Buying or Selling Soon? Contact ROY First!

Many down payment assitance programs available!

Roy’s Market Take: The real estate market was red hot for sellers in 2020. COVID-19 drastically changed the playing field in 2020 and sellers benefitted greatly from the limited inventory. This scenario was fine for sellers, but terrible for buyers. 2021 will be easier and more flexible for buyers. The lending industry was caught off guard a little, but now lenders are offering fantastic down payment assistance programs. Buyers can receive down payment assistance, easier qualifying ratios, receive down payment grants, and in some cases down payment forgiveness. Contact me for more info.

Roy’s Market Take: The real estate market was red hot for sellers in 2020. COVID-19 drastically changed the playing field in 2020 and sellers benefitted greatly from the limited inventory. This scenario was fine for sellers, but terrible for buyers. 2021 will be easier and more flexible for buyers. The lending industry was caught off guard a little, but now lenders are offering fantastic down payment assistance programs. Buyers can receive down payment assistance, easier qualifying ratios, receive down payment grants, and in some cases down payment forgiveness. Contact me for more info.

OC Housing Report: Buyers’ Frustration

With an unrelenting lack of supply of homes FOR SALE, it will not be a buyer’s market anytime soon.

An Ongoing Seller’s Market

Housing has lined up in favor of sellers for years now and it is due to a low inventory of homes available to purchase coupled with strong demand boosted by historically low mortgage rates.

It is tough buying a home in today’s housing market. A couple browses home after home until they find one worth seeing. After scheduling a showing, they write an offer to purchase because the house would be perfect for their growing family. It meets all of their requirements and it has the added bonus of a downstairs bedroom. Excitement and anticipation are in the air as they wait for a response. Their enthusiasm begins to dim as they find out that there are nine additional offers on their “perfect” home. After going back and forth with the seller, the buyers learn that they were not the winning bidder on the home. They have to go back to the drawing board and browse for their next opportunity.

This scenario plays out repeatedly across the United States, not just in Orange County. Many buyers find success, just not immediately. Other buyers, especially in the lower price ranges, write offers over and over again, but just cannot seem to get one of them accepted. It is frustrating and many buyers come to a point where they simply want to give up. Should they wait until the market slows and tilts more in the buyer’s favor? Will it get easier anytime soon? Unfortunately, it will not get any easier and it does not make sense to wait to purchase.

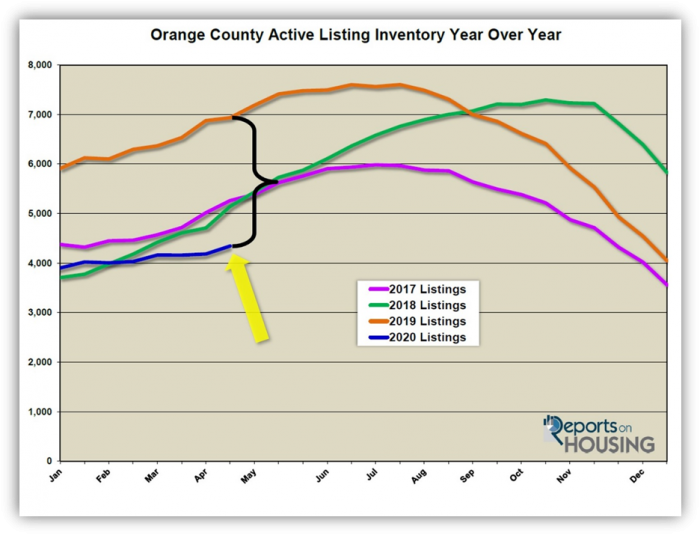

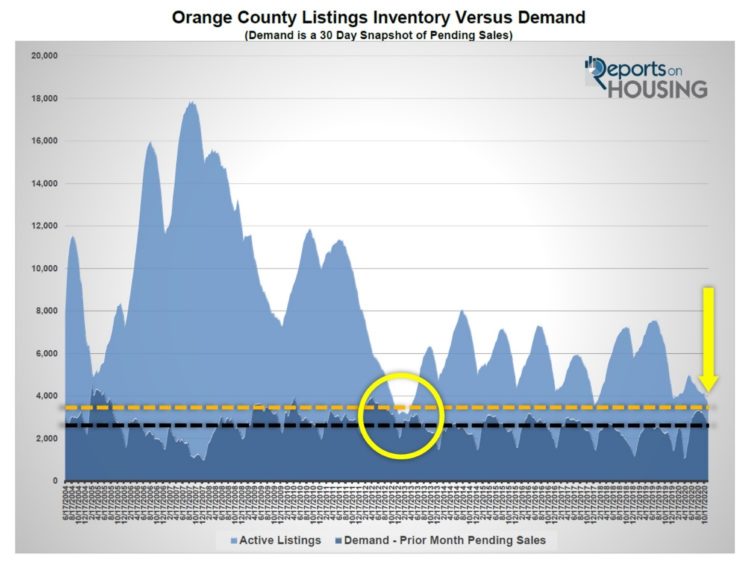

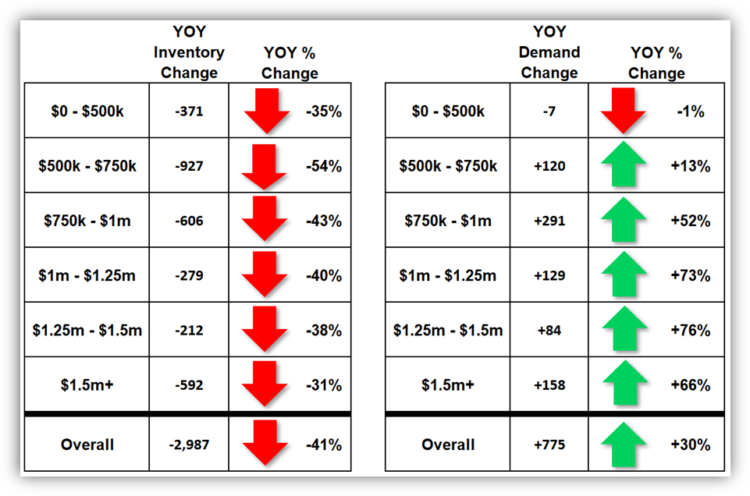

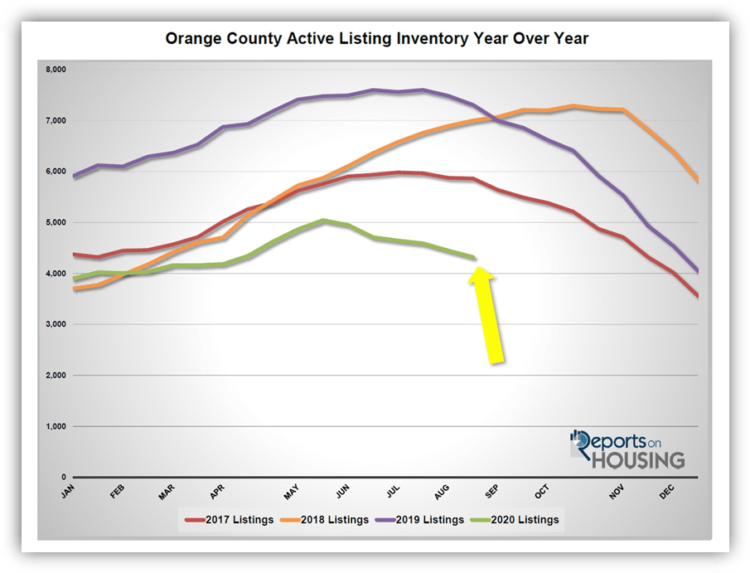

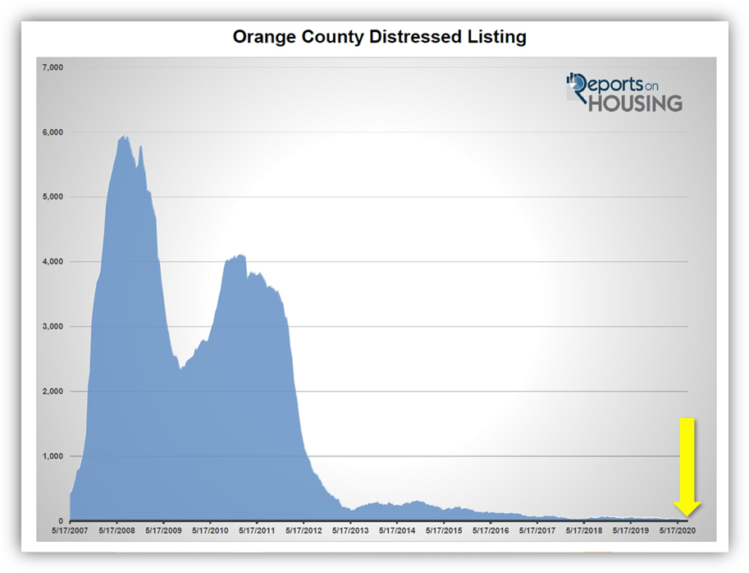

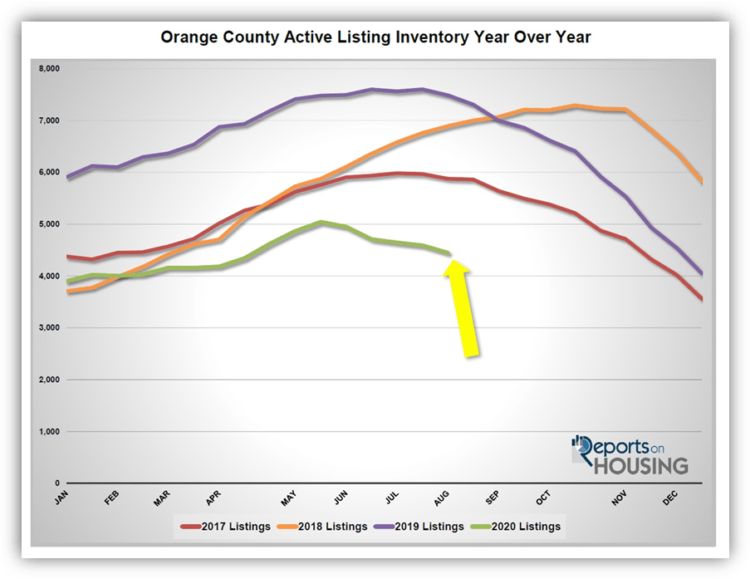

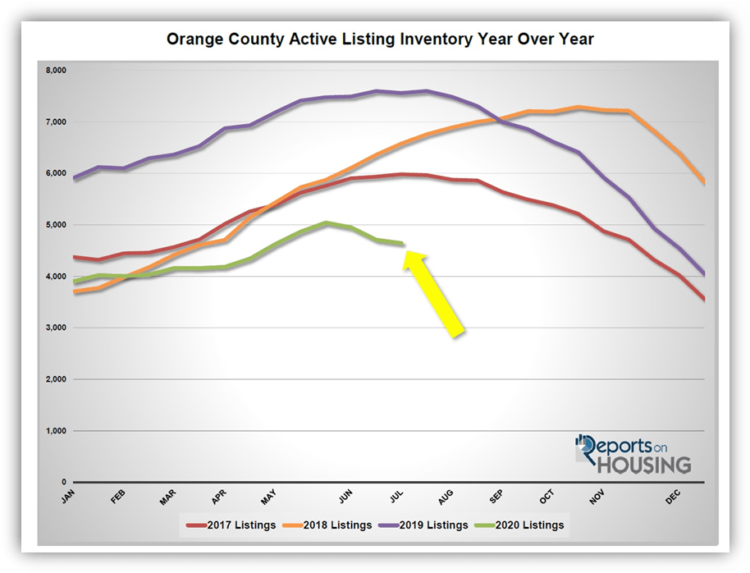

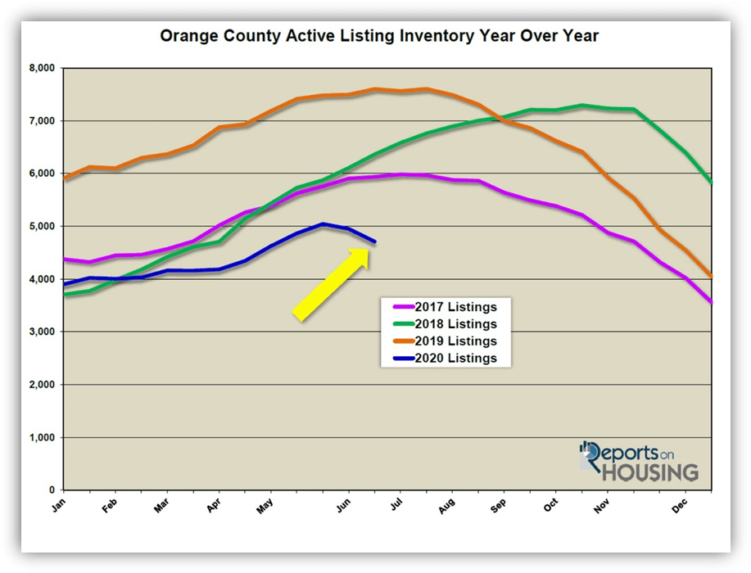

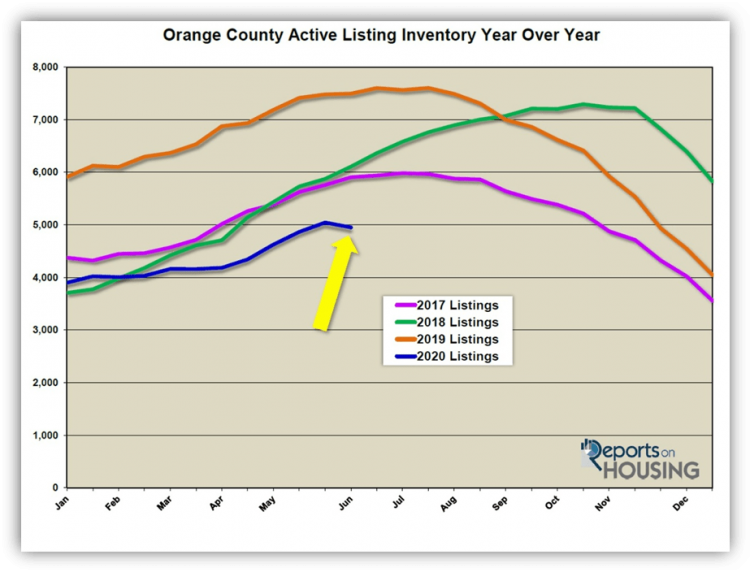

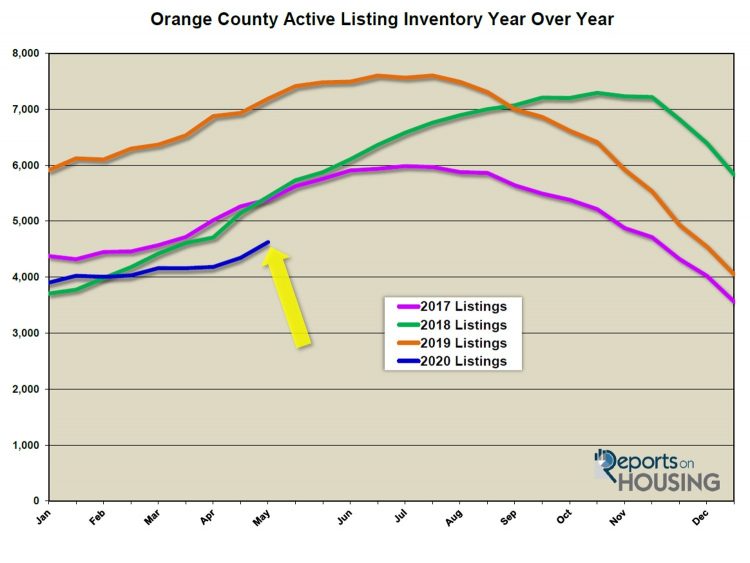

What is going on is simple supply and demand. The active inventory has been at low levels ever since 2012 and a few times has dropped to unprecedented lows. From November 2012 through May 2013, and from December 2017 through February 2018, there were less than 4,000 homes available to purchase. It has only occurred twice since 2004, until this year. The Orange County active listing inventory dipped below 4,000 at the end of October. The New Year will start with fewer homes than 2013. That means that the inventory in 2021 will be below 4,000 into the Spring Market.

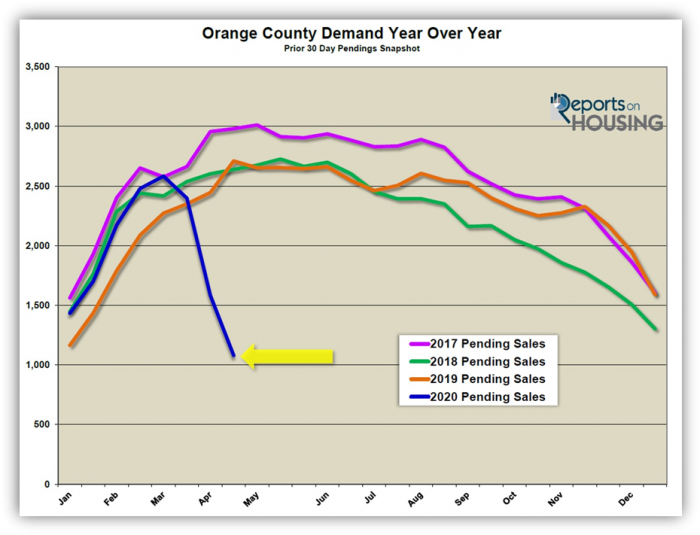

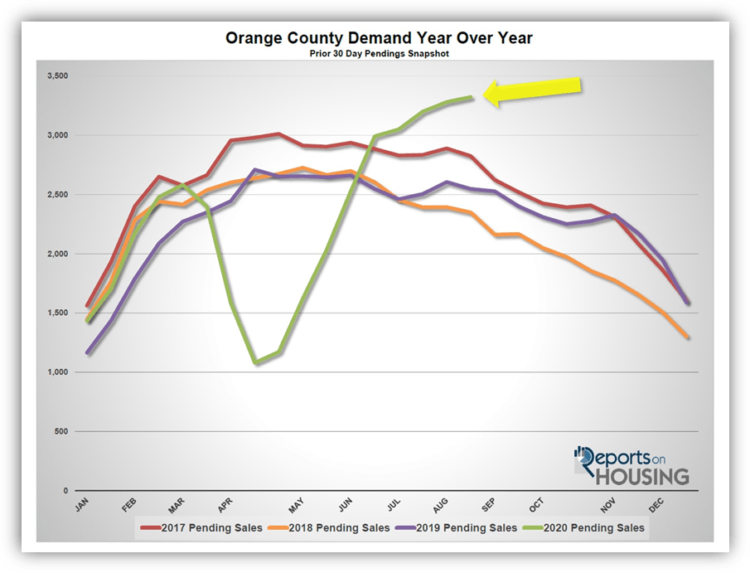

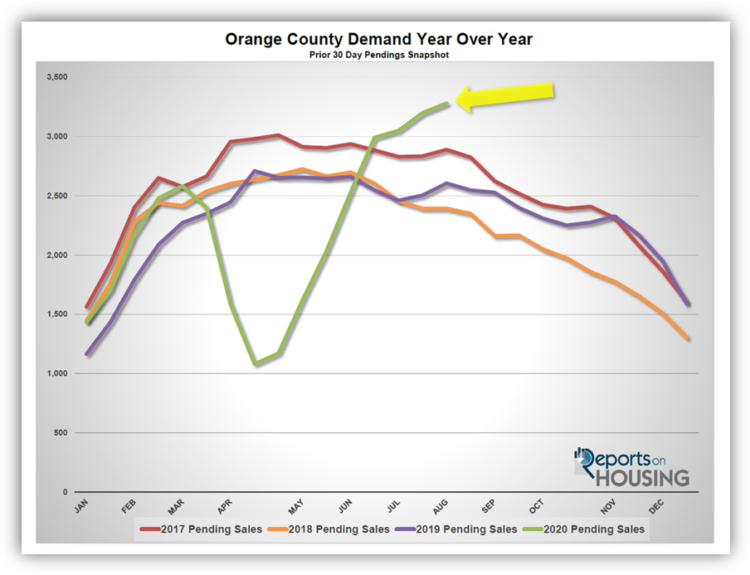

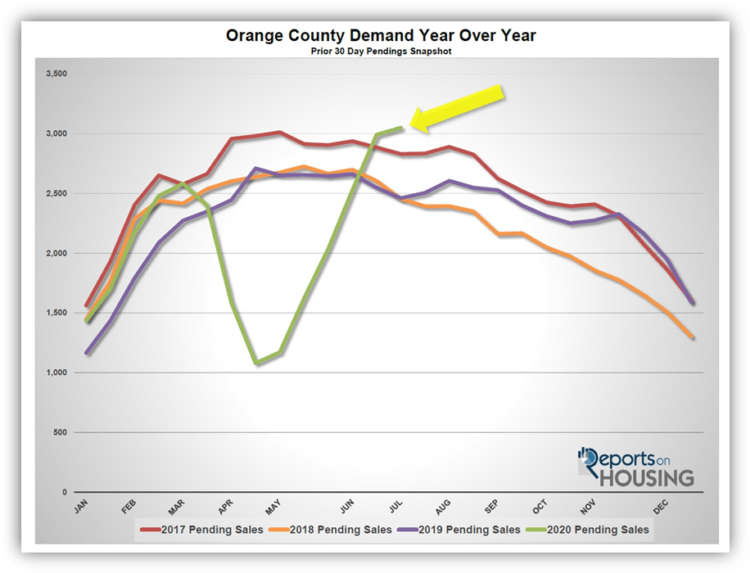

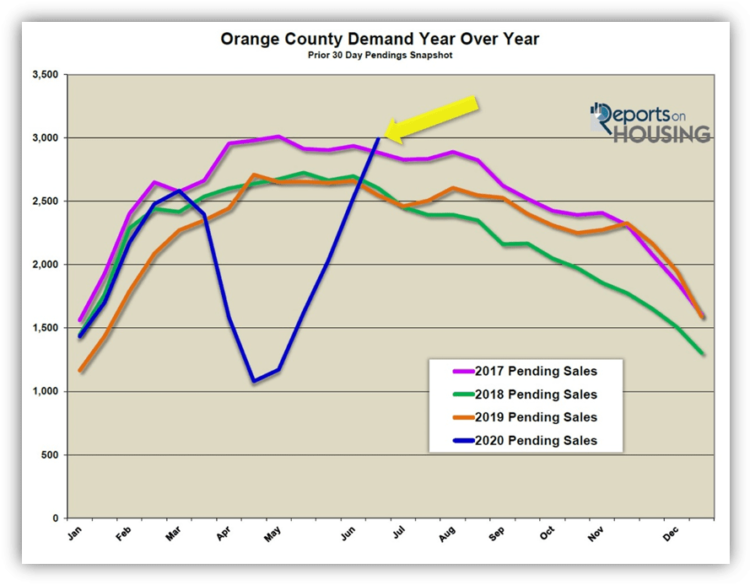

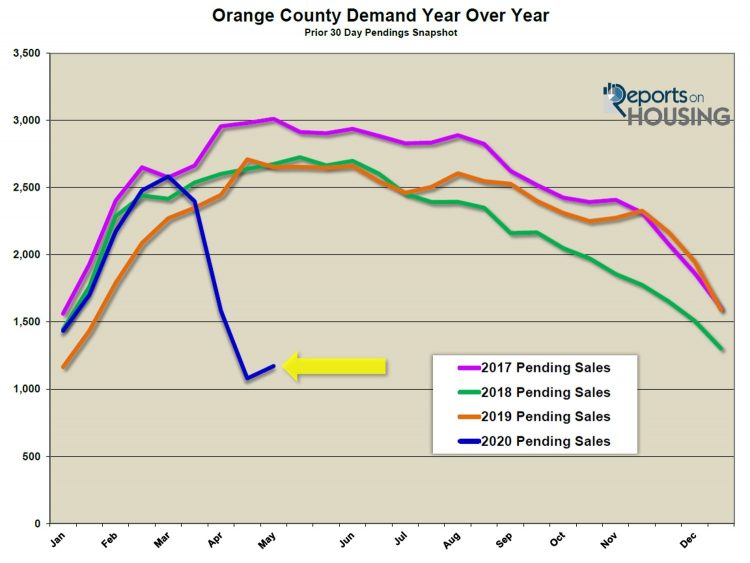

Demand, the last 30-days of new escrow activity, is also currently at unprecedented levels. The Spring and Summer Markets from 2013 through 2019 have ranged between 2,500 to 3,200 pending sales. Today’s demand is at 2,621 pending sales, above the 2,500 threshold. It has not been this high at the end of November since 2012 when housing just came out of its Great Recession slumber and was sizzling hot. With mortgage rates at record low levels, below 3%, demand will remain elevated. The low mortgage rate environment is forecasted to continue throughout 2021.

Another way to gauge just how hot the market is today is to look at the spread between the supply of available homes to purchase and current demand levels. When the number of homes going into escrow is close to the number of available homes, it indicates a powerful market that leans heavily in favor of sellers. That is precisely where it sits today. The difference between the number of available homes and demand is only 848. It was at 2,765 last year and 5,166 just two years ago. The only other time that the spread between the inventory and demand dipped below 1,000 was between October 2012 through June 2013. That is also when home values appreciated rapidly. There were not enough homes available to satiate the voracious appetite of buyer demand.

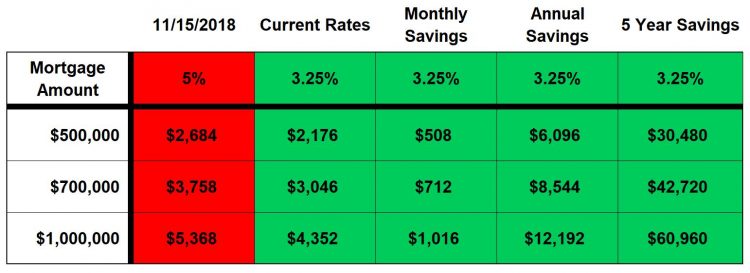

It is not going to get easier anytime soon for buyers. Waiting is not the answer. Based upon today’s supply and demand, the longer a buyer waits, the more homes will appreciate. That will be the story in 2021 as well. Additionally, mortgage rates are at unprecedented record low levels. According to Freddie Mac’s weekly Primary Mortgage Market Survey® released on November 25th, the 30-year fixed remained at 2.72%, its thirteenth record low this year. Mortgage rates are not forecasted to go any lower in 2021. In fact, there is a stronger chance that they will slightly rise as the economy improves next year. Higher rates combined with higher prices does not work in a buyer’s favor.

ATTENTION BUYERS: Do not wait to purchase. Delaying a purchase will result in higher prices and higher mortgage rates, cutting into home affordability. The current housing market may be frustrating, but it would be foolish to wait and not take advantage of record-low rates and lower home values.

Active Listings

The current active inventory plunged by 10% in the past two weeks, its largest drop of the year.

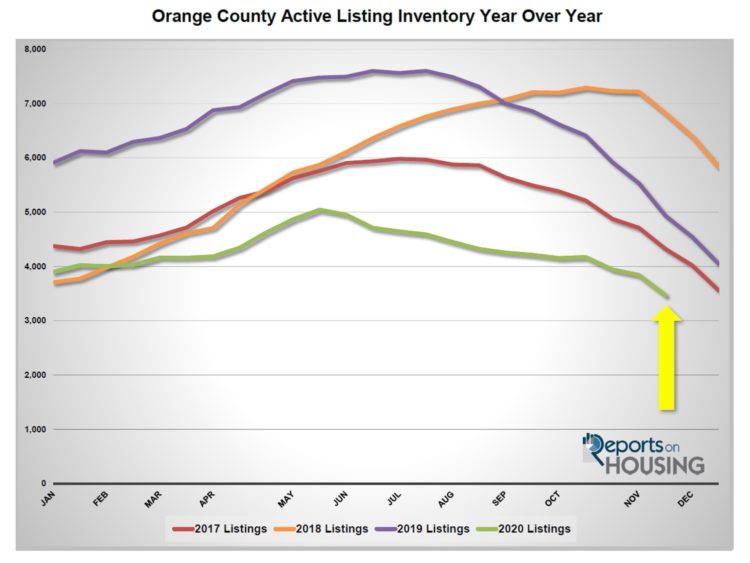

The active listing inventory shed 374 homes in the past two-weeks, down an astonishing 10%, and now sits at 3,469, its lowest level since April 2013. It is also at its lowest level for this time of the year since tracking began in 2004. Now that housing is in the thick of the Holiday Market, expect the inventory to rapidly drop through the end of the year. December is cyclically when fewer homeowners opt to sell due to the time of the year. It is also when unsuccessful sellers throw in the towel, choosing to enjoy the holidays and wait until the Spring Market of 2021. The lack of available homes to purchase will set the stage for a very hot 2021

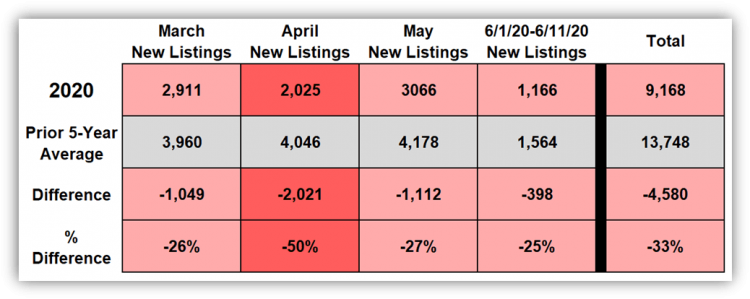

Even with the drop in the active inventory, there are MORE homes coming on the market right now compared to last year. COVID-19 suppressed homeowners from entering the fray earlier in the year, but that ended in Orange County in July. Now there are more homes coming on the market year over year. From mid-October to mid-November, there were 9% more homes that came on the market compared to 2019, an additional 247 FOR-SALE signs. Even with the recent increase in COVID-19 cases, homeowners are being lured into selling their homes.

Last year at this time, there were 4,935 homes on the market, 1,466 additional homes, or 42% more. There were a lot more choices for buyers last year.

Demand

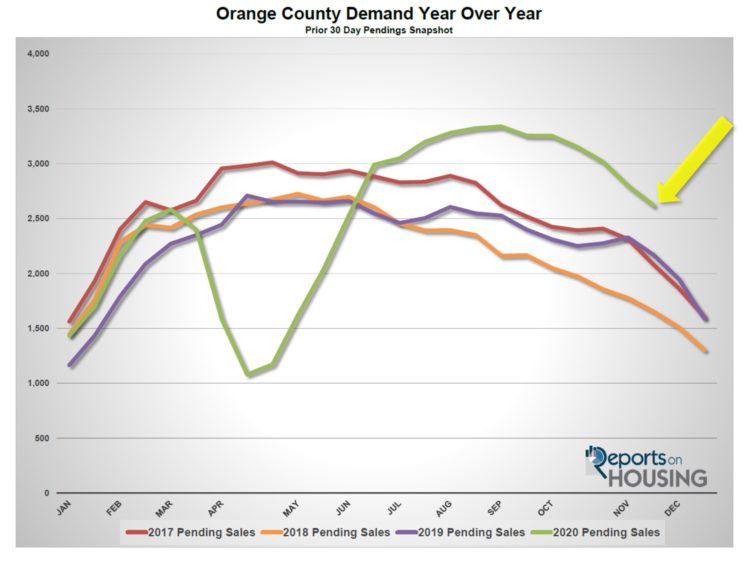

Demand dropped by 6% in the past two weeks.

Demand, the number of new pending sales over the prior month, decreased from 2,799 to 2,621 in the past couple of weeks, shedding 178 pending sales, down 6%. Even with the drop, it is still the highest demand reading for an end to November since 2012. With the active inventory dropping there are fewer choices for sellers, which translates to fewer escrows and a drop in demand. Also, many buyers are sidelining their home purchasing efforts to focus and enjoy the holidays. This is a cyclical phenomenon that occurs between Thanksgiving and New Year’s Day. Expect the drops to continue until ringing in 2021.

Last year, demand was at 2,170, that is 451 fewer pending sales compared to today, or 17% less.

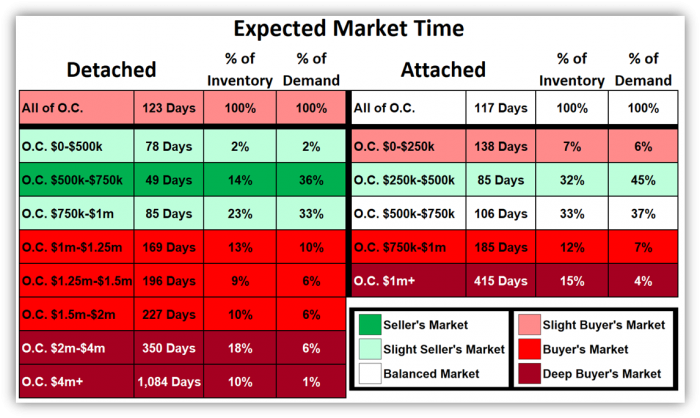

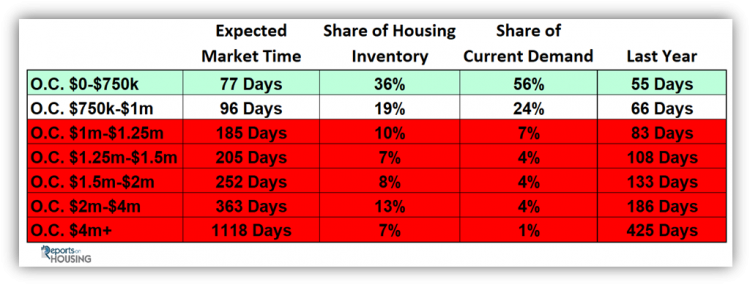

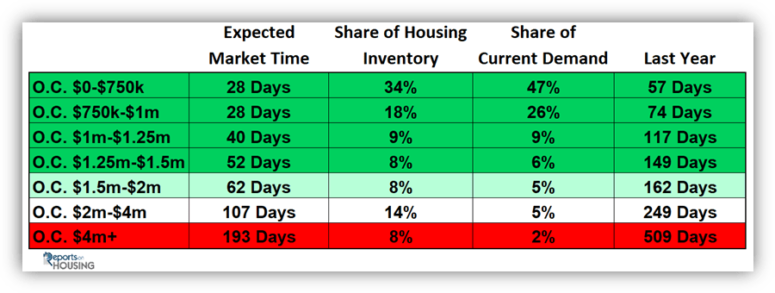

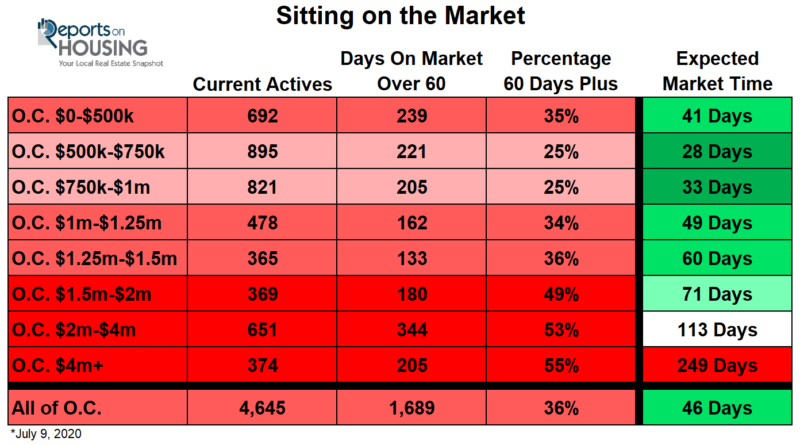

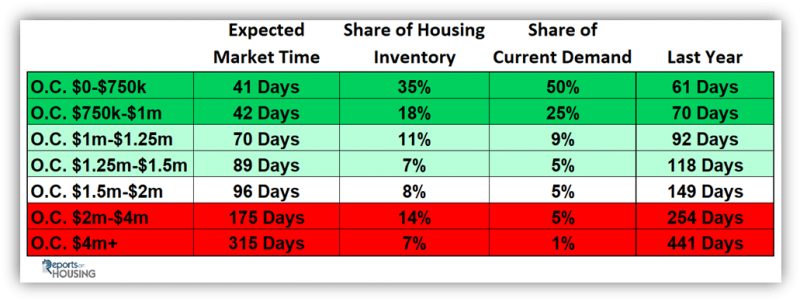

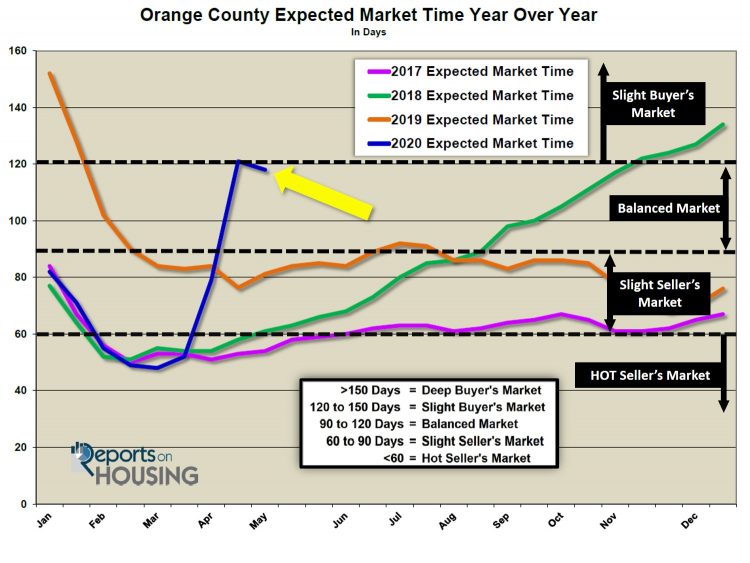

In the past two-weeks the Expected Market Time decreased from 41 to 40 days, a Hot Seller’s Market (less than 60 days), where sellers get to call the shots during the negotiating process and home values are on the rise. Last year the Expected Market Time was at 68 days, slower than today.

Luxury End

The luxury inventory sank by 8%.

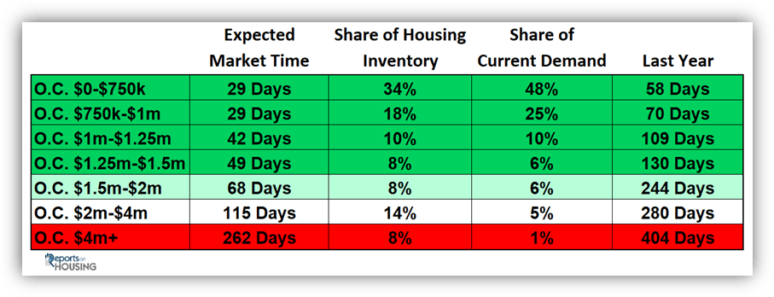

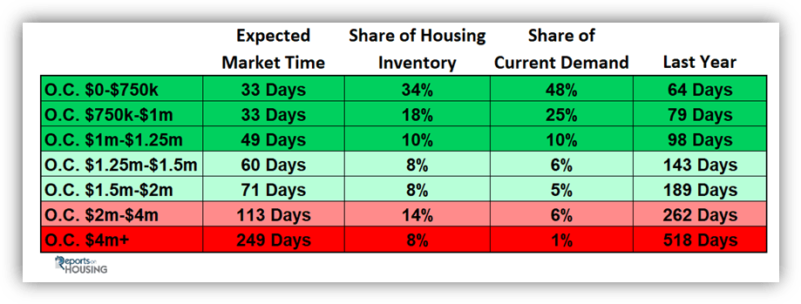

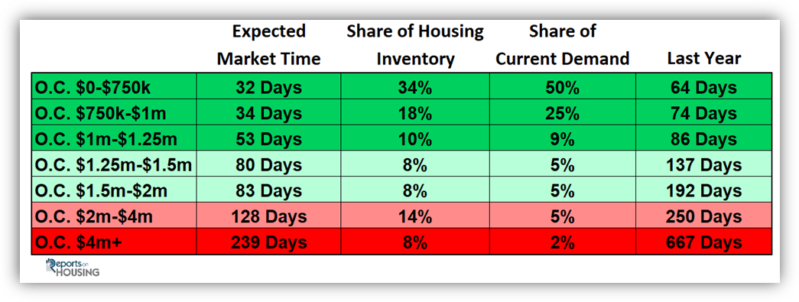

In the past two-weeks, the luxury inventory for homes above $1.25 million shed 123 homes, or 8%, and now sits at 1,435. Demand dropped as well, but not nearly as much, dipping from 481 to 466 pending sales, down 15, or 3%. The Holiday Market is denoted by a drop in both supply and demand, which will continue through year’s end. Luxury is not an exception. With a giant drop in the supply of luxury homes, the overall Expected Market Time for homes priced above $1.25 million decreased from 97 to 92 days in the past couple of weeks. Luxury is at an unprecedented level for this time of the year.

Year over year, luxury demand is up by 160 pending sales, or 52%, and the active luxury listing inventory is down by 405 homes, or 22%. The Expected Market Time last year was at 180 days, nearly double where it stands today.

For homes priced between $1.25 million and $1.5 million, in the past two-weeks, the Expected Market Time decreased from 56 to 47 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 72 to 63 days. For homes priced between $2 million and $4 million, the Expected Market Time increased from 118 to 126 days. For homes priced above $4 million, the Expected Market Time increased from 308 to 322 days. At 322 days, a seller would be looking at placing their home into escrow around October 2021.

ike the rest of “daily life,” the housing market has not been spared from the sweeping effects of sheltering in place.

ike the rest of “daily life,” the housing market has not been spared from the sweeping effects of sheltering in place.