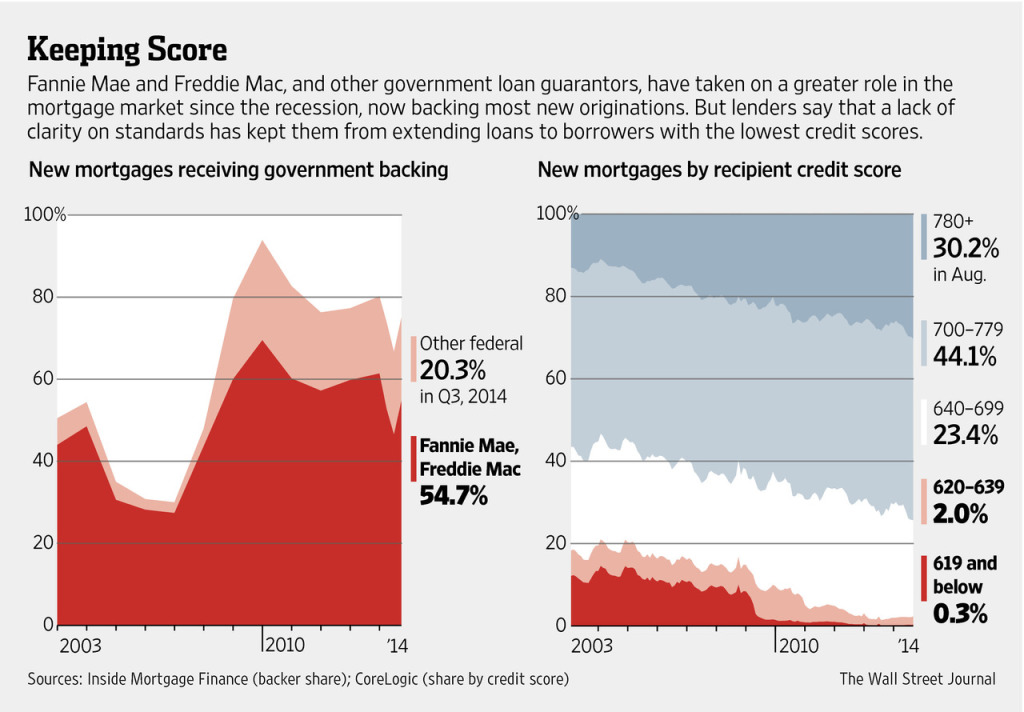

In recent weeks, Fannie Mae and Freddie Mac agreed to return of mortgages with as little as a 3% down payment – but for those struggling with affordability, the good news doesn’t end here. Just recently, mortgage rates dropped to a new low for 2014 – giving agents, brokers and the clients they serve one more reason to celebrate this holiday season.

The average rate for a 30-year fixed-rate loan now stands at 3.8%, a rate not seen since May 2013, according to Freddie Mac.

The average 15-year fixed loan, which is popular among those looking to refinance, fell to 3.1%. That rate is about where the 15-year stood in October.

Rates have been falling in tandem with 10-year Treasury yields, which have also fallen to their lowest level since May 2013, noted Frank Nothaft the chief economist at Freddie Mac.

Plunging oil prices, due to a slowdown in Russia and other global economies, have been sending investors into safe havens like U.S. Treasuries, said Keith Gumbinger, vice president of mortgage information firm, HSH.com.

“This is again driving down yields and pulling mortgage rates right along with them,” he said.

Another factor weighing on rates: few people are seeking loans, said Gumbinger.

Despite the bargain rates, the Mortgage Bankers Association reported a 3.3% decline in the number of people applying for mortgages last week.

If buyers and existing homeowners seeking to refinance do strike while rates are this low, they can save a lot of money. This week’s 0.13 percentage point drop alone results in a $15 a month savings on a $200,000 mortgage balance, or $180 a year.

That’s not such a bad Christmas bonus.

Halloween Fair and Haunted House

Halloween Fair and Haunted House Anaheim Fall Festival & Halloween Parade

Anaheim Fall Festival & Halloween Parade Halloween Treat-or-Treating at Anaheim Town Square

Halloween Treat-or-Treating at Anaheim Town Square Kidz Block Party

Kidz Block Party

Pacific Symphony ‘Sherlock Holmes Halloween’

Pacific Symphony ‘Sherlock Holmes Halloween’

City of Cypress Halloween Carnival

City of Cypress Halloween Carnival Halloween Kids Boo Cruise

Halloween Kids Boo Cruise