The window of opportunity to take advantage of today’s historically low

The window of opportunity to take advantage of today’s historically low

interest rates is starting to close.

Interest Rates: after a couple of years of hinting at an eventual hike in rates, the Federal Reserve appears ready to make a move and raise the short term rate for the first time in nine years.

The Federal Reserve has been talking about raising the short term rate for a couple of years now. They kept kicking the proverbial can further down the road. It was supposed to be at the end of last year, then it was going to be the Spring of 2015, then in the Autumn, but they never pulled the trigger.

They have fooled just about everybody, from experts to the average person on the street. They seem to be talking out of both sides of their mouths. By mid-September of this year, the entire world had already factored in an increase in the short term rate. Instead, the Federal Reserve pointed out instability in China and other global markets and decided to maintain the status quo. The U.S. and world stock markets were already volatile and they responded negatively, dropping like a rock.

The following week, Janet Yellen, the Chair of the Federal Reserve, delivered a speech at the University of Massachusetts, and, out of character for the Fed, stated something of profound substance. She said that they were going to raise the rate by the end of the year as long as there weren’t any major changes to the economic landscape. The U.S. and world stock markets soared after her speech.

The reason the world sees a rise in our rates as something good is because it indicates that the Federal Reserve has faith in the U.S. economy. Their lack of action, especially in September, proved to be too much for the worldwide psyche. “Do they know something we don’t know?” They used to change the rate every other month and sometimes in between. It would go up, down, up, up, down, up, down, etcetera. It felt as if somebody was behind the wheel of the U.S. economic bus.

They did not pull the trigger in mid-October, but all indicators are “go” for mid-December. They are looking at a quarter of a percent hike in the short term rate. They are moving off of zero for the first time in seven years and getting back behind the wheel of the U.S. economic bus. The changes in the short term rate will not be as swift as prior Federal Reserve movements in the past, but nonetheless, they are moving in a positive direction. The short term rate effects savings

accounts, CD’s, commercial loans, and the rate at which banks borrow money from the Federal Bank window. As banks are charged more, long term rates, mortgages for homes, eventually go up as well.

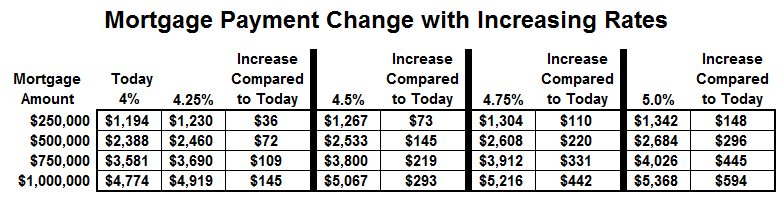

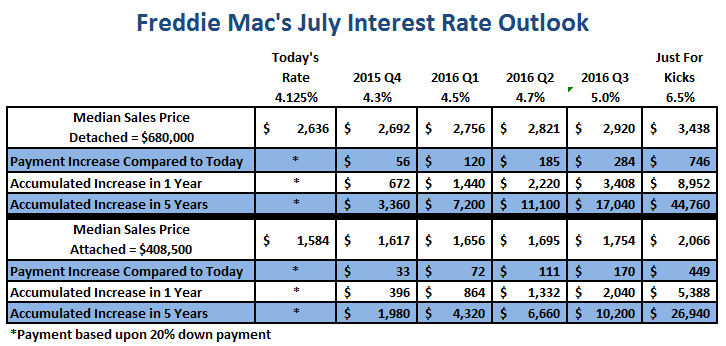

An increase of a quarter of a point does not drastically change the monthly mortgage payment. But, as interest rates continue to climb, it certainly will put a dent in a borrower’s wallet. Remember, this is a monthly payment. So, for a $750,000 mortgage payment, the payment increases $109 per month every single month when the interest rate rises by just a quarter of a point. That’s an extra $1,308 per year. And, if the Fed continues to increase rates, we could find rates rising to 4.75% by the end of 2016. If that happens, the monthly mortgage payment for a $750,000 mortgage climbs by an extra $331 per month compared to today, or nearly $4,000 a year. That’s a lot of money. For a $500,000 mortgage at 4.75%, the monthly payment increases by $220 per month compared to today, or $2,640 per year. That’s a lot of money for the middle class family.

Keep in mind, historically speaking, 4.75% and 5% are not bad rates. We have just become accustom to ridiculously low rates complements of the Federal Reserve stimulating the U.S. economic engine for nearly a decade. The long term average for interest rates since 1972 is 8.5% and since 1990 it’s 6.6%. Eventually, down the road, interest rates will hit 5% and beyond, most likely topping at around 5.25%. For the $500,000 middle class borrower, a 5% interest rates means an extra $296 per month more compared to today. That’s $3,552 extra every single year, equivalent to a nice Hawaiian vacation every year for the term of the loan if a buyer acts NOW.

That’s right, NOW is the time to take advantage of today’s rock bottom rates. They might not be as low as they were earlier in the year, but the gift from the Federal Reserve is coming to an end.

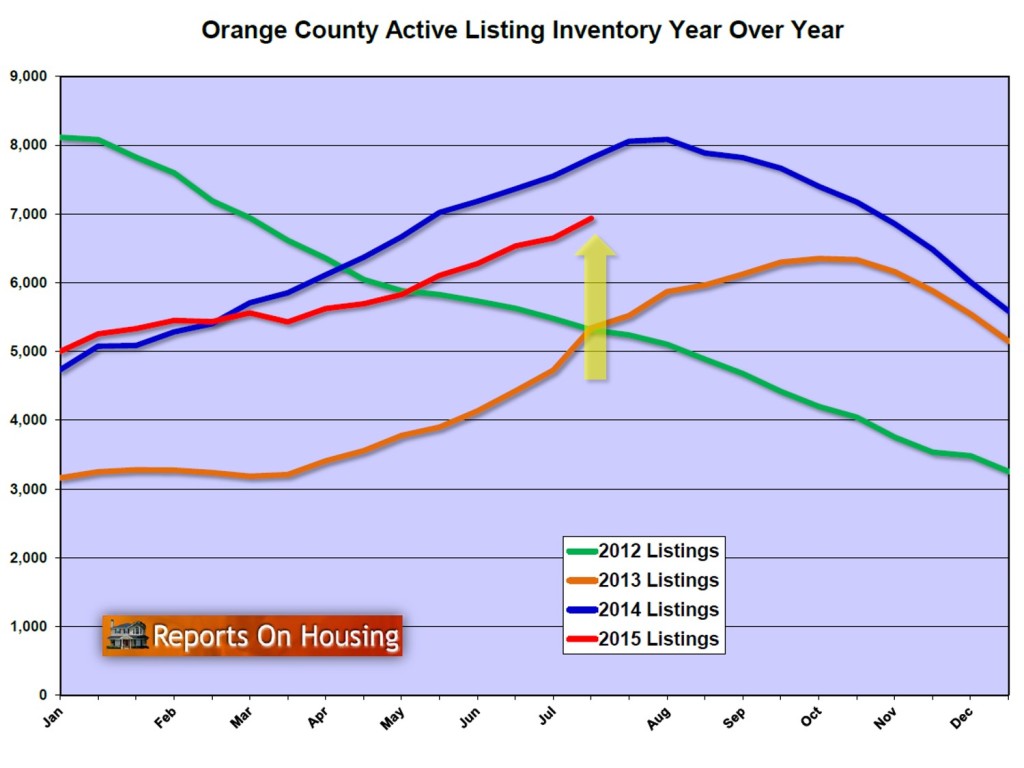

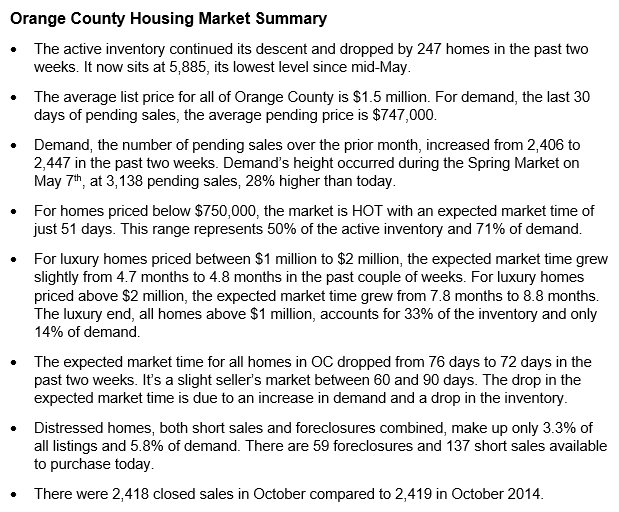

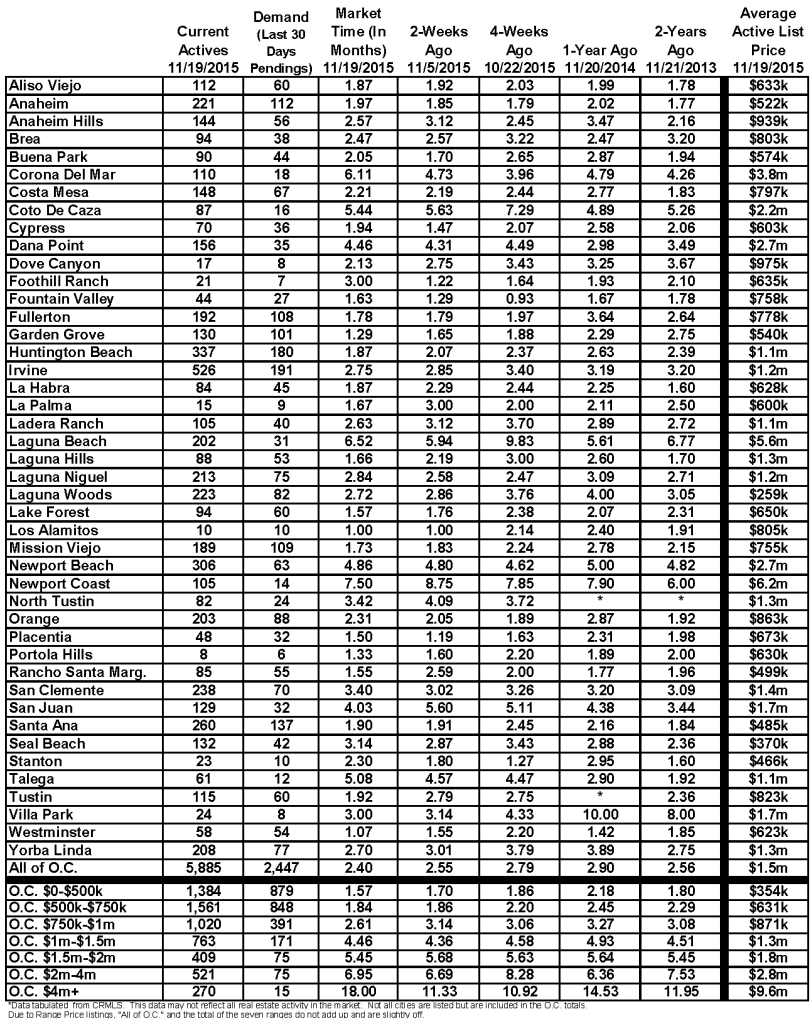

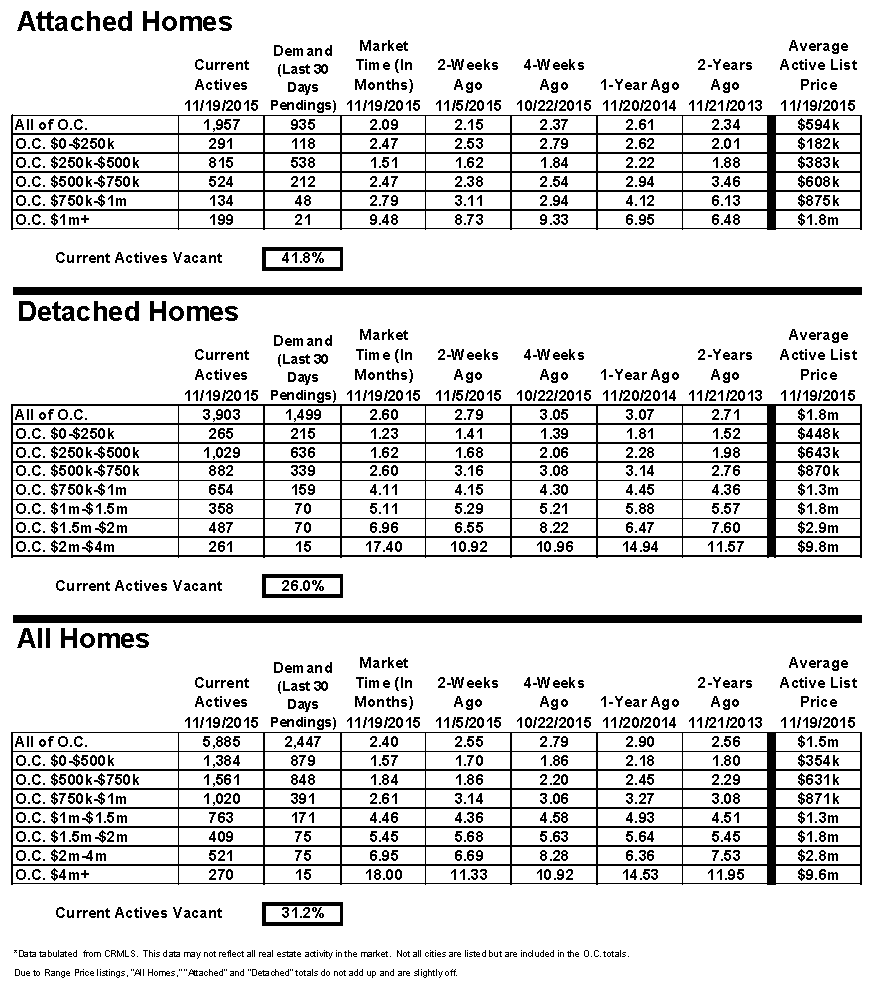

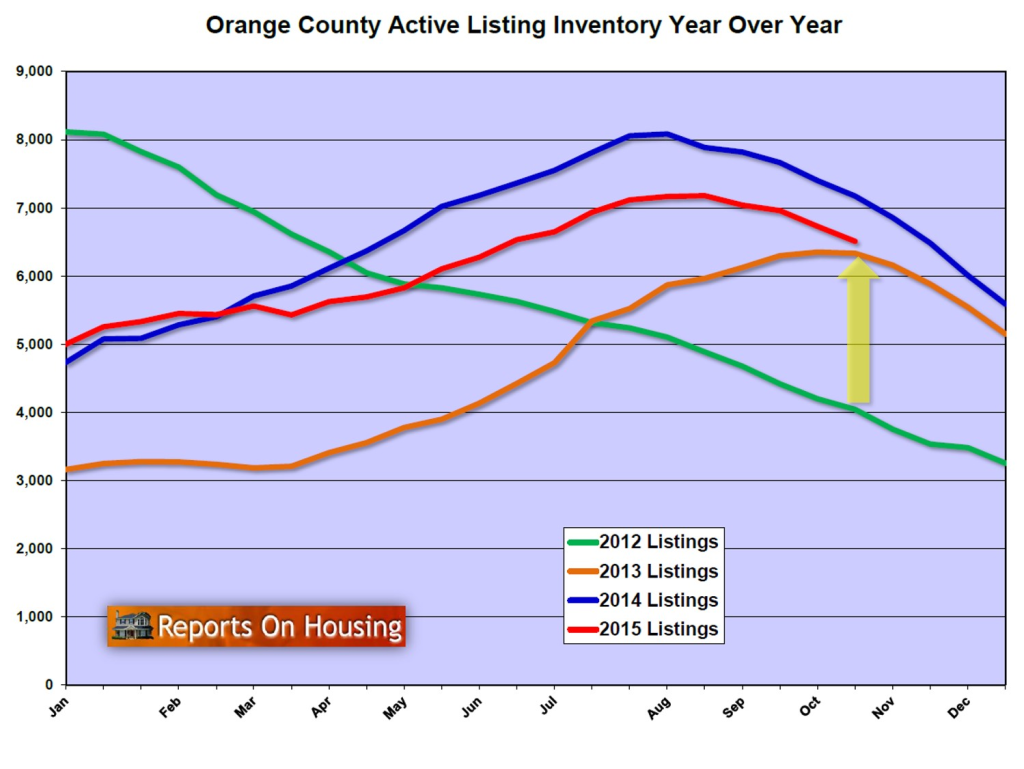

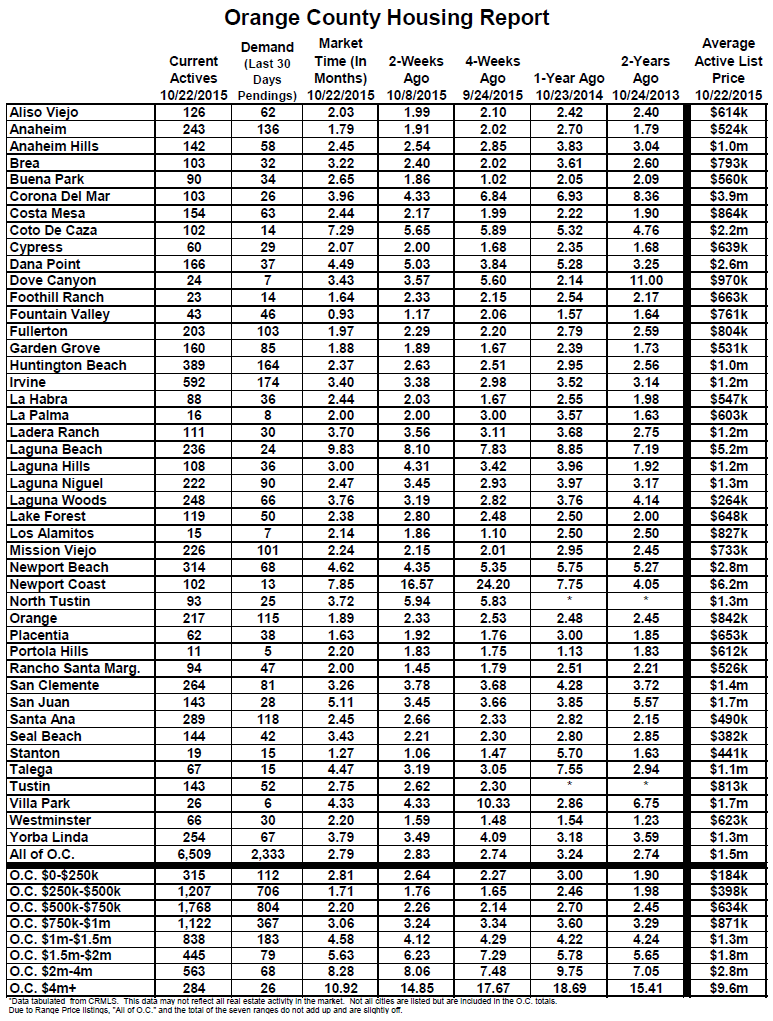

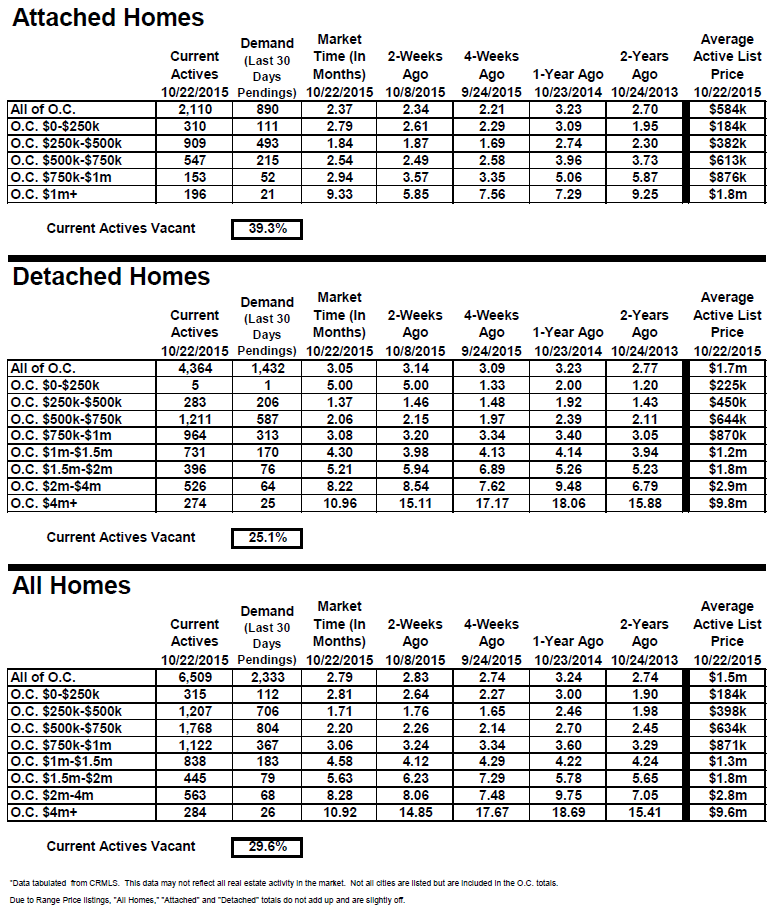

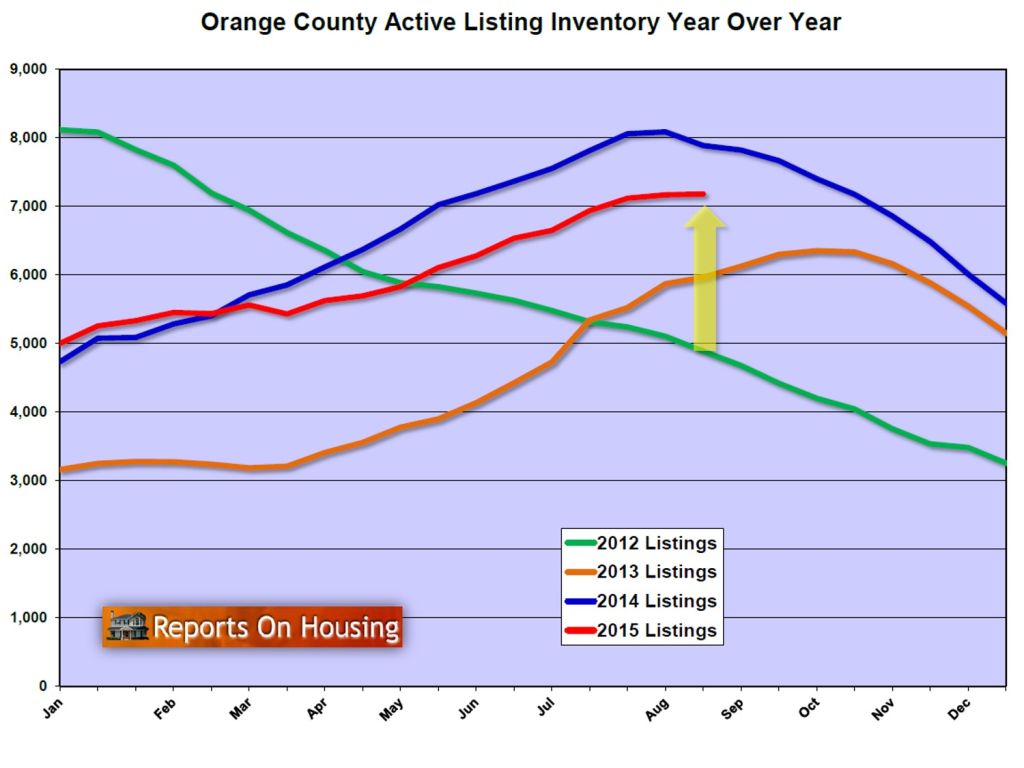

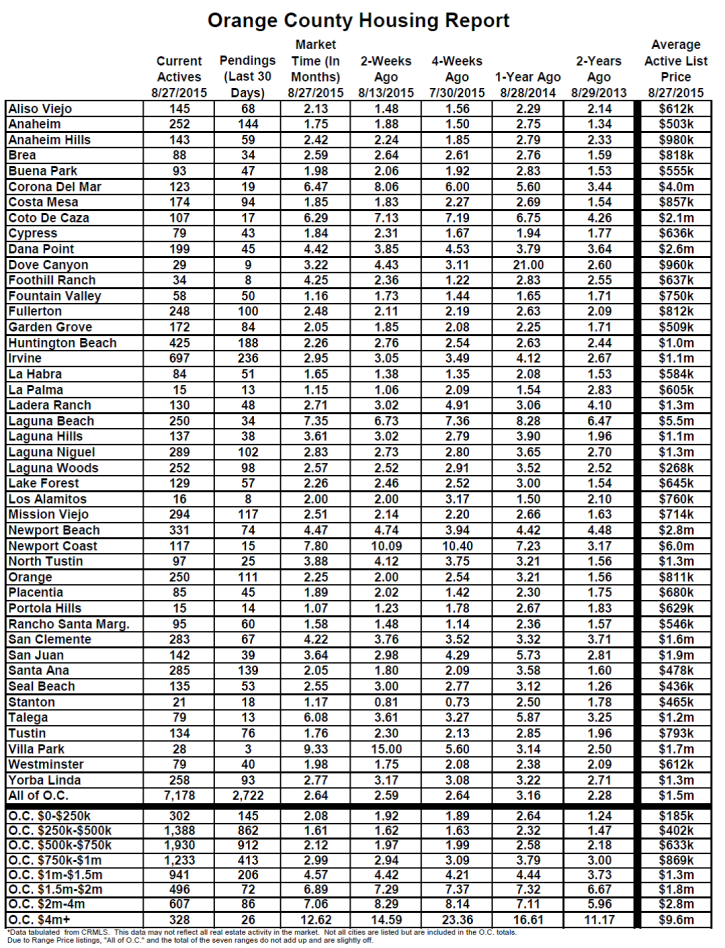

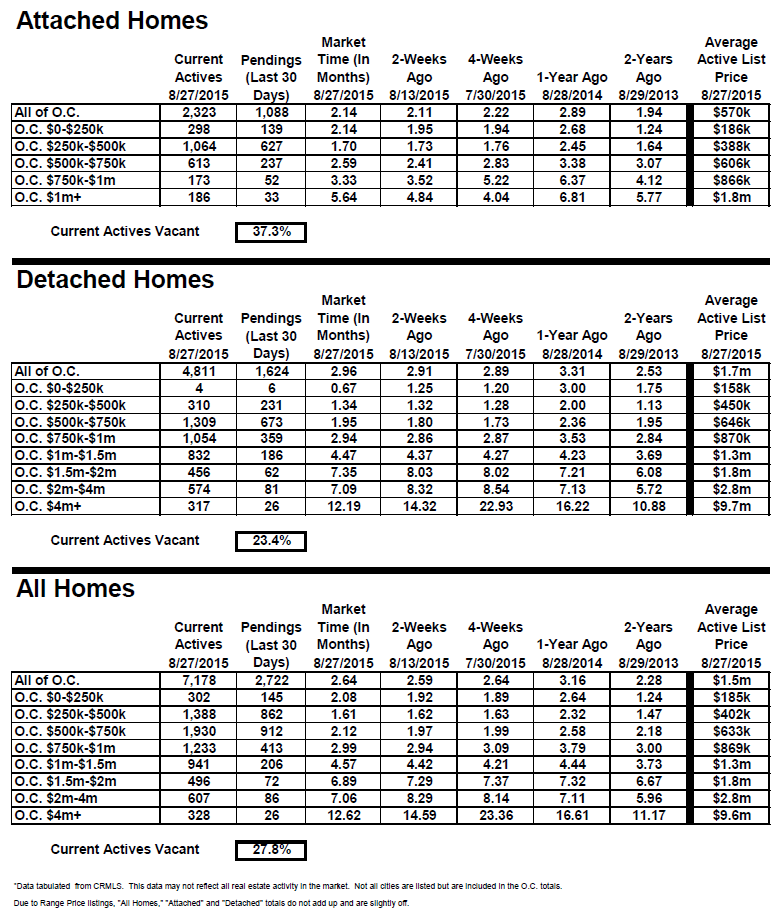

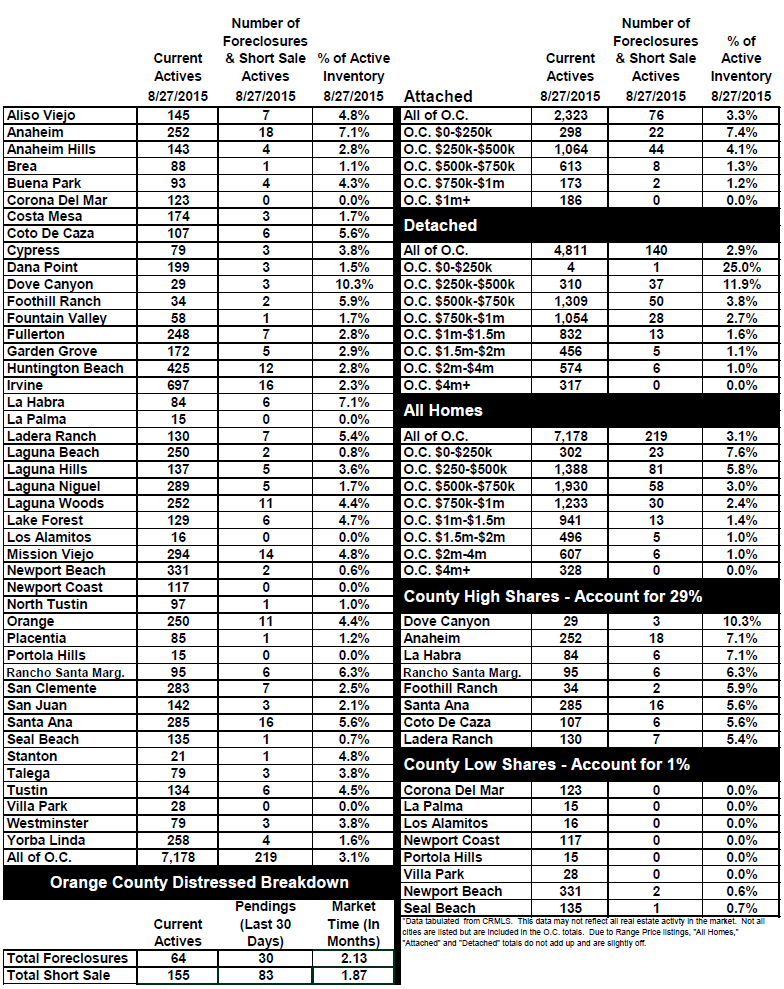

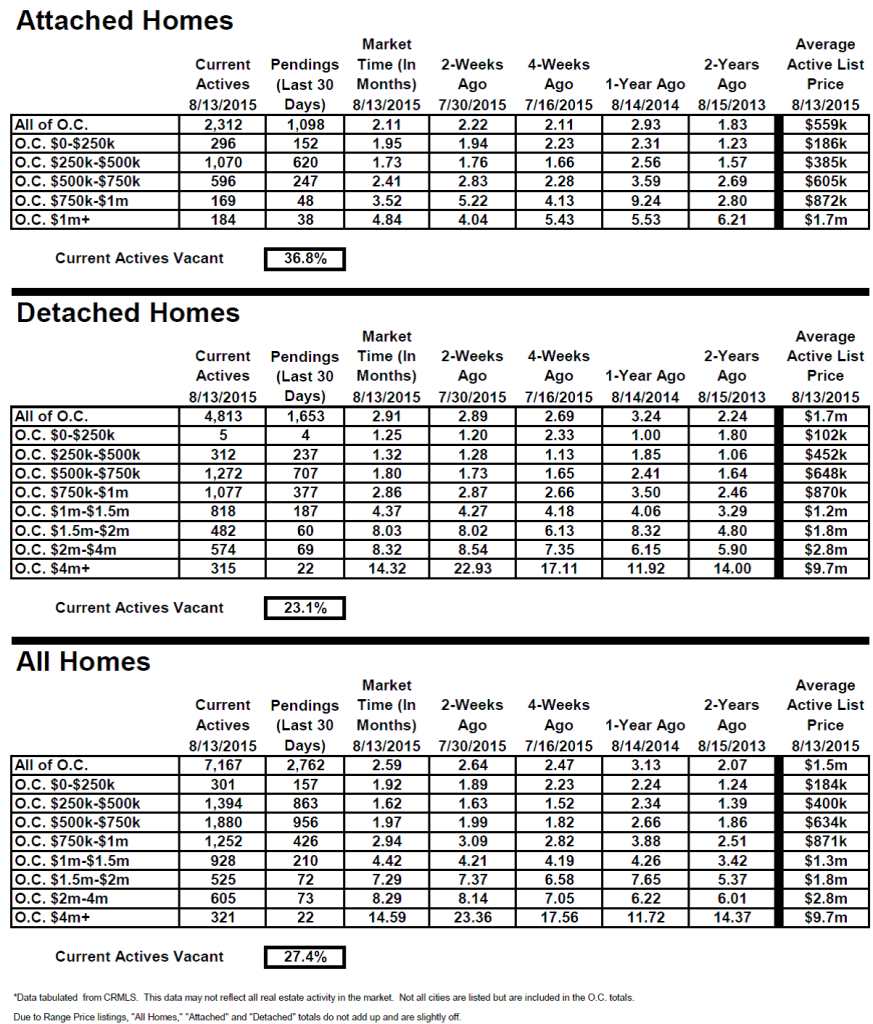

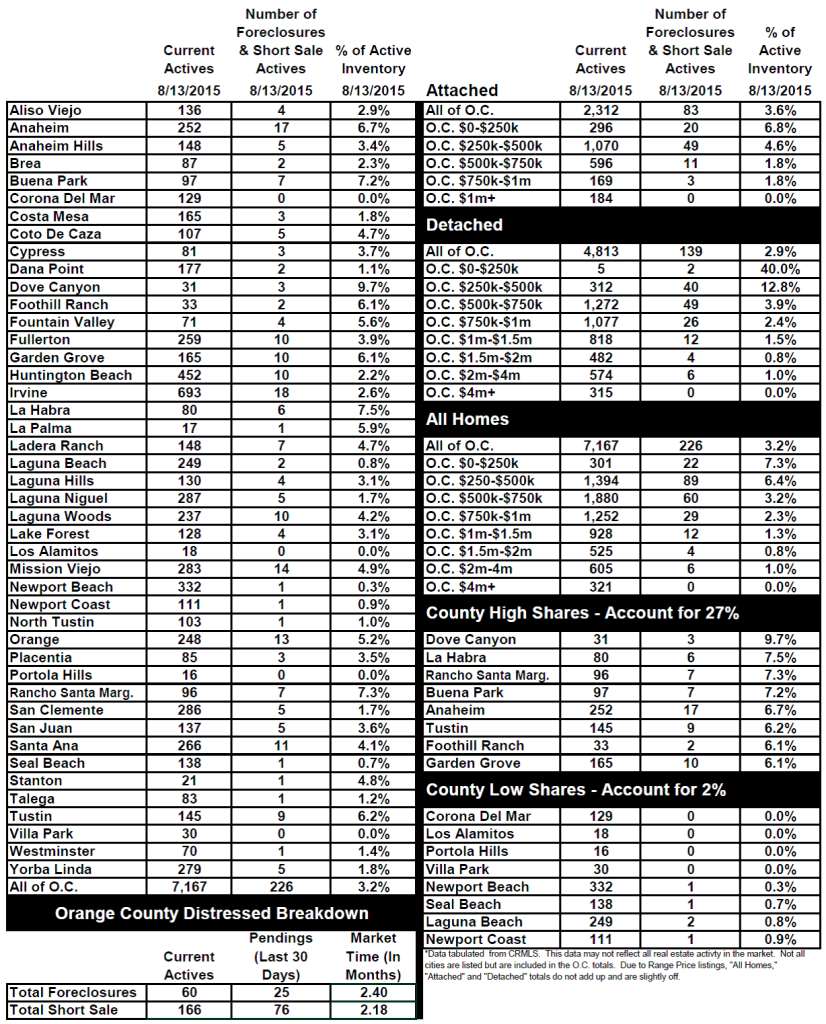

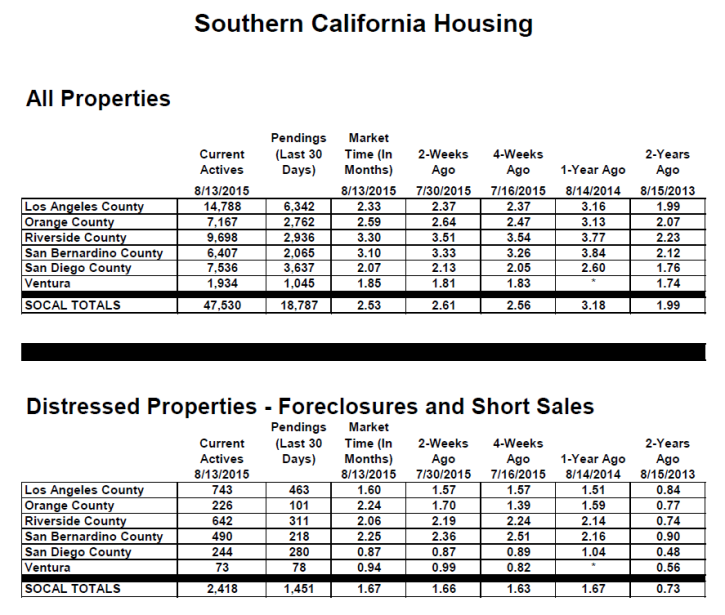

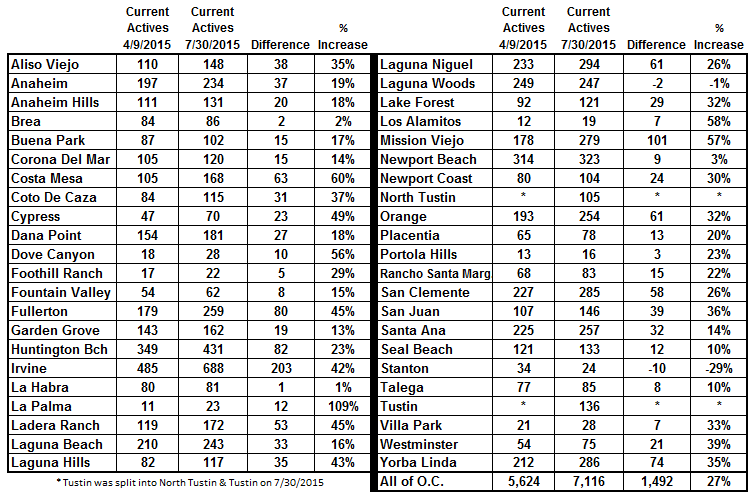

Active Inventory: the inventory dropped by 10% in the past month.

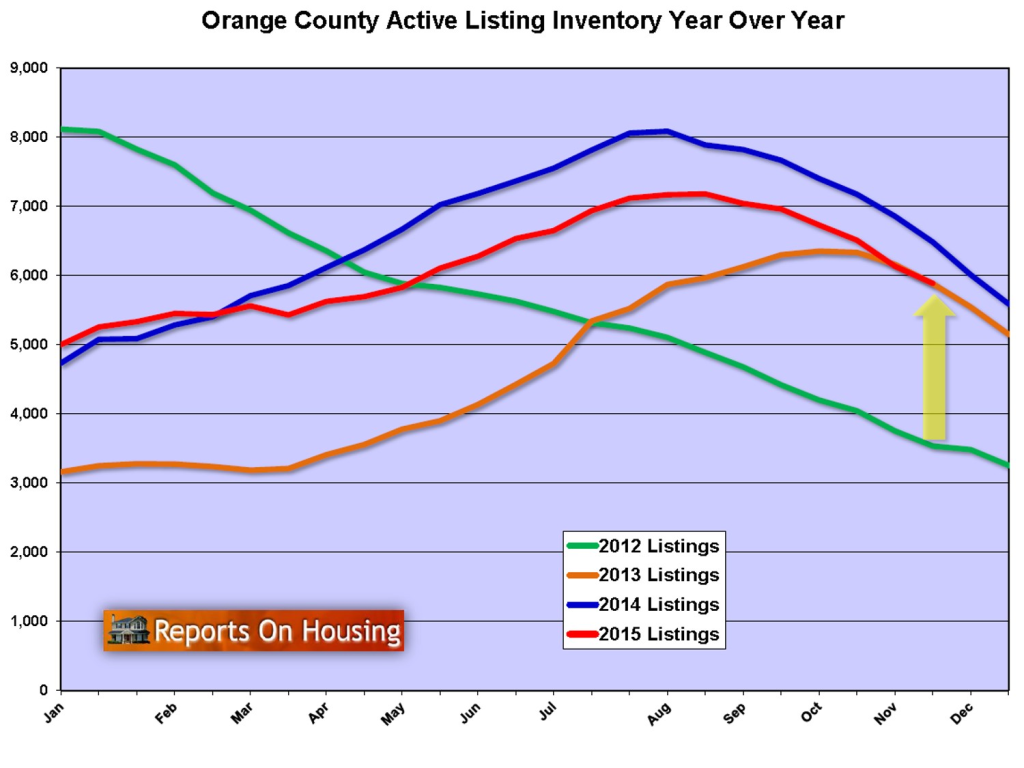

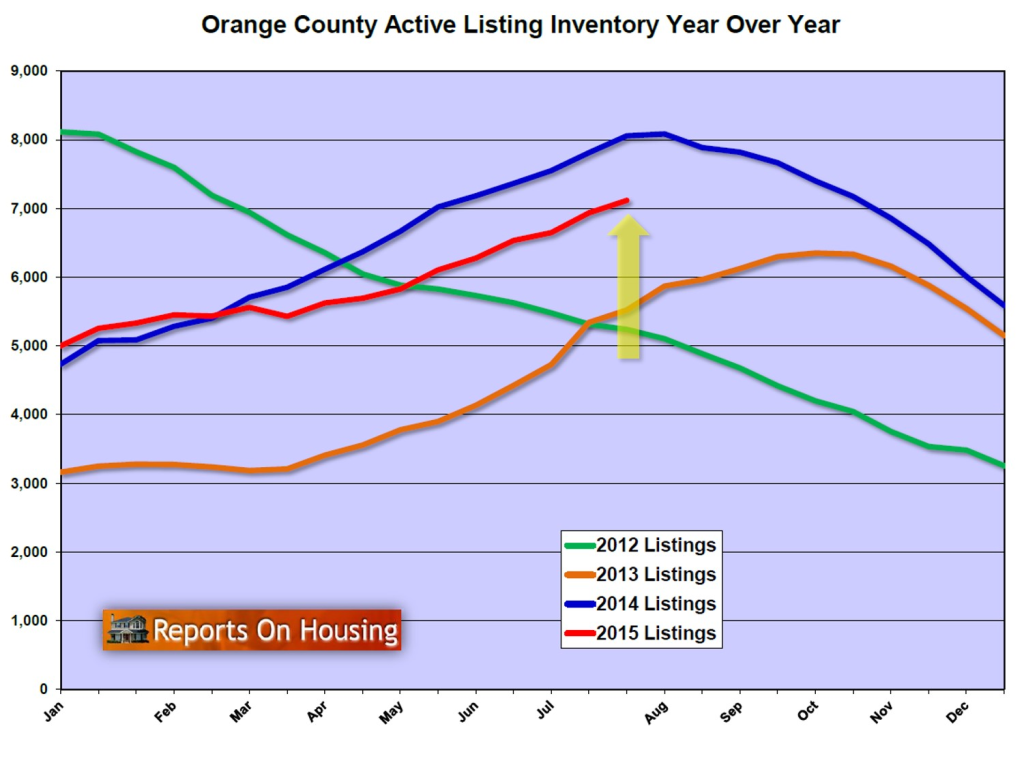

In the past month, the active inventory dropped by 624 homes, or 10%, and now sits at 5,885. The Holiday Market has officially begun with Thanksgiving just a few days away. This is the slowest season for Orange County real estate. It’s when both supply, the active inventory, and demand, new escrows, drop to their lowest point of the year. The active inventory will continue to fall like a rock and will reach its lowest point of the year on December 31st. The season continues through Super Bowl Sunday, when Orange County begins its transition into the Spring Market.

Last year at this time the inventory totaled 6,484 homes, 599 more than today, with an expected market time of 2.9 months, or 87 days, nearly a balanced market that does not favor a buyer or seller. In comparison, today’s expected market time is 72 days, a slight seller’s market. A slight seller’s market means that there is not much price appreciation, but sellers are able to call more of the shots.

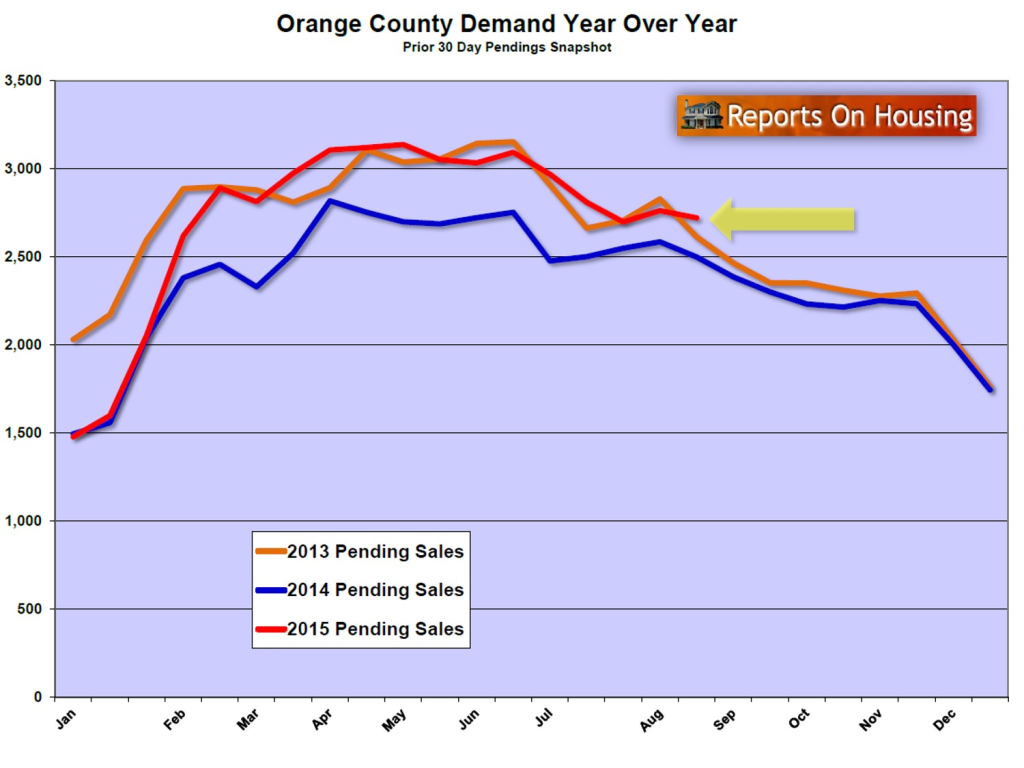

Demand: Demand increased by 5% in the past month.

Demand, the number of new pending sales over the prior month, increased by 114 homes in the past month and now totals 2,447 pending homes. This bump in demand is typical for this time of the year as buyers are poised to take advantage of closing just prior to the New Year, an okay time to move a family while the kids are on Winter Break.

Now that we have entered the Holiday Market, demand will drop to its lowest level of the year by year’s end. It will start to rise at the start of 2016, but will not start its Spring Market surge until after Super Bowl weekend.

Last year at this time there were 213 fewer pending sales, 10% less, totaling 2,234.

Summary:

Have a great week and have a terrific Thanksgiving!

Roy Hernandez

[gravityform id=”13″ title=”true” description=”true”]

Orange County Housing Report: A Mid-Year Checkup

Orange County Housing Report: A Mid-Year Checkup