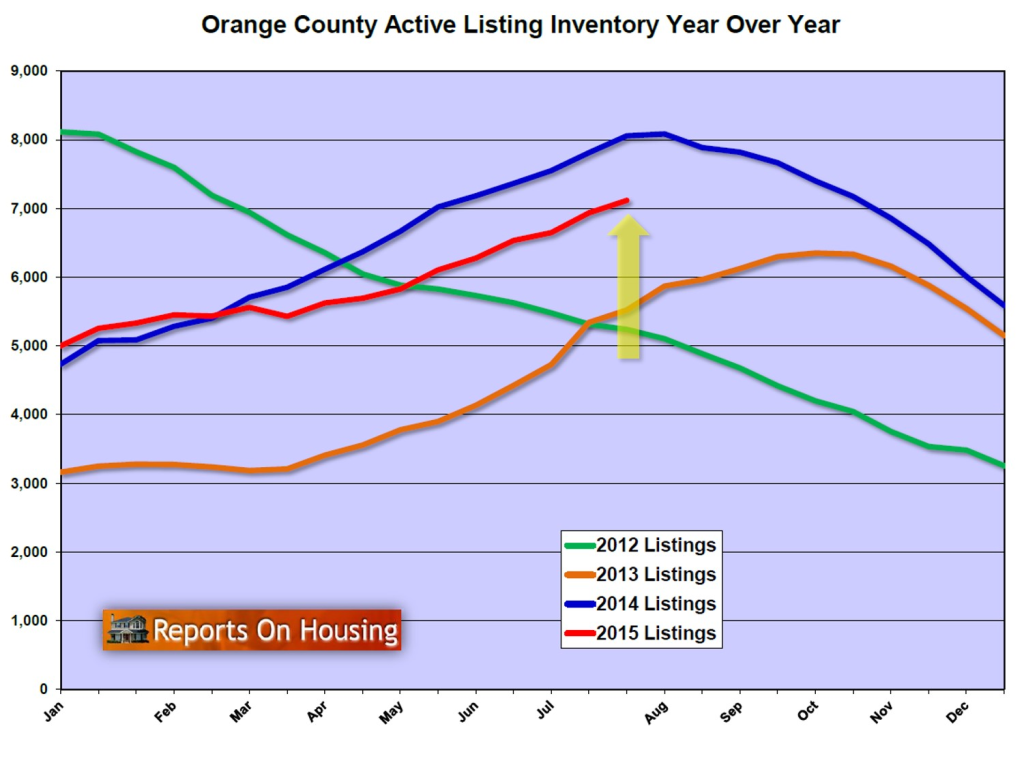

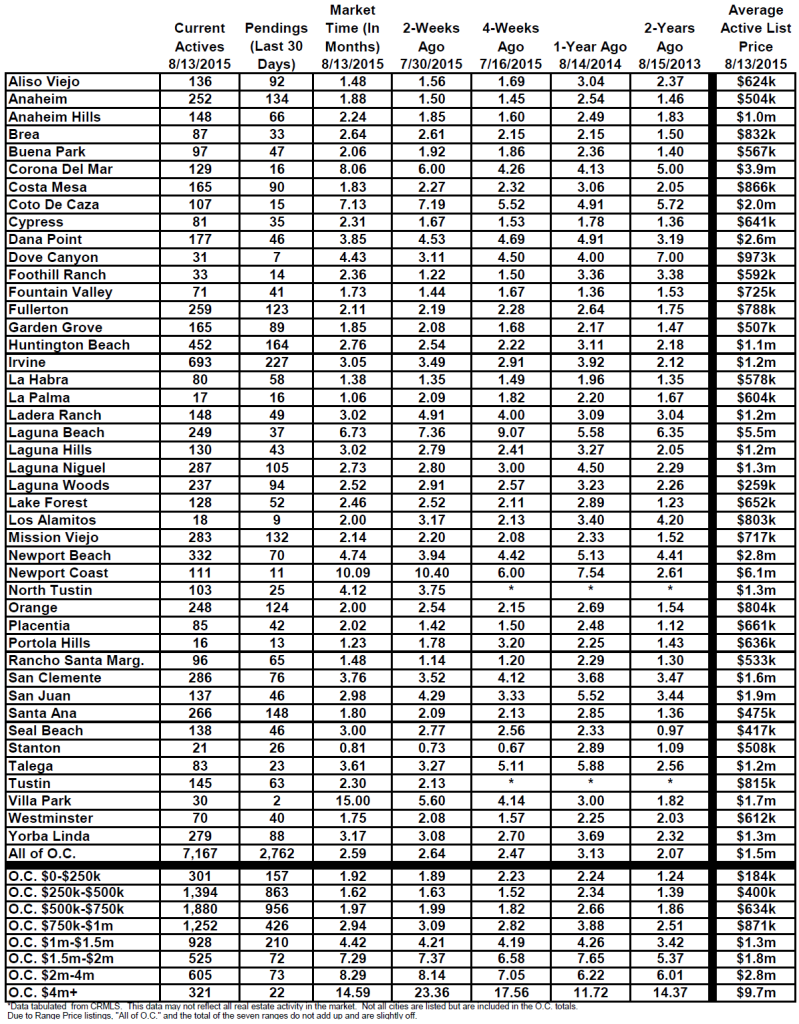

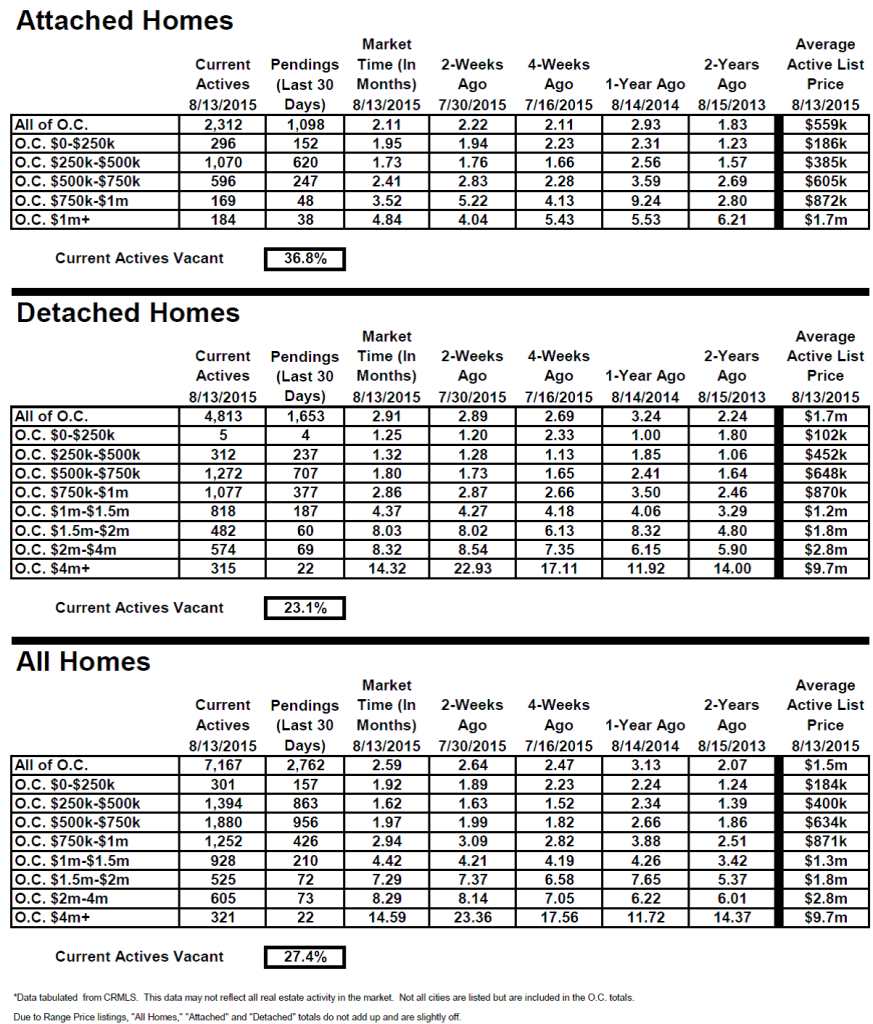

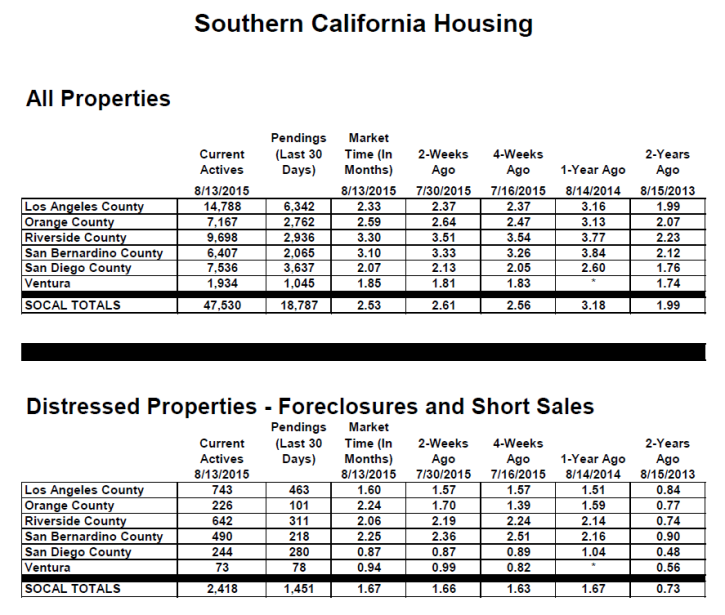

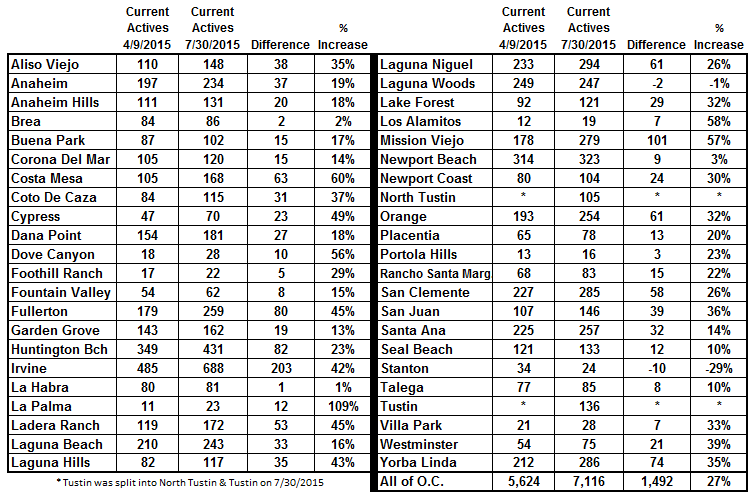

After sharply increasing for four straight months, the active inventory in the past two weeks only increased by 51 homes in and now totals 7,167. Since 2004, the inventory has only grown by 1% during the same two week period. That’s a direct result of fewer homes coming on the market as summer slowly draws to an end. For many of those year, the peak actually came two weeks from now, the end of August. That was last year’s peak too. It looks as if this year’s Orange County housing market will peak right around then too, about 11% lower than last year’s peak.

Last year at this time the inventory totaled 8,084 homes, 917 more than today, with an expected market time of 3.13 months, or 94 days. That’s 16 additional days compared to today.

Demand: Demand increased by 2% in the past couple of weeks.

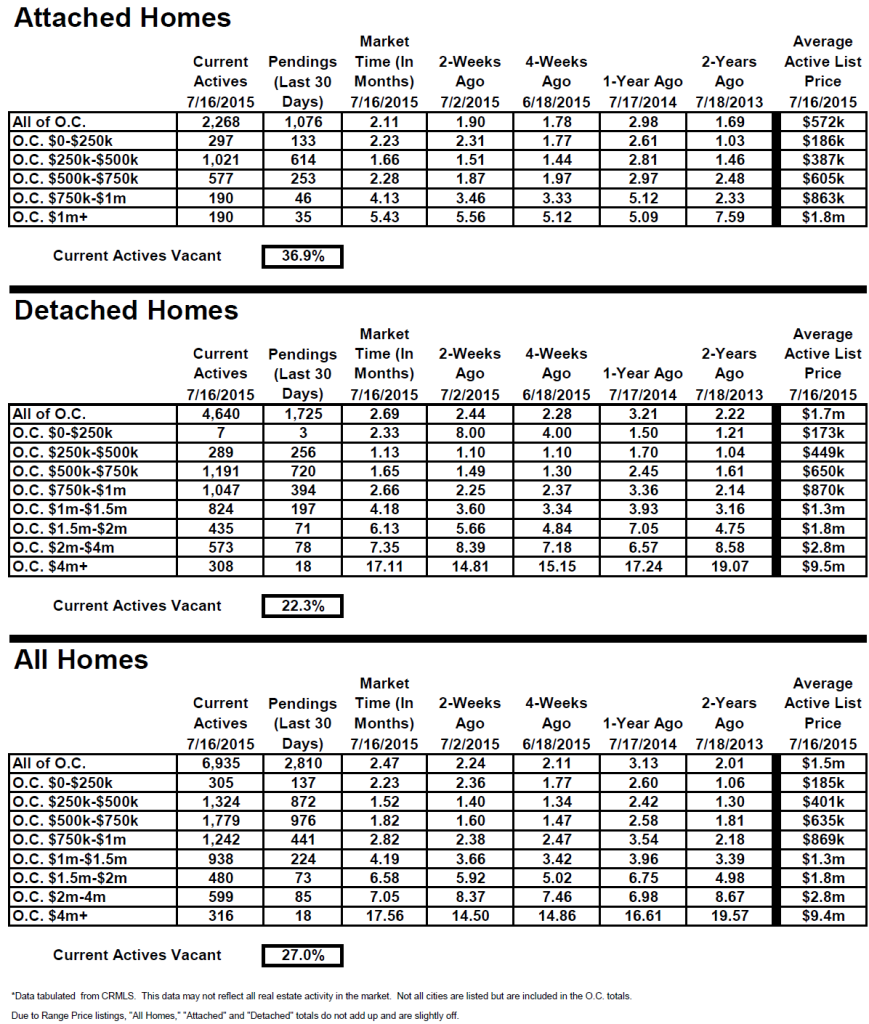

Demand, the number of new pending sales over the prior month, increased by 64 homes in the past two weeks and now totals 2,762 homes. Even with the increase, demand is still currently at February levels. From here, we can expect demand to start to drop a bit as the kids go back to school.

Last year at this time there were 177 fewer pending sales, totaling 2,585. The threat of an increase in rates will probably keep demand slightly elevated year over year throughout the Autumn Market.

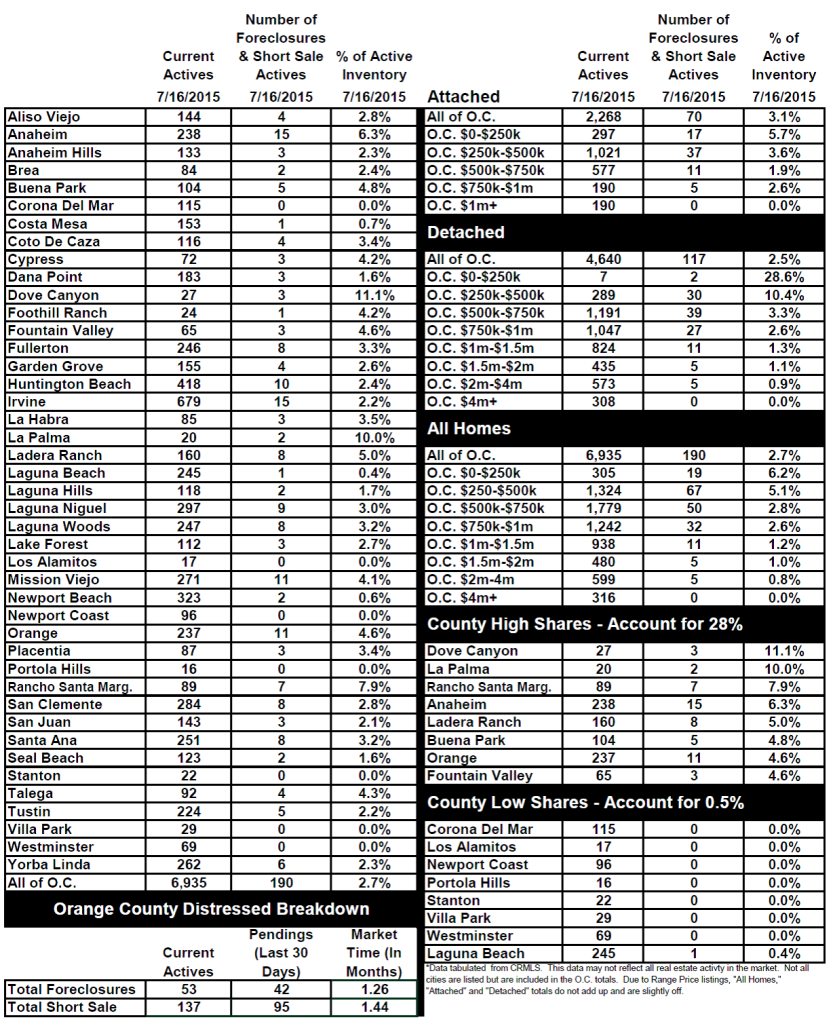

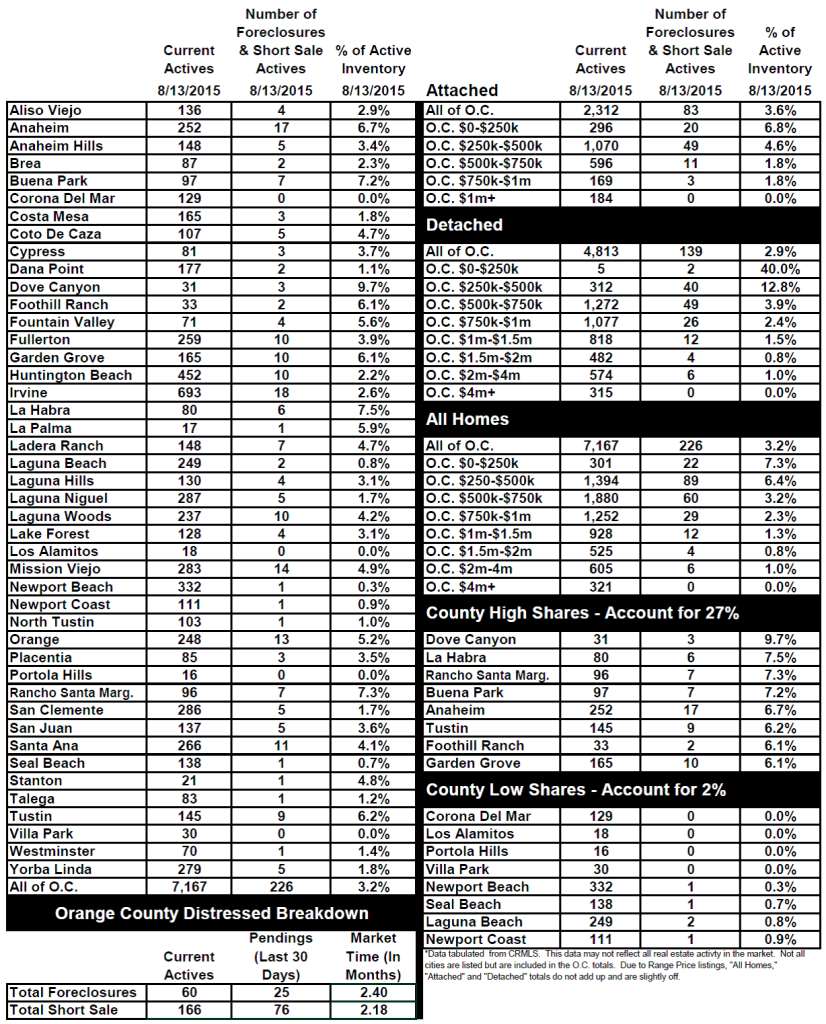

Distressed Breakdown: The distressed inventory increased by 26 home in the past couple of weeks.

The distressed inventory, foreclosures and short sales combined, increased by 26 homes in the past two weeks, a 12% jump, and now totals 226. It’s the highest level since March of this year. But, do not get too caught up in the numbers; the year started with a distressed inventory of 262 foreclosures and short sales. The uptick is not due to an increase in foreclosures; it’s because of a spike in short sales. Short sale spikes have occurred before. The most recent one came in September of last year when it climbed by 31 in just two weeks. Once again, it’s all about perspective. There are currently 166 short sales, compared to 208 last year, 170 in 2013, 599 in 2012, and 2,935 in 2011. Historically, 166 short sales on the market is a drop in the bucket compared to prior years and the depths of the recession.

In July, only 2.6% of all closed sales were short sales and a meager 1% were foreclosures, leaving 96.4% that were good ol’ fashioned healthy sellers with equity in their homes. Even with the recent slight increase in short sales, the distressed market has become nothing more than a footnote to the current housing story.

In the past two weeks, the foreclosure inventory decreased by 3 homes and now totals 60. Less than 1% of the inventory is a foreclosure. The expected market time for foreclosures is 72 days. The short sale inventory increased by 27 homes in the past two weeks and now totals 166. The expected market time is 66 days. Short sales represent just 2% of the total active inventory.

Have a great week.

[gravityform id=”13″ title=”true” description=”true”]

Orange County Housing Report: A Mid-Year Checkup

Orange County Housing Report: A Mid-Year Checkup