[idx-listing mlsnumber=”pw14162134″ showall=”true”]

[gravityform id=”5″ name=”Tell me what you’re looking for?”]

Roy Hernandez Real Estate Services

Orange county real estate houses for sale

[idx-listing mlsnumber=”pw14162134″ showall=”true”]

[gravityform id=”5″ name=”Tell me what you’re looking for?”]

Home selling in the summer is often a bit more tricky than home selling during other times of the year. For example, spring time selling is the most popular time to put your home on the market. The second best time of the year to sell a home is in the autumn. Summer ranks in meager third position.

Home selling in the summer is often a bit more tricky than home selling during other times of the year. For example, spring time selling is the most popular time to put your home on the market. The second best time of the year to sell a home is in the autumn. Summer ranks in meager third position.

Summer is good for a lot of things, but home selling is not necessarily one of them. In fact, if you don’t have to sell in the summer, you might get more for your home if you wait until fall. Why? Because in the summer

There’s just too much going on during the summer to pay close attention to home selling. Most sellers would rather wait until everything calms down in the fall.

Not everybody can wait until fall, though. Sometimes people need to sell during the months of June, July and August. They might be transferred to a new job in another state or be experiencing other pressing “life” issues that could necessitate an immediate sale. Here are a few things you can do help attract a summertime buyer who might be leaning instead toward lying in a hammock and sipping lemonade.

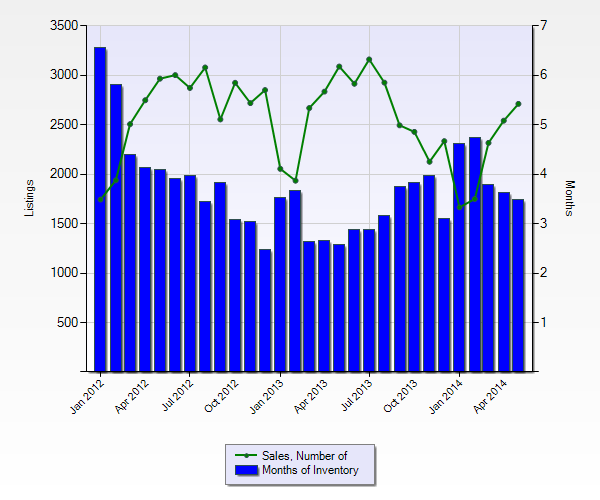

Good news for buyers in the upper end of the buying spectrum. Properties are staying on the market longer and inventory is UP. Meanwhile, lower end buyers are having a tough go of it with smaller inventory and rising prices.

After plunging throughout 2012 and for much of 2013, and rising only modestly through the beginning of this year, the inventory of all for-sale homes nationwide spiked in May, jumping 11.8% year-over-year according to Zillow (Z).

But most of those gains in inventory were made among homes priced in the middle and top one-third of home values, according to Zillow Real Estate Market Reports.

The number of homes available for sale in the most affordable price bracket, those homes most sought by first-time homebuyers, fell year-over-year in 28 of the nation’s largest metro areas analyzed by Zillow.

“It’s good to see overall inventory rising. It’s likely that many would-be sellers have decided to capitalize on recent home value gains, particularly as the pace slows, and list their home for sale now in order to move into a new home while mortgage interest rates remain low,” said Zillow chief economist Stan Humphries. “But persistent inventory constraints at the low end of the market continue to make it a tough environment for first-time and lower-income homebuyers. Low inventory and high demand can lead to rapid price spikes, which make homes even more difficult to afford for many buyers. Hopefully the inventory gains we’re seeing in the middle and upper tiers of the market will begin trickling down to the most affordable homes soon.”

The total number of homes listed for sale on Zillow in May was up 4.3% over April, and has risen month-over-month in each of the past three months on a seasonally adjusted basis.

Overall inventory of for-sale homes was up year-over-year in 506 (78%) of the more than 600 metro areas analyzed by Zillow. Large metros where inventory has increased the most include Las Vegas (up 51.5% year-over-year), Washington, DC (up 45.7% year-over-year) and Riverside, Calif. (up 42.7% year-over-year).

In addition to low numbers of affordable homes for sale, first-time and lower-income homebuyers armed with traditional financing are also competing with all-cash buyers at the lower end of the market. Zillow reported last week that in 27 of the top 30 metros analyzed by Zillow, more than one third of all sales of the lowest-priced homes were made with cash. In three of the top 30 metros – Tampa, Detroit and Miami – more than 80% of all sales in the lowest price bracket were cash deals.

National home values in May were up 0.1% from April to a Zillow Home Value Index of $172,300, and have now risen for 28 consecutive months.

Year-over-year, U.S. home values rose 5.4% in May, the slowest annual pace of appreciation in more than a year. For the 12-month period from May 2014 to May 2015, national home values are expected to rise another 2.9% to approximately $177,321, according to the Zillow Home Value Forecast.

[gravityform id=”13″ name=”Have a question or comment?”]

Home prices continue upward. Equity home sales near 90 % all home sales.

Home prices continue upward. Equity home sales near 90 % all home sales.

LOS ANGELES (June 23) – Higher home values continued to fuel more equity home sales, which have made up more than 80 percent of all home sales for the past 11 consecutive months. Meanwhile, pending home sales fell in May as investors pulled out of the market due to higher home prices, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Distressed housing market data:

• The share of equity sales – or non-distressed property sales – rose further in May, rising to 89.2 percent, up from 88.4 percent in April. Equity sales have been rising steadily again since the beginning of this year. May marks the 11th straight month that equity sales have been more than 80 percent of total sales. Equity sales made up 78 percent of sales in May 2013.

• The combined share of all distressed property sales continued to decline in May, primarily due to a drop in REO sales. The share of distressed property sales was down from 11.6 percent in April to 10.8 percent in May. Distressed sales continued to be down by more than 50 percent from a year ago, when the share was 22 percent.

• Twenty-seven of the 41 reported counties showed a month-to-month decrease in the share of distressed sales, with 11 of the counties recording in the single-digits, including Alameda, Marin, San Diego, San Luis Obispo, San Mateo, and Santa Clara counties — all of which registered a share of five percent or less.

• Of the distressed properties, the share of short sales dropped to levels last observed in late 2007 at 5.6 percent, down from 5.9 percent in April. May’s figure was nearly a third of the 14 percent recorded in May 2013.

• The share of REO sales fell in May to 4.7 percent, down from 5.3 percent in April and from 7.6 percent in May 2013.

• The supply of inventory increased for equity sales and REO sales in May. The Unsold Inventory Index for equity sales edged up from 3.6 months in April to 3.7 months in May, and from 2.3 months in April to 2.4 months in May for REO sales. The supply of short sales dipped from 4.4 months in May to 4.3 months in April.

Pending home sales data:

• California pending home sales fell in May, with the Pending Home Sales Index (PHSI)* dropping 3.4 percent from a revised 114.1 in April to 110.1 in May, based on signed contracts.

• Pending sales were down 10.6 percent from the revised 123.2 index recorded in May 2013. The year-over-year decline in the PHSI was the first double-digit decline in three months. Pending home sales are forward-looking indicators of future home sales activity, providing information on the future direction of the market.

Charts (click link to open):

• Pending sales compared with closed sales.

• Historical trend in the share of equity sales compared with distressed sales.

• Closed housing sales in May by sales type (equity, distressed).

• Housing supply of REOs, short sales, and equity sales in May.

• A historical trend of REO, short sale, and equity sales housing supply.

• Year-to-year change in sales by property type.

[gravityform id=”13″ name=”Have a question or comment?”]

[idx-listing mlsnumber=”PW14128608″ showall=”true”]

[gravityform id=”6″ name=”Make an appointment to view property.”]

[idx-listing mlsnumber=”pw14112865″ showall=”true”]

[gravityform id=”6″ name=”Make an appointment to view property.”]

Mortgage rates have fallen close to their lowest levels in nearly a year, but housing demand hasn’t budged much yet.

Freddie Mac FMCC -1.36% reported Thursday that the average 30-year, fixed-rate mortgage rose to 4.14% this week, up from 4.12% last week but down from 4.4% just two months ago. This puts rates at roughly the same level seen in late October 2013 and again last June, when rates were zipping up as investors braced for an end to the Federal Reserve’s bond-buying programs.

But even with low rates, mortgage applications have been soft, according to a separate report from the Mortgage Bankers Association, a sign of still muted demand for home loans.

What’s going on?

First, a longer view helps. True, mortgage rates are low—as low as they’ve been in almost 12 months. But in the same way that shoppers may not be lured by “low prices” at a department store that is always advertising a sale, mortgage rates at 4.1% may not be seen as a steal by buyers who lived with rates that were even lower for all of 2012 and the first half of 2013—especially considering that prices have moved higher.

Put differently, which change is more dramatic—a decline in interest rates from 5% to 3.5% over the two years beginning in February 2011 or the decline from 4.5% in January to 4.1% in May?

Given the time it takes for home purchases to come together and the fact that the decision to purchase a home isn’t purely rate-driven—buyers also must weigh what’s for sale, their family and job situation, etc.—it could take a while to see what effect, if any, the recent drop in interest rates has had on demand.

So do rates really matter? At the margins, yes. They’re a key component of a borrower’s monthly payment. And often the first conversation between a real-estate agent and a potential buyer—”How much are you willing to spend?”—can be influenced quite a bit by mortgage rates, provided the buyer isn’t paying entirely in cash.

What does this payment picture look like right now? The monthly payment on the median-priced U.S. home fell from $673 in February 2011 to $552 in September 2012 as interest rates fell. Interest rates stayed low through May 2013, but the average payment rose to $586 as home prices ticked up. (These calculations assume a 20% down payment on the national median home value as calculated by Zillow).

After interest rates jumped last summer, that average payment bounced to $674 in September 2013. Rising prices and, especially, higher rates eroded the affordability gains of the previous 2½ years in a matter of months. Payments haven’t budged much since then. Modest declines in interest rates have offset modest gains in home prices.

Some look at this and say: wait a minute, a 4.5% mortgage is still an insanely good deal. Why would a rise in rates to levels that are still quite low hurt housing demand? One possible explanation: the overall level of rate matters over the long run, but the speed with which rates rose last year could have dented demand in the short run.

Several economists have argued recently that mortgage rates increases played an important role in last year’s sales slowdown. In part, that’s because activity received a larger boost when mortgage rates were falling from 2011 to 2013 than previously anticipated, wrote Goldman Sachs economists Sven Jari Stehn and David Mericle in a recent report.

The Goldman analysis suggests that the slide in mortgage rates between 2011 and 2013 increased residential investment—the primary measure of housing’s contribution to GDP—by 5 percentage points. “As this tailwind dissipates going forward, the trend in housing activity might be somewhat lower than previously assumed,” they write.

Last year’s mortgage rate increase accounts for nearly half of the difference in expected housing growth and the lower, actual growth, according to a separate analysis published last week by economists at the Federal Reserve Bank of Cleveland.

This isn’t to say that the cold winter and the rate jump are the only reasons housing has slowed down. Low rates and prices may have spurred the release of pent-up demand throughout 2012, as home prices began to rise. This one-time benefit, together with aggressive home purchase by investors (also a temporary phenomenon), could have given false signals about the true health of the demand side of the market in 2012 and 2013.

Moreover, incomes have showed little growth, meaning that it will be harder for more buyers to buy homes if prices continue to rise absent some gains in wages or even bigger declines in financing costs. Sales are also being restrained by low levels of homes for sale, which is pushing prices higher. Some would-be buyers don’t have enough equity to sell their current home, while others have high levels of student debt.

WSJ by Nick Timiraos

[idx-listing mlsnumber=”PW14122151″ showall=”true”]

[gravityform id=”6″ name=”Make an appointment to view property.”]

[idx-listing mlsnumber=”PW14105834″ showall=”true”]

[gravityform id=”6″ name=”Make an appointment to view property.”]

There has never been a better time to buy a home this year.

And yet despite three major advantages for homebuyers, sales so far have been slow.

Buying is cheaper than renting in most markets. And with mortgage activity down, originators, one would think, would be bending over backwards for applicants.

More people want to be homeowners, even younger buyers. A recent Fannie Mae survey of younger renters and buyers finds that though most younger renters prefer owning, many of them may stay renters longer due to insufficient financial capability and/or preparation. They don’t want to be renters – 90% would prefer to be homeowners.

Additionally, according to the latest quarterly report from the Federal Housing Finance Agency, both Fannie Mae and Freddie Mac are reducing the money set aside to cushion any blow to their business, making it fair to say this is the result of the government-sponsored enterprises betting on a continued housing recovery.

There are three reasons this may be the best time to buy a home. (Click the next page below to see the list)

1) Mortgage rates are at six-month lows

Mortgage rates in the first week of May fell once again and this time to the lowest level since Nov. 7, 2013.

The latest Freddie Mac Primary Mortgage Market Survey recorded an average 30-year, fixed-rate mortgage of 4.21% for the week ending May 8, continuing to fall from 4.29% a week ago, but up from 3.42% a year earlier.

“Mortgage rates continued moving down following the decline in 10-year Treasury yields after a dismal report on real GDP growth in the first quarter,” Frank Nothaft, vice president and chief economist with Freddie Mac, said.

2) Home price growth is slowing

According to CoreLogic’s (CLGX) March HPI index, home prices rose year-over-year for 25 months straight in March.

Also, existing home inventory is increasing. Home prices nationwide, including distressed sales, grew 11.1% in March from one year prior.

This is not too far off the February 12.2%, January 12% and December 11% rise over the past three months, respectively.

Looking ahead, the CoreLogic HPI forecast indicates that home prices, including distressed sales, are projected to increase 0.8% month over month from March 2014 to April 2014 and by 6.7% from March 2014 to March 2015.

3) Most housing markets have recovered

Fifty-nine metros have fully recovered from the last housing market crash, and 300 saw year-over-year gains, according to an index of markets put together by the National Association of Home Builders/First American.

The nationwide economic score rose slightly to 0.88 from a revised April reading of 0.87.

This means that based on current permit, price and employment data, the nationwide average is running at 88% of normal economic and housing activity. The index showed an overall reading of 0.82 a year ago.

“Our builder members tell us they are starting to see more optimism in the field,” said NAHB chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “Mortgage rates are low, home prices are affordable and with the harsh winter behind us our latest surveys show builders are feeling more bullish about future sales conditions.”

Credit and affordability issues remain, but this may be the best time for the buyer who is on the fence.

[gravityform id=”13″ name=”Have a question or comment?”]