Lack of inventory has been the theme of the Orange County housing market for several years now.

Lack of inventory has been the theme of the Orange County housing market for several years now.

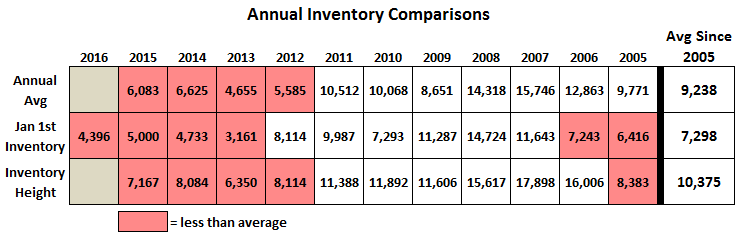

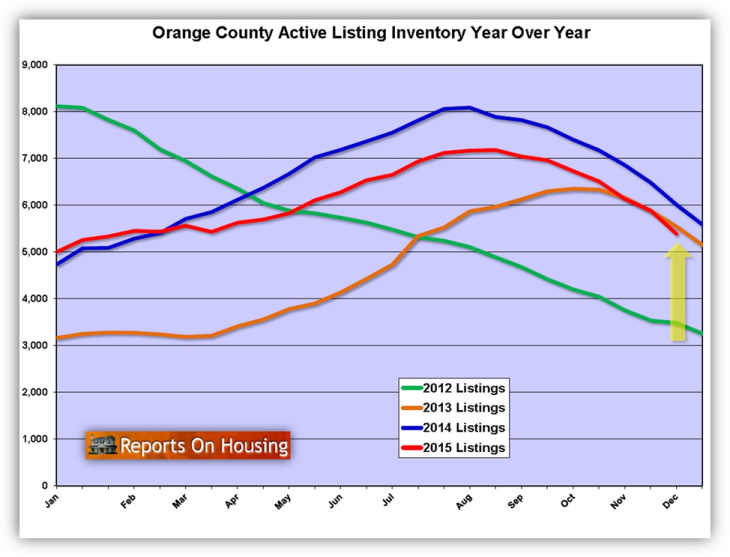

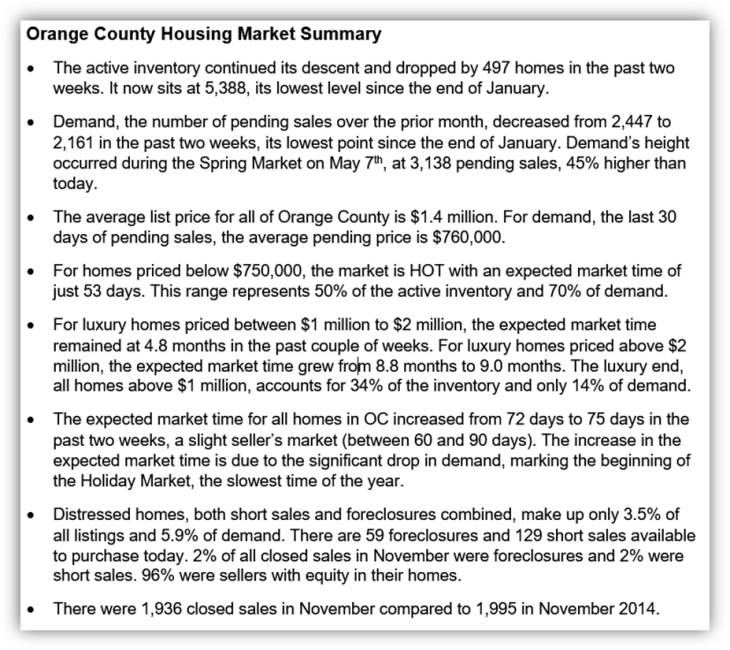

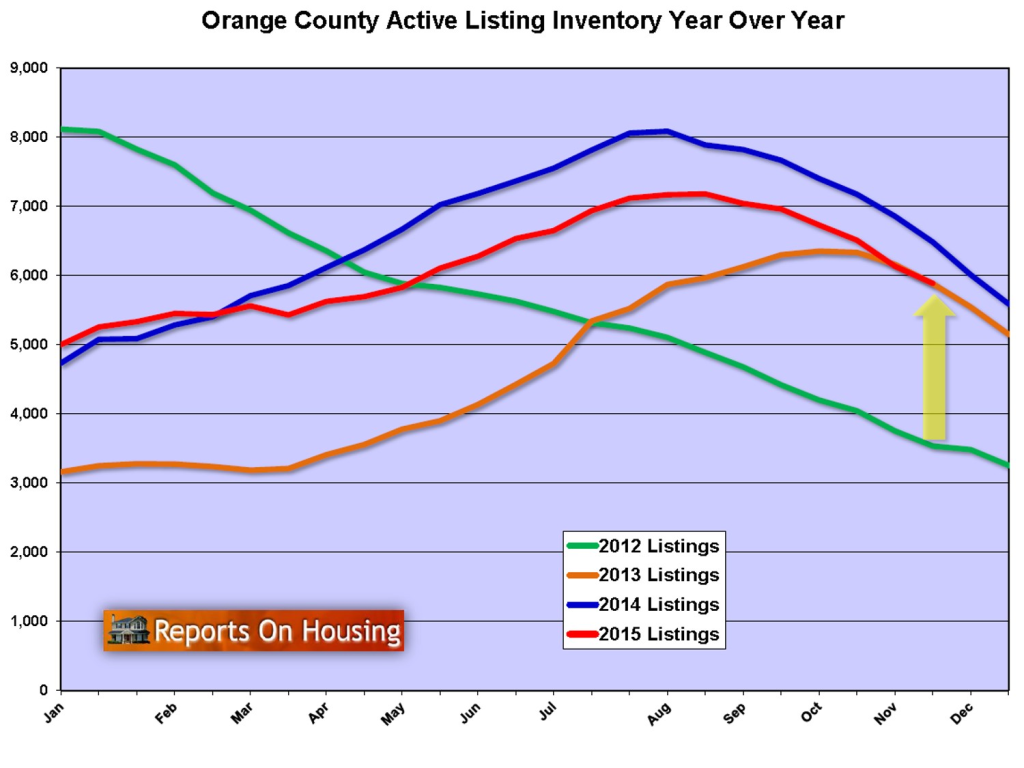

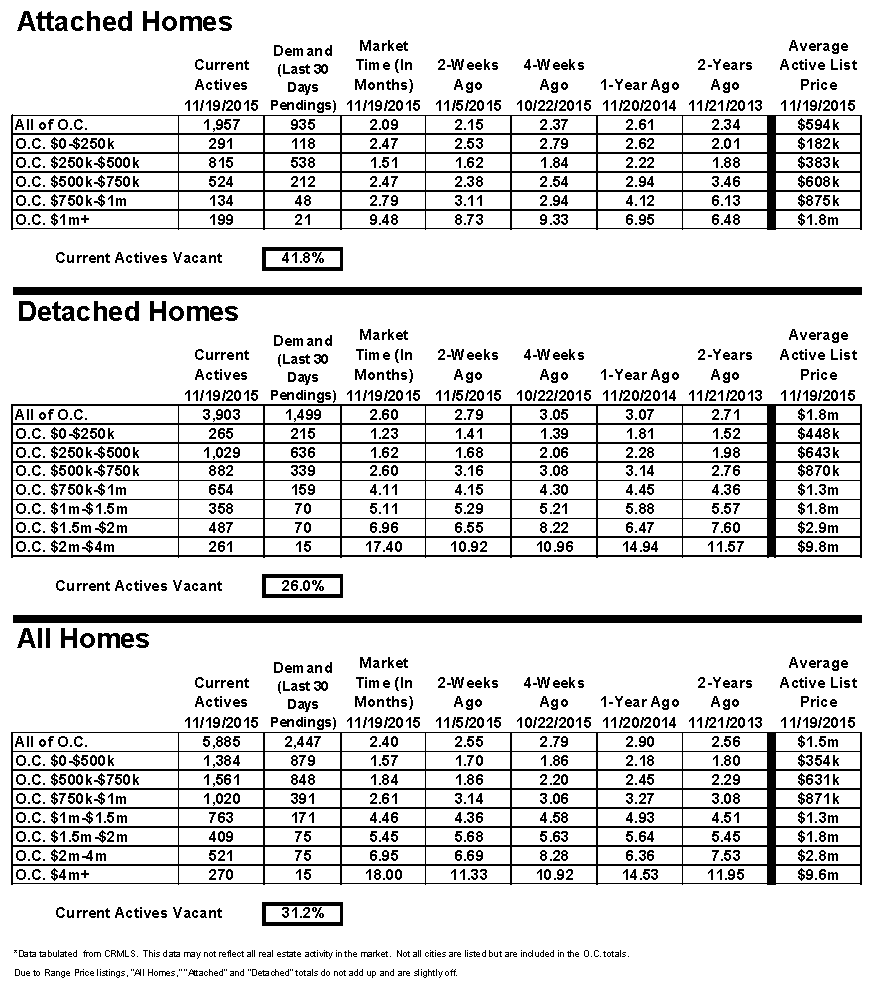

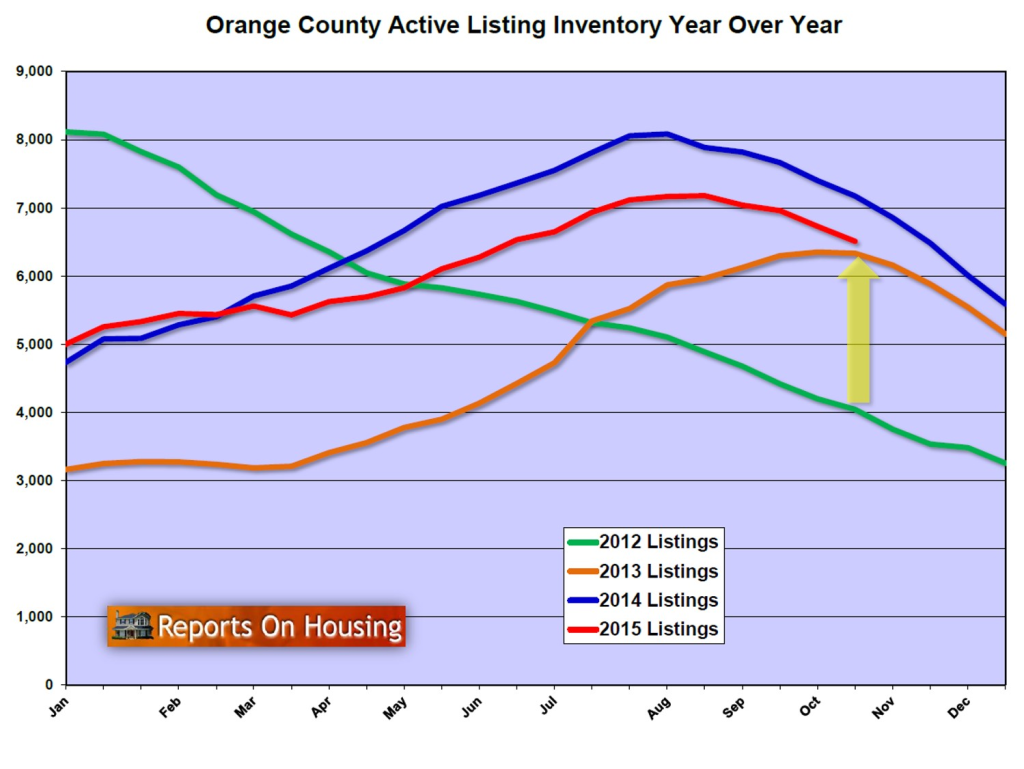

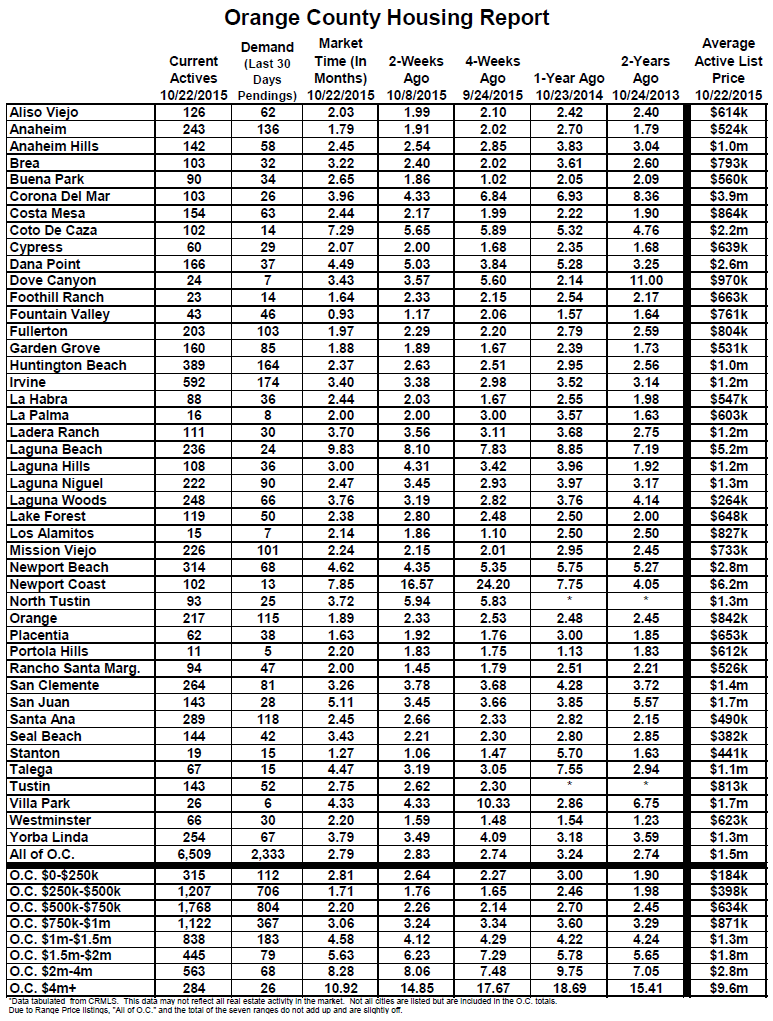

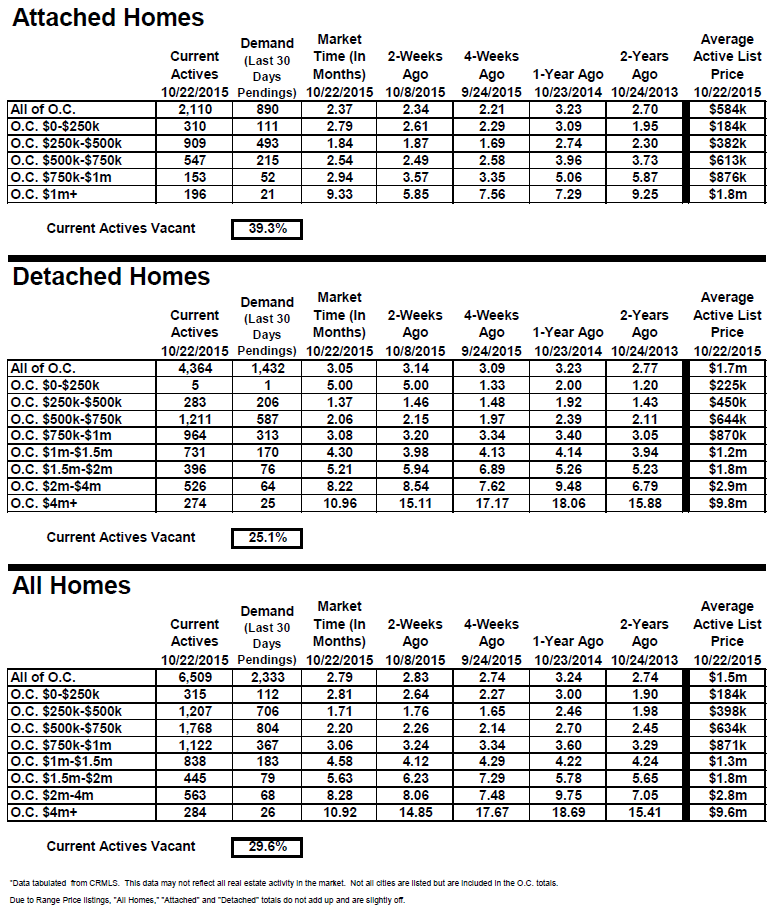

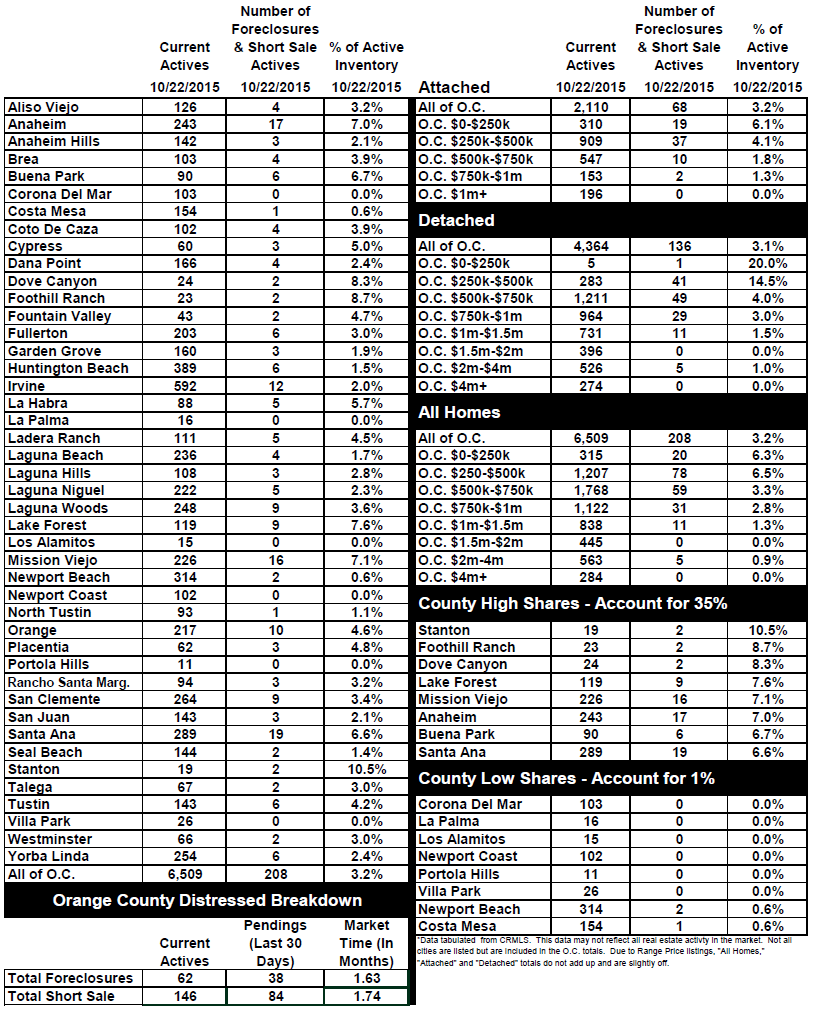

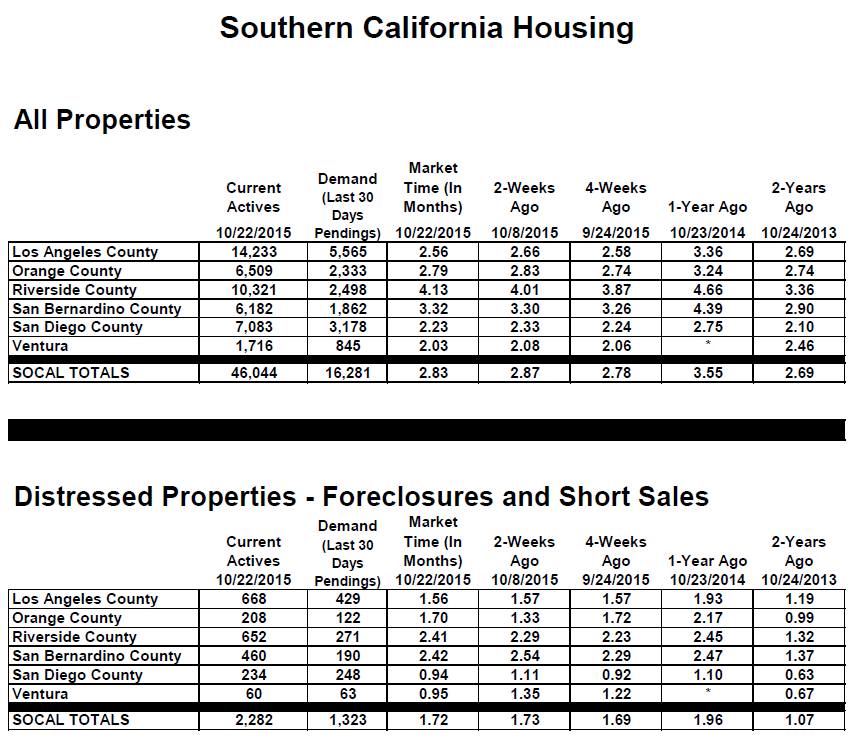

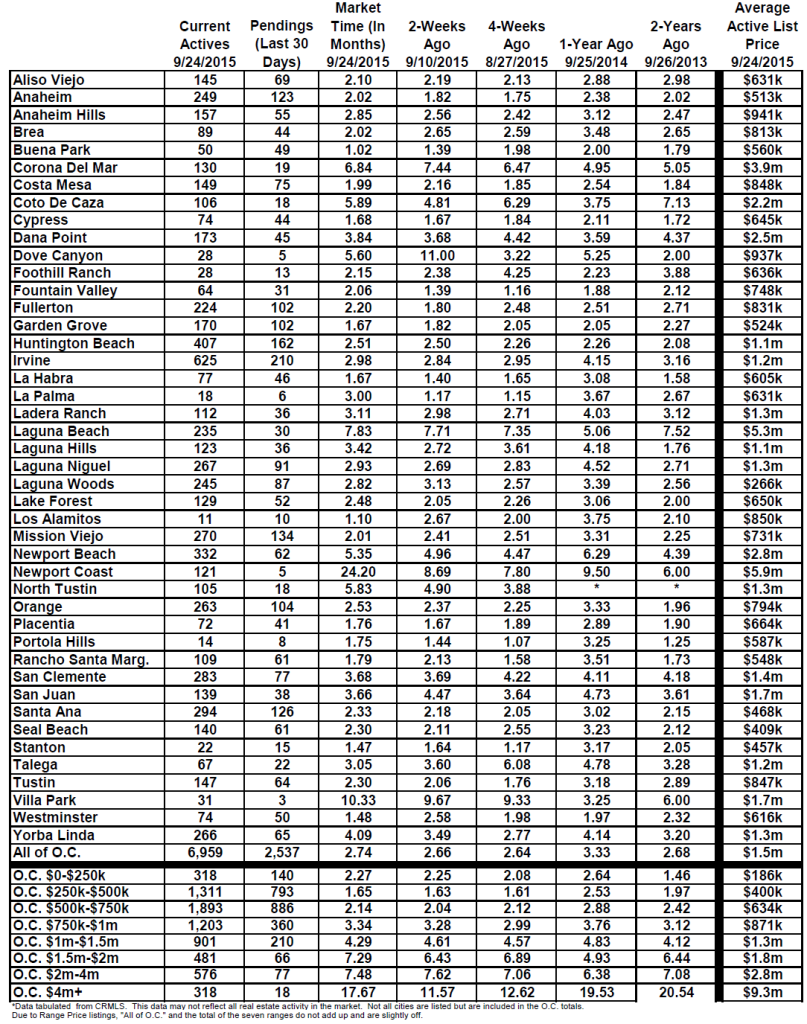

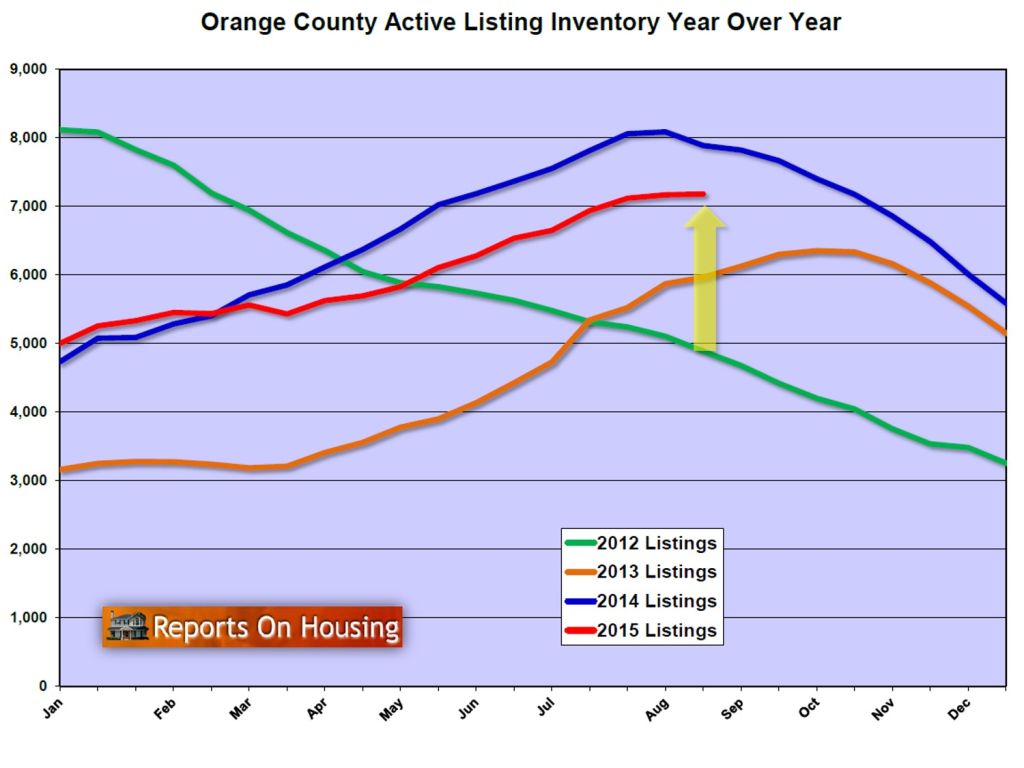

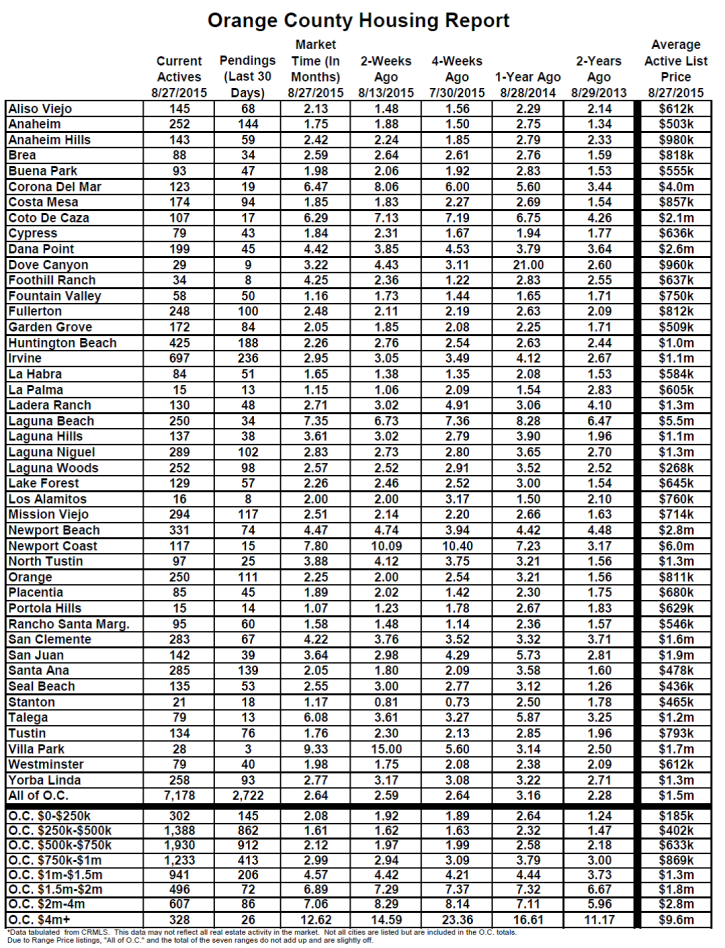

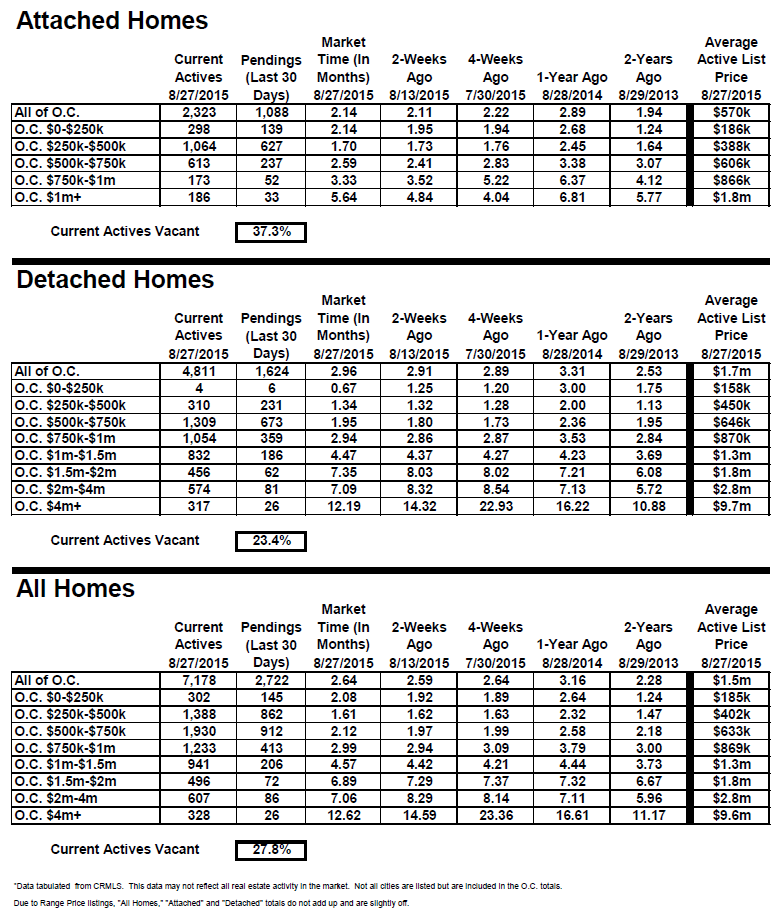

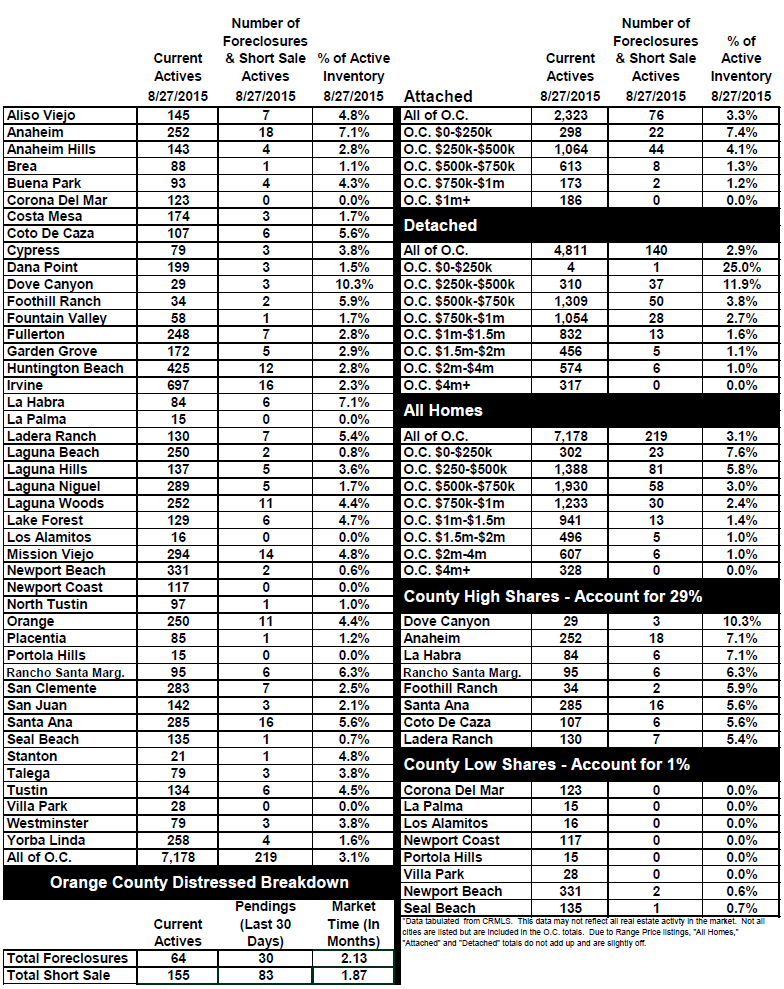

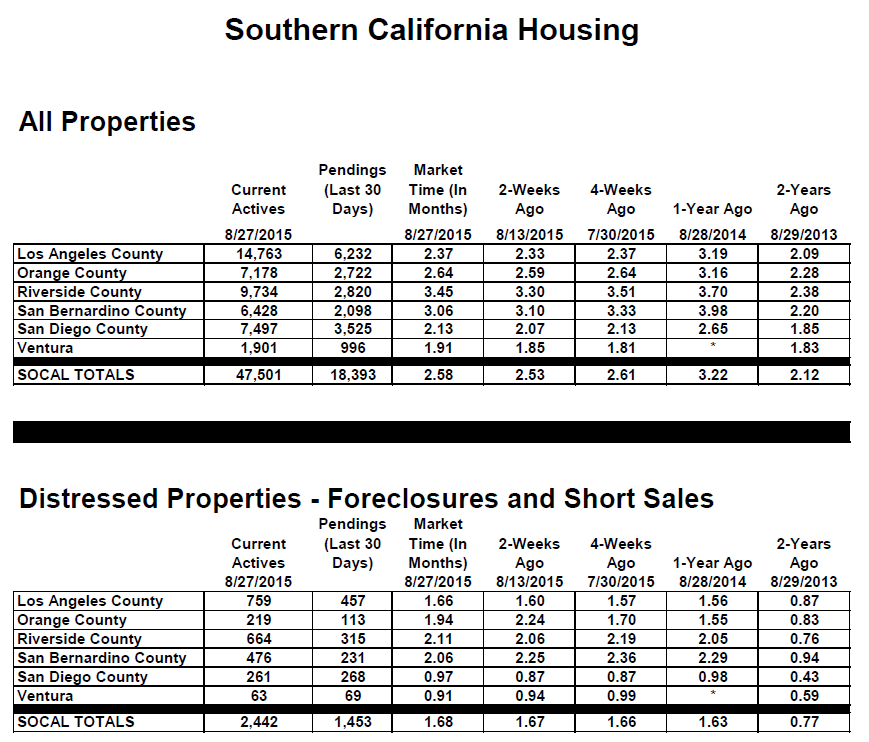

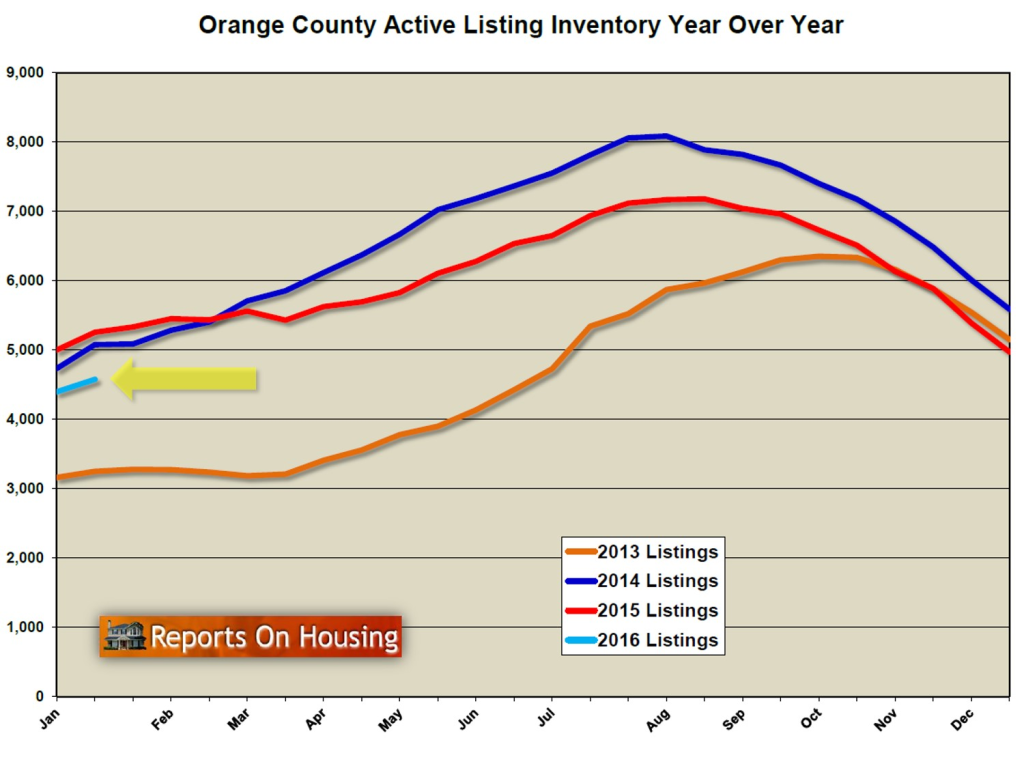

Active Inventory: There just are not that many sellers on the market to start 2016. The Orange County housing market has a bad habit of starting the year off with an anemic inventory. This trend dates back to 2013 when almost nothing was on the market, only 3,196 homes. This year’s start is not quite that low, 4,396 homes, but it means that there are still not enough homes to satiate current demand. Today’s inventory is down 12% compared to just one year ago.

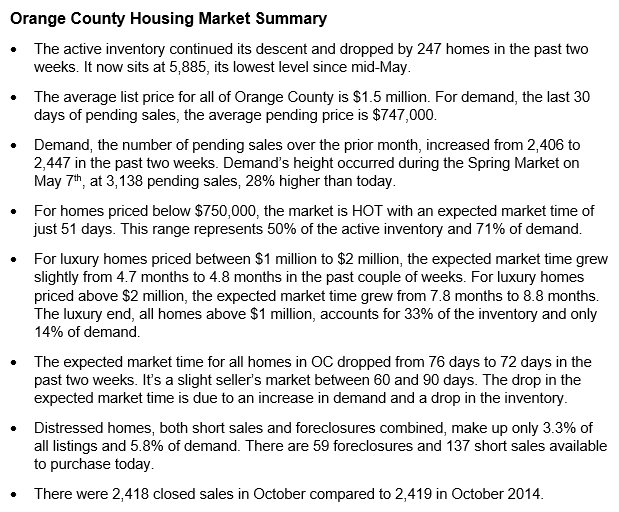

There’s definite pent up demand for homes, but just not enough inventory to match. Typically, that is a recipe for appreciation, low supply and high demand, but not in today’s market. Instead, buyers are approaching the housing market much more cautiously. They are very aware that homes have already appreciated considerably since 2012, so they are careful to not overpay. Today’s buyers are seeking the Fair Market Value for a home.

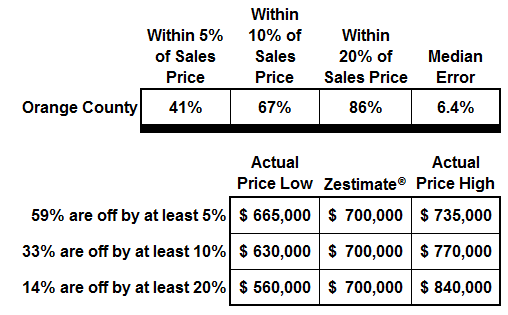

People often ask what is the Fair Market Value of a home and how does a homeowner ascertain that value for their home? It is the value of a home that is determined by factoring in the most recent comparable sales and pending activity. Active listings in the neighborhood are typically not factored into this value, as most active listings start off overpriced and a bit outside of the realm of reality. It’s not uncommon to find an entire neighborhood that is overpriced. It takes quite a bit of legwork and a seasoned professional to figure out the Fair Market Value of a home. The professional is NOT

Zillow.com or the plethora of other online valuation sites. These sites are so incredibly inaccurate. People used to think the earth was flat too. Today, people believe they can go to a website and it will tell them the value of their home. The professional that can help determine the true value of a home is a REALTOR®. They are able to factor in the condition, amenities, upgrades, and location of a home compared to the most recent closed and pending sales. Does a home have purple tile? Does it back to a busy street? Is there a partial view, panoramic view, or no view? Crown molding, plantation shutters, wood shutters, aluminum blinds, custom drapes, wainscoting, vinyl flooring, green carpet, 5×5 kitchen tiles, granite counters, high baseboards, custom paint, recently upgraded kitchen and/or baths, popcorn ceilings, vaulted ceilings, custom cabinets, outdoor pool and spa, outdoor fireplace, an entertainer’s backyard, garage storage, etcetera, all factor into the price of a home. There are details of a home that add to its value, just as there are features that subtract from value. The professional REALTOR® with the experience to weight everything will blow the socks off a home valuation site.

With buyers carefully approaching the market, it is extremely important that sellers price their homes as accurately as possible to properly take advantage of today’s lack of inventory. Homes that are priced right will fly off the market. The rest will sit until the price is brought more in alignment with the Fair Market Value. This is precisely why the active inventory will continue to grow from now through August; it will be on the backs of sellers who stretch their value.

Homeowners are foolish if they wait to place their home on the market in anticipation of cashing in on future appreciation. Since homes are not appreciating rapidly, waiting until later in the spring or next year will not be as beneficial as many people think. A great time to get a jump on the competition is actually now while the inventory is extremely low. The only caveat is that the home is priced appropriately.

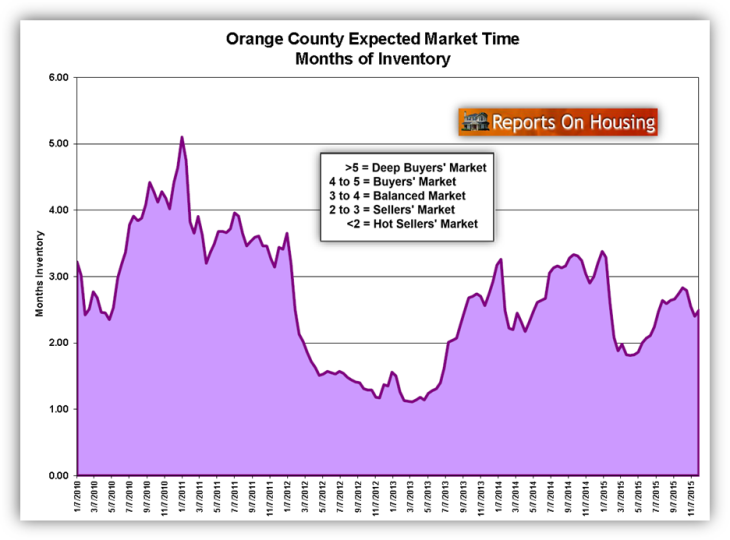

The active inventory increased by 180 homes, or 4%, in the past two weeks and now sits at 4,576. It will continue to rise through August, but won’t really pick up steam until March.

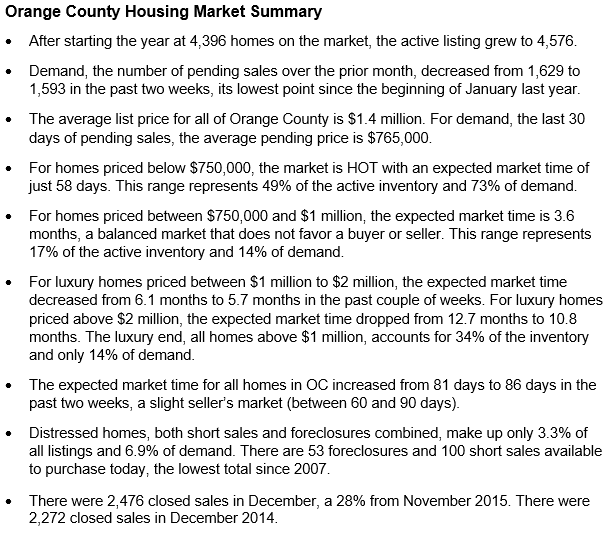

Last year at this time the inventory totaled 5,255 homes, 679 more than today, with an expected market time of 3.29 months, or 99 days, a balanced market that does not favor a buyer or seller. In comparison, today’s expected market time is 2.87 months, or 86 days, an extremely slight seller’s market.

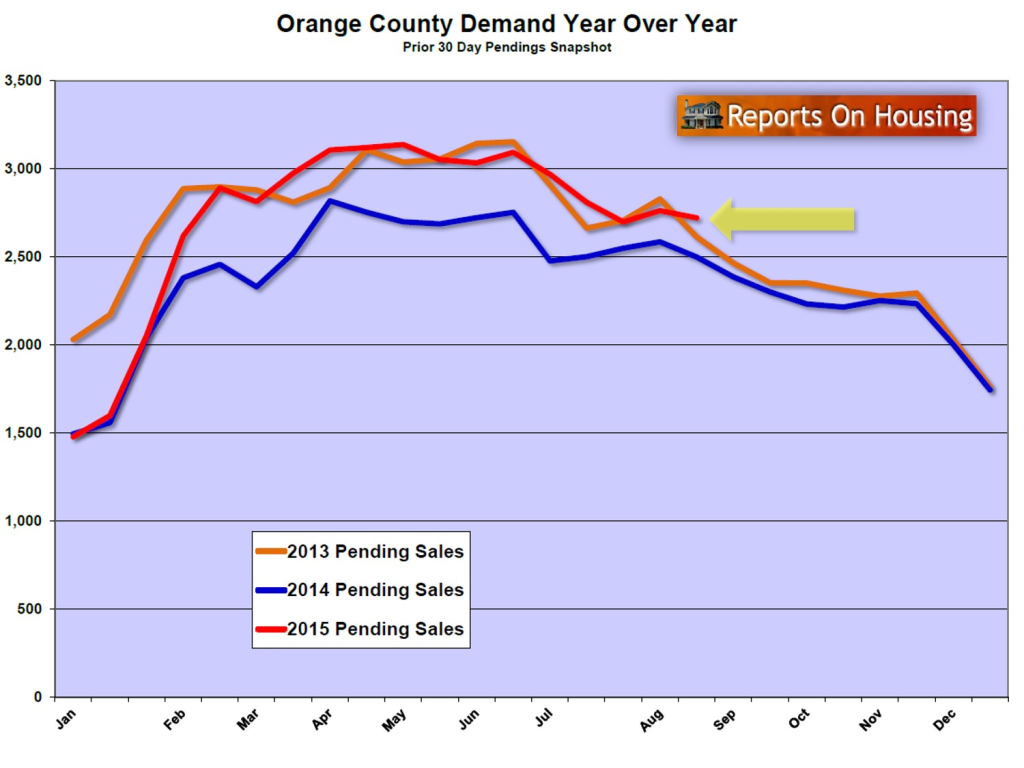

Demand: with not that many homes on the market to start the year, demand remained flat.

Demand: with not that many homes on the market to start the year, demand remained flat.

Demand, the number of new pending sales over the prior month, dropped by 36 homes, or 2%, in the past two weeks, and now totals 1,593. It’s having a bit of trouble launching because of the lack of new, fresh inventory. For the first couple of weeks of the year, the number of homes to come on the market is down by 14%. More homes will come on the market now as everybody collectively shakes off the holiday fog and New Year’s resolutions drop by the wayside. Expect demand to increase sharply over the next couple of weeks as the number of homes coming on the market increases dramatically as well. This trend will catapult further right after the Super Bowl and start the transition to the most active season of the year, the Spring Market.

Last year at this time there were 6 more pending sales, nearly identical to today.

Summary:

Have a great week.

Sincerely,

Roy Hernandez

[gravityform id=”13″ title=”true” description=”true”]